Summary:

- Micron’s stock is a buy due to attractive valuation and strong long-term revenue prospects, driven by AI, 5G, and other technological advancements.

- Recent Q4 results show strong performance with revenue growth, margin expansion, and high demand for high-value solutions like HBM and SSDs.

- Improved pricing outlook and industry supply constraints are expected to drive higher ASPs, benefiting Micron’s profitability and capital returns.

- Micron’s transition towards faster-growing sectors like data centers, automotive, and industrial will likely result in higher growth compared to the overall memory industry.

BlackJack3D

Background

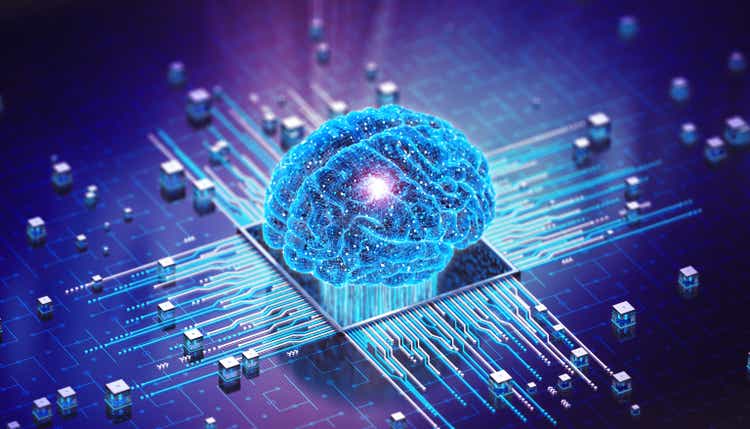

Over the past 3 years, Investors of Micron (NASDAQ:MU) (NEOE:MU:CA) have been on a volatile journey. From all-time highs in late 2022, the stock fell 50% due to the worst memory downturn in 15 years. The downturn was driven by several factors, including shortages of non-memory components & supply chain constraints leading to reductions in customer inventory levels, rising interest rates & inflation impacting demand & profitability, while the CAC decision amplified demand struggles for Micron specifically. The lack of demand created supply/demand imbalances, causing average selling prices to collapse, DRAM prices fell 75%, while NAND fell 55% since Q3 2021.

Micron 5 year drawdown chart (FinChat.io)

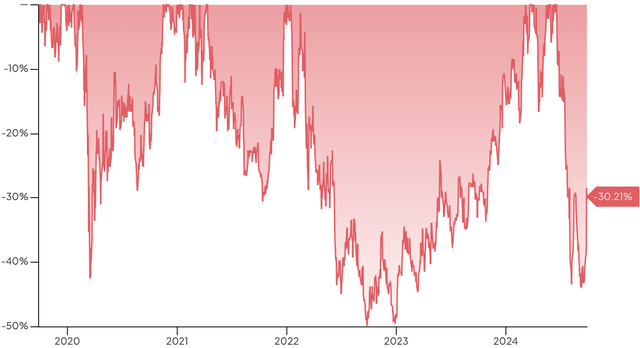

Micron was the first player to react to this downturn, with the industry following suit over time. Players cut production to balance supply & demand and cut capex to preserve cash. Micron specifically imposed several cost-cutting measures such as productivity programs, suspension of short-term incentive plans, executive salary cuts and lower discretionary spending. Micron incurred $382M in underutilisation costs in 2023, with further costs accruing through the beginning of 2024, they also wrote down $1.83B in inventory and experienced significant losses through the income statement, with gross margins of negative 32% at the trough.

Micron quarterly gross & operating margins (FinChat.io)

Through 2023, the industry started to stabilise with healthier customer inventory levels, causing higher demand for memory, balancing supply & demand, this caused ASPs to flatten. AI-related demand has since caused the industry to rebound rapidly, with leading-edge solutions creating a tight supply environment, leading to higher bit shipments & ASPs.

Q4 results

The rebound brings us to Micron’s Fiscal Q4 results. The company delivered a strong quarter, beating guidance across the board, with revenue growing 93% and gross margins expanding 800bps sequentially. Growth was driven by strong AI demand and the ramp of high-value solutions like HBM & SSDs. The company achieved growth across all end markets, specifically data centres, with the CNBU segment growing over 150%. Despite the strong growth, PC & Mobile are likely over-earning in the near term as customers build inventories due to rising prices and anticipated growth from new AI solutions, this could cause some weakness in these segments over the next few quarters. The margin improvement was driven by ASP growth, strong execution of cost downs and the capture of higher profits from high-value solutions.

