Summary:

- Abbott Laboratories, a healthcare giant with diverse divisions, is normalizing post-pandemic as its medical devices drive growth following a drop in Covid-test demand.

- The company reported 9% revenue growth in terms of pure organic sales, with several of its segments reeling in double-digit growth.

- ABT appears fairly valued, showing no strong buy or sell signals based on its P/E to EPS growth relationship.

- Historical trends also support ABT’s fair valuation compared to how the market has valued it over the past five years.

Sundry Photography

Abbott Laboratories (NYSE:ABT) is a healthcare giant with a market cap exceeding $200 billion. Its business is diversely segmented across several healthcare divisions which include medical devices, nutrition, diagnostic products and established pharmaceutical products. Its most significant exposure lies in its medical device segment, which reels in about 45% of total revenue for the company.

Following the outbreak of the Covid-19 pandemic, the company saw an abnormal boost in its diagnostic division with high volumes of Covid-testing. In 2022, revenues from these diagnoses surpassed $8.4 billion, and represented a fifth of total sales. Now, with demand for these products plummeting, the company has been facing off tough comps, which have been leading to the illusion of a decline. These comps are finally approaching normalization, at present, and the company appears to be back on its growth chart. However, as I will elaborate below, I believe all the company’s growth potential is fully priced in.

Performance Assessment

During Q3, the company came in with a solid 4.85% jump on its topline, pushing its total revenue figure up to $10.64 billion. If we focus only on its organic growth, the YoY change was over 8% during the year, which is really impressive.

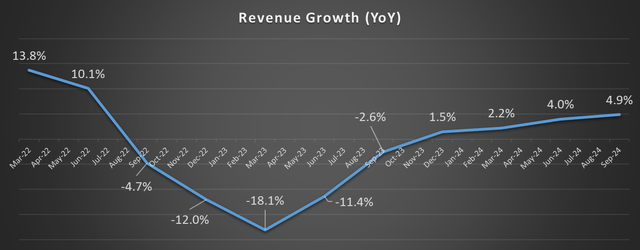

Looking at the last 11 quarters, we see a slump leading towards the March 2023 quarter. This downtrend can be explained by abnormally high comps including high Covid testing, the decline of which is depicting a hard fall. The climbs seen in the recent quarters point to this comp normalization, with Covid testing continuing to become a less significant portion of the company’s revenue. In the next few quarters, I believe we will once again see consistent double-digit climbs for the company.

As mentioned above, excluding Covid-testing, the company actually grew its organic sales by over 8%, which is impressive given the fact that it has reeled in over $40 billion in revenue, for the financial year-end of 2023. For FY24, the company has set a guidance for organic sales growth, excluding Covid Testing, to amount to between 9.5% and 10%.

What I like about Abbott is that it has established diverse lines of business, each of which are capable of pushing forward stellar growth on the company’s overall topline. The medical devices front, which happens to be the company’s biggest segment (45% of total revenue in Q3), proved to be the best performing side of the business, bringing in a YoY jump of 11.7%. When excluding the impact of foreign exchange, this jump amounted to an incredible 13.3%. Notably, sales of the FreeStyle Libre, the popular glucose scanning device has contributed $1.6 billion in the overall revenue figure, and bringing in a jump of 21% during the quarter.

In fact, between 2023 and 2024, the diabetes care area under the medical devices segment alone pushed a YoY climb of 19.1%, internationally, after removing the impact of foreign currency translation. On the US side, this was even more impressive, with a 23.6% YoY organic jump from $545 million to $673 million. This is a promising shift, considering that global diabetes cases are expected to more than double in the next 30 years. Banking on these trends may continue to push topline growth for the company throughout the upcoming years.

Similarly, the company has been seeing strong performance in a number of diverse areas, that continue to prove promising with broader trends. US pediatric nutrition climbed by 12.2% YoY, and contributed $568 million in sales. There was strong demand for the Ensure and Glucerna brands, which solidify Abbott’s position as a global market leader in the nutritional space, both adult and pediatric.

The company’s Electrophysiology and Structural Hearts businesses under its medical devices segment each brought in revenue increases of 14.3% and 16.5%, respectively, after excluding the impacts of foreign exchange.

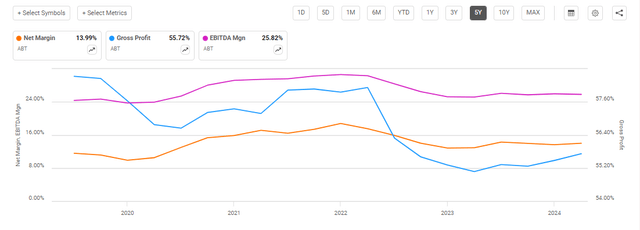

On the margin front, there have also been some noteworthy gains. Gross profit for the quarter was at 55.84%, denoting a 124 basis point improvement from Q3 in 2023. Similarly, operating income, during this same time, climbed by 11 basis points, to 17.55%. I must point out, however, that the company saw its EBITDA margin drop by 45 basis points to 25.11%

Seeing the margin trend over the last 5 years, the company’s tough comparable due to large volumes of Covid testing give the impression of declining margins; however, they are actually approaching normal levels. CFO Phil Boudreau pointed out in the Q2 earnings call, Q1 was really the last significant comp impacted by Covid testing. However, the company continues to separate Covid-19 testing sales from its metrics, which indicates that the effect still exists in its comps.

