Summary:

- Medtronic is modestly undervalued based on DCF analysis, but slow revenue growth limits upside potential.

- The company’s diabetes segment lags behind competitors like DexCom and Abbott due to inferior CGM technology.

- Medtronic’s cardiovascular and neuroscience segments show steady mid-single-digit growth annually.

- Recent recalls of insulin pumps may hinder growth in Medtronic’s diabetes business, despite partnerships with Abbott.

- I recommend selling Medtronic stock until it achieves significant innovation or operational improvements to drive revenue growth.

DusanBartolovic

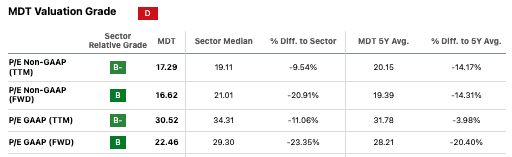

Analysis will often point out that Medtronic (NYSE:MDT) is “undervalued.” It probably is, but not by a lot.

Seeking Alpha

Within the context of an efficient market, there are typically good reasons why securities are priced the way they are. Medtronic, founded in 1949, is a $100 billion-plus health care equipment behemoth, known for its cardiac pacemakers, ablation products, and much more. So this is not a stock that the market would easily and simply “get wrong.” It’s valued as is. Instead of writing an article attempting to prove Medtronic is undervalued and by how much, I am more curious to discover the implicit assumptions the market is making in valuing it.

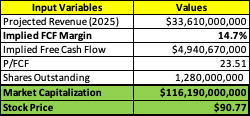

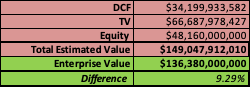

Yes, my DCF analysis (that discounts the next eight years of projected FCFs to “present value” and adds a terminal value via the perpetuity growth model) dashboard also suggests Medtronic is modestly undervalued. First, let’s look at expectations for 2025.

Author

The FCF margin is implied from projected revenue, MDT’s current P/FCF, and market capitalization. 14.7% is in line with Medtronic’s trailing twelve-month performance.

Author

The revenue estimate for 2025 is the consensus among analysts.

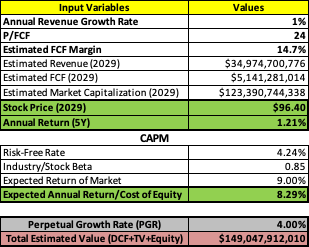

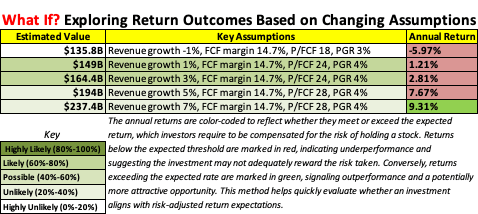

With the baseline FCF established, even 1% constant revenue growth moving forward still suggests Medtronic is undervalued, but by just 9.29%.

Author Author

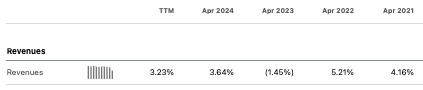

Medtronic hasn’t had a problem growing revenues at 1%+ YoY, on average.

Seeking Alpha

But notice the implied annual return for stockholders—just 1.2% and far below the expected annual return of 8.29%. Bump up the annual revenue growth rate to 3%? The annual return climbs to 2.81%, which is still paltry. It’s important to note that equity holders take on risk and expect to be compensated for it. That’s where the CAPM/expected annual return comes from. If you invest in a very risky stock for a year and its return matches the S&P 500, it was a bad investment because you were not fully compensated for the risk. Medtronic is a lower-risk stock with a beta of 0.85, but in order for it to be a worthwhile investment, its returns must exceed its cost of equity. To put it simply, Medtronic is undervalued because their slow growth is failing to generate sufficient returns for equity holders relative to the risk they are taking.

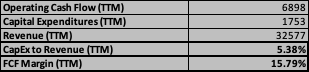

The company can solve this problem in two ways: significantly increase revenue growth, margins, or both. Margin improvements are somewhat limited by the nature of their business. They develop, manufacture, and sell physical products. Gross profit has been ~65% historically. SG&A expenses take up another one-third of revenues. CapEx is in the mid-single digits. There isn’t much you can do to change these figures.

On the revenue growth front, it’s been business as usual. They, seemingly, haven’t been able to find that “next big thing” to boost revenues. For example, Medtronic’s continuous glucose monitoring [CGM] systems have taken a backseat to DexCom (DXCM) and Abbott (ABT) due to poor user experience, innovation, and regulatory issues. Abbott’s FreeStyle CGM delivered $1.6 billion in Q3 2024 alone. In the meantime, Medtronic’s entire diabetes portfolio generated just $647 million in Q3. Imagine if Medtronic rose to the occasion in this multi-billion-dollar market expected to eclipse $30 billion by 2032. Its stock probably wouldn’t be “undervalued.”

