Summary:

- We believe Apple’s financial performance remains rock solid, its valuation inexpensive, and its stock chart bullish.

- The slow-burn slow-build approach to AI at Apple will, in our view, benefit the stock price over time.

- We rate the stock at Hold with a price target of $280.

ambadas wadisherla/iStock Editorial via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Yet More Reasons To Ignore Tech Bros

Knowing a lot about technology is often a great way to be a terrible investor in technology. Does Apple (NASDAQ:AAPL) make the latest, greatest smartphones? Probably not. Can you build your own laptop with superior performance to a MacBook? Most likely, you can. Are there better display technologies on the market than Retina? Quite possibly. Do enough people care enough to search out the nth degree of performance over and above the frankly remarkable power on offer from your on-every-street iPhone, MacBook, AppleTV and so forth? They do not. And this is rather the point. Apple is, in my opinion, the finest consumer electronics business that ever lived. There was a time when I was in short trousers that I liked to assemble PCs from best-of-breed components, but then I grew up, got busy, grew tired of things making my life more difficult, and switched to Apple stuff. And then my life got a lot easier. And I think a lot of people feel that way. No single purchase has changed my working life as much as an ARM-powered MacBook. The thing will work all day and night on one charge, connects to anything without complaining, makes no noise, doesn’t weigh much, doesn’t run hot, has a wonderful screen, and fits in a small bag. Do I care about the details? I do not.

Tech bros will tell you that Apple is late to the party with AI. I don’t think anyone in the real-world cares. The iPhone, and for that matter, the Mac and other Apple client devices, are likely in the end to be trusted on-ramps for the consumer experience of AI applications. Grok, ChatGPT, Gemini, all these applications have the air of early computing when you had to have a roomful of kit and dress a lot like a Hollywood stereotype scientist to pass muster.

If you take a moment to compare how Google Gemini or ChatGPT looks today, you may find it not so different to how an MS-DOS command prompt looked in about 1982. Today’s UI is neater, for sure, but it’s still all about learning how to make the computer do what you want. It’s not about how the computer can bend to work how you want.

I don’t know, but I suspect, that Apple will slowly transform and normalize its users’ interaction with AI such that users won’t even think about AI as a thing – just as early iPhone users stopped thinking about “mobile data” as a thing and instead just got on with buying music and books and stuff and playing games and … paying Apple for the privilege. Want to know what the much-searched for killer app was in mobile data? The killer app was … actually being able to use anything if you were a normal human.

I assume the actual amount of innovation that Apple will contribute to the AI arms race will be muted, save that via UI / UX design it will on board vast numbers of users and this will be its major contribution to this new era of compute.

Which brings me to the numbers.

Apple – Financial Fundamentals

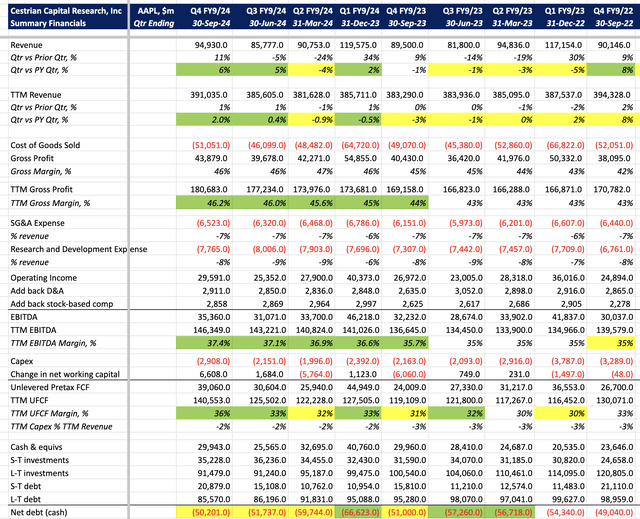

Even with no AI offering to speak of, Apple was able to accelerate revenue growth this quarter, and to do so whilst also growing cash flow margins. The balance sheet remains impervious to attack even after a large buyback program.

AAPL Financial Summary (Company SEC Filings, YCharts, Cestrian Analysis)

And just like Meta Platforms (META) – see our most recent note here – the market is not asking you to pay a big price for this name.

