Summary:

- Abbott Laboratories is a diversified healthcare company with strong segments, particularly Medical Devices, contributing to steady growth and consistent dividends.

- ABT’s Q2 earnings showed solid performance, with Medical Devices leading organic revenue growth, despite some segments facing challenges including discontinuing products and COVID-19 sales decline.

- The company authorized a new $7 billion buyback program, reinforcing its commitment to returning cash to shareholders through dividends and share repurchases.

- While ABT’s long-term growth prospects are positive, current valuations appear stretched, leading to a Hold rating in line with cautious market sentiment.

Sundry Photography/iStock Editorial via Getty Images

Abbott Laboratories (NYSE:ABT) is a global-diversified healthcare company that develops, manufactures, and sells healthcare products worldwide. It has four main segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and the largest, Medical Devices. The company has been around since 1888 and has over 114,000 making it an established mega-cap company. As of October 18th, its market capitalization was $205.12 billion, putting it in the top 50 largest US public companies.

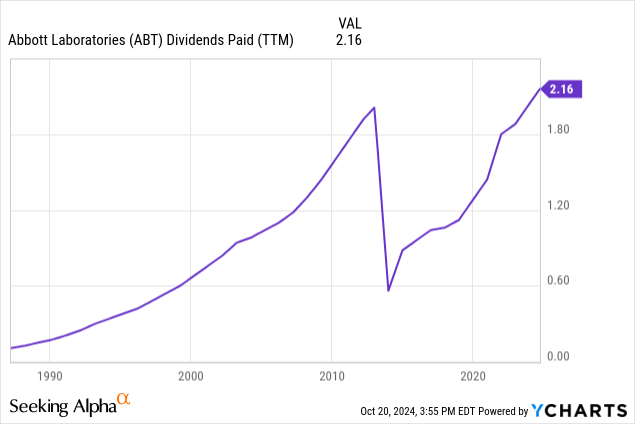

ABT is known for being a “Dividend Aristocrat” meaning it is an S&P 500 company that has raised its dividend for a minimum of 25 years. The consistency of its dividend makes it a consistent source of income, and an attractive investment for investors looking for security. However, its dividend yield (TTM) of 1.87% is only about 60 bps higher than the current dividend yield of the S&P 500 ETF (SPY), so that makes it slightly less attractive for income-focused investors. Seeking Alpha gives ABT’s dividend yield (TTM) a B rating because it is somewhat higher than the Health Care sector’s median yield of 1.40%.

Q2 Earnings

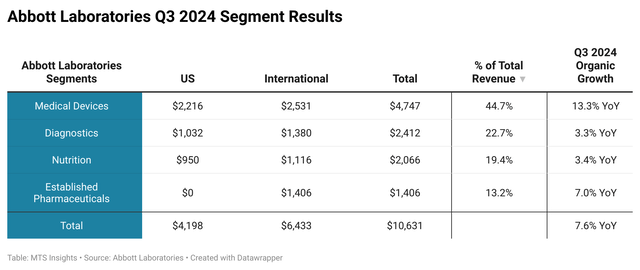

ABT announced earnings this past week and reported results that were mostly in-line with expectations. Adjusted EPS beat by a penny at $1.21 per share, while total revenue came in at $10.64 billion, just $84.4 million above Wall Street expectations. This was the third earnings beat in a row. ABT leaned on its strong Medical Devices segment to fuel organic revenue growth of 7.6% YoY (and reported growth of 4.9%) while other segments saw a mixture of slow and moderate growth. For the context of ABT’s earnings, organic growth excludes the impact of foreign exchange, discontinued businesses, and (specifically for the Diagnostics segment) COVID-19 test revenues.

Abbott Laboratories

Here is a quick segment breakdown:

- The Medical Devices segment saw organic growth of 13.3% YoY, with strong growth in both the US and International geographies. ABT’s launch of Lingo, the company’s first continuous glucose monitoring system, boosted the Diabetes Care subsegment sales with a sharp 19.1% YoY increase. Just below that were the Structural Heart (+16.5% YoY) and Heart Failure (+14.4% YoY) subsegments, with several strong-performing products across the board. With Medical Devices accounting for around 45% of the company’s revenues, it is very encouraging to see this segment as the growth leader.

- The next largest segment, the Diagnostics segment, saw a reported sales decline of -1.5% YoY as the winding down of the COVID-19 crisis into an endemic status caused sales of COVID-19 tests to fall. Organic growth, on the other hand, was positive at 3.3% YoY. Core Laboratory sales growth was a contributor to the organic expansion at 4.5% YoY.

