Summary:

- Micron provides essential memory and storage solutions, which are crucial for AI and cloud computing.

- Micron’s new 12-Hi HBM3E memory stacks offer 36GB capacity, 50% more than previous versions, enabling larger AI models and faster data processing.

- Micron benefits from strategic partnerships with NVIDIA and TSM, ensuring compatibility and enhancing its role in the AI-driven hardware space.

- Micron’s advanced memory technology meets the growing demand for AI hardware, positioning the company to thrive alongside industry leaders like NVIDIA.

- Despite of the great market positioning, set to benefit from the ongoing AI revolution, Micron Technology remains undervalued.

Just_Super

When we think of the ongoing AI revolution, one of the first (probably the first) businesses that comes to mind is NVIDIA (NVDA). Rightly so, the Company is an undisputed leader in the GPU environment, delivering cutting-edge processing hardware that facilitates the era of computing and AI training.

However, the hardware space is versatile and more complex than it may seem. While NVDA is the leading ‘shovel’ provider for the big tech concerns looking for a Holy Grail through ‘digging gold’, Micron Technology (NASDAQ:MU) facilitates the whole process by providing ‘barrows’ to store the results.

Returning to the current age, Micron specializes in Dynamic Random-Access Memory (DRAM), and flash memory (NAND), so basically storage and memory solutions that are crucial to not only mobile devices or personal computers but also large data centres working behind the scenes of cloud solutions and training large language models.

Therefore, widely recognised NVDA is not a direct competitor to Micron, leaving plenty of room for MU to reestablish its key role in the AI-driven hardware space, but there’s even more to that.

Micron Will Continue To Benefit From the AI Revolution, Especially Given Its Partnerships With NVDA

The dynamic development of the AI hardware, led by NVIDIA’s outstanding innovations (e.g., the upcoming GB200 from the Blackwell architecture), which continue to reshape the computing landscape, will support the demand for MU’s products, as the Company has a history of strategic partnerships with the market-leading NVDA.

Both companies can be considered interdependent in the broad AI-oriented hardware space, as NVDA creates the demand for MU, while MU facilitates NVDA’s solutions with state-of-the-art memory technology:

Micron formally announced its 12-Hi HBM3E memory stacks on Monday. The new products feature a 36 GB capacity and are aimed at leading-edge processors for AI and HPC workloads, such as Nvidia’s H200 and B100/B200 GPUs.

Moreover, as Tom’s Hardware (linked above) published:

Micron’s 12-Hi HBM3E memory stacks boast a 36GB capacity, 50% more than the previous 8-Hi versions, which had 24 GB. This increased capacity allows data centers to run larger AI models, such as Llama 2, with up to 70 billion parameters on a single processor. This capability eliminates the need for frequent CPU offloading and reduces delays in communication between GPUs, speeding up data processing.

In terms of performance, Micron’s 12-Hi HBM3E stacks deliver over 1.2 TB/s of memory bandwidth with data transfer rates exceeding 9.2 Gb/s. According to the company, despite offering 50% higher memory capacity than competitors, Micron’s HBM3E consumes less power than 8-Hi HBM3E stacks.

It’s also worth emphasizing that MU has benefited from its long-standing partnership with Taiwan Semiconductor Manufacturing Company (TSM), which ensures that its products are compatible with the packaging used for NVDA’s leading products.

Don’t Worry – The AI Hype Is Not Just A Story

And the best thing is that you don’t have to rely on my word. You can look at the data and the industry insight provided by the most prominent figures in the AI landscape.

The demand for hardware from the leading technological players building AI models remains optimistic and will continue to accelerate. Just take a look at some of the comments from Sam Altman or Satya Nadalla:

Blackwell offers massive performance leaps, and will accelerate our ability to deliver leading-edge models. We’re excited to continue working with NVIDIA to enhance AI compute. – Sam Altman, CEO of OpenAI

We are committed to offering our customers the most advanced infrastructure to power their AI workloads. By bringing the GB200 Grace Blackwell processor to our datacenters globally, we are building on our long-standing history of optimizing NVIDIA GPUs for our cloud, as we make the promise of AI real for organizations everywhere. – Satya Nadella, CEO of Microsoft (MSFT)

What’s more, let’s take it further and examine the demand for AI-driven solutions in business. Amazon (AMZN) has a very optimistic outlook:

We remain very bullish on the medium to long-term impact of AI in every business we know and can imagine. The progress may not be one straight line for companies. Generative AI especially is quite iterative, and companies have to build muscle around the best way to solve actual customer problems. But we see so much potential to change customer experiences.

