Summary:

- Since my previous article, shares of Abbott Laboratories have returned 10% versus the 7% gains of the S&P 500 index.

- The healthcare company’s sales and adjusted diluted EPS rose in the third quarter.

- Abbott Laboratories maintains a fortress-like balance sheet.

- The stock could be slightly overvalued from the current share price.

- Abbott Laboratories looks set up for 7% annual total returns through 2026.

A surgical team works in the operating room. shapecharge/iStock via Getty Images

In the stock market, buying opportunities can be long-lasting or they can be very fickle. A stock could be chronically undervalued in a bear market for years.

A mere improvement in market sentiment could come from one strong earnings report or a string of healthy earnings reports. Other catalysts could include major product launches or a generous capital return program (e.g., large share repurchase programs or sizable dividend boosts).

One example of a stock that has seen its market sentiment improve in recent months is Abbott Laboratories (NYSE:ABT). When I last covered ABT with a buy rating in August, I thought it was a dividend growth stock with a sound balance sheet and secure dividend.

Fundamentally, I still believe those things to be true after the company’s third-quarter earnings report shared earlier today. ABT posted yet another quarter of double-beats led by its impressive product portfolio. The balance sheet is still AA-rated. ABT’s dividend is easily covered by profits and has room to keep growing.

However, the rally in shares over the last two months has pushed the valuation to an uncompelling level. Thus, I’m downgrading shares to a hold rating now.

Abbott Is Delivering Growth Again

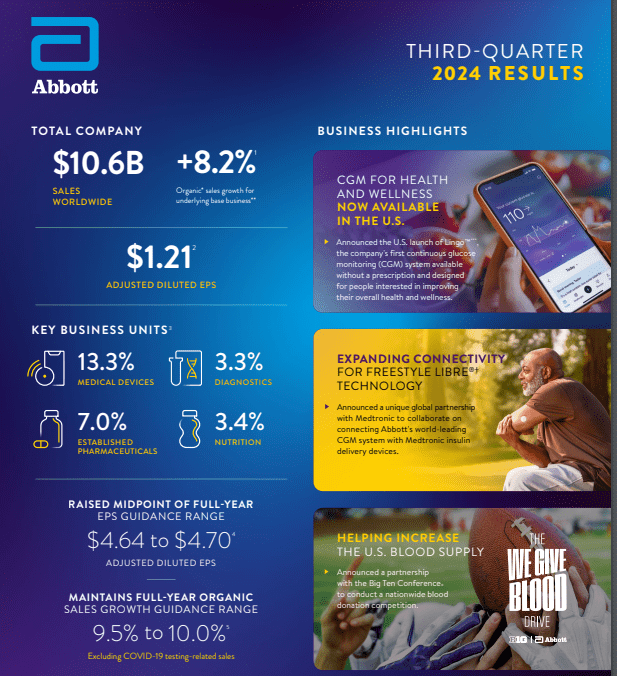

ABT Q3 2024 Infographic

As a shareholder, ABT didn’t let me down with the release of its third-quarter results. The company’s sales increased by 4.9% over the year-ago period to $10.6 billion during the quarter. For perspective, that was $90 million beyond the Seeking Alpha analyst consensus for the quarter.

It gets even better, too. Backing out unfavorable foreign currency translation (2.5%) and the exit of the ZonePerfect product line in the nutrition business (0.2%), ABT’s organic sales would have risen by 7.6%. Taking COVID-19 testing sales out of the mix, this organic sales growth would have been even better at 8.2% in the third quarter.

The Medical Devices segment remained pivotal to this topline growth. Reported sales during the third quarter jumped by 11.7% year-over-year (13.3% organically accounting for currency headwinds) to $4.7 billion. This was made possible by double-digit growth rates in diabetes care via greater FreeStyle Libre adoption. CGM sales topped $1.6 billion for the quarter, which represents a 19.1% reported growth rate over the year-ago period. Continued strength from product launches like TriClip and Amulet also contributed to this topline growth.

Reported sales for the Established Pharmaceuticals segment increased by 2.7% year-over-year (and 7.0% organically including currency translation) to $1.4 billion in the third quarter. That was thanks to growth in the gastroenterology, cardiometabolic, and pain management therapy areas.