- The Nutrition segment had some extenuating circumstances affecting Q3 results. First, the winddown of the ZonePerfect product line resulted in some natural runoff of sales there. Additionally, ABT continues to be tied up in lawsuits over its infant formula potentially causing necrotizing enterocolitis (NEC). Through all of that, the segment saw reported sales down -0.3% YoY, but an adjusted organic sales growth rate of 3.4% YoY. ABT’s Ensure and Glucerna products continue to be rock-solid products, driving growth. The Adult subsegment, which includes these two products, saw sales up 9.1% YoY in Q3.

- The smallest segment, Established Pharmaceuticals, is completely international and represents ABT’s opportunities in emerging markets. This segment was heavily impacted by foreign exchange. The company reported sales up just 2.7% YoY, but adjusted organic growth was 7.0% YoY.

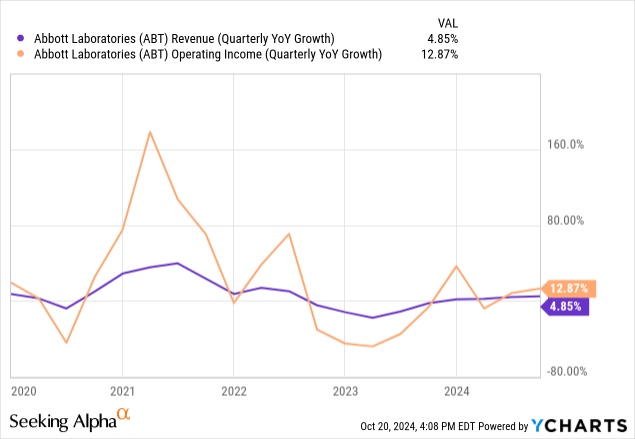

Across all business units, ABT reported total operating costs and expenses up 3.3% YoY, notably slower than the 4.9% YoY increase in reported sales. Cost of goods was up just 2.0% YoY but was outpaced by both R&D expenses up 6.3% YoY and SG&A expenses up 6.3% YoY. With revenue growth outpacing cost growth, ABT saw a strong increase of 12.9% YoY in operating income and an even better net income expansion of 14.6% YoY. However, when adjusted for special after-tax charges, net earnings growth was a slower 5.9% YoY. For the 2024 fiscal year so far, ABT has been able to convert 3.7% YoY revenue growth to a 2.5% YoY increase in adjusted earnings.

ABT also reported that its board authorized a new $7 billion buyback program in Q3 2024 as the program approved in 2021 had been running low. In the last five years, around $5 billion has been allocated towards buybacks. In the past few quarters, share repurchasing had slowed down as ABT completed the acquisition of CSI a year ago, which cost around $826 million in cash as well as other acquisition-related expenses. CEO Robert Ford stated in the earnings call that ABT would start to “step up” repurchases and shared that “about $750 million” was spent on repurchases in Q3.

Valuation

ABT has proven itself to be a reliable cash flow generator that is committed to returning that cash to shareholders through both consistent dividends and share buybacks when it sees that as an efficient allocation of capital. With this in mind, I believe that a dividend growth model with an adjustment for share buybacks is an appropriate method to evaluate ABT’s value.

The first thing to consider is ABT’s long-term growth prospects which are supported by diversification and demographics:

- The massive healthcare company has a diversified portfolio with several segments growing at different speeds. For example, the Medical Devices segment is growing at a strong rate as it adds successful new products like Lingo and capitalizes on strong established market positions that other products have. This offsets some underperformance in Nutrition and Diagnostics. This diversification supports the assumption that ABT can maintain a steady, but relatively low, growth rate into the future.

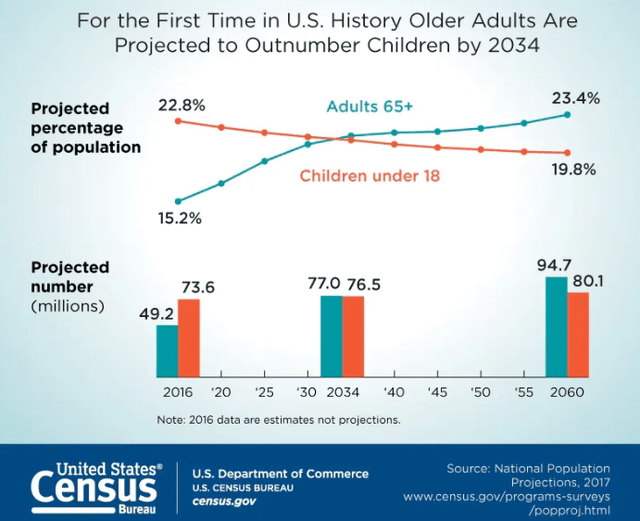

Census Bureau

- As a healthcare company, ABT will benefit from the aging of populations in the US and other key developed markets like countries in Europe. The Census Bureau projected that the number of people in the US aged 65 or over will surpass the number of children under 18 by 2034. That imbalance is expected to continue to get worse in the years following. This drastic demographic shift is expected to be a major factor pushing health care spending in the US higher in the next ten years. Research suggests that from 2027-2032, the growth of per capita spending on health care is projected to moderate at an average annual rate of 5.0%. From 2014-2019, that growth averaged just 4.0% per year.

