Summary:

- Bitfarms has experienced significant changes, including a hostile takeover attempt by Riot Platforms, a new CEO, and a board shakeup since mid-May.

- The company mined 703 BTC in Q3, with 242 BTC added to their treasury, totaling 1,147 BTC worth $71.1 million.

- With major overhangs seemingly resolved, it’s an opportune time to reassess Bitfarms’ investment thesis.

- Dilution remains an ongoing concern.

peshkov/iStock via Getty Images

To call it an ‘unusual’ summer for Bitfarms (NASDAQ:BITF) would likely be an understatement. Here’s a list of the things that have happened since I last covered the stock in mid-May:

- A hostile takeover attempt by mining peer Riot Platforms (RIOT)

- Ben Gagnon became the company’s 4th CEO since 2022

- A Board of Directors shakeup

- The company bought Stronghold Digital Mining (SDIG) in a stock-for-stock merger

When I covered BITF back in May, I specifically mentioned the leadership question marks going forward as a cause for concern. Those concerns have been mitigated. In my opinion, Gagnon is a good choice for CEO given his previous role as the company’s Chief Mining Officer and his CEO experience prior to joining Bitfarms. In addition to that, Bitfarms announced the company reached a settlement with former-CEO Geoffrey Morphy.

While the Riot takeover attempt was not something that was on my radar in mid-May, I do think the short-term conclusion of that fiasco is a good thing. I suspect most of the major overhangs for BITF shareholders are presumably in the rearview mirror. Thus, I think it’s a good time to revisit the thesis for BITF. In this update, we’ll look at recent production numbers, stock performance versus peers, and valuation considerations.

Q3 Production & Mining Data

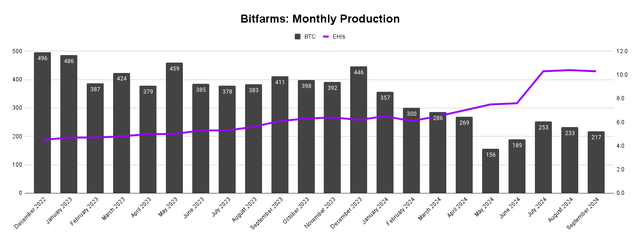

Monthly Production (Bitfarms, Author’s Chart)

Between July and September, Bitfarms mined 703 Bitcoin (BTC-USD) at an average of about 10.3 EH/s during the quarter. Approximately 242 of those coins have been ‘banked’ via the company’s BTC treasury holdings.

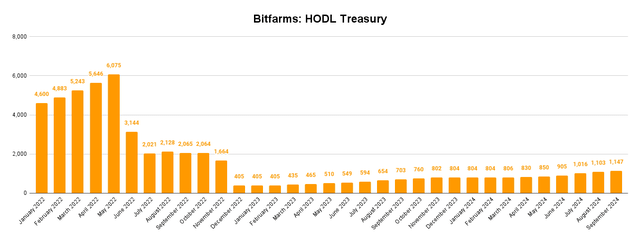

Monthly BTC Holdings (Bitfarms, Author’s Chart)

Currently, Bitfarms’ 1,147 BTC stack has a market value of $71.1 million. This is in addition to the $73 million in cash the company reported having at the end of September. Mining economics are still a concern for all Bitcoin miners:

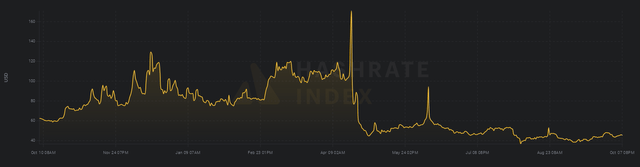

Bitcoin’s USD Hashprice (Hashrateindex)

The average USD-denominated hash price so far in October has been about $44.50 per PH/s. This is an important metric for Bitcoin mining stock shareholders to reference because it shows the broad profitability of the industry. While the USD hash price is off the August low of $35, the industry is still clearly feeling the impact of April’s block reward halving.

