Summary:

- Advanced Micro Devices experienced a significant pullback following a slight miss on 4Q revenue and a weaker-than-expected margin profile, leading to an in-line EPS result for 3Q.

- Its Data Center GPU business remains robust in 3Q, driven by strong AI demand that accelerates overall revenue and EPS growth, despite a declining Gaming and Embedded revenue.

- Despite anticipated gross margin expansion in 4Q, AMD management noted that the margin profile is currently below the corporate average as the company prioritizes demand growth.

- The recent sell-off reset some market expectations, yet its valuation multiples remain at a premium, with a forward non-GAAP P/E of 50.4x, comparable to NVIDIA’s.

- The premium multiples are justified by AMD’s sustained growth acceleration and margin expansion phase heading into FY2025, in contrast to NVIDIA’s growth deceleration and margin normalization stage.

JHVEPhoto

What Happened

Advanced Micro Devices’ (NASDAQ:AMD) stock fell more than 10% following a lackluster 3Q FY2024 earnings report. While the results were not disastrous, investor expectations were high, as the stock currently trades at a premium multiple. The company beat revenue expectations, but its non-GAAP EPS in-line with market consensus. Additionally, the midpoint of 4Q revenue guidance came in slightly below estimates.

In my previous analysis, I upgraded AMD from sell to buy following a 20% pullback, which helped reset market expectations. Since then, the stock had rallied 14%, outperforming the S&P 500 Index by 9%. The post-3Q earnings decline has nearly sent the stock to my last publication price. Although AMD’s gaming segment saw an accelerated revenue decline in 3Q, its Data Center GPU business continues to show robust growth, driving growth acceleration in total revenue and margin expansion. Overall, I believe AMD remains well-positioned to accelerate its revenue growth and margin expansion in 4Q and beyond. Therefore, I view the post-earnings pullback as a buying opportunity and reiterate my buy rating on the stock, as its growth acceleration phase supports its premium valuation.

Revenue Growth Continues Accelerating in 4Q

The company model

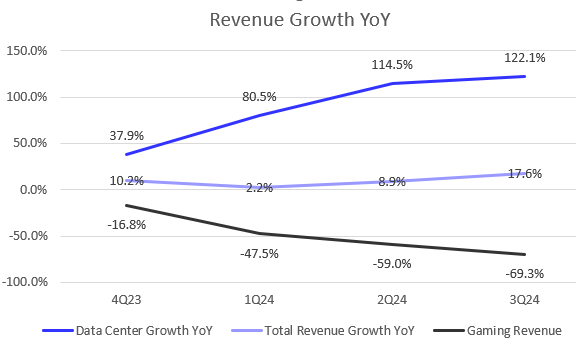

Despite an accelerated decline in Gaming revenue, which dropped 69% YoY in 3Q, AMD reported solid total revenue growth of 17.6% YoY in 3Q, showing sequential acceleration from 8.9% YoY in 2Q and beating my estimate of 16%. This strong revenue momentum was primarily driven by robust growth in the Data Center segment, which grew 122.1% YoY. This performance aligns with management’s previous comments that the strength in the Data Center and Client segments could more than offset the slower performance in the Embedded and Gaming segments. During the 3Q FY2024 earnings call, the management raised Data Center GPU revenue guidance to more than $5 billion in 2024, up from $4.5 billion guided in the previous quarter, indicating solid AI demand on its MI300 product family.

For its 4Q FY2024 outlook, AMD projects revenue growth of 21.6% YoY based on the midpoint of its guidance, with a potential variance of plus or minus $300 million. The growth acceleration is largely driven by continued expansion in Data Center GPU business. Although the midpoint of 4Q revenue guidance is slightly below market consensus, I think the company is well-positioned to exceed the midpoint number, given its track record. My estimate for AMD’s 4Q revenue is $150 million above the midpoint, implying a 24% YoY growth rate.

3Q EPS In-Line with Estimates Signals Margin Pressure

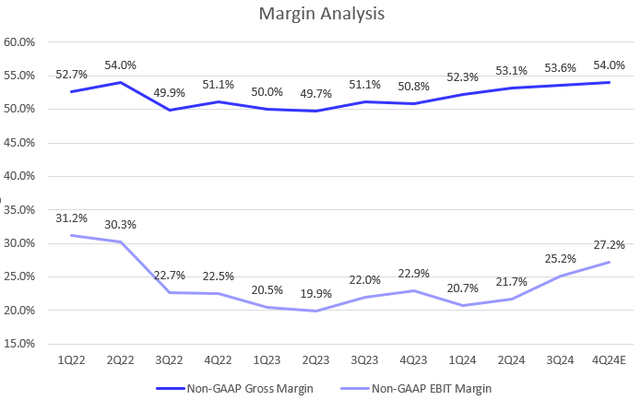

Since 4Q FY2023, AMD has been steadily improving its margins, though the pace of expansion in 3Q fell short of investor expectations. Technically, EPS met estimates despite a revenue beat, suggesting weaker-than-expected margins. While the non-GAAP gross margin increased by 50 bps sequentially in 3Q, it’s encouraging to see a strong expansion in the non-GAAP EBIT margin, which rose by 350 bps QoQ, breaking its previous flattish trend.

