Summary:

- Micron Technology is an American multinational semiconductor manufacturer with a market cap of about $110 billion that develops memory and data storage technologies.

- Micron Technology announced its results for fiscal Q4 2024 in late September, marking the company’s dramatic turnaround thanks to strong memory recovery and location in lucrative areas such as AI.

- As memory prices rise, and demand, especially for AI solutions, continues to increase, I believe Micron will likely see robust sales and profit growth indeed in 2025.

- The decline in the MU stock price since mid-summer has created a valuation discount. I believe that Micron Technology could easily trade at 30% above its price without being overvalued.

- MU stock deserves a “Buy” rating, as it is poised to rise significantly from here, in my view.

vzphotos

Introduction

Micron Technology, Inc. (NASDAQ:MU) is an American multinational semiconductor manufacturer with a market cap of about $110 billion that develops memory and data storage technologies. Based in Boise, Idaho, Micron is known for its innovative products, such as dynamic random-access memory (DRAM), flash memory, and solid-state drives [SSD]. The company sells consumer products under the Crucial brand and is particularly focused on developing technology for the data economy. From data centers and AI accelerators to mobile devices and desktops, Micron products are built into applications for faster and more efficient data processing and storage.

Micron’s direct competitors in the market are other large semiconductor makers such as Samsung Electronics (OTCPK:SSNLF), SK Hynix, and Intel (INTC), all of which produce memory and storage. In addition to this list of companies, MU has some other peers in the memory market – recent research from Goldman Sachs [proprietary source, October 2024] helps to identify some of them:

Goldman Sachs [proprietary source, October 2024], Oakoff’s notes![Goldman Sachs [proprietary source, October 2024], Oakoff's notes](https://static.seekingalpha.com/uploads/2024/11/2/53838465-1730538038308306.png)

In terms of customers, Micron works with companies across several different sectors, including the tech, automotive, and telecom end markets. Its customers are typically large enterprises that need efficient memory to power their services and products.

My Thesis

I consider Micron Technology stock a “Buy” given the recent explosion in the market for AI-powered cloud data centers that turned back the years of NAND and DRAM price drop. This recovery should be further supported by prior production reductions and inventory replenishments from distributors and OEMs. The stock is up after management released their bullish guidance for Q1 2025 (revenue and non-GAAP profits will be above initial estimates) – as memory prices rise, and demand, especially for AI solutions continues to increase, I believe Micron will likely see robust sales and profit growth indeed in 2025. Also, the stock seems to be undervalued relative to its peers when EPS growth estimates are considered.

My Reasoning

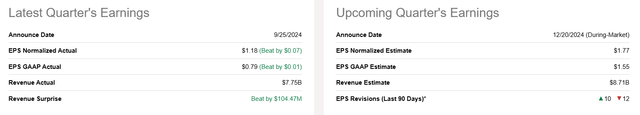

Micron Technology announced its results for fiscal Q4 2024 in late September, marking the company’s dramatic turnaround thanks to strong memory recovery and location in lucrative areas such as AI and data centers. It posted a remarkable 93% YoY growth in its top line (to $7.75 billion) – well above management’s guidance and above analyst estimates. This revenue increase coincided with a non-GAAP profit shift that helped the EPS rise to $1.18 from $1.07 in the same quarter last year (+10.3% YoY). As the press release noted, the strong earnings resulted primarily from the artificial intelligence-led surge in data center demand, which turned around the declining NAND and DRAM prices for the past few years (additional factors included the normalization of inventories across end markets and positive supply-demand forces). For some reason, Wall Street wasn’t forthright in its reaction to these strong Q4 results, with over half of the analysts choosing to downgrade their Q1 FY2025 estimates:

MU’s NAND revenue and record storage business unit revenue reached all-time highs in Q4 2024 with year-over-year revenue up more than 60%. Micron’s leading position in 1-beta DRAM and high-end NAND technology allowed it to take advantage of the expanding market for high-performance memory solutions. According to the CEO, more than 80% of DRAM bits are now generated on 1-alpha and 1-beta nodes, and more than 90% of NAND bits are generated on G7 and G8 nodes. This competitive advantage has allowed Micron to address the rising demand for memory solutions in AI, data centers, and other high-growth sectors.

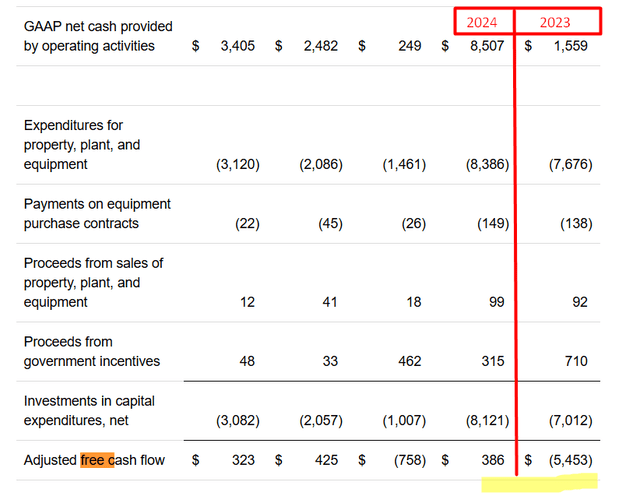

Micron’s financial viability lies in its massive free cash flow and conservative capital allocation. The firm generated $8.51 billion in cash flow from operations in fiscal 2024, up from $1.56 billion in fiscal 2023 (almost +5.5x). This strong CFO has allowed Micron to continue to invest in capacity expansion and technology development without depleting the balance sheet. Despite heavy CapEx during the year (~$8.4 billion), MU managed to report adjusted free cash flows of $323 million for Q4 2024 and $386 million for the full year of 2024 – incomparably better than last year:

MU’s Q4 press release, Oakoff’s notes added

By the end of the quarter, the company’s debt totaled ~$13.40 billion, and its cash and investments were ~$8.11 billion. MU expects to ramp up CapEx substantially in 2025 to meet growth and expand facilities in Idaho and New York, but I believe this is a must-have activity to keep growing and expanding the market share. According to TrendForce, Micron is targeting 25% of HBM market share by 2025 – that’s an extremely high-growth market with a projected CAGR of ~26.10% (or even more) for the next few years at least. It’s a relatively small end market, valued at slightly over $7 billion in 2022, but still, its growth rates should make MU’s revenue streams more stable, in my view. At the same time, as it expands and becomes more significant for manufacturers, its resistance should support the cyclical margins for its leaders.

A way larger end market for Micron – the AI-powered storage market – has a size valued at $18.56 billion in 2022, according to Fortune Business Insights, which is projecting it to grow from $22.90 billion in 2023 to $110.68 billion by 2030, exhibiting a CAGR of 25.2%. This CAGR projection seems more than justified to me, so as companies continue to enhance their AI capabilities, the need for more memory would place Micron in a favorable position as it’s capable of delivering high volumes reliably.

Looking ahead, Micron’s management has given rosy guidance for Q1 2025 with revenue in the $8.5-8.9 billion range and non-GAAP EPS of $1.74 (beyond the figures initially anticipated by the market). Micron expects to see increased demand for its memory products, including AI servers, data centers, and DDR5 migration. Micron’s HBM devices, sold out for 2024 and 2025, will see significant revenue, with prices locked in for 2025 shipments. Its focus on high-growth applications and cutting-edge technology means that the company has a strong foundation for winning market share and long-term expansion.

