Summary:

- Bloomberg reported that Carl Icahn established a short position in January of 2021 and since then, GME has tumbled over -70%.

- I disagree with management’s remarks on the Q3 call and GME isn’t in a stronger position today than in recent times based on the financials.

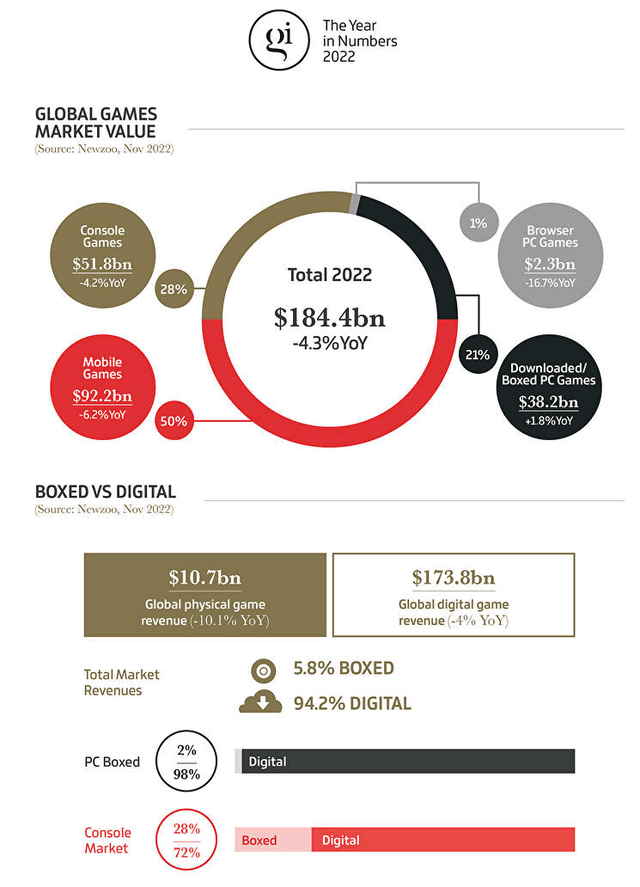

- The video game market continues to go digital as physical sales only represent 5.8% of the market.

- I don’t think GameStop can outrun the shift to digital, and I am not seeing a path to transform its business.

Justin Sullivan

GameStop (NYSE:GME) reported its Q3 earnings on 12/7/22, and the results were ugly. While GME is classified as a meme stock, it’s in a much different position than AMC Entertainment (AMC) or Bed Bath & Beyond (BBBY). AMC and BBBY are on the brink of destruction, with over-levered balance sheets resulting in negative shareholder equity, while GME has minimal debt, positive shareholder equity, and enough cash to figure things out in 2023. That’s the real question though, will GME be able to figure out how to become profitable again, or is their cash going to just prolong the inevitable? In Q3, GME missed earnings estimates and generated -$0.31 of Non-GAAP EPS and missed top-line revenue estimates by $160 million. I am in disagreement with Matt Furlong’s comments on the Q3 conference call, as he stated that GME is in a stronger position today than at any time in GME’s recent past. I understand the statement from a moral perspective, but by the numbers, it’s incorrect. GME hasn’t given the street a reason to believe there is a clear path to sustained profitability; as the industry changes, things will only get harder for GME.

GameStop is not stronger today when looking through the financials

Below is the exact quote from Matt Furlong:

I want to finish by reiterating what we’ve said in the past. We’re attempting to accomplish something unprecedented in the retail sector. We’re seeking to transform a legacy brick-and-mortar business that was on the brink of bankruptcy into a retailer that meets customers’ needs through our stores, e-commerce properties, and emerging sales channels. This path carries risk and is taking time, but it is the path we are on. With that said, GameStop is a stronger business today than at any time in the recent past. I’ll leave it there for this quarter. Thank you.

