Summary:

- 3M stock has performed badly due to hefty lawsuit risks.

- Underlying progress is solid, however — profits and dividends are climbing.

- With 3M trading well below its normal valuation range, shares have upside potential if the legal risks can be solved without hurting the company too much.

gorodenkoff

Article Thesis

Income investors like investing in predictable dividend payers, especially if those have proven to be able to increase their dividends for very long periods of time even in adverse circumstances. That holds true for 3M Company (NYSE:MMM), which has raised its payout for a hefty 64 years in a row. At the same time, 3M is currently inexpensively priced, trading well below its normal earnings multiple. Before being too eager to buy into the stock, investors should consider the lawsuit risks, however, which we will look at in this article as well.

Overview

3M Company is a diversified industrial company. It sells an enormous range of different products, including personal safety gear, adhesives, surgical and other medical products, and so on. With more than 50,000 different products that it sells in 200 countries, 3M is very diversified when it comes to geographical markets and when it comes to products and product categories.

That has helped the company stay resilient versus adverse macro developments in the past. While industrials generally aren’t overly resilient versus recessions and other external shocks, 3M has shown above-average resilience in the past, as it is not overly reliant on one product or product category. Some of its business units, such as the Healthcare unit that sells a range of medical products, are not affected by economic downturns, as patients require care no matter what the economy looks like.

Overall, this has allowed 3M to be a steady and reliable performer in the past. Over the last decade, its earnings per share increased by a little more than 60%, which pencils out to a ~5% annual growth rate. While that is not overly much, a steady mid-single digit annual earnings per share growth rate from a resilient company is still a very solid feat. Earnings per share dipped by 16% in 2020, relative to the pre-crisis high — considering the large-scale lockdowns and economic downturn during the initial phase of the pandemic, that’s far from a bad result, I believe. Even in 2020, following this earnings pullback, the dividend was well-covered, as the payout ratio stood at 67% in 2020.

It is also worth noting that earnings per share started to recover in 2021, rising by 16% versus 2020, and another, although smallish, earnings per share increase is expected for 2022 (Q4 results have not yet been announced) and for the current year, 2023.

Shares Are Down Due To Lawsuit Worries

This brings up the question of why 3M is down 28% over the last year, and why the 5-year performance is even worse, at -47% (not accounting for dividend payments). With 3M forecasted to hit new record earnings per share this year, why has its stock been such a bad performer in recent years?

The answer is that investors and analysts worry about 3M’s exposure to several major lawsuits that pose considerable legal risks. While it is not uncommon for major companies to get sued, 3M’s lawsuits are more relevant compared to what happens to many other companies. The sums that 3M might be forced to pay are enormous, and many analysts believe that there is a high likelihood that 3M will lose the respective lawsuits — a risky combination for the company. In a sense, 3M might be comparable to Bayer (OTCPK:BAYRY), which suffered from hefty lawsuit losses once it had taken over Monsanto due to the latter’s glyphosate herbicide products.

3M is currently fighting two major lawsuits. The first one is centered around so-called forever chemicals, toxic pollutants that stay dangerous for long periods of time. PFOS and similar products have (according to the lawsuit) been known to be toxic for decades, and yet, 3M and other companies continued to manufacture them, thereby exposing both the environment and the public. It’s not yet known whether 3M will lose this lawsuit, of course, and it’s definitely possible that this court battle will drag on for years. But as the glyphosate lawsuits Bayer has suffered from show, health-endangering chemicals can be a major risk for a company.

The other major lawsuit that is a key risk for 3M is related to some of its hearing protection equipment. Earplugs that 3M manufactured and that were used by the US military in the 2000s and 2010s apparently malfunctioned, causing hearing loss and other related health problems for many soldiers. A massive 230,000 federal lawsuits are pending. 3M tried to move out of harm’s way by shifting the blame for these issues on a now-bankrupt unit, but not surprisingly, that was blocked by a judge, meaning 3M itself is still on the hook for lawsuits it loses.

