Summary:

- Micron Technology’s fiscal 2024 results have sparked interest, but I remain skeptical due to the company’s cyclical financial history.

- Despite AI-driven demand, there isn’t a compelling reason to think that this will prove to be more than just another cycle for this business.

- Lacking clear leadership in the DRAM and NAND markets, this increases downside in the event of a cyclical turn.

- I rate Micron a Hold, awaiting a market cap closer to $55B, which I think more accurately reflects a moderate case for the business.

Deagreez/iStock via Getty Images

Micron Technology (NASDAQ:MU) has been making rounds recently upon the release of its fiscal 2024 results. Many are hailing it as the latest Buy to ride the AI boom.

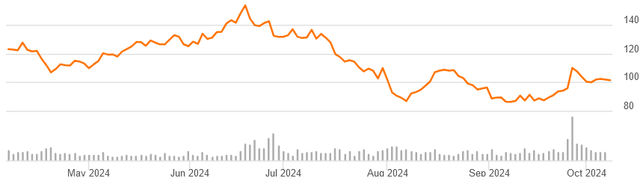

MU 6M Price History (Seeking Alpha)

This also happens on the backdrop of a dip from the stock’s recent peak of about $150 per share in the late spring. Sitting around $101 as I write this (for a market cap of $113 billion), many feel that the recent results and valuation create an opportunity.

I remain skeptical. While upside exists for AI, I believe the financial history of Micron shows cyclical risks that complicate these optimistic growth assumptions. For those reasons, I rate MU a Hold until a better valuation presents itself.

Financial History

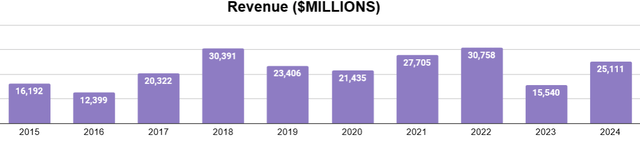

As one reviews Micron’s financial results over time, they might conclude that it could be a poster child for the cyclical stock. Consider revenues over the past decade.

They seem to rise and fall, almost on schedule. The sharpest price declines occur in fiscal years (ending August/September) 2016, 2019, and 2023. There’s a pattern to this.

2016 Form 10K (pg. 31):

Total net sales for 2016 decreased 23% as compared to 2015 primarily due to lower CNBU, MBU, and SBU sales as declines in average selling prices outpaced increases in gigabit sales volumes.

2019 Form 10K (pg. 32):

Total revenue for 2019 decreased 23% as compared to 2018 primarily due to pricing declines resulting from the challenging memory market environment in 2019. Sales of DRAM products for 2019 decreased 28% as compared to 2018 primarily due to declines in average selling prices of approximately 30% resulting from supply and demand imbalances, customer inventory corrections, and CPU shortages. Sales of NAND products for 2019 decreased 12% as compared to 2018 primarily due to declines in average selling prices in the mid-40% range resulting from supply and demand imbalances, which were partially offset by significant increases in sales volumes.

2023 Form 10K (pg. 46):

- Sales of DRAM products decreased 51% primarily due to a high-40s percent range decline in average selling prices and decreases in bit shipments in the high-single-digit percent range.

- Sales of NAND products decreased 46% primarily due to a low-50s percent range decline in average selling prices partially offset by increases in bit shipments in the high-single-digit percent range.

The pattern is a lack of pricing power that rears its head at each cyclical peak. It isn’t volume; it’s price. In some cases, they even report significant increase in volume but still absorb a massive hit to revenue.

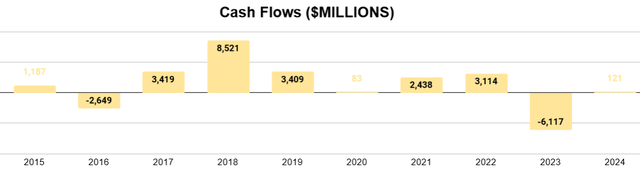

If we look at the impact to free cash flow, the result is even more exaggerated. Curiously, the peak of FCF was in 2018 at $8.5B. The annual average for the decade was $1.35B. With fiscal 2024 ending a year into the AI boom that took off in the summer of 2023, FCF narrowly broke even.

