Summary:

- As great as Photoshop was and is nothing transformed Adobe’s bottom line as powerfully as did its greatest “innovation” – Software as a Service.

- From a certain perspective, one could argue that the Ironsource merger was a defensive move, they needed the cash. But from another perspective, Ironsource unlocks additional levers to drive growth.

- What Adobe lacks in revenue growth it more than makes up for with its gross margins which are best in class.

- I like Unity and I like Adobe, both companies provide powerful software and have strong competitive moats. But which is the better buy?

standret/iStock via Getty Images

Introduction

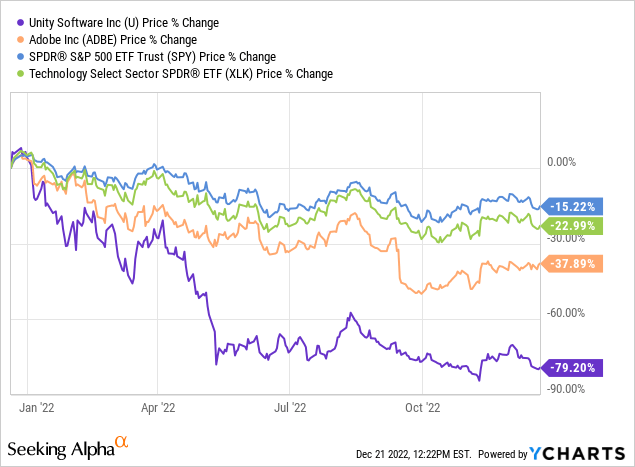

Hello everyone and happy holidays, in today’s article I’ll be comparing and contrasting two creative SaaS juggernauts, Unity Software (NYSE:U) and Adobe (NASDAQ:ADBE). Given the ongoing weakness in technology, I feel that now is a great time to reassess both companies in terms of strategy and valuation.

Adobe, now a household name, creates the tools artists, videographers, and editors use daily to edit and create content, some of their most popular products include Premier and Photoshop. Like Adobe, Unity creates software for creators but, unlike Adobe, most of its tools are aimed at 3D creation, especially video games, whereas Adobe has a much stronger offering in the 2D realm.

Apart from poor stock price performance, both companies have been in the news for another reason. Acquisitions. Earlier this year Adobe announced the acquisition of Figma for $20B, their largest acquisition to date. And Unity as I wrote about a couple of months back merged with Ironsource (IS).

In this article, I will provide my commentary as to the reason why I suspect these companies have had their share prices punished so hard. And provide a prediction as to where I believe these companies will go in the future based on their strategy and valuations. Finally, I will present to you which company I believe is the better buy in this environment.

Figma and Ironsource: Defensive Acquisitions?

Unity and Adobe have both become staples within their industries. If you are in digital art, chances are you use photoshop, if you are an indie developer chances are you use Unity.

But, it’s one thing to make it to the top, but it’s another thing to stay there and to build a “moat” around your business.

In the world of technology, to maintain your competitive advantage (and pricing power), you have to innovate. In my opinion, in no other industry is innovation moving as fast as it is in information technology.

So how have Adobe and Unity fared in the realm of innovation?

Adobe and Figma

Let’s start with Adobe, a company a bit older than Unity, founded in 1982, Adobe’s tools were truly innovative at the time. Its photo editing tools became ubiquitous in the industry, to the point where “photoshopping” became a verb not just a niche tool for creatives. Over the following years, Adobe launched a number of additional services, including Premiere for video editing.