Thesis

Despite the strong rebound, I believe Micron is a good buy for two reasons. First, The stock trades at an attractive valuation. Second, Micron has strong long-term revenue prospects, driven by demand trends and improved pricing prospects going forward.

Valuation

I believe Micron trades at an attractive valuation. When I run a reverse DCF, the outcome demonstrates the stock is trading at a price where the market is pricing in very little growth going forward. For the DCF, I have used a stock price of $107.50 and a discount rate of 8%. I have used a book value per share of $39 (approximately $45B), I’d argue this book value is very conservative, the company has $93.2B of gross PPE on the balance sheet, with accumulated depreciation of $54.6B leaving $38.6B of net PPE as of May 2024. I’d argue the replacement value of Micron’s assets is closer to the gross figure with a leading global manufacturing presence with technological leadership, over $20B in cumulative R&D, over 50,000 lifetime patents in a product category that is becoming more important and higher quality. This lower number potentially provides some margin of safety. I have also used an EPS of $6, this may look high vs the $1.30 of EPS generated in Fiscal 2024. However, I would argue again that $6 is conservative, analyst consensus for Fiscal 2025 is $8.88 in EPS, again this will provide some margin of safety.

| Stock Price | $107.50 |

| Discount rate | 8% |

| Book value per share | $39 |

| EPS | $6 |

With these numbers in mind, a reverse DCF shows that the stock will grow at a 2% rate annually for 10 years, with a terminal growth rate of 1%. I think this underestimates the future potential growth of Micron, leaving a margin of safety.

Revenue growth

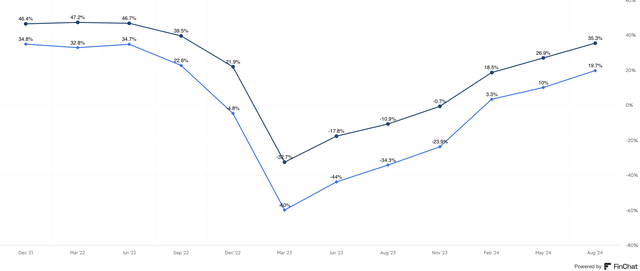

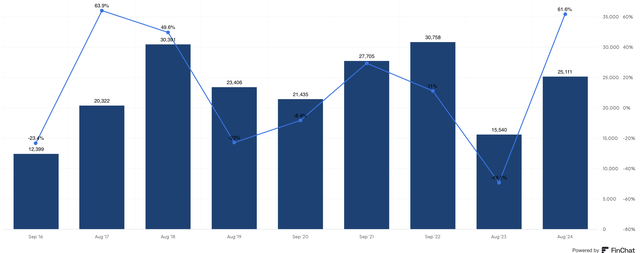

Micron annual revenue growth (FinChat.io)

In the previous cycle from 2016-2023, Micron generated revenue growth of 3.28% annually from trough to trough. This growth is slower than reality due to the worse drawdown of 49.5% in 2023 compared to only 23.4% in 2016. When revenue is compared from peak to peak, growth is 9.6% annually, a more representative number.

During the next cycle, I think growth will continue to grow in the high single-digits, driven by strong long-term demand tailwinds and improved pricing prospects.

Demand Tailwinds

The memory market is estimated to be worth roughly $149B today; it is estimated to grow at 7.5% annually through 2029 to a size of $215B. The growth will be driven by an increasingly digital world, with advances in AI, 5G, Autonomous vehicles, the Internet of Things along with many other sectors. This growth will result in increased shipments from Micron and other players through the production of more chips and increased capacity per chip as memory demands rise.

In the near term, growth will likely continue to be driven by the data centre as AI workload demand is strong and inventory normalisation in traditional servers accelerates the growth of traditional servers as older servers are replaced by higher-performance and more efficient ones. Despite some short-term weakness, I expect Mobile & PC to drive growth beginning towards the end of 2025. This growth will be driven by two factors: the replacement cycle and higher-capacity products. PC & mobile products often go through replacement cycles as consumers upgrade to the latest product releases. The next product cycle has the potential to be bigger than normal because of new AI feature enhancements added to both new PCs and smartphones. The PC cycle will also be powered by the end of support for Windows 10 and the launch of Windows 12, forcing consumers to buy new PCs. The second factor is the increased capacity per chip, within PCs, the average DRAM content per PC was 12GB. New PC announcements show DRAM contents of roughly 16GB for value products, 32GB in the mid-range and 64GB for premium products. Even at the low end, this is a 33% bit increase. The likelihood is the average PC content will be near the middle of that range, which will increase capacity dramatically. The combination of these two factors will drive the Mobile & PC segments for the next several-year cycle.