ABT’s Nutrition segment sales decreased by 0.3% over the year-ago period (and increased by 3.4% organically) to $2.1 billion during the third quarter. Growth in adult nutrition through Ensure was the driving factor for the segment.

Reported sales for the Diagnostics segment declined by 1.5% year-over-year (and grew by 3.3% organically) to $2.4 billion for the third quarter. This was the result of growth in non-COVID-19 testing sales, offsetting most of the decline from COVID-19 testing sales.

ABT’s adjusted diluted EPS climbed higher by 6.1% over the year-ago period to $1.21 in the third quarter. That beat the analyst consensus by $0.01 during the quarter. This was the result of a 20-basis point expansion in the non-GAAP net profit margin to 19.9% for the quarter. That is how adjusted diluted EPS growth outpaced sales growth in the quarter.

Looking out to the future, ABT still has tangible catalysts to fuel growth for the foreseeable future. In his opening remarks during the Q3 2024 Earnings Call, Chairman and CEO Robert Ford pointed to recent large account wins in its core labs business. This should help the Diagnostics segment keep up its growth into next year and beyond.

The launch of the Protality nutrition shake in January, which I have cited in the past is another element. This is targeted toward patients on GLP-1 medications and aimed at maintaining muscle mass that tends to be lost on these medications.

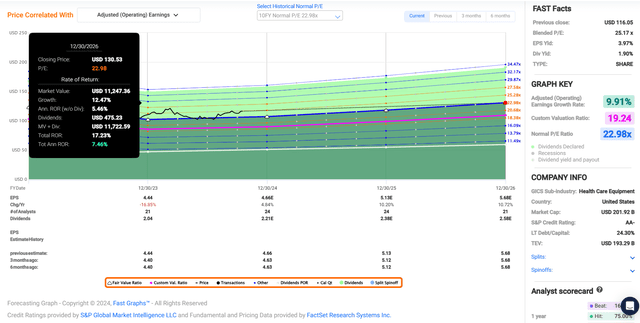

Per the FAST Graphs analyst consensus, ABT’s exceptional product portfolio is expected to translate into a 4.8% increase in adjusted diluted EPS in 2024 to $4.66. Another 10.2% rise in adjusted diluted EPS to $5.13 is expected for 2025. In 2026, an additional 10.7% boost in adjusted diluted EPS to $5.68 is being projected.

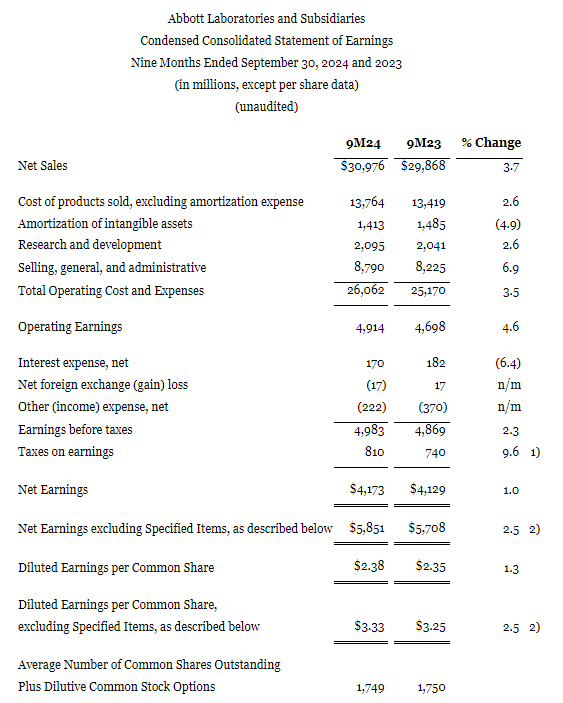

ABT Q3 2024 Earnings Press Release

As if ABT’s improving growth outlook wasn’t enough to paint an attractive picture fundamentally, its financial standing is another positive. The company’s interest coverage ratio through the first nine months of 2024 was 29.3. This is why ABT enjoys an AA- credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to ABT’s Q3 2024 Earnings Press Release and ABT’s Q3 2024 Infographic).