As great as those product offerings were, nothing transformed Adobe’s bottom line as powerfully as did its next “innovation”…

Software as a Service

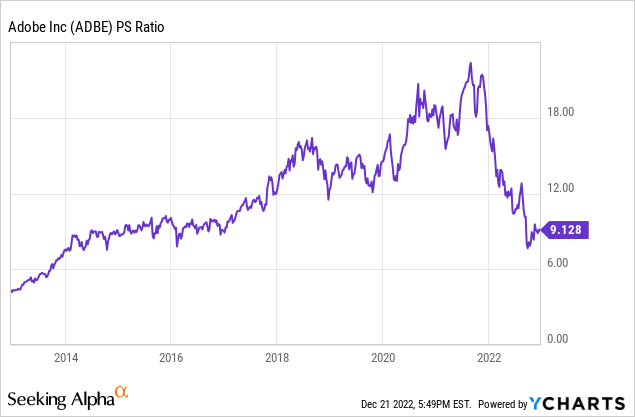

When you can convert a one-time lumpy sale into a predictable stream of cash flows, Wall street will reward you handsomely. Such is the reason, in my view, why Adobe has seen such strong multiple expansions over the past couple of decades. Investors simply love predictability.

And that worked for some time, the proof is in the stock price as shares moved from ~$35 in 2010 to ~$350 a decade later. But as financial innovation took the front stage, technological innovation began to slow…

For whatever reason, maybe hubris, Adobe was late to the start of the next major technological innovation… cloud computing.

You see, Adobe’s products were not born “cloud-native”, yes Adobe has been increasingly moving its products to the cloud and enabling various functionalities, but it was not “born” in the cloud. So to compete Adobe began moving some features to the cloud. But moving those features to the cloud, while enjoyed by others, frustrated a number of their legacy customers who enjoyed the traditional service and grew frustrated by the additional complexity and increased cost.

In an attempt to please everyone, Adobe missed the mark and competitors rose to satisfy unmet customer needs.

And where did they look? In some cases, especially for those looking for cloud-native collaboration tools, it was Figma.

If you’re interested in something more in depth you can read more about Figma here, but for the purposes of this article, all you really need to know is that they enable real-time collaborative design software as a cloud-native service.

In my opinion, had Adobe stayed away, Figma would have continued to be a great stand-alone company as they were profitable and taking massive share. I’m not sure that the same can be said about Adobe, when you have a competitor growing at the speed Figma was growing, if you don’t take action it could severely threaten your business in the long run.

From the outside looking in it appears that Adobe realized exactly that threat.

So they acquired Figma at a HEFTY price. A 50x price-to-sales ratio.

BOY OH BOY.

The last time I heard 50x price to sales was at the height of the software stock rally in 2020/2021. Hearing 50x sales in 2020 is almost laughable, even 50x earnings is laughable now.

Was it the right decision?

Time will tell…

But did Adobe have a choice? I’m not so sure, the Figma acquisition may have truly been an eat-or-be-eaten situation for Adobe.

Unity and Ironsource

If you’d like to learn more about Unity’s merger with Ironsource I would suggest you read my full article on the matter here. But let me at least give you the context you need to understand my argumentation here within this article.

Unity, though growing fast, bleeds cash.

Developing real-time 3D editing software from the ground up takes time, and can be quite expensive. When rates are at zero, the market is more than happy to finance any and all growth stories. It was near the peak of that exuberance when Unity acquired Peter Jackson’s Weta Digital to expand from gaming into VFX. A novel idea, one which I still support, but to continue developing these long-term projects, money-losing projects Unity needed funding. Its largest competitor, Epic, had Fortnite to help it fund unreal.

But what did Unity have?

Not much. And that’s where Ironsource comes into play…

Ironsource with its profitable ad mediation platform can serve as the fuel Unity needs to burn to keep the engine running.

From a certain perspective one could argue that the Ironsource merger was a defensive move, they needed the cash.

