Summary:

- Abbott Laboratories will announce its Q3 results on the morning of 16th October, with earnings and topline growth largely expected to be in line with the Q2 trend.

- A year ago, all of Abbott’s divisions had generated double-digit topline growth, making the base effect quite challenging to overcome.

- We touch upon some of the important goings-on in Abbott’s two largest divisions – Medical Devices and Diagnostics – which jointly account for two-thirds of group sales.

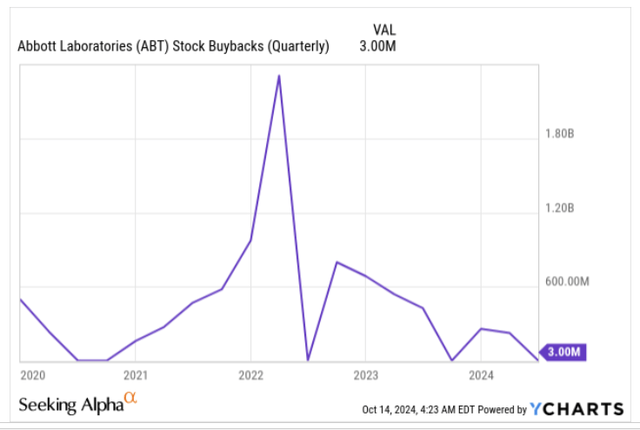

- We would expect ABT’s share buyback initiatives to ramp up, as YTD spend is rather low, and cash flow generation is expected to pick up in H2.

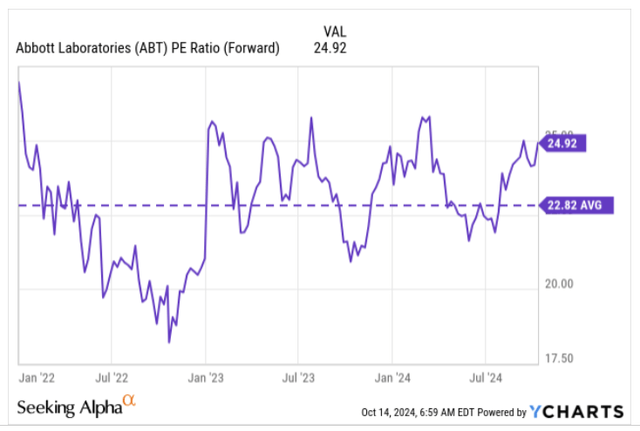

- ABT does not come across as the most attractive rotational opportunity in the large-cap healthcare space, and at a forward P/E of nearly 25x (a 9% premium over its 5-year average), it only offers single-digit earnings growth.

hapabapa

Introduction

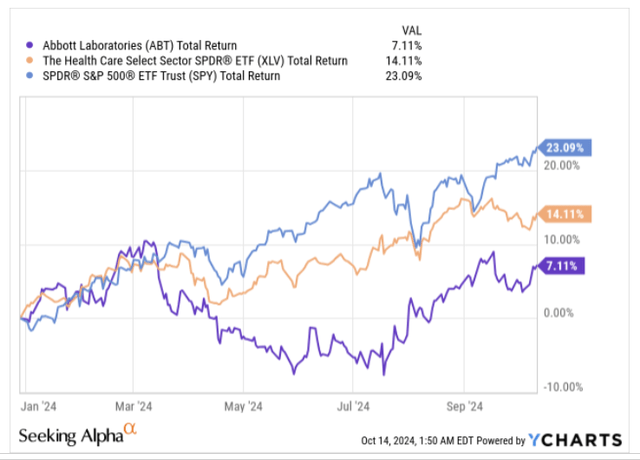

The stock of healthcare behemoth Abbott Laboratories (NYSE:ABT) has experienced an uninspiring 2024 so far; in a year where the prime equity bellwether has generated solid returns of 23%, and even the healthcare cohort of the S&P 500 has notched up respectable returns of 14%, ABT has lagged quite significantly, generating only half the returns of its peer set.