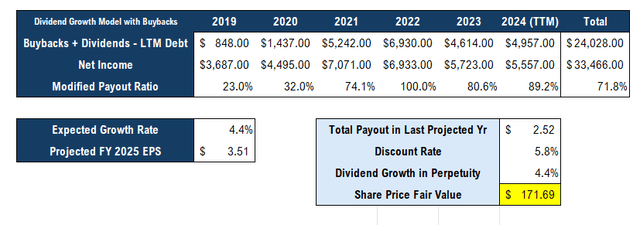

With solid corporate fundamentals and a strong economic case for the long-term growth of ABT, it seems fair to suggest that the company can be described as being in a “steady state” of growth. For my model, I assumed long-term annual nominal growth of 4.4% in earnings based on a return on equity of 15.4% and a payout ratio, through both dividends and share buybacks, of 71.8%. The payout ratio has been estimated using the total of the last six years (2019 to 2024 where I use the most recent TTM data for 2024) of buybacks, dividends, and net long-term debt issued as a percentage of the total net income in the last six years. Similarly, the return on equity has been calculated using the same period.

Author’s calculations

For the discount rate, I calculate the cost of equity using a beta (trailing 24 months) of 0.51, an equity risk premium of 3.9%, and a risk-free rate of 3.8% (ERP and risk-free rate both come from Aswath Damodaran). The projection of next year’s total payout per share assumes GAAP EPS growth of 4.4% YoY and a 71.8% payout ratio (both in line with long-term estimates). The result of this constructed dividend growth model, which accounts for share buybacks, suggests that shares of ABT are valued at around $171.69 which means that the market is currently undervaluing shares of ABT with a price of just under $120.

Discussion

The simple model devised above has some limitations that should be recognized:

- The model assumes GAAP EPS growth in 2024 and 2025 as the company is working through declines in COVID-19 testing sales and some negative impacts from discontinuing products. I do believe that growth in the Medical Devices segment can offset these declines, but that may be too optimistic.

- A payout ratio that considers both dividends and buybacks may be difficult to estimate since recent results have been impacted by acquisitions and, of course, the pandemic. ABT has a very consistent dividend, but its trends in stock buybacks have been more volatile. Overall, smoothing out the data for the past five years seems like the most sensible thing to do.

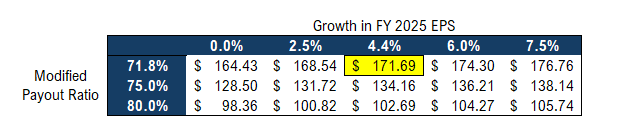

Looking at a quick sensitivity analysis, we see that if ABT’s EPS growth in 2025 were to be less or none at all and the payout ratio were to increase as a result of lower earnings, the estimated value of the stock would be lower.

Author’s calculations

From a more simplified valuation perspective, using the P/E and EV/EBITDA ratios, shares of ABT have higher valuations. The Non-GAAP forward P/E ratio of 25.6x is slightly above the sector median and is assigned a C by Seeking Alpha’s Quant Rating System. The forward EV/EBITDA ratio of 20.2x gets a C- rating for being about 45% higher than the sector median. ABT’s stock at this valuation is not absurd as the demographic driver of growth is strong, and the company’s portfolio is robust. However, investors shouldn’t expect an explosive expansion from ABT any time soon which is why there is a focus on returning cash to shareholders.

Conclusion

ABT’s Q2 earnings were a strong signal to investors that its strongest segment is still strong, and that it is leading the way as other business units face some sluggishness from the drawing down of the COVID-19 pandemic cash flows and sales from restructuring. An optimistic perspective suggests that the stock has good long-term prospects and can return cash to investors while maintaining a low, steady growth rate, and in that context, the stock is undervalued. However, the market is currently more cautious on growth, and perhaps, has already priced in the effects of the new $7 billion buyback program. I assign a Hold rating to ABT which is in line with the Quant Rating System grade, and in line with other analysts who see valuations as a bit stretched at the moment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.