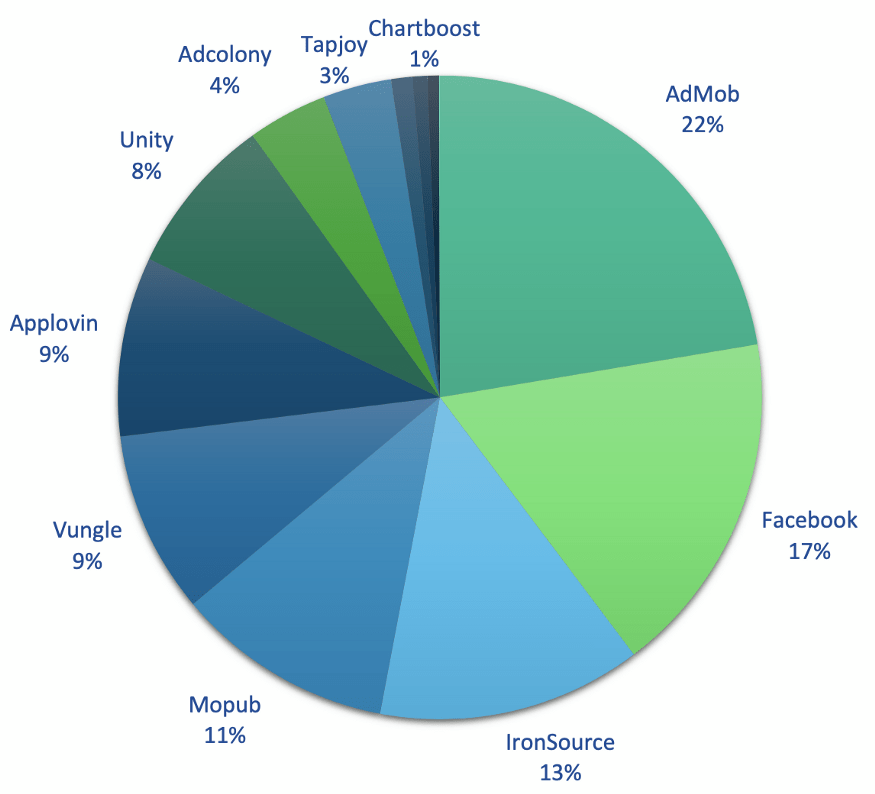

But from another perspective Ironsource unlocks additional levers to drive growth. Combining Ironsource’s ad mediation software with Unity’s transforms them both from small players in a competitive market to a force large enough to rival giants like Alphabet (GOOG) and Meta (META).

Ad Mediation Marketshare (Soomla 2019)

Recession Risk

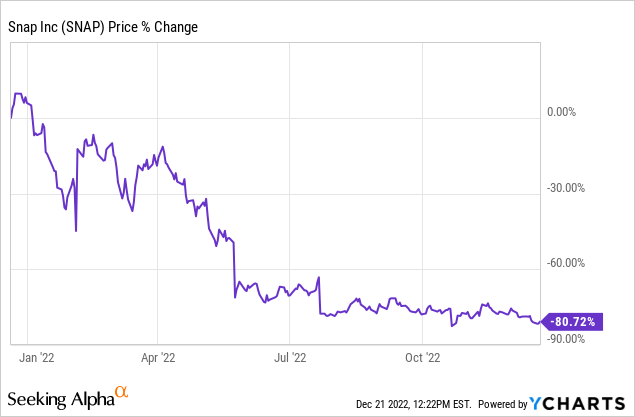

Unfortunately for Unity, it’s also been hit by a major slowdown in the ad sales market. Few companies have been hit harder than Snapchat (SNAP), which is almost exclusively reliant on ad sales. Just take a look at its stock price performance after earnings did not live up to prior expectations.

When companies begin to fear a recession they will pull back on ad-spend, that much is clear. Unity and Ironsource suffer from the same challenges. But ultimately that does not change the long-term growth story. Recessions come and go, and the US is one of, if not the, most resilient economies in the history of the world. So, once we put recessionary fears to bed, either through a soft landing, or going through the recession the old fashioned way, I expect ad revenues to skyrocket back to historic levels… and then some.

In the intermediate term, Unity just needs to weather the storm (ideally with minimal dilution).

