Summary:

- Tilray’s Q1 revenue missed estimates by $21 million, showing 13% year-over-year growth driven by beverage acquisitions, while cannabis revenue declined nearly 13%.

- The company reported a larger GAAP operating loss, but improved GAAP net loss, and a 13% decline in adjusted EBITDA, with significant cash burn and shareholder dilution.

- Tilray’s valuation discount to Canopy Growth has narrowed, with analysts still very positive but cutting their price targets over time.

Morsa Images

Last week, shares of Canadian cannabis and beverage firm Tilray (NASDAQ:TLRY) saw its shares hit a new multi-year low after the company reported its fiscal Q1 results. While the stock did bounce back, it still was down more than 3.5% for the week, primarily as its quarterly report featured a large revenue miss. The company continues to make progress on its balance sheet, albeit at a large cost to investors, which is limiting potential upside for the longer-term story.

Previous coverage on the name

The last time I covered Tilray was back in July, after the company had just reported some nice improvement with its quarterly results. Tilray reported solid year over year revenue growth, helped by its beverage acquisitions, and it came in ahead of the street’s top line estimate average. Adjusted net income showed a swing into positive territory, while further progress was made on reducing the net debt pile.

Unfortunately, I haven’t been able to fully buy in to the Tilray story just yet. With the company still losing money and burning cash over time, it has had to significantly dilute shareholders to keep things going. Since I last covered the stock, shares have lost more than 20% of their value, compared to a nearly 7% gain for the S&P 500.

The fiscal Q1 report

The company reported record fiscal Q1 revenue of $200 million for the period ending on August 31st. While this was 13% year-over-year growth, the number badly missed street estimates by nearly $21 million. The entire growth story was due to acquisitions in the beverage space, which boosted that segment’s revenue by 132% year over year. The bad news is that net cannabis revenues were down by nearly 13% over the prior year period, while distribution and wellness revenues combined showed a small increase.

On the margin front, overall adjusted gross margins increased by a couple of percentage points. Non-beverage segments all showed some improvement, and the overall total was boosted by higher margin beverage revenues becoming a larger portion of the business. However, adjusted beverage margins did drop by 15 percentage points year over year. Management talked on the call about this drop being due to certain co-manufacturing agreements from the acquisitions, and these restrictions have since ended.

The rest of the income statement is always messy, due to a number of one-time items from the acquisitions and other factors. The company did report a larger GAAP operating loss than the prior year period, but the GAAP net loss did improve by roughly $21 million. Unfortunately, adjusted EBITDA declined by about 13% to just around $9.3 million.

The balance sheet and cash flow situation

Between the ongoing losses and some working capital issues in the period, Tilray reported adjusted cash burn of nearly $40 million for the quarter, more than 6 times what was seen in the year ago period. Tilray finished Q1 with about $280 million in cash, against roughly $322 million in debt. The net debt balance did decrease by more than $19 million, but that comes with a major caveat, as seen in the chart below.

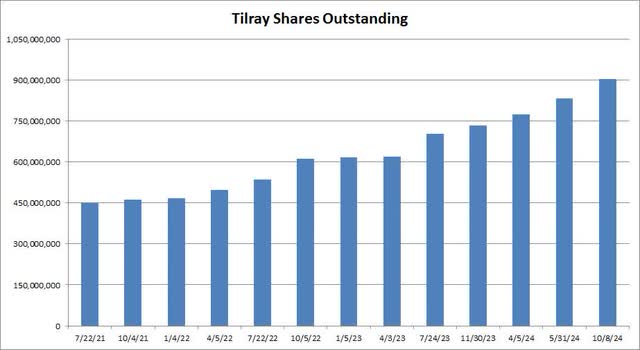

Tilray Shares Outstanding (Company Filings)

As detailed in the company’s 10-Q filing, Tilray issued 36,693,307 shares under its At-the-Market (“ATM”) program, generating gross proceeds of $68.3 million during the quarter. This plan, which can raise up to $250 million over time, is helping the company with its ongoing cash needs. However, investors are facing significant dilution between the ATM, acquisitions, and convertible debt deals. In fact, the outstanding share count has now more than doubled since July 2021.

Looking at valuation

On the valuation front, Tilray was trading Monday afternoon for about 1.56 times its expected sales for the May 2025 fiscal year. That’s a discount to the valuation that peer Canopy Growth (CGC) went for at 1.74 times its March 2025 expected revenue. Tilray is projected to see more near-term revenue growth, although Tilray was trading at a nearly full point discount on price to sales for their respective periods when I last analyzed the name, and the gap has closed even more than that if you go back another quarter or two.

Street analysts are still fairly positive on Tilray. The average price target is currently $2.21, which would imply nearly 38% upside from where shares were trading on Monday’s afternoon. I should note, however, that the street average was $2.75 a year ago and more than $15 just three years, so analysts have cut their targets a bit, partly due to this massive dilution over time.

Final thoughts and recommendation

Last week’s report from Tilray was rather mixed to say the least. Revenues badly missed street estimates, and while GAAP losses came down, beverage margins were dinged by some one-time items. The company continued to burn quite a bit of cash, and while the balance sheet does look better, it was the result of even more dilution. Shares hit a new multi-year low before rebounding, and the valuation looks less attractive to Canopy now with the discount narrowing quite a bit.

At the moment, I’m going to continue with my hold rating on Tilray shares. I do think the upcoming US election has the potential to be a positive catalyst, but that process will take some time to play out. I’d also like to see a clean quarter of margins now that those beverage agreements have expired, and I want to see the balance sheet get closer to a net cash situation. Of course, that likely means more dilution in the short term, which could provide an overhang on the stock. Tilray could be a good story for 2025 if things go right, but I’m not ready to bet on that happening just yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.