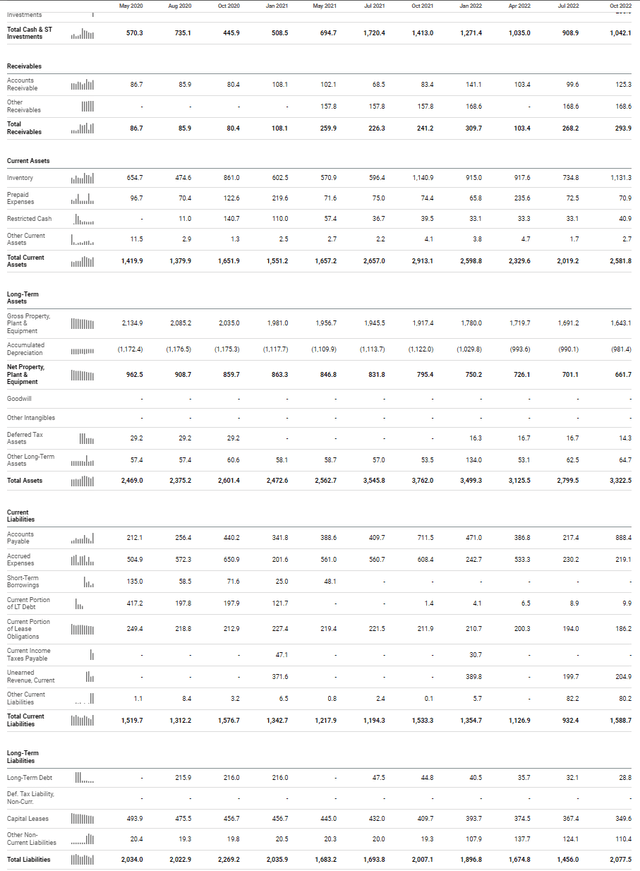

Prior to dissecting why I feel this statement was incorrect, I want to give GME’s management team some credit. GME utilized the meme stock craze to issue shares and fortify its balance sheet by raising cash and eliminating almost all its debt. GME has over $1 billion in shareholder equity, $803.8 million in cash on hand, and an additional $238.3 million in short-term investments, with only $28.8 million in long-term debt. Unlike AMC or BBBY, GME was able to navigate the landscape and reduce its leverage and risk, buying GME time to try and turn around its business.

The keyword in Matt Furlong’s quote was recent. This subjective word could mean a specific period to him and a different period to others. Since he didn’t give an exact time period, his definition of recent could in fact lead to GME being in its strongest position.

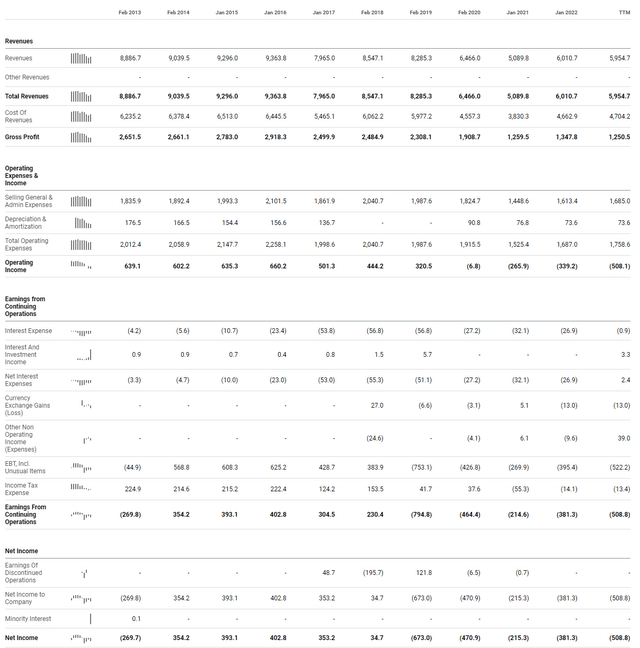

Above is a 10-year snapshot of GME’s income statement. I am not sure which set of financials the GME management team is reading, but GME is not in a better position today than it was in what I would consider recent or mid-range time periods.

Every business is in the business of turning a profit. GME has not had a profitable year since its 2018 fiscal year. From a net income standpoint, GME’s financials do not support Matt Furlong’s statement regarding GME being in its strongest position in recent times unless he is basing this on a 6-month period. From a QoQ perspective, he would be correct as GME has seen its losses decline QoQ from -$157.9 million to -$108.7 million to -$94.7 million. Maybe this is his definition of recent times, but I don’t believe you can judge a company on 2 quarters. GME went from turning a $34.7 million profit in 2018 to losing -$673 million in 2019, losing -$470.9 million in 2020, losing -$215.3 million in 2021, losing -$381.3 million in 2022, and losing -$508.8 million in the trailing twelve months [TTM]. While GME has seen its QoQ net income losses decrease, it’s overall net income losses are expanding. Cumulatively, GME has lost -$981 million over the past 11 years, having 5 profitable and 6 negative years. When looking at GME on an annual basis, GME hasn’t produced numbers this bad since 2019, which happens to be the only year from the past 11 years that losses have exceeded the current losses in the TTM.