In 2023, management disclosed their “2023 Restructure Plan,” whose main feature was to reduce company headcount by 15% prior to the end of calendar 2023. In their 2024 Form 10K (pg. 47), they disclosed it was accomplished:

The 2023 Restructure Plan, which was substantially completed in 2023, yielded estimated cost savings of approximately $130 million per quarter (approximately 60% in cost of goods sold, 30% in R&D, and 10% in SG&A) subsequent to 2023.

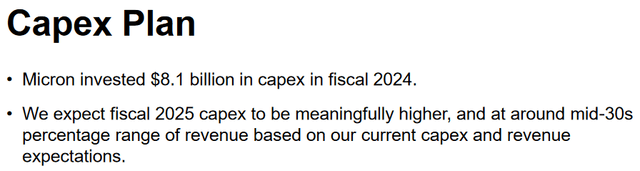

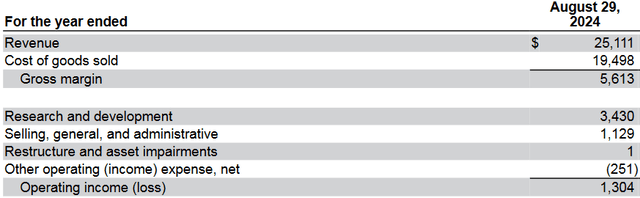

Income Statement (2024 Form 10K)

In spite of these efforts, operating expenses between 2022 and 2024 are still up.

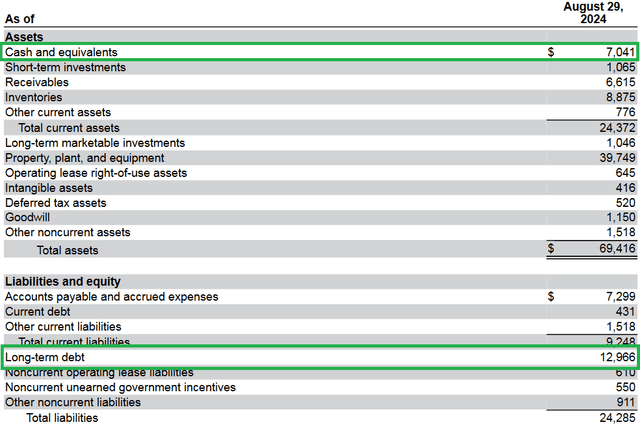

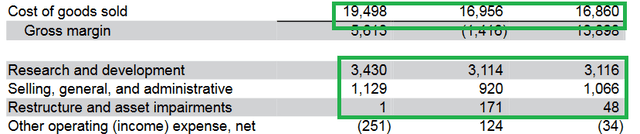

The good news is that Micron has avoided too much leverage, given its cyclical nature, and it only sits on about $13B in long-term debt, against $7B in cash.

2024 Form 10K

They have also staggered this out across many years, with the nearest maturity being in 2026. Overall, it’s a healthy balance sheet to make up for the volatile earnings.

Future Outlook

The question looming in my head is: What makes Micron worth $113B on the market right now? For that valuation, I would want to see that the business can at least earn $11B each year. Whatever my Discounted Cash Flow calculation would be, I’d at least want to feel certain that it can do that.

If it does not yet earn that much (and FCF has never exceeded $8.5B), then I have to ask myself what will get it there.

Income Statement (2024 Form 10K)

Let’s just look at current expenses. Outside of cost of goods, there’s only about $4.5B for improvement here. Most of this is R&D, and cutting back on this will likely make their productive less competitive, so I don’t see this declining or staying flat very easily. They also already just reduced their headcount by 15%. I suspect getting that number lower would prove difficult.

Revenue could grow to about $36B. As cost of goods would also rise, it’s more likely revenue would need to reach $46B to produce a gain of $11B. Pricing would need to outpace cost of goods, and then it would need to maintain these financial improvements over a prolonged period of time, defying cycles.

In the Q4 2024 earnings call, Vice President Manish Bhatia spoke to the boosted demand for AI servers:

And then, of course, the growth in AI servers is expected to be strong this year, strong next year. We don’t see any kind of change in that expectation that we have provided over the last couple of quarters. For 2025, definitely that momentum in AI continues. And of course, we have a lot of improvement in our competitive positioning in the server arena.

Perhaps revenues will be up for a couple of years as customers need their hardware to build out their AI servers. That’s not different from the cyclical pattern we have tended to see here. Once AI servers are built out, that zero-to-one rise ends, and data centers will be looking to minimize capex into the future. I think we need to allow for the possibility that demand will plateau for a bit until customers truly need expanded infrastructure.