Over the long term, I expect Micron to capture the growth of high-value solutions such as HBM, CXL and SSDs, while capturing the growth of industries such as automotive, industrial and data centres as the company transitions from a revenue mix skewed towards Mobile & PC towards higher growth areas just mentioned.

HBM has been talked about a lot on conference calls recently; the product has been ramping up extremely quickly as the company has executed very well on improving the output and yields, reaching several hundred million in revenue for Fiscal 2024 from a near zero base. Despite the rapid growth, the product is still only a small part of the business today, likely representing less than 1% of revenue this year. The market is estimated to be worth $4B currently, with Micron expecting it to grow to $25B by 2025, with HBM being sold out for 2025, revenue is expected to be several billion in FY25, making the market size estimate likely fairly accurate. Micron is likely to reach its DRAM market share of low to mid-20s within calendar 2025 due to their superior HBM3E 8 high product and future 12 high product that’s currently being qualified with customers. With that industry growth and market share gain, Micron could generate roughly $6B in revenue in FY26. With that kind of growth, HBM revenue would increase from 1% of total revenue to 10-20% within 2 years, depending on the revenue growth of the rest of the business. The result of this will be a significant revenue tailwind and higher margins due to the premium nature of the product in general, along with Micron’s premium over competitor’s products due to its strong performance advantage.

Similar to HBM, CXL will likely be a significant growth driver for the business in the longer term. Although slightly later than expected, Micron was the first company to achieve qualification milestones for the CXL 2.0 product. This product, again has a very small market TAM currently, but it is expected to grow into a significant market within the decade, one estimate predicts the CXL market will be worth $16B by 2028, again providing significant tailwinds for Micron’s growth, other future advancements include 3D DRAM and High NA EUV, these will both likely increase bit demand.

Currently, Micron’s revenue mix is weighted towards PC & mobile solutions. Over the next decade, I expect this composition to transition towards faster-growing areas such as data centre, automotive, networking and industrial. As explained before, I still expect PC & mobile to experience growth; however, this will be at a slower rate over the long term vs these sectors. I believe Micron is well positioned to capture outsized growth in the faster-growing sectors, For example, Micron currently has the highest market share within automotive, they believe the market will grow at a 28% CAGR as the industry transitions towards hybrids and EVs, increasingly technical infotainment systems, and self-driving capabilities. These advances require increasing amounts of both DRAM & NAND that will drive growth faster than the overall memory industry, I expect the other mentioned sectors to also grow faster than the overall industry. This transition in Micron’s portfolio will likely result in the company growing slightly quicker than the overall memory industry, as the company captures a greater portion of the faster-growing segments.

Improved pricing outlook

The history of the memory industry is characterised by boom and bust cycles with multiple players chasing growth by undercutting competitor’s pricing, this resulted in consolidation of the industry over the long term as competitors were either bought out or went out of business. The result of this aggressive competition was a 36% decline in DRAM prices annually between 1957 and 2010. During this early period, the competition consolidated, resulting in more rational competition and less steep price declines over time, after 2010 price declines averaged 15%, resulting in less of a headwind to bit growth. Over time, I believe price declines will continue to see less declines going forward.

After the recent downturn, the company has been seeing strong pricing trends. In Q4, DRAM saw mid-teens price increases sequentially and high single digit NAND prices. I expect pricing will remain strong through calendar 2025 due to the tight industry supply from capex cuts and supply reductions made during the 2022 downturn, resulting in capacity below its peak output. The growth of HBM is also taking incremental supply due to the 3:1 trade ratio requirement to produce that product, this likely reduced supply an additional 3% in FY24, which is set to increase to 6% of supply in FY25. Future generations of HBM are likely to have even higher trade ratios due to the layer stacking resulting in lower yields, leading to even tighter supply. This is affecting all products, not just HBM, resulting in tight supply across the board, leading to higher ASPs. I expect this to continue longer term with the introduction of products such as 3D DRAM, likely to have similar trade ratio trajectories. Other factors affecting pricing going forward include the slowing of Moore’s law, the slowing of Moore’s law is reducing the gain in bits per new generation, in turn, this increases the capital intensity per chip, which reduces cost downs, slowing supply growth. The result of reduced supply growth is an improved balance between supply & demand, making prices less volatile, increasing margins over the cycle, and allowing EPS to grow faster than revenue and for increased capital returns.

Takeaway

Despite strong execution and financial performance from Micron in Q4, I believe Micron remains an attractive buy due to a cheap valuation and strong long-term demand trends, coupled with improved pricing outlook. These factors should result in strong fundamental performance over the cycles as growth remains in the HSD range and cross-cycle margins expand thanks to improved pricing, resulting in EPS growth faster than revenue, allowing for increased capital returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.