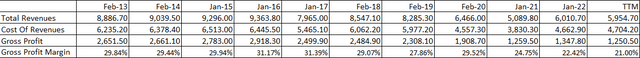

GME has also seen its gross profit margin decline YoY over the previous 6 years, falling from 31.99% to 21% in the TTM. Compression in margins is one of the last things GME needs as its revenue has declined by -36.41% (-$3.41 billion) since its peak in 2016. I guess my interpretation of relative strength is different from Mr. Furlong’s, but GME’s numbers don’t paint a pretty picture. Look at 2020 compared to the TTM. In 2020 GME generated $6.47 billion of revenue, its cost of revenue was $4.56 billion, and it generated $1.91 billion in gross profit for a gross profit margin of 29.52%. In the TTM compared to 2020, revenue has declined by -7.91%, the cost of revenue increased by 3.22%, and the gross profit declined by -34.48%.

Seeking Alpha, Steven Fiorillo

To be fair, I will gladly retract my statements and agree that GME is in a stronger position than in recent times if its current trajectory continues and the annual YoY numbers shift. This could occur but as of now, GME isn’t performing better than in recent years.

GameStop doesn’t have its back against the wall the way Bed Bath or AMC does, but things need to change

GME doesn’t suffer from looming debt obligations as they only have $28.8 million of long-term debt, which has eliminated interest expenses. The big problem is that GME continues to burn cash and reduce the total shareholder equity on its balance sheet. Over the previous 5 quarters, GME has burned $916.6 million in cash as its cash position declined -53.28% from $1.72 billion to $803.8 million. Over the previous 4 quarters, GME’s average cash burn has been -$152.3 million, which excludes the $238.3 million of short-term investments that recently appeared on the balance sheet. At this rate, GME will burn through its existing cash over the next 6 quarters, so there is time to figure things out. The problem for GME is that its business is in a perpetual state of decline and could be forced to issue more shares to boost its reserves and dilute shareholders if it’s business operations don’t reverse the trend.

Management did provide some insight into how they will manage cash going forward. They are in the process of reductions in corporate headcount. Management did indicate that its two focuses are achieving profitability in the near term, and driving pragmatic growth over the long term. GME is also keeping its eyes out for a strategic asset or complementary business that they could acquire for the right price. Management knows what they need to do, the problem that I can’t get past is that there is increased competition in the space, and gaming is going digital.

Not only has GME faced increased competition from big box retailers such as Walmart (WMT), and Target (TGT), but the video game industry is transforming into a digital market. I outlined my concerns about this back in March of 2021 (can be read here), and many commenters said that the sources I was sighting were incorrect. 2022 has now come to a close, and GamesIndustry.biz Editor-in-Chief James Batchelor has published the year in numbers for the video game market, and it’s horrible news for GME.

In 2022 the total video game market was valued at $184.4 billion. Console revenue accounted for 28% of the market, while mobile games captured 50% of the market, and downloaded/boxed PC games captured 21% of the market. Here is the most troubling statistic, global physical games only accounted for $10.7 billion, which is 5.8% of the total market revenue, while digital game revenue accounted for 94.2% of the market with $173.8 billion. The physical market continues to shrink, and as it continues to shrink, less used games will come through GME’s doors, drastically impacting the 2nd hand market they control. It’s inevitable that everything will be downloaded content, and 94.2% of the market has already shifted that way. GME is fighting for a sliver of a segment that has been decimated by the evolution of technology.

Carl Icahn’s short position continues to work

According to Bloomberg (article can be read here) Carl Icahn started accumulating a short position in GME back in January of 2021. Shares of GME have plunged over -70% from its 2021 highs and -67.92% since my article from March of 2021. Carl Icahn is also said to have a short bet against the S&P 500 as he believes we are in a bear market and doesn’t expect inflation to go away in the near team. Carl Icahn’s short position has worked out very well, and if he is still holding it after riding GME down over -70%, there is a chance he believes GME will go under. Carl Icahn built his empire on being correct and making strategic investments. While I can’t tell the future, and GME could transform its business, I think the writing is on the wall, and Carl Icahn’s short position could continue to work in 2023.

Conclusion

I believe GME will continue to see its share price fall and that the deck is stacked against them with respect to transforming its business. In the short term, GME has more than enough cash to provide a considerable amount of breathing room in 2023 without having to tap the debt market or issue new shares based on its current cash burn rate. The problem that I see is that console games going digital isn’t reversing the trend as some thought it would, and only 5.8% of the video game market is from physical sales. As the secondary used market gets tighter and tighter, there will be less of a reason to shop at GME. 2023 is a make-or-break year for GME, and even if GME can return to profitability, they can’t outrun the industry’s shift to digital.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

II will be launching a subscription service called Barbell Capital on the Seeking Alpha Marketplace. Barbell Capital will provide exclusive research, model portfolios, investment tools, Q&A sessions, watchlists, and additional features for its members. I will also have a live portfolio dedicated to generating capital from trading, selling puts and selling covered calls. The profits will be allocated to future capital appreciating investments and investing in dividend investments to generate income while we sleep.

https://seekingalpha.com/checkout?service_id=mp_1315