Summary:

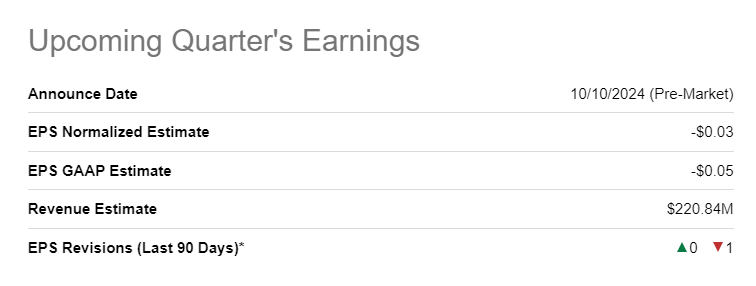

- Tilray is set to report its Q1 FY 2025 earnings on October 10th.

- I expect the Company to beat analysts’ estimates for revenue due to the high demand for cannabis in Germany, where it has a leading market share.

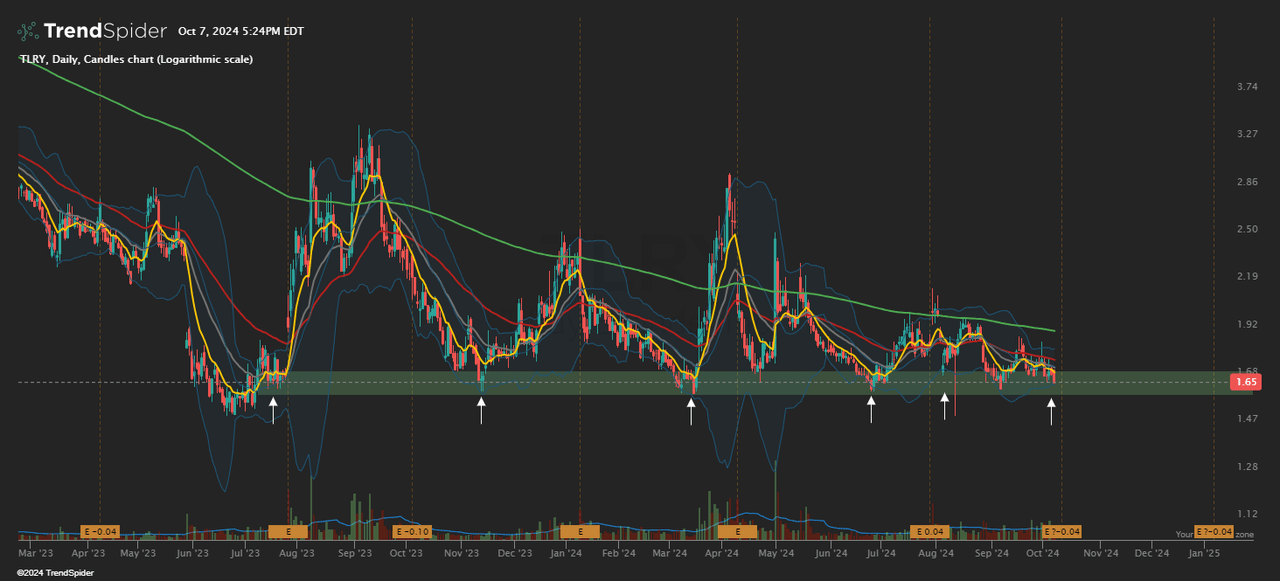

- TLRY is at a critical support level, from which it has historically rebounded to test the 200 EMA.

- My price target for Tilray is $4.20, representing 154% upside from its current valuation.

PromesaArtStudio/iStock via Getty Images

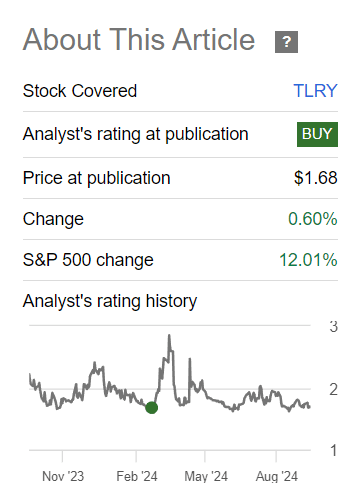

Last March, I initiated my coverage of Tilray Brands, Inc. (NASDAQ:TLRY) with a buy rating in light of Germany’s new cannabis law which made it easier for patients to receive medical cannabis products. While the stock shot up momentarily following my initial coverage, it is now trading at the same level as it was back then.