Luckily for Adobe, they don’t share the same challenges Unity faces, as they are already a highly profitable business, and only have minimal exposure to the ad market.

On the note of dilution…

In tandem with its announced all-stock merger with Ironsource, Unity announced a convertible bond placement of $1B to fund share price repurchases once the deal closes to help offset dilution.

On one hand, this is a welcome development, as interest rate fears sucked liquidity out of the market and led to a sharp decline in Unity’s share price. But on the other hand, should the bond convert in the future that’ll only exacerbate the dilution it was intended to correct.

Given the structure of the convertible bond, the share price would have to appreciate from where it is now to $48.89 per share by 2027 to convert. So no, this move isn’t some sort of magic bullet, but it may provide some intermediate share price support for suffering long-term investors (such as myself).

Financials

Now that we are all up to speed with the facts on the ground I’ll shift your attention to the financial performance of those companies which will ultimately lead into my valuation. The key metrics I’d like to highlight today are revenue growth and gross margins.

Revenue Growth

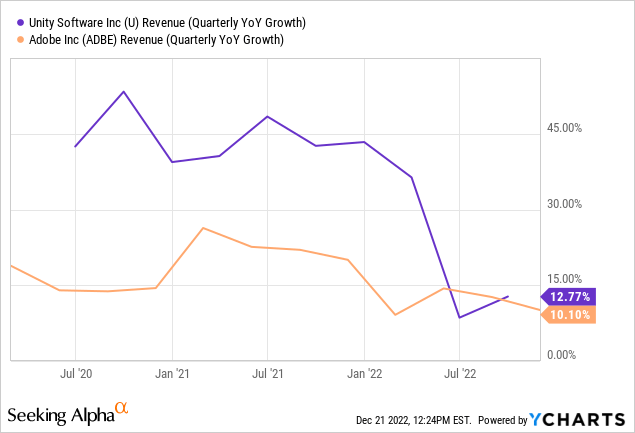

Taking a look at the quarterly YoY revenue growth rate we can see that Unity had trended in the high 30’s range prior to the sharp slowdown in ad sales we have experienced in 2022. Despite that sharp dropoff in ad sales Unity’s revenue growth rate still exceeds that of Adobe, which has trended in the low double digits for the past couple of years. In the most recent earnings call Unity CEO John Riccitiello shared that its create solutions grew revenues by 54% YoY, while part of this is a result of inorganic growth a large portion is organic. Despite macro weakness Unity’s CEO is still forecasting sustainable 30% revenue growth (as of the latest earnings call).

Despite recent weakness I believe that Unity takes the cake in terms of revenue growth as they have greater prospects for the future.

Gross Margins

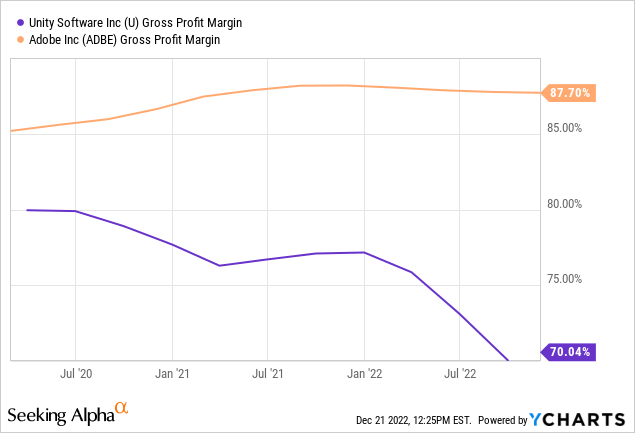

What Adobe lacks in revenue growth it more than makes up for in gross margins. With gross margins reliably in the high 80’s nearly each additional dollar in revenue generated converts in gross profit, few businesses in the world sport gross margins as high as those at Adobe. Unfortunately for Unity, gross margins have been moving in the wrong direction; they were once at 80% but have drifted down to 70%, still impressive compared to your average company, but lackluster compared to SaaS companies like Adobe. Going forward I would expect margins to stabilize in the high 70’s low 80’s for Unity as they continue to invest in growing in adjacent verticals like VFX taking into consideration the enhanced profitability stemming from its Ironsource merger.