Fair Value Has Breached $115 A Share

In the two months since I covered ABT, it has posted 10% total returns to the 7% gains put up by the S&P 500 index (SP500). For a stock that was only marginally undervalued at the time, this seems to have been too much gain in too little time.

ABT’s current-year P/E ratio of 25.3 is moderately above its 10-year normal P/E ratio of 23 per FAST Graphs. The P/E ratio for next year of 23 is in line with its 10-year normal valuation multiple.

I continue to believe that the fair value P/E ratio is 23. That is because ABT’s annual forward adjusted diluted EPS outlook of 9.9% mirrors its high single-digit average annual growth rate in the past decade.

The calendar year 2024 is nearly 81% complete. This leaves another 19% of 2024 and 81% of 2025 yet to come in the next 12 months. That’s what yields a 12-month forward adjusted diluted EPS input of $5.04.

Using my fair value multiple of 23, I arrive at a fair value of $116 a share. Against the current $118 share price (as of October 16th, 2024), this is a 2% premium to fair value. If ABT reverts to fair value and matches growth expectations, it could generate 17% cumulative total returns by the end of 2026.

To be clear, that’s respectable. It’s just not up to par with what I would need to see to maintain my buy rating. I would need to see a pullback to around $110 a share before I would again view ABT as buyable. This would present a much higher likelihood of double-digit annual total returns for the foreseeable future.

Expect More Healthy Dividend Hikes

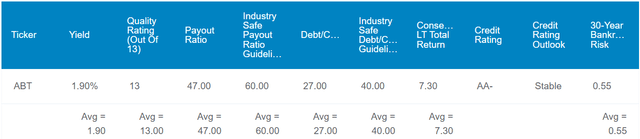

The Dividend Kings’ Zen Research Terminal

ABT’s 1.9% forward dividend yield registers above the healthcare sector median forward yield of 1.4%. This is adequate for Seeking Alpha’s Quant System to award a B grade for forward dividend yield and a C+ grade for overall dividend yield.

ABT’s above-average starting income is also buoyed by the fact that this income is very safe. The company’s EPS payout ratio is positioned to be in the high 40% range in 2024. That’s meaningfully better than the 60% EPS payout ratio that rating agencies desire from the industry, per The Dividend Kings’ Zen Research Terminal. This is how ABT earns a B+ grade from the Quant System for overall dividend safety.

Unsurprisingly, a pairing of a low payout ratio and respectable future growth bodes well for the company’s payout growth prospects. Like last time, the Quant System anticipates an annual forward dividend growth rate of 7.6%. This is comfortably above the sector median of 5.2% and enough for an A- overall dividend growth grade.

Best of all, buying ABT doesn’t involve a lot of guesswork on the dividend policy. This is a company that has hiked its payout to shareholders for 51 years straight. That’s enough for an A grade from the Quant System for overall dividend consistency.

So, ABT has the fundamentals and the culture to support admirable dividend growth moving forward.

Risks To Consider

ABT continues to do what it has to do to return to solid growth. Yet, there are still risks that could derail the investment thesis if they materialize.

One risk to the company is its substantial intellectual property. Yes, this is helping to drive the results that it is logging. On the other hand, this pins a big target on ABT’s back.

That’s because the sheer volume of data on the company’s IT networks makes it a prime target for attempted cyber breaches. If any of these play out on a large scale, the company’s trade secrets could be revealed. That could undermine ABT’s fundamentals.

Another risk to the company is that it is more of an international healthcare company than a domestic one. This subjects ABT to foreign currency exchange risk (though, this tends to even out over time) and varying regulations throughout its markets. Failure to abide by regulations in any major markets could result in sizable penalties being imposed on ABT.

Lastly, there’s the competitive nature of the industries in which the company operates. For ABT to keep enriching shareholders, it must never stop innovating. Just because the company consistently devotes ample resources to research and development, this isn’t a guarantee that innovation will always follow. If ABT fails to innovate enough, it could lose its competitive positioning, and the growth profile could lose steam.

Summary: Worth Owning But Not A Buy Here

I own a modest stake in ABT in my portfolio, and also envision increasing my percentage allocation over time. The business is a clear leader in industries with secular trends going for it like an aging and growing population. ABT also benefits from excellent financial health. The only downside is that the valuation arguably prices in all of these attributes now. Thus, my hold rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.