Overall, however, the steady margin climb is a positive for the company, and its shareholders, as the strong and broad-based organic growth will better reveal itself in the numbers. I believe with better clarity on the company’s core, value-adding operations, sentiment around the stock may generally turn to more bullish in the market.

Valuation

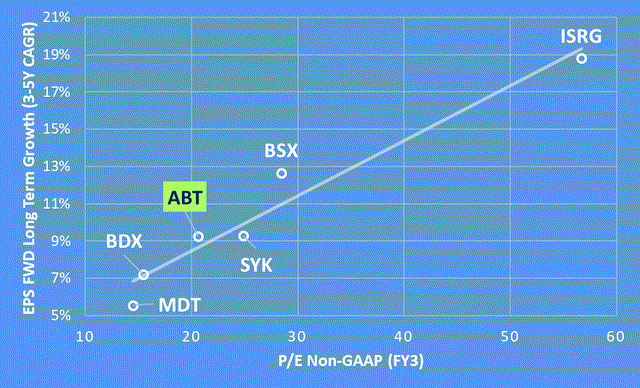

To determine how fairly ABT stock is valued, I’ve decided to take a rather simple approach. I have gone with Abbott’s peers from the healthcare equipment industry, and plotted their P/E (non-GAAP) FY3 ratios against the respective EPS growth rates. These are CAGR figures for the EPS, based on the next three to five years.

As we can see above, there is a pretty clear linear relationship between how the market values a company, given its PE ratio based on estimated future earnings, and the long-term EPS growth expectations. MDT seems to be priced a lot higher given its EPS LTG rate, whereas BSX is showing higher growth than how much value the market seems to be assigning. The graph also shows that ABT seems to be valued pretty fairly, and its LTG to PE relationship shows neither a buying nor selling opportunity.

In addition to this approach, based on the company’s peer groups, I also believe its valuation is fair, compared to 5-year historical trends of how the market has been valuing the company.

|

ABT |

ABT 5Y Avg. |

% Diff. to 5Y Avg. |

|

|

P/E Non-GAAP (‘FWD’) |

25.03 |

25.18 |

-0.5% |

|

EV / Sales (‘TTM’) |

5.13 |

5.18 |

-1% |

|

Price / Sales (‘FWD’) |

4.85 |

4.85 |

0% |

As can be seen above, the company’s multiples are pretty much at their five-year averages, with a very negligible deviation. Overall, this points to me that the market is valuing the company pretty fairly in terms of its earnings and sales. Moreover, the trailing EV/Sales ratio shows that the company’s enterprise value is pretty proportionate to the company’s revenue level, given the trend seen in the last five years.

Overall, I believe the data pretty strongly points to ABT trading at a fair value, and therefore, a hold rating on the stock is more than justified.

Risk to Thesis

Although I think Abbott Labs is a solid business with growth coming in broadly from its various segments, we cannot overlook some of the risks inherent to it. The most notable of these, I believe, is that of litigation, particularly the recent case against its preterm infant formula and human milk fortifier products. According to the plaintiff, the company’s human milk fortifier products, which contain cow milk, allegedly go on to cause necrotizing enterocolitis, without any risk disclosure from Abbott, on the packaging or otherwise. Earlier in July, a Missouri court ordered the company to pay $495 million in damages to the family of a child that developed necrotizing enterocolitis.

The company continues to stand by its product, which is endorsed by specialists and medical associations, not only in the US, but across the world. The division returns only $9 million in annual revenue to the company, which represents 0.02% of its total topline. The level of risk seems disproportionate given the razor-thin exposure the company holds.

Although I do not think the risk from these litigations are material, they do have the potential of becoming significant, and end up costing billions to the company. Earlier this July, a medical expert predicted that the company may see between two and four thousand cases of a similar nature annually. This could be a major blow to the company, and would limit its growth, as resources used to invest in the growth of the company would end up being paid in legal fees and damages.

Investor Takeaway

Abbott Laboratories is a solid company that is seeing topline growth, and profit margin improvement. With its various segments, its growth can be described as being broad-based, and is supported by a number of external trends, such as an increase in diabetes worldwide. With Covid-testing comps finally normalizing, the growth chart ahead looks promising. Despite these positives, however, it would seem that the market has priced in the company’s potential. I would not consider buying the stock unless a dip brings it down to levels where I am more comfortable to go long. I rate the stock as a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.