Seeking Alpha

With Tilray reporting its FY 2025 Q1 earnings on October 10th before market opens, I believe the stock has a compelling risk to reward profile at its current valuation. As is, I expect the company to beat estimates due to the high demand for cannabis in the German market. Considering that the stock is trading at a major support level, I’m reiterating my buy rating for Tilray with a price target of $4.20, implying 154% upside from current levels.

Record Revenues Could Be Ahead

For Q1 2025, analysts expect Tilray to report revenues of $220.84 million and a GAAP EPS of -$0.05.

Seeking Alpha

While the revenue estimates imply YoY growth of 24.8%, I believe Tilray has the potential to generate significantly higher revenues. As I mentioned in my previous coverage, Tilray has a leading presence in the German cannabis market, with an estimated share of 25%. This factor alone could help the company beat analysts’ estimates, considering the current conditions of the German cannabis market.

The German medical cannabis market is now lenient, as patients only need to attend a short initial consultation with their doctor to receive a purchase certificate that allows them to purchase cannabis from their local pharmacy. Currently, several companies are offering these consultations that can take as little as 10 minutes. At the same time, patients can secure cannabis prescriptions for conditions such as sleep problems, stress, ADHD, and chronic pain, which makes cannabis easily accessible in Germany.

In an interview conducted last month, Demecan’s managing director, Philipp Goebel, shared that cannabis demand has increased significantly since the reclassification of cannabis on April 1st, stating that “Every gram we have is basically sold out”. The reason for this high demand in Germany is due to the prices of legal cannabis products, which are sold at attractive prices, rivaling the black market. This indicates that the legal cannabis market in Germany could be more efficient than the Canadian market, which is a positive sign in case Germany outright legalizes recreational cannabis use in the future.

Moreover, IM Cannabis Corp.’s (IMCC) German subsidiary reported a preliminary 50% revenue growth during its Q3 FY 2024 due to high demand since the reclassification of cannabis in Germany. This high demand allowed IMCC’s German subsidiary to sell CAD3.5 million worth of cannabis products during this period. This is further supported by Tilray’s management as they shared in the Q4 FY 2024 earnings call that the company saw a 65% increase in sales during the quarter since the reclassification of cannabis.

Valuation

Given the significant growth opportunity in the German market, I believe Tilray is extremely undervalued at its current valuation. With a share price of $1.65, Tilray has an EV of $1.4 billion which translates to an EV/sales multiple of 1.46, at the midpoint of management’s FY 2025 revenue guidance between $950 million to $1 billion, compared to a sector median of 3.66. Accordingly, my price target for the stock is $4.20, representing 154% upside from its current valuation.

|

Revenue |

$975,000,000 |

|

EV |

$1,419,764,899 |

|

EV/Sales |

1.46 |

|

Target Multiple |

3.66 |

|

Implied EV |

$3,568,500,000 |

|

Net Debt |

$28,878,000 |

|

Equity Value |

$3,539,622,000 |

|

OS |

842,961,757 |

|

Price Target |

$4.20 |

|

Share Price |

$1.65 |

|

Upside |

154% |

Technical Analysis

The TrendSpider chart above shows that Tilray is currently in a demand zone on the daily timeframe for the sixth time since July 2023. Considering that the stock has always rebounded from this zone to test the 200 EMA, it is likely that Tilray’s could replicate this trend when it reports its Q1 earnings on October 10th. In that case, the stock could have 15% upside in the short term, as the 200 EMA is currently near $1.9.

Risks

The main risk to my bullish thesis on Tilray remains to be dilution. At the time of my last coverage, the company had 742.7 million shares outstanding, which has ballooned to 842.9 million as of July 25th. With that in mind, it is likely that Tilray has issued more shares following its latest acquisition of craft beer brands and breweries from Molson Coors (TAP). In addition, the company is looking to increase its authorized shares from 1.208 billion to 1.426 billion in the upcoming shareholder meeting on November 21st.

Conclusion

In conclusion, I’m bullish on Tilray ahead of its Q1 earnings on October 10th. The company’s leading position in the German medical cannabis market could allow it to see substantial revenue growth and beat analysts’ estimates following the latest results and insights of IMCC and Demecan. Moreover, the stock appears to be at a critical support level, from which it has historically rebounded to test the 200 EMA. In light of this, I’m reiterating my buy rating for Tilray with a price target of $4.20, implying 154% upside from current levels.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.