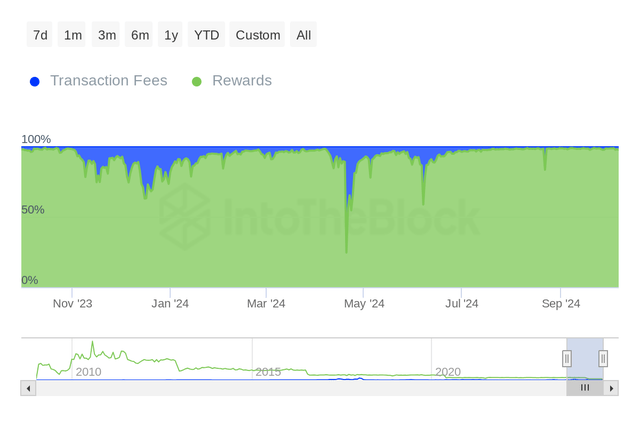

Miner Reward Distribution (IntoTheBlock)

Transaction fees have simply not been a meaningful driver of revenue for Bitcoin miners over the last three or four months. Despite what I view to be obvious fundamental issues for the industry broadly, Bitfarms stock specifically has been a laggard among public equity miners since the beginning of the year.

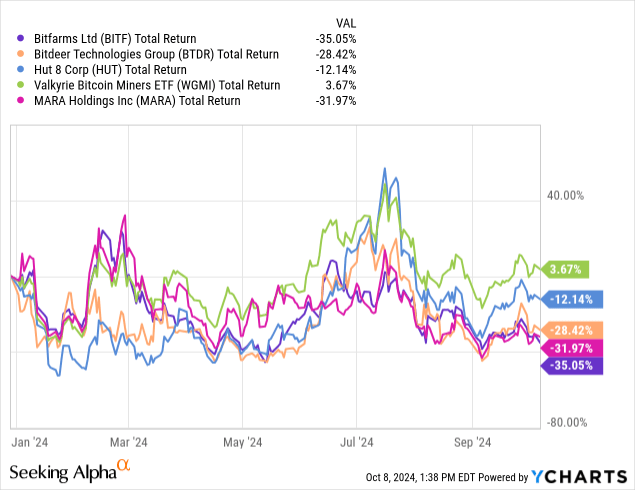

BITF Performance vs Peers

It’s been a mixed bag for the mining industry since the start of the year, in the chart below I’m showing Bitfarms against similarly sized peers by market capitalization, Marathon Digital (MARA), and the Valkyrie Bitcoin Miners ETF (WGMI):

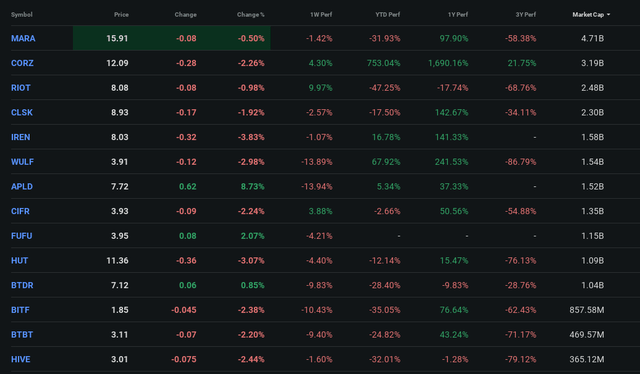

Of our sample, BITF has performed the worst at a 35% year to date loss. MARA is somewhat close at a 32% loss. RIOT has actually been the worst YTD performer in the space of any company with at least $100 million in market capitalization.

Mining Stock Performances (Seeking Alpha)

BITF’s year to date performance comes in second worst after RIOT. I suspect the failed takeover attempt has hurt RIOT shareholders more than BITF shareholders to this point due to the fact that RIOT has piled so much capital into BITF shares as part of the company’s takeover plan. However, there is certainly an AI/HPC angle on display here as well. The out-performance of WGMI is very interesting and likely indicative of the market rewarding Bitcoin miners that have prioritized HPC efforts over just Bitcoin mining business lines. I explored this a bit more in my recent WGMI article from September:

At least five of the top seven companies in the fund are openly trying to build an HPC/AI compute segment in addition to BTC mining. Furthermore, the top company in the industry by market capitalization is only the 8th largest holding in the fund. Thus, it would appear that a bet on WGMI is becoming just as much of a play on HPC data centers as it is Bitcoin miners.

For Bitfarms, the commitment to new revenue streams outside of Bitcoin mining was hinted at earlier this summer. And doubt about that now seems to be a thing of the past based on recent comments from Gagnon:

We remain focused on diversifying the business beyond Bitcoin mining into exciting and synergistic new areas like energy generation, energy trading, heat recycling and other high value revenue streams like HPC/AI.