Nonetheless, over the next couple of days, ABT will have to deal with a potential catalyst (the Q3 results, due to be announced on the morning of October 16th) that could be instrumental in triggering large moves that may either help bridge this gap (with its peers) or make it a lot worse.

What are the key themes to monitor during this important event, and is it advisable to pursue ABT now? Read on to find out.

Earnings Headlines

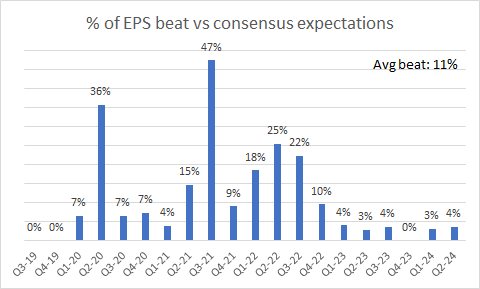

As far as the earnings headlines go, we don’t believe that stakeholders need to be overly concerned about ABT missing the mark, as it has a long track record of delivering the goods. For context, during each quarter over the last 5 years, ABT has not missed quarterly bottom line estimates even once (although there have been three instances where it has delivered numbers on par with consensus, rather than a beat). Meanwhile, on the topline, one needs to rewind the clock by 13 quarters (Q1-21) to see when it last missed consensus numbers (by ~2%).

All in all, we’re looking at a stock that typically facilitates a quarterly earnings beat (in percentage terms) within the early double-digit magnitude (average of the last 20 quarters), although note, that over the last 6 quarters, the magnitude of beat has been a lot smaller within the low to mid-single digit mark.

Seeking Alpha

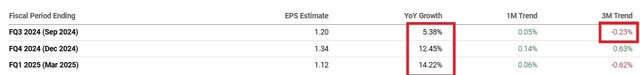

With regard to Q3, it’s worth considering that expectations are not particularly huge, even though Abbott had lifted and narrowed the range of its FY EPS expectations by around 1% in July, from what was stated during the Q1 earnings event. Ironically, consensus has marginally trimmed its Q3 EPS estimate by -0.23% over the past 3 months, with an expected figure of $1.20. If ABT ends up meeting this figure, it would represent earnings growth that is only roughly in line with the Q2 threshold of 5-6% (even on the topline, Abbott is expected to deliver reported revenue growth which will be similar to the Q2 trend of 4%). Encouragingly, investors can take heart from the likelihood that ABT will embark on a period of superior earnings growth from Q4 onwards after two straight quarters of single-digit growth.

Topline Nuances

ABT’s reported revenue growth may only be around the mid-single-digit growth levels, but their organic growth has been trending at a much superior level. To elaborate, note that until Q2, this business was delivering consistent double-digit organic growth for 5 straight quarters. In Q2, that long trend ended, with a drop to 9.3%, and given the even tougher base effect of Q3-23 (organic growth had come in at almost 14% a year ago, up from the 11% levels seen in Q2-23), it would be unrealistic to expect a pivot back to the double-digit organic growth levels in Q3-24.

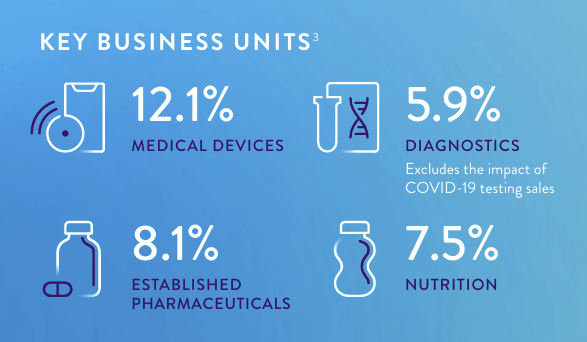

For the uninitiated, ABT has 4 divisions, and it’s always a healthy sign when your largest division also sees the greatest traction from a growth angle. The company’s medical devices segment, which alone accounted for 45% of H1 sales, was the only division to see organic sales growth of double-digits in Q2 (12.1%). In Q3-24, all these divisions will have their tasks cut out, as a year ago, every one of them had facilitated double-digit organic growth, which won’t be easy to replicate for the second year running.

