Eoneren/E+ via Getty Images

Short interest for healthcare stocks in S&P 500 increased during September end vs. last month, with Moderna being most shorted for the third consecutive time.

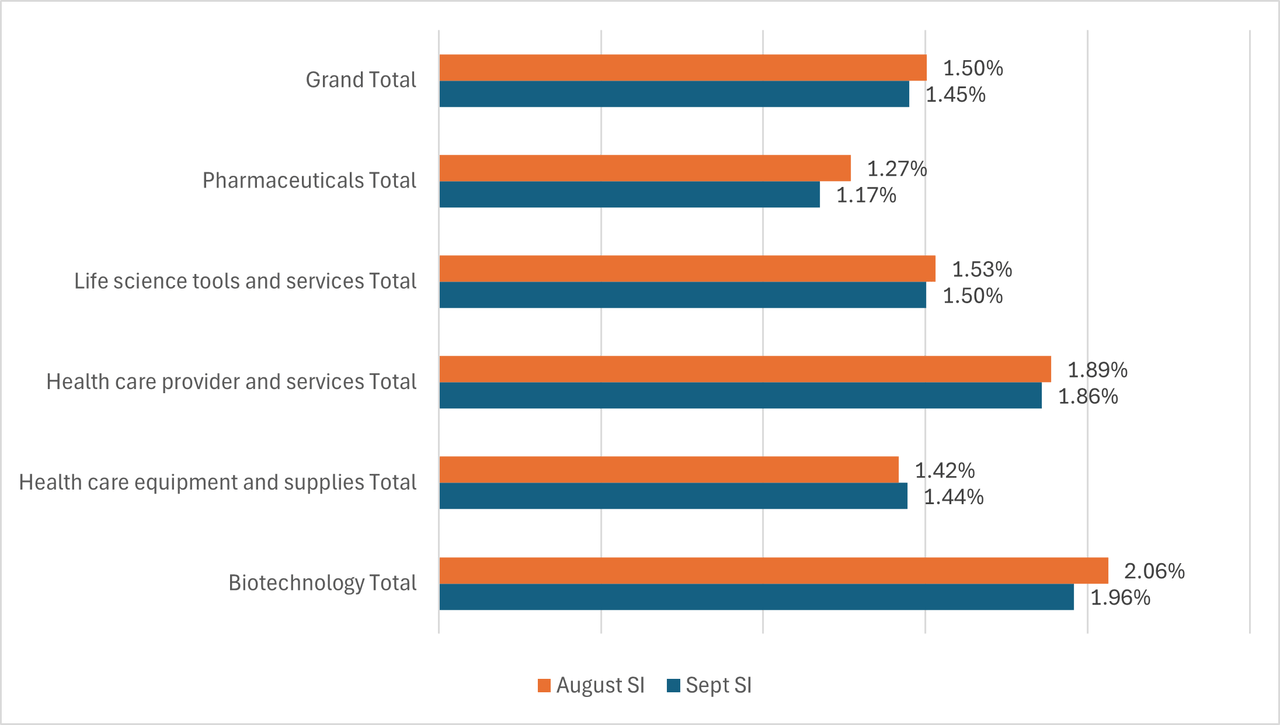

The average short interest for S&P 500 Health Care Index Sector (NYSEARCA:XLV) went down 5 basis points to 1.45% in September, from 1.50% in August.

XLV, which has a 12.12% weightage in the broader S&P 500 index, fell 2.7% in the last month, compared to S&P 500 index’s (SP500) gain of 3.6%.

Industry analysis:

Average short Interest as percentage of floating shares

Biotechnology was the most shorted industry in the healthcare index in September for the sixth time in a row. Short interest in this sub-sector, however fell to 1.96% from 2.06% in August.

Healthcare provider and services sector was in the second position with short interest at 1.86% in September end.

Pharmaceuticals industry continued to be the least shorted sub-sector with 1.17% short percentage of float, falling from 1.27% last month.

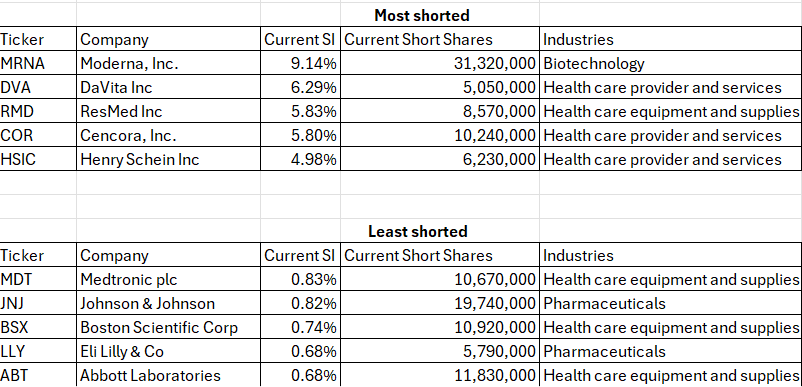

Stocks with highest and lowest short positions

Ranked by short interest as a percentage of shares float

Moderna (MRNA)—most shorted—saw short interest rise to 9.14% from 7.48% in August. DaVita (DVA) came in second with a short interest of 6.29%, followed by ResMed (RMD) with a short interest of 5.83%.

Abbott Laboratory (ABT) was the least shorted stock in September, with a short interest of 0.68%, tied with Eli Lilly (LLY), which has the highest weightage in the XLV index, with the same short percentage.

Boston Scientific (BSX) was the third least shorted company in the month of September, with a short percentage of 0.74%, same as the previous month.

More on Short Interest report