Valuation

Since Adobe is such a mature, cash flow generative company and Unity is a leaner and faster growing company I will employ two different methods to value them. For Adobe I will employ a discounted cash flow model, and for Unity I will use a price to sales comparison. Let’s start with Unity…

Price to Sales

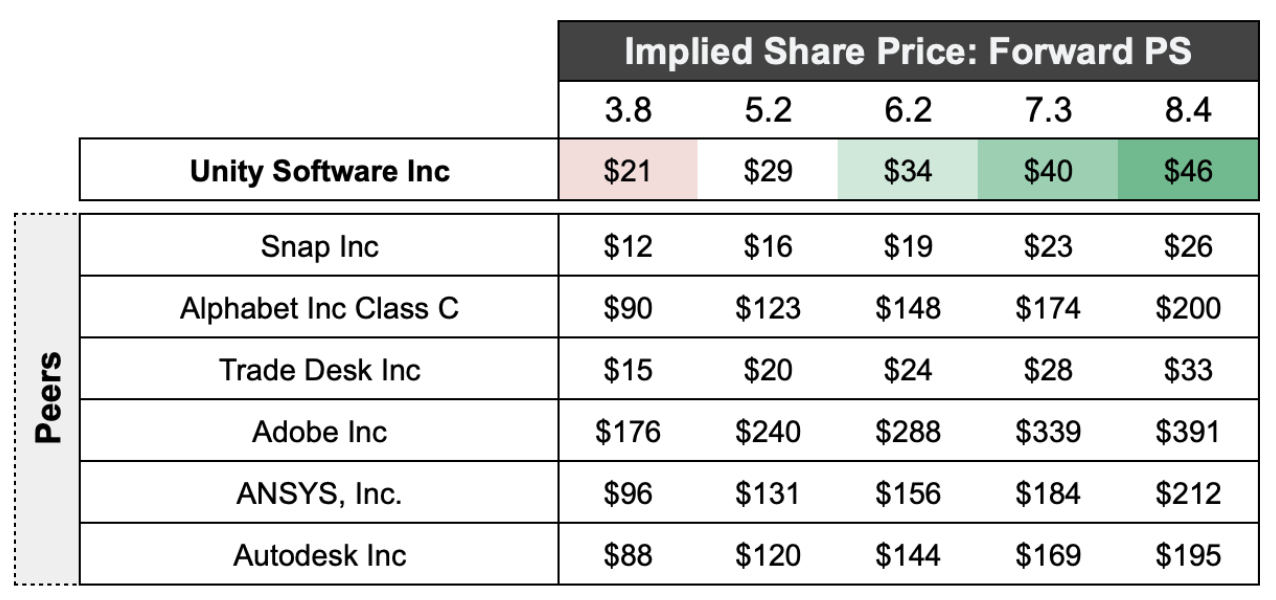

Understanding that Unity primarily earns its revenues from two sources, create solutions, and operate solutions, with the former being more akin to SaaS business model, and the latter closer to an ad sales model, I selected a variety of companies similar to either Unity’s “create” or “operate”. I ultimately selected 6 companies, 3 for Create: Adobe, Ansys (ANSS), and Autodesk (ADSK) and 3 for Operate Snap, Google, and Trade Desk (TTD).