Again, it’s unclear how many of these lawsuits 3M will ultimately lose, and how much it will have to pay for lost lawsuits or whether it will settle some cases otherwise. But with 200,000+ lawsuits pending, it’s pretty clear that this is a major risk for the company. A measly $5000 per lawsuit would result in a total cost of more than $1 billion already, but some analysts believe that 3M might be forced to pay as much as $100 billion as reported here on Seeking Alpha. For a company with a market capitalization of $73 billion, a $100 billion legal cost could be company-breaking. I personally do not believe that a $100 billion cost is likely, but even one-tenth of that, or $10 billion, would be equal to around two years of 3M’s net profit.

With these risks in mind, it is not surprising to see that 3M has underperformed the market over the last year and the last five years, despite solid operational progress. That being said, the stock price downturn could also create opportunity, at least if losses due to the aforementioned lawsuits are not too large. After all, the share price underperformance has resulted in a steep increase in 3M’s dividend yield.

3M: A High Yield And A Low Valuation

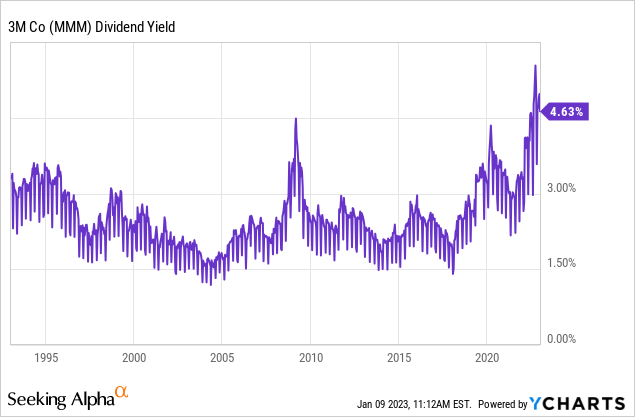

Based on current prices, 3M is currently trading at a dividend yield of 4.7%. That compares very favorably to its average yield in the past:

Over the last 30 years, 3M’s dividend yield has never been as high as it’s been in recent months, not even during the Great Recession. This could indicate a good buying opportunity for income investors — at least as long as the company survives the aforementioned legal problems and is able to maintain its dividend.

Over the last decade, 3M has grown its dividend by 10% a year. The dividend growth rate has slowed down considerably in recent years, however. The company raised its dividend by 2% in 2020, and by less than 1% in 2021 and 2022. Due to the uncertainties around the pandemic and the earnings pullback in 2020, combined with the legal risks that make it sensible to preserve money, the slowdown in the dividend growth rate is not surprising. I expect that 3M’s dividend growth will remain muted until the legal issues have been solved one way or another.

If 3M were to prevail, its dividend growth should accelerate again. Even a 5% dividend growth rate could be quite attractive in the long run when combined with a starting yield of almost 5%.

If, however, these lawsuits result in major costs, 3M might be forced to cut its dividend. While I do not believe this is particularly likely, the risk exists for sure. Investors thus shouldn’t get lulled by the dividend growth track record of more than 60 years — it is possible that this track record ends in the foreseeable future.

The weak share price performance in recent years has also made 3M stock pretty inexpensive. Based on current estimates for 2023, 3M trades at just 12.2x this year’s net profits today. The 10-year median earnings multiple is 20.3 and the 5-year median earnings multiple is 19.6. 3M thus has upside potential of around 60% versus its long-term median earnings multiples. I do not expect 3M’s shares to be valued at a high earnings multiple unless the legal risks are solved in a positive way. But if that were to happen, 3M would have hefty upside potential from its current inexpensive valuation level.

Takeaway

3M looks like a high-risk, high-reward pick right here. On one hand, the massive lawsuits pose a serious risk, and there is no way of knowing how much 3M will ultimately pay to solve these issues — some believe that the losses could be hefty. On the other hand, the stock price has performed weakly in recent years and it looks like investors are already pricing in some serious payouts due to the lawsuits. With 3M trading well below its normal valuation and offering a decades-high dividend yield, 3M could be a good long-term investment as long as the lawsuits do not break the company — underlying progress is solid, after all.

To me, 3M has too many uncertainties right now, but for more risk-hungry investors, 3M might have merit with its shares trading at half the price they traded at five years ago, despite higher profits and higher dividends today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!