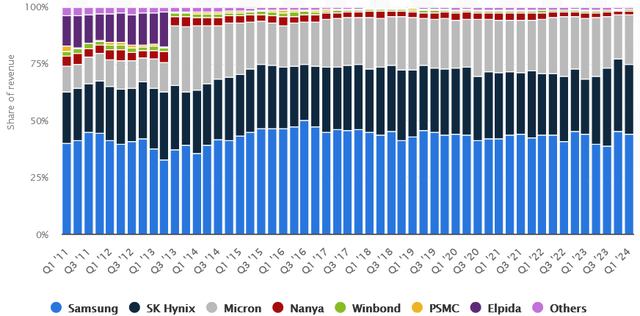

Against such possibilities, Micron is third in the DRAM market, behind Samsung (OTCPK:SSNLF) and SK hynix (OTCPK:HXSCF).

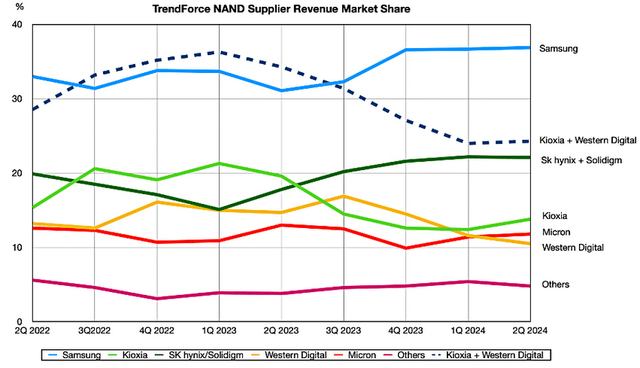

NAND Market Share (blocksandfiles.com)

They are also fourth in the NAND market share, their other main product line. These are typically not desirable places to be whenever pricing wars for margin advantages break out, whatever the industry. If industry demand should slow, Micron seems like to have pricing problems all over again.

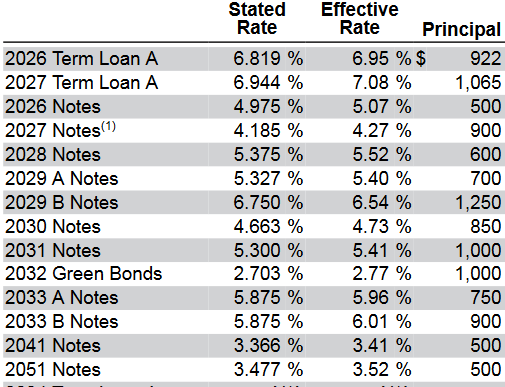

Keep in mind that management also projects capex to increase by over 30% for the next year. This will reduce free cash flow that could be gained from boosted revenues by at least $2.5B. 2022’s capex was also $15B, so it is conceivable that it could always be much higher, as that’s the nature of a cyclical.

Where Nvidia (NVDA) and AMD (AMD) have seen improved financial performances from AI, it’s because they have a superior product that is under-supplied and is priced at attractive margins. Even before AI, their GPU products led their niche markets. Companies like Micron sit farther down the AI line and lack a similarly compelling advantage.

If a company that averaged $1.35B in FCF for the previous decade could average $5.5B for the next (just half of $11B), then I would find that to be very impressive. I wouldn’t buy it at a market cap of $113B, though.

MU 10Y Market Cap (Seeking Alpha)

If history has shown us anything, it’s that the market cap has been much lower, even after the recent dip, even during years of higher FCF. That’s why I’d at least want a price of $55B before I considered buying.

Conclusion

Micron is courting increased demand in the face of AI-driven expansion of data centers and servers. With this has come a rise in a share price over time, even with a recent dip. In my view, nothing sufficiently demonstrates that this will be more than just another cycle for Micron, especially as not all of its product is for AI and as management is giving guidance for a timeline of a cycle.

It’s not a terribly risky business. The balance sheet is fine. There is some basis for generally increased revenue throughout the decade. It’s not a market leader, but Micron also isn’t the runt of the pack.

$113B is a market cap that imagines few setbacks in the future and plenty of good news, something Micron isn’t known for accomplishing. Otherwise, previous Forms 10K would have told us, “Revenues remained strong as our superior products enjoyed robust demand, while competitors experienced decreased volumes.” MU needs another dip, and I’ll be interested when it’s closer to $50 instead of $101. Until then, I think the shares are better treated as a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.