My read on the situation is essentially this; Bitcoin miners have increasingly realized it takes AI/HPC commitments to move the needle on share price. Since most of these companies generally raise capital through dilution, higher share prices are a benefit to existing shareholders as it minimizes growth in shares outstanding. Now that Bitfarms is more overtly signaling HPC intentions, I believe the market will regain interest.

Valuation & Breakeven Price

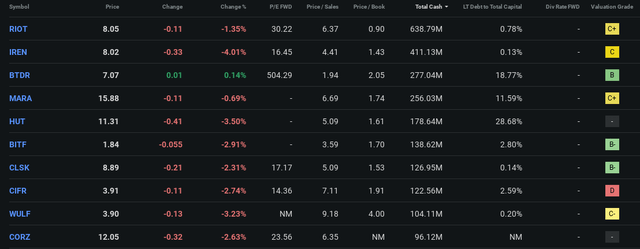

Miner Valuations (Seeking Alpha)

From a valuation standpoint, I would actually say BITF is on the cheaper side relative to peers with similar liquidity, though there may be good reason for that. Of the top ten public mining companies ranked by recently reported cash holdings, Bitfarms trades at the second-lowest price to sales multiple and is competitive in both P/B and long term debt to total capital. The company has the 8th largest HODL stack should BTC liquidity need to be accessed.

Going forward, I think shareholders really need to see efficiency metrics improve if Bitfarms is ever going to return value to shareholders as a business. In the table below, I’m showing two years of quarterly break-even price data based on (COGS + Opex) divided by BTC mined:

| Cost of Revenues | Total Opex | BTC Mined | Break-even Price | |

|---|---|---|---|---|

| Q3-22 | $37,200,000 | $10,300,000 | 1,515 | $31,353 |

| Q4-22 | $39,100,000 | $12,000,000 | 1,435 | $35,610 |

| Q1-23 | $38,400,000 | $8,400,000 | 1,297 | $36,083 |

| Q2-23 | $41,500,000 | $12,200,000 | 1,223 | $43,908 |

| Q3-23 | $43,500,000 | $8,400,000 | 1,172 | $44,283 |

| Q4-23 | $44,500,000 | $10,400,000 | 1,236 | $44,417 |

| Q1-24 | $42,500,000 | $13,200,000 | 943 | $59,067 |

| Q2-24 | $52,800,000 | $12,400,000 | 614 | $106,189 |

| TTM | $183,300,000 | $44,400,000 | 3,965 | $57,427 |

Source: Seeking Alpha, Bitfarms, Author’s Calculations

We can see the long-term trend has been a rising break-even price. The Q2 figure is highly alarming as it takes a $106k BTC price for Bitfarms to breakeven judging from the post-halving data that we have at our disposal. We’ll likely get a much better idea of how the company’s mining breakeven is progressing when we see the company’s Q3 earnings report. But I’m admittedly not expecting much improvement there based on the comparable number of BTC mined to Q2 and what I’d imagine is a much higher COGS figure based on monthly EH/s numbers between July and September.

Closing Thoughts

Raising capital via the ATM and diluting shareholders can’t be the only way this company survives long term. At a certain point, the business will have to be self-sustaining or there is very little reason to hold shares in the company’s equity. Given that, as a long-term investment, I still can’t get there on BITF. Perhaps if the company can legitimately build out a meaningful HPC business line, I’ll entertain changing my mind.

However, as a short-term trade, I think there is possible upside to taking a position here if one expects the price of BTC to rise. And I do expect BTC to increase in price between now and the end of the year. The best ways to express that thesis would perhaps be owning BTC directly, spot ETFs, or through a leveraged proxy like MicroStrategy (MSTR). But beyond that, the miners historically offer significantly larger short-term returns if traders can time their moves well.

I expect the price of BTC to rise and yield a higher USD-denominated hash price. That’s typically good for mining equities. Riot Platforms is sort of trapped in its sizable BITF investment while takeover talks have hit a standstill through Bitfarms’ 2026 Annual Meeting. Given Riot’s position as a major holder, the company likely can’t sell out now as it would depress the price and run counter to its own interests. Finally, judging by the resurgence in NVIDIA (NVDA) stock over the last month, the market still loves a good AI story. We can now add BITF to the long list of Bitcoin miners-turned HPC data center builders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BTC-USD, BITF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not an investment advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.