Q2 Infographic

The Medical devices segment is also helped by the fact that its largest category of sales -Diabetes Care (35% of segment sales), is also leading all the other sub-categories when it comes to organic growth (an impressive 19.4% organic growth in H1-24).

Buoyancy here is mainly on account of the company’s continuous glucose monitoring portfolio called FreeStyle Libre which is currently used by more than 6m patients across the world and growing at over 20% per quarter on an organic basis, generating $1.6bn of sales. Also note that in the last month of Q2, we also saw Abbott receive US FDA approval for two new continuous glucose monitoring products (Lingo and Libre Rio) which is based on the tech of FreeStyle Libre. At least one of these products is expected to have launched in Q3, which should support sales here, and over time, both these products have the potential to hit $1bn in sales. The marketing of these products won’t necessarily be a huge encumbrance on Abbott as it intends to follow guerilla marketing tactics (such as on-ground outreach and social media campaigns) which are relatively more economical.

Meanwhile, ABT’s other key division- Diagnostics (which accounted for 21% of H1 sales) has been its slowest-growing division as it has been hampered by lower COVID-19 testing volumes for a while now. What could help mitigate pressure for this segment, is the resilience of lab diagnostic sales which has been trending higher this year (Q1 organic growth of 6.2%, Q2: 8.8%) driven in large part by the growing popularity of Alinity diagnostic systems. We expect demand for the Alinity portfolio to get stoked even more, as earlier in this month, the WHO approved the Alinity m MPXV assay (a PCR test that detects monkeypox virus DNA from the swab of human skin lesions) as the first mpox diagnostic test for emergency use. A few investors may believe that the outbreak has only been limited to the African continent, but recent reports suggest it has spread to India as well.

Cash Flow And Capital Allocation Dynamics

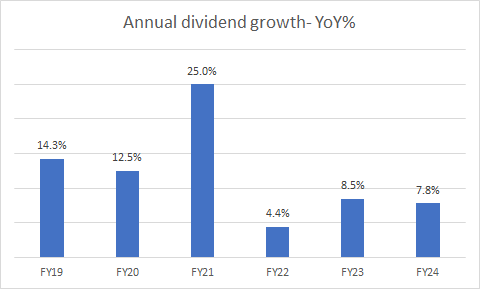

Tracking Abbott’s cash flow progress too is pivotal, as it serves as the foundation of the company’s Dividend King Status (ABT has grown its dividends for 52 years). Besides, ABT management has previously reiterated how they consider dividends to be their primary allocation of cash.

Seeking Alpha

Note that in recent years, the pace of dividend growth hasn’t been a patch on what was seen during FY19-FY21, where annual growth used to come in at 17% p.a. on average (the next hike will take place in Jan 2025).

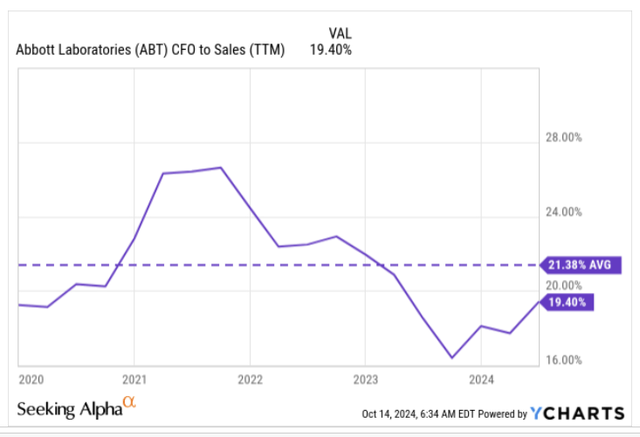

Part of this could be dictated by how ABT isn’t converting an adequate amount, of sales to operating cash flow (on a TTM basis, the CFO margin is currently lagging its 5-year average by 200bps).