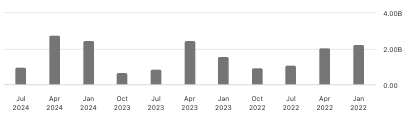

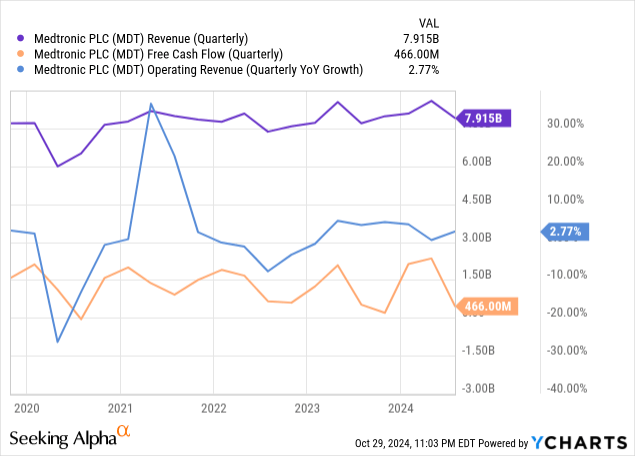

In Q2 (or fiscal Q1 2025 for Medtronic), there were signs of encouragement. Revenue came in at $7.92 billion, beating estimates by $18 million. This represented 2.77% YoY growth. Cash from operations totaled $986 million—lower than typical.

Seeking Alpha

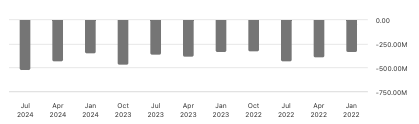

Capital expenditures were higher than typical—at $520 million. This resulted in FCF of $466 million, or only 5.9% of revenues.

MDT’s historical CapEx (Seeking Alpha)

So, I wouldn’t read much into Medtronic’s quarter-to-quarter differences in FCF margin.

The key question for investors remains: where will the revenue growth come from?

Medtronic reports revenues from their four major segments: cardiovascular (traditionally their largest segment), medical-surgical, neuroscience (e.g., cranial and spinal technologies), and diabetes. Due to fierce competition and a lack of edge in medical-surgical, revenue growth has stalled. Their cardiovascular segment remains strong, growing in the mid-single digits YoY. Neuroscience sports similar growth rates to cardiovascular. Surprisingly, and what has probably sparked the stock’s 29% 1Y rally, their diabetes segment is showing signs of life, growing ~12% YoY. Medtronic highlights their MiniMed 780G system, an automated insulin delivery system designed to improve glucose control for patients with diabetes. This device automates insulin delivery with advanced algorithms based on CGM data (the Guardian Sensor 3). This is a smaller and different market from the CGM that is popular among people with type 2 diabetes who may or may not require insulin injections. Within it, Medtronic competes with Tandem (TNDM) and Insulet (PODD). In August, Abbott announced its intention to integrate its CGM with Medtronic’s insulin pumps. This was a pretty important development in this space and caused some volatility in Tandem’s and DexCom’s stocks. Earlier this month, Medtronic voluntarily recalled all MiniMed 600 and 700 series insulin pumps due to reports of shortened battery life, which could be linked to hyperglycemia and diabetic ketoacidosis cases. The latter is a severe and potentially fatal condition that affects people with type 1 diabetes. The recall is classified as a Class I, which is the most serious type of recall. Subsequently, this could increase scrutiny of Medtronic from both regulators and users.

Medtronic reports Q3 (fiscal Q2) earnings on 11/19. The revenue estimate is $8.28 billion, while the EPS GAAP estimate is $0.94. Investors should pay particular attention to how the MiniMed recall is impacting their diabetes segment revenue.

Financial Health

As of July 26, Medtronic reported having $1.311 billion in cash and cash equivalents. Short-term investments totaled $6.532 billion. Total current assets were $21.947 billion, while total current liabilities were $10.287 billion. This indicates a current ratio of approximately 2, suggesting that Medtronic has sufficient liquidity to cover its short-term obligations. Medtronic does owe $26.26 billion in long-term debt.

Here’s a look at some key trends during the past few years:

MDT Stock: Undervalued but Trapped in Slow Growth

In conclusion, just when things appear to be heating up in one of their key segments, that has, largely, been a disappointment due to their underperformance in the CGM market; the devices that were driving growth get recalled. Yes, it’s the battery. It’s fixable. But this doesn’t bode well for its future performance on the market. Fortunately for Medtronic, they have dozens of prospects outside of their insulin pumps and a considerable moat in cardiac devices. Make no mistake about it, while Medtronic is a solid company, its stock has been another story. In the last ten years, the return has been only 33%. If you had invested in the S&P 500 during the same time period, you would have received 197% returns and could have slept better at night.

Indeed, according to my dashboard, assuming FCF margins remain the same, Medtronic will have to grow revenues at a rate of 7% and merit a higher P/FCF (which should theoretically adjust to the upside if revenue growth improves) for its annual returns to exceed expected annual returns (8.29%).

Author

Until this happens, Medtronic will likely remain undervalued, and its stock will continue to underperform (“sell“).

Risks to my sell recommendation include operational efficiencies that significantly increase profit margins, outperformance in one of their key segments, or successful innovation in a new area such as CGM or robotic surgery. Furthermore, if Medtronic can resolve the recall issue and restore confidence in its diabetes business, there may be significant upside in that segment.

Appendix

Note regarding dividend consideration:

When I estimate returns in my DCF model, the focus is on projected FCF and their present value. The stock price and annual return are driven by the company’s ability to generate FCF over time, independent of dividends. Remember that dividends are simply a distribution of profits. They do not influence the company’s intrinsic value, which is derived from cash flows. So, dividends don’t impact the estimated annual returns or the company’s valuation because my DCF framework already assumes that all FCF is reinvested into the business or returned to shareholders in other forms.

To put it simply, dividends are a use of FCF rather than a source of value themselves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.