Summary:

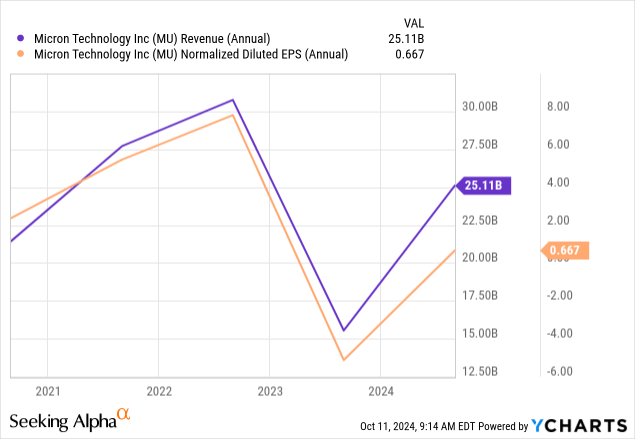

- Micron is swiftly recovering from the 2023 geopolitical-related revenue and profit dip, leveraging strong AI and data center demand to fuel its resurgence.

- Micron’s collaborations with key semiconductor leaders like Nvidia position it at the forefront of the AI revolution, ensuring robust demand for its high-bandwidth memory products.

- With products sold out until 2025, Micron’s commitment to innovation and strong pricing power drive strong profitability and reinforce its competitive edge in the HBM and SSD markets.

- A healthy balance sheet, significant reinvestment in R&D and CAPEX, and a 25% undervaluation based on DCF analysis highlight Micron’s solid financial foundation and growth prospects.

vzphotos

My thesis

Micron (NASDAQ:MU) stock is a Strong Buy due to various solid reasons. The company partners with all key semiconductor AI darlings, meaning that it has strong exposure to the AI revolution.

The company is committed to innovation, and some of its products are sold out up to 2025. Experiencing high demand for its offerings means that Micron enjoys solid pricing power, which results in solid profitability. Strong profits help in accumulating financial resources, which are then once again reinvested in developing new products or expanding production facilities. The business mix is solid because the company is poised to capitalize on solid trends in the HBM and SSD niches. Both products are utilized in data centers, meaning that Micron will benefit from the data center spending craze from technological behemoths. Last but not least, the DCF model suggests that MU is 25% undervalued.

MU stock analysis

Micron is company that is poised to benefit from the AI revolution, which is a big tailwind. Micron is one of the largest providers of DRAM and NAND memory products for various applications including high-performance computing, communications, PCs, industrial applications, wireless, and embedded applications. Therefore, it is not surprising that the company has already sold out its high-bandwidth memory (HBM) production capacity up to 2025. This is a strong indication that Micron’s offerings in this niche are compelling.

Micron’s HBM offerings are utilized in Nvidia’s (NVDA) flagship H200 AI chips, which speaks volumes about Micron’s positioning in the AI revolution. Analysts believe that Micron’s partnership position is also robust when we speak about Nvidia’s new generation of AI accelerators called Blackwell. Therefore, the company is poised to benefit from the ‘insane demand’ for Nvidia’s new family of accelerators. Of course, as one of the greatest entrepreneurs of the last few decades, Jensen Huang’s words about “insane demand” can be a slight exaggeration to draw more attention to Blackwell. On the other hand, analysts of Citi (C) recently shared an insight that data center capex spending is likely to spike by 40% in 2025. This is not “insane”, but still a 40% growth is significant for an industry that is already worth more than $400 billion.

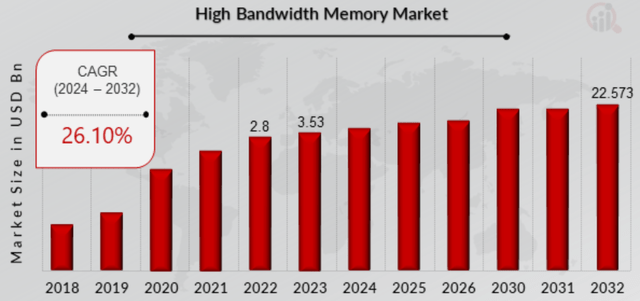

This is extremely important to understand because the HBM industry is expected to thrive for the next several years thanks to AI tailwinds. According to Market Research Future, the HBM market is expected to deliver a strong 26.1% CAGR by 2032. Therefore, the company’s plans to expand production capacity for these products looks like a wise strategic move.

