Summary:

- Tilray fell another 6% following another weak quarterly report, with revenue missing estimates by $13.1 million.

- The Canadian cannabis company even saw a revenue boost from closing the Montauk Beverage Company deal during November.

- The stock is far too expensive, trading at nearly 5x sales when excluding the distribution business.

Dzmitry Dzemidovich

Quarter after quarter, Tilray Brands (NASDAQ:TLRY) reports disappointing results. The Canadian cannabis firm disappointed again with FQ2’23 results far below expectations and the business continues heading in the wrong direction. My investment thesis remains Bearish on the stock, with a limited cannabis business and no history of organic growth.

Promising Business Always Fades

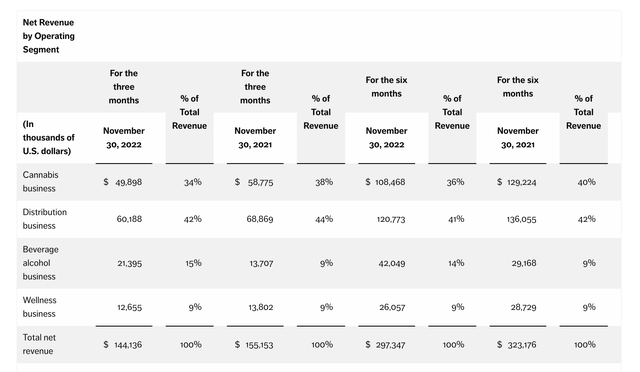

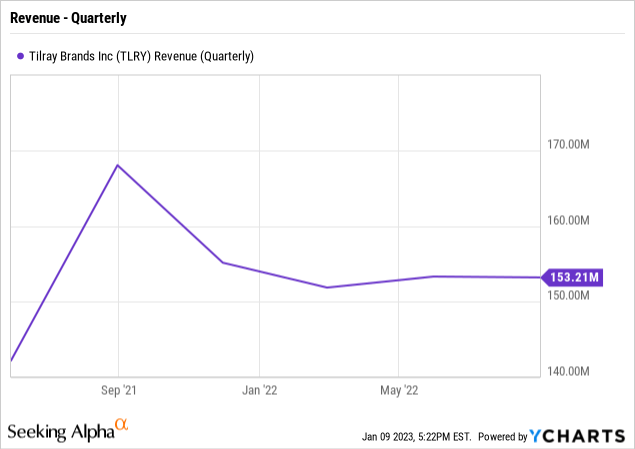

While Tilray was hit by currency headwinds in the quarter, the company also reported revenues greatly boosted by acquisitions. In total, FQ2’23 revenues were only $144.1 million, down from $155.2 million in the prior November quarter.

Source: FQ2’23 earnings report

The Cannabis business fell by $8.9 million from the prior year while the distribution business collapsed $8.7 million, though this business would’ve been up $2.1 million on a constant currency basis. Regardless, the distribution business has very low margins.

The Beverage alcohol business saw the only growth in the quarter. Revenues grew over 50% to $21.4 million. The majority of this gain came from the acquired Montauk Brewing Company business during November, but additional upside came from the prior acquisitions of Breckenridge and the Green Flash last December.

Underneath the details in the cannabis business was the decline in the International segment to only $7.7 million from $13.7 million in the prior year period. Of course, the International revenues were hit by a $1.8 million currency impact, but this portion of the cannabis business was supposed to easily hurdle such minor headwinds.

Tilray only reported adjusted gross margins of 29% due to the limited 13% margins of the Distribution business. Even the strong 57% gross margins of the Beverage alcohol business took a hit during the quarter to 52% after the acquisitions were factored into the results.

The once promising cannabis business is again fading, with gross margins down to just 37%. Tilray only produced $11.7 million in adjusted EBITDA for the quarter, down $2.0 million from last year.

The biggest problem facing shareholders is that Tilray hasn’t been effective competing in the Canadian cannabis market or the wellness sector, yet the company has entered international markets and now is very aggressive in craft beer. The company plans to parlay these brands into THC-based products in the U.S., but the Federal government hasn’t approval cannabis yet.

The Montauk craft beer business can easily be expanded with the inclusion in the existing Sweetwater national infrastructure. Montauk was very concentrated in the Northeast, but the problem with Tilray is the inability to take the business beyond the low-hanging fruit, due in part to the wide net of the business and the lack of focus by management.

Tilray reported quarterly revenues of $168 million back in FQ1’22 and has seen revenues collapse during this period. At the time Beverage alcohol revenues started near $16.0 million per quarter, but those revenues had already fallen prior to the acquisitions now pushing revenues above $21 million.

Still No Value

Despite the market cap now falling below $2 billion, Tilray still isn’t cheap. The company only produced $84.0 million in non-distribution revenues.

The consensus analyst estimates have revenue at $638 million and at least $240 million is related to the Distribution business with limited to no value. In essence, Tilray only has a target for revenues of ~$400 million for the businesses that count.

The Canadian cannabis company has long failed to generate revenue growth, much less profitable growth. When one business segment falls apart, management turns around and acquires businesses in another sector, with the primary example being the Beverage alcohol segment.

The company has $434 million in cash, but Tilray has $578 million in debt, for a net debt position of $144 million. The enterprise value of the stock sits close to $2 billion for a company failing to grow organically with only $400 million in revenues.

The stock still trades at nearly 5x revenues for a cannabis sector where most U.S. stocks have fallen to only 1x to 2x revenue forecasts. In addition, Tilray only guides to adjusted EBITDA profits of $70 to $80 million, placing the stock at ~25x these minimal profit targets.

Takeaway

The key investor takeaway is that Tilray still isn’t a bargain, with the stock trading below $3. Investors should continue avoiding the stock, with the cannabis company only appealing once CEO Irwin actually grows cannabis revenues to match the current stock valuation.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.