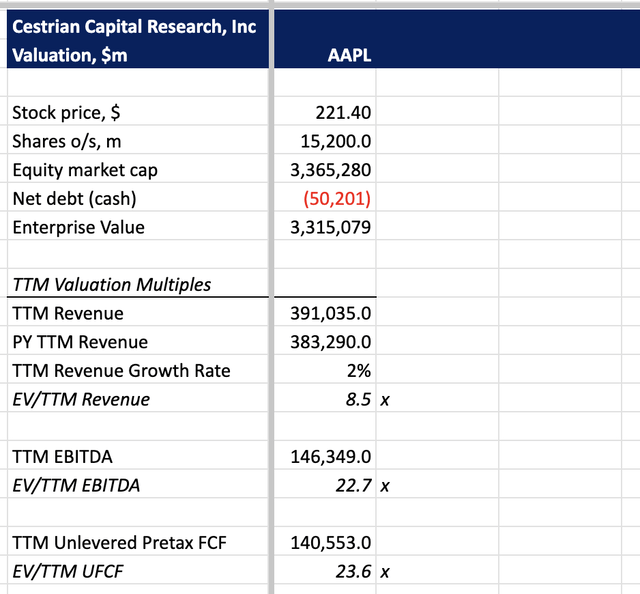

Apple – Valuation Analysis

24x trailing twelve months’ unlevered pretax free cash flow is not expensive, in my opinion.

Apple Valuation Analysis (Company SEC filings, Ycharts, Cestrian Analysis)

Let’s take a look at the stock chart and our rating.

Apple – Stock Chart

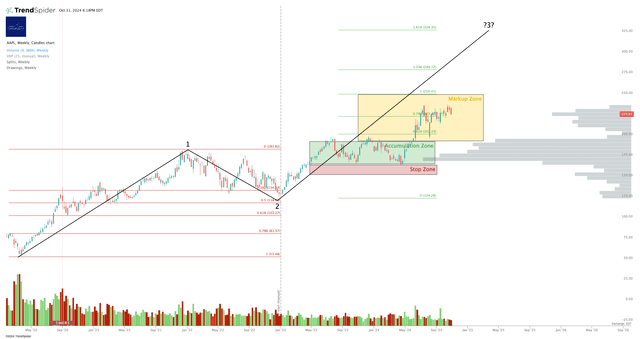

You can open a full-page version of this chart, here.

AAPL Stock Chart (TrendSpider, Cestrian Analysis)

This is AAPL since the COVID crisis lows. The stock held up remarkably well during the 2022 rate hike cycle, the drop not even hitting the 50% retracement of the Wave 1 up you see there (or in normal speak, the stock dropped less than half the value it created between March 2020 and the end of 2021). This was more resilient than the S&P 500 and way more resilient than the Nasdaq. The move up from the bear market lows has been volatile but insistent. In our Investing Group service here on Seeking Alpha, Growth Investor Pro, we rated AAPL at “Accumulate” between $166-193/share, because of that big volume x price spike you see in the chart above – the gray bars on the right-hand side. That, I believe, is institutional accumulation in the name as a precursor to a new leg up. We moved to Hold rating at $193/share and remain there. We believe the stock can reach $280 (the 1.236 extension of the prior Wave 1 placed at the Wave 2 low) and if you really pushed us, we would say that $328 had a fighting chance (that’s the 1.618 extension of the prior Wave 1 placed at the Wave 2 low).

Apple – Stock Rating

We rate AAPL as Hold. (Note, for us, Hold means Hold – unlike much of the sell side analyst community, “Hold” does not mean “Sell”!).

Cestrian Capital Research, Inc – 31 October 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Business relationship disclosure: See disclaimer text at the top of this article. Cestrian Capital Research, Inc is an affiliate partner of TrendSpider.

Cestrian Capital Research, Inc staff personal accounts hold no direct positions in AAPL but do hold beneficial positions via, inter alia, S&P500 and Nasdaq-100 ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Our Investor Community.

Our Growth Investor Pro service is one of the most highly-respected and most popular services on all of Seeking Alpha. And right now you can take a one-month trial for just $99 before deciding if you want to take an annual subscription. You can learn all about it here including the wall of 5-star reviews we’ve received in bear and bull markets alike.