The numbers that Microsoft records also paint a clear picture that AI movement is not present just in the media – it’s becoming an everyday environment for numerous businesses:

Now, on to future of work. Copilot for Microsoft 365 is becoming a daily habit for knowledge workers, as it transforms work, workflow, and work artifacts. The number of people who use Copilot daily at work nearly doubled quarter-over-quarter, as they use it to complete tasks faster, hold more effective meetings, and automate business workflows and processes.

Copilot customers increased more than 60% quarter-over-quarter. Feedback has been positive, with majority of enterprise customers coming back to purchase more seats. All-up, the number of customers with more than 10,000 seats more than doubled quarter-over-quarter, including Capital Group, Disney, Dow, Kyndryl, Novartis. And EY alone will deploy Copilot to 150,000 of its employees.

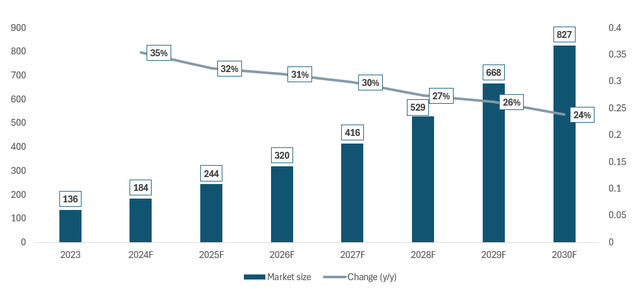

AI is not going anywhere. In fact, it will continue to increase its adoption across the globe, as Statista projects the global AI market size to grow at a CAGR of 29.4% until 2030 and approach $827B. Please review the chart below for details. Such dynamic growth projections may be hard to acknowledge, but numerous testimonies of adopting leading AI-powered solutions (e.g. Copilot) justify that ‘optimism’.

With strong demand for computing power and efficiency, the demand for earlier mentioned ‘shovels’ and ‘wheel trucks’ follows, leaving hardware providers well-positioned to capitalize on these trends. As Jensen Huang said in the latest CNBC interview:

Blackwell is as planned, and the demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.

Financial and Valuation Outlook

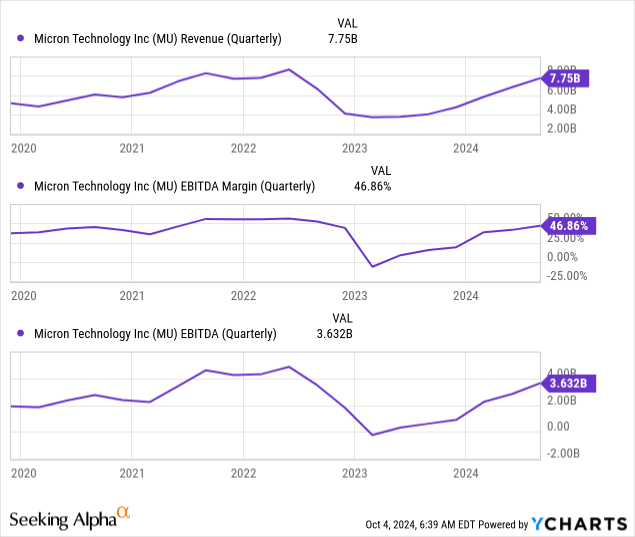

After recording poor performance in the first half of 2023 (in terms of low revenue and either lack or negligible profitability) due to the negative supply-to-demand relationship (oversupply issues), the Company’s financials returned on the right track.