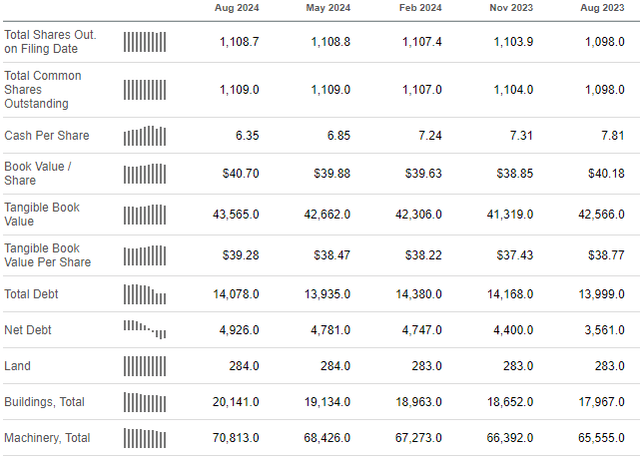

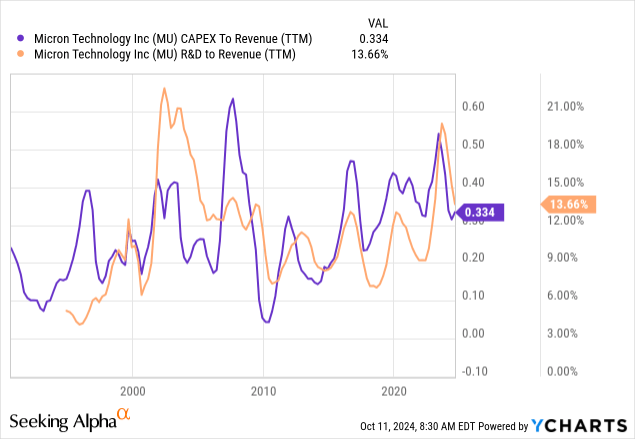

Tailwinds are strong, and it is highly likely that the management clearly understands that this opportunity cannot be missed. We see above that the company reinvests around one third of its revenue in CAPEX and around 13% in R&D. This indicates that the company prioritizes growth and innovation, which will highly likely help in fortifying its technological and competitive edge. It is crucial that the company’s financial position is healthy with low net debt compared to its over $100 billion market cap. The outstanding shares count is also quite stable, which is good for investors meaning there are low dilution risks.

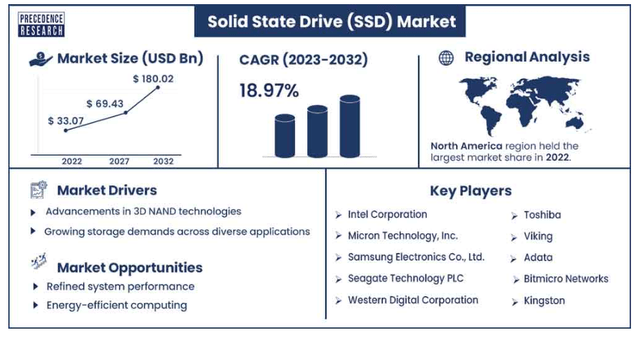

Micron’s R&D efforts appear to be efficient as the company has strong partnership with the GPU leader, Nvidia, but with other prominent players as well. Micron partners with AMD (AMD), Broadcom (AVGO), and Intel (INTC). Another reason why Micron succeeds in innovation is its consistency in releasing new powerful products, which is related not only to HBM. For example, in July the company released ‘the world’s fastest data center SSD’. This is another crucial milestone because the SSD niche is also demonstrating strong dynamic. Precedence Research names Micron Technology as one of the key players in this niche, which is forecasted to deliver a 19% CAGR by 2032.