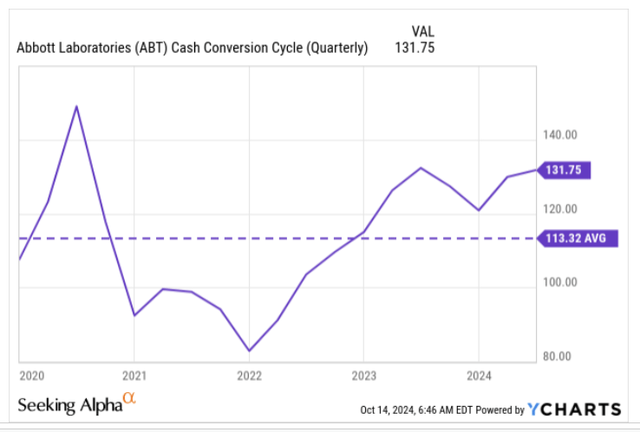

In Q3, we would be looking for signs to see improvement on the working capital front, as the cash conversion cycle (the number of days that working capital is tied up) is currently around 17% more than what they’ve typically maintained over 5 years (113 days). Also, the September quarter has proven to be seasonally stronger.

A potentially better CFO performance may also help stoke the pace of share buybacks in Q3, which had dropped to inordinately low levels of just single digits in Q2. Do consider that even though ABT had the ammunition to buy back $1.41bn of shares at the start of 2024, they’ve only deployed 16% of that sum this year ($229m).

Closing Thoughts – Is Abbott Laboratories Stock A Good Buy Now?

We don’t believe the ABT stock would make for a good buy now on account of the following reasons.

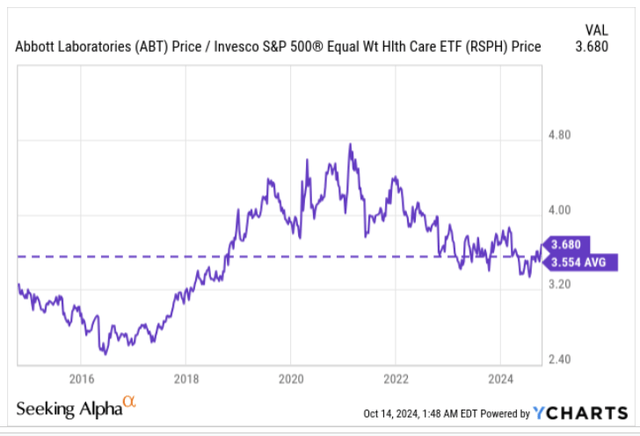

Firstly, the chart below shows why investors who rotate within the healthcare stocks of the S&P 500 may not find ABT as a suitable pocket to rotate into. Note that ABT’s current relative strength vs the equally weighted portfolio of large-cap healthcare stocks is currently above the long-term average.

ABT’s investment case is not helped, by its rather steep valuation quotient, where the stock is now priced at a forward P/E of almost 25x, which translates to a 9% premium over its long-term average.

For such a sturdy P/E multiple, we would expect a better cadence of earnings growth, but consensus averages point to less than 8% growth (on average) over the next two years.

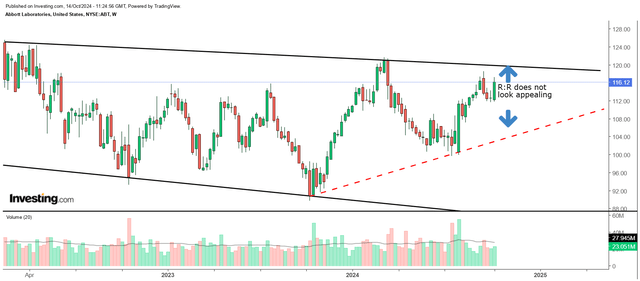

Finally, also take note of the unappealing risk-reward on ABT’s weekly chart over the last 20 months. In July, we saw the stock bottom out at the sub $100 levels, and if we connect those lows to the lows seen in Oct 2023, we get a trendline (red line with dashes) which appears to serve as a zone of intermediate support. Note also that the price is currently a long way from its lower trendline, but is hardly a few percentage points from hitting its upper trendline. We’ve also seen previous instances where the stock typically flattens out or pivots lower as it hits enters the $117-$125 range. Considering all these guideposts, we think it wouldn’t be too prudent to be bullish on ABT now. The stock is a HOLD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.