Looking ahead, AMD forecasts a 4Q non-GAAP gross margin of 54% and non-GAAP operating expenses of $2.05 billion. This improvement is due to a higher-margin effect from strong growth in Data Center revenue in 4Q, which doubled its revenue mix (52% in 3Q) compared to a year ago. However, during the call, the management noted that the Data Center gross margin is currently below its corporate average, as the company prioritizes customer demand and market expansion to drive revenue growth in CY2025. This suggests that NIVIDA’s (NVDA) Data Center gross margin is significantly higher than AMD, though neither company discloses specific details.

With the 4Q revenue consensus at $7.65 billion, this projects a non-GAAP EBIT margin of 27.2%, implying an additional 200 bps of sequential expansion in 4Q. Therefore, the company remains on track to achieve both revenue growth acceleration and margin expansion going forward, even as its valuation trends lower due to the recent pullback.

4Q EPS Consensus Indicates a Sequential Growth Acceleration

The company model

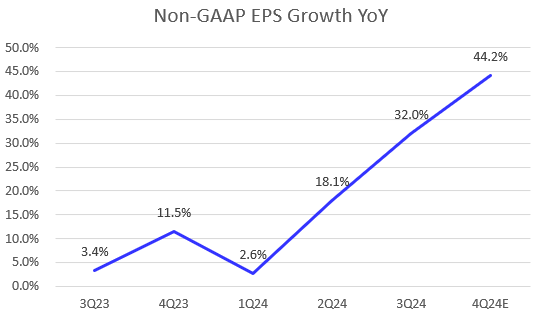

Despite in-line non-GAAP EPS in 3Q, AMD showed significant growth acceleration, from 18.1% YoY in 2Q to 32% YoY in 3Q. However, the post-earnings selloff suggests that the buy-side consensus anticipated an even higher growth rate. Based on management’s 4Q outlook shared during the earnings call, we estimate its non-GAAP EPS to be $1.10, indicating a 44% YoY growth in 4Q, as shown on the chart.

Additionally, AMD continues to improve its FCF profile, generating $496 million in FCF, which was a 13% QoQ increase despite a $123 million non-recurring acquisition-related headwind. The company anticipates higher capex in FY2025 to support the MI300 ramp and sustain growth momentum.

Elevated Market Expectations Caused Post-Earnings Selloff

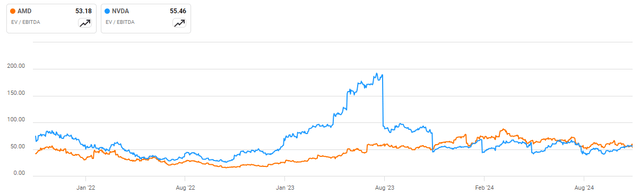

Prior to the more than 10% post-3Q earnings selloff, AMD’s EV/EBITDA TTM was trading above NVIDIA’s. Now, they are trading at similar levels, despite AMD’s gross margin and growth momentum being significantly lower than NVIDIA’s. AMD’s non-GAAP EV/EBITDA fwd is 46.3x, which is still above NVIDIA’s 42.6x.

Looking at AMD’s forward 12 months earnings outlook, its non-GAAP P/E fwd is now 50.4x, about 17% above its 5-year average. This multiple is also higher than NVIDIA’s 49.7x, highlighting that AMD is trading at a premium valuation.

However, I believe AMD is currently in a growth acceleration phase, while NVIDIA is in a growth deceleration phase, with its previous triple-digit YoY non-GAAP EPS growth unlikely to be sustainable. Furthermore, NVIDIA’s gross margin declined last quarter. Therefore, AMD’s premium valuation can be justified if it maintains its growth acceleration and continues to expand its margins in FY2025.

Conclusion

The recent 3Q earnings selloff has brought AMD’s stock back to a 0% YTD return due to a margin outlook that fell below investors’ high expectations. Additionally, its gaming and embedded segments continued to weigh on overall revenue growth, though Embedded revenue is recovering slowly. Nevertheless, AMD’s growth trajectory remains robust, with strong gains in its Data Center segment and consistent upward momentum in revenue and margin expansion, indicating a growth acceleration phase that supports a higher valuation compared to NVDA, which is currently experiencing growth deceleration and margin normalization. Therefore, I believe the recent selloff has reset some market expectations once again. With sustained AI-driven demand, AMD’s growth acceleration phase is likely to extend into FY2025, making the recent pullback a compelling buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.