Thanks to the technological edge of Micron’s products and high demand, the company is able to exercise strong pricing power, which we see from its ‘A+’ profitability mark.

So, what we have at the end of the day? Micron is a highly innovative company with healthy balance sheet, strong profitability, and massive AI tailwinds behind its back. The company looks very strong and well-rounded, which makes me confident in my bullish opinion.

Intrinsic value calculation

Micron’s market cap is $117 billion, and the stock currently trades at around $106 price. The forward non-GAAP P/E is around 12, which is significantly lower compared to the last five years’ average of around 85.

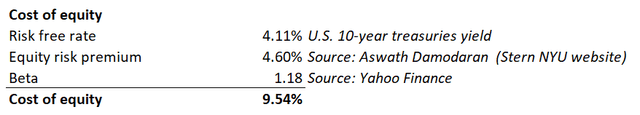

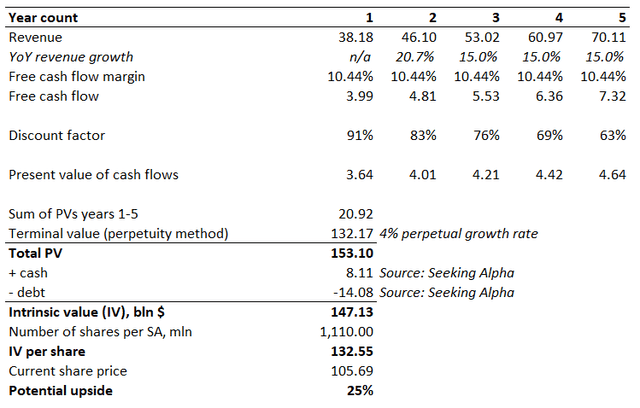

The forward P/E ratio looks good, but for a growth stock, it might be misleading. Therefore, a discounted cash flow (DCF) model must be simulated. I am starting with figuring out the cost of equity, which will be used as a discount rate because I usually rely on the levered free cash flow (FCF). The discount rate is 9.54%, according to the below CAPM working.

Revenue estimates for years 1-2 are backed by consensus of 30 Wall Street analysts. Due to strong secular tailwinds behind Micron’s back, I am implementing a 15% revenue CAGR for years 3-5 and a 5% perpetual growth rate. Micron’s historical FCF margin cannot be used for the DCF model as the company experienced massive geopolitical headwinds in recent years, which I will discuss in the next section of my analysis. Therefore, for the DCF model I use a flat 10.44% level in order to be conservative.

The company’s intrinsic value (IV) is around $147 billion after I add up outstanding cash and deduct total debt. On a per share basis, IV is $147. This is around 25% higher than the current share price, meaning that there is a solid upside potential.

What can go wrong with my thesis?

Micron looks like a fundamentally strong company, and its shares are attractively valued. However, investing in stocks is inherently risky, and there are also some company-specific risks as well.

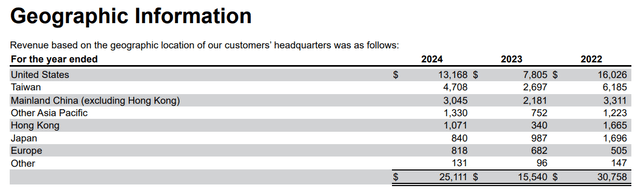

In the previous part of my analysis, I mentioned that the company suffered from massive geopolitical headwinds in recent years. There was a big drop in revenue and EPS during 2023 because the company faced a ban from China, which was an episode of a big trade war between the U.S. and the world’s second economy. China is still an important market for the company, meaning that the company still faces substantial geopolitical risks.

We see above that Taiwan is also a crucial market for Micron. This country also faces risks due to historically complex relationships with China. Some experts even believe that there might potentially be a military conflict between these two countries in 2025.

Summary

I think that a 25% upside potential for such a fundamentally strong business with solid AI exposure is worth investing despite elevated geopolitical risks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.