After I identified the relevant peers I sourced the analyst expectations for revenue in 2023 and compared that against their current market caps. The results were as follows:

|

Company |

Market Cap ($B) |

2023 Revenue Est.($B) |

Next Year P/S |

|

U |

12 |

2.2 |

5.2 |

|

SNAP |

14 |

5.0 |

2.8 |

|

GOOG |

1165 |

306.2 |

3.8 |

|

TTD |

23 |

1.9 |

12.1 |

|

ADBE |

159 |

21.6 |

7.4 |

|

ANSS |

21 |

2.2 |

9.6 |

|

ADSK |

42 |

5.0 |

8.3 |

|

Average PS: Total (excl. U) |

7.3 |

||

|

Average PS: Ad Sales (excl. U) |

6.2 |

||

|

Average PS: SaaS (excl. U) |

8.4 |

As you can see, Unity’s forward price to sales of 5.2x is lower than many of its peers, but somewhat above Alphabet and Snap. Given Alphabet’s size, I would expect a lower PS ratio, given the influence of TikTok and Instagram it’s no shock that Snap trades at a relatively lower multiple too. In the aggregate we can see the average price to sales is 7.3x, two turns higher than Unity’s.

Forward PS Comparison (Yahoo Finance, Analyst Expectations, and Author Calculations)

At the time of writing, Unity’s share price is hovering around the $29 range, based on the table above we can see that the bear case for Unity’s shares is around $21, and the bull case is at $46.

In the most recent quarter, create solutions generate $128mm and operate generated $172 excluding revenue from strategic partnerships and using some back of the napkin math we can assume that roughly 33% of revenue generated comes from create and 67% comes from operate. If we take the average creative SaaS forward PE of 8.4 and assign it a weighting of one third and then take the average Ad Sales forward PE of 6.2 and assign it a weighting of two thirds we come to an estimated PS ratio of 6.93. A 6.93 PS ratio implies that the shares should trade around $38.

This implies a potential return of roughly 30%!

Discounted Cash Flow

The beauty of SaaS companies like Adobe is that their revenues and earnings are much easier to model than younger companies like Unity.

Within this model I am using the analyst expectations for Y1 and Y2 followed by an assumed 11% growth rate through 2029 dropping off to a 2% terminal growth rate. In addition, I am also assuming a 9% discount rate given the increased risk free return rate thanks to the federal reserve. Using those assumptions, here is a portion of my DCF model:

|

Year |

Year 1 |

Year 2 |

Year 3 |

Year 4 |

Year 5 |

|

Revenue |

$17,606.0 |

$19,260.0 |

$21,560.0 |

$23,931.6 |

$26,564.1 |

|

Net Income |

$5,811.3 |

$7,066.5 |

$8,228.7 |

$9,133.9 |

$10,138.6 |

|

Cash Flow |

$5,230.1 |

$6,359.8 |

$7,405.9 |

$8,220.5 |

$9,124.8 |

According to my model, and the 9% discount rate, shares are worth around $327, this compares unfavorably with their current share price of $341.

That said, if the Fed can orchestrate a soft landing and avert a financial crisis we could see rates settle much lower, potentially moving the acceptable discount rate down to 8% or so. If that were the case an argument could be made that shares are actually worth around $390.

Conclusion

I like Unity and I like Adobe, both companies provide powerful software and have strong competitive moats. Adobe has grown steadily over the past decade as it shifted more and more consumers to its recurring revenue model. Unity on the other hand has grown at breakneck pace over the past decade, only before stumbling hard in 2022.

But which is the better buy today?

I am taking Unity on this one. Both companies are priced much lower than they were earlier in the year, but I feel that Unity has the potential for much stronger capital appreciation given how hard it was hit earlier in the year and my expectation for higher revenue growth in the future.

I rate Unity a “Strong Buy” with a 1 year price target of $38

I rate Adobe a “Hold” with a 1 year price target of $341

Merry Christmas and Happy Holidays

I hope you all enjoyed reading my article, if you have any feedback, questions, or comments feel free to comment below! I try hard to engage with my readers as much as possible. Hope you all have a wonderful Christmas season, wishing health and prosperity to all! God bless.

Disclosure: I/we have a beneficial long position in the shares of U either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is not financial advice. Consider speaking to a registered financial advisor before making any investment.