MU has significantly rebuilt its revenue and restored its EBITDA margin to over 45%, which is likely to continue due to the positive demand and the best in history market position of MU:

We are entering fiscal 2025 with the strongest competitive positioning in Micron’s history. We have leadership 1-beta DRAM and G8 and G9 NAND process technology, and leadership products across our end markets. Robust data center demand is exceeding our leading-edge node supply and is driving overall healthy supply-demand dynamics.

As an M&A advisor (fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method that is a leading tool in transaction processes, as it allows for accessible and market-driven benchmarking.

I use this method because many investors fail to recognise a business’s value by concentrating too much on the stock price itself. This isn’t a reasonable benchmark, as one has to factor in changes in the business’s scale and the number of shares outstanding (due to buybacks or issues).

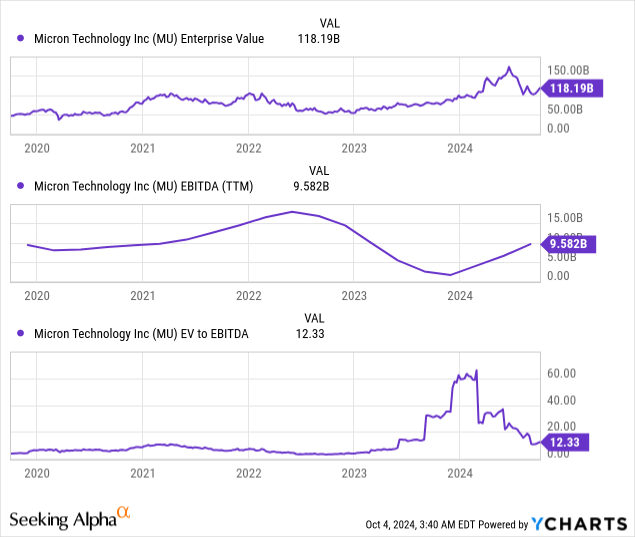

With that said, let’s take a look at the ‘rule-of-thumb’ multiple: EV/EBITDA.

As we can see, despite decreasing EBITDA in 2023, MU’s Enterprise Value continued to increase, driving the EV/EBITDA multiple to somewhat disturbing levels of as high as 60x. However, with the solid return of revenue and profitability, as well as the recent pullback of the stock price driving down the enterprise value, MU’s TTM EV/EBITDA went as low as 12-13x.

Given MU’s progressing improvement in financial performance and great positioning (mentioned above), the market expects even better results. Therefore, MU’s forward-looking EV/EBITDA stands at ~6x.

Let me tell you something. I’ve advised many businesses, including privately held ones, that were significantly smaller, had a weaker competitive edge, had worse products, and operated in less future-oriented industries. Still, many of them received offers for high single-digit and double-digit multiples. With that in mind, I believe MU currently offers significant upside potential resulting from its multiple expansion and further improvement of its financial stance, which is well-positioned to occur.

Investment Thesis And Risk Factors

I believe the market is sleeping on MU. To showcase that my ‘money’ is tight to what my ‘mouth’ says, I’ve recently put skin in the game – I am a shareholder of Micron Technology. For transparency, I haven’t taken a significant position, as I prefer to concentrate my tech-oriented portfolio on other players like NVDA or MSFT.

Nevertheless, I believe that MU is well-positioned to provide double-digit total returns to new shareholders. To briefly summarize my thoughts:

- I consider the challenges faced in early 2023 as temporary and overcome, as they were related to the oversupply that’s currently turning into undersupply

- MU is set to capitalize on the ongoing AI revolution and support leading players (like NVDA) on the road to taking the world into the next era

- The demand for AI-driving hardware is supported by the robust demand for AI solutions, which is reflected in the data that leading players like MSFT or AMZN keep on providing

- The AI revolution is more than just a story, as the numbers are already here, and I think it’s just the beginning.

Therefore, I am bullish on MU and consider it a ‘buy’.

However, one has to keep in mind that each investment comes with market and company-specific risk factors, which include:

- Failing to deliver in a timely manner and with sufficient quality

- Failing to uphold the competitive edge over other players

- Susceptibility to the economic environment, interest rates environment, business sentiment towards AI, and supply chain developments (incl. supply-to-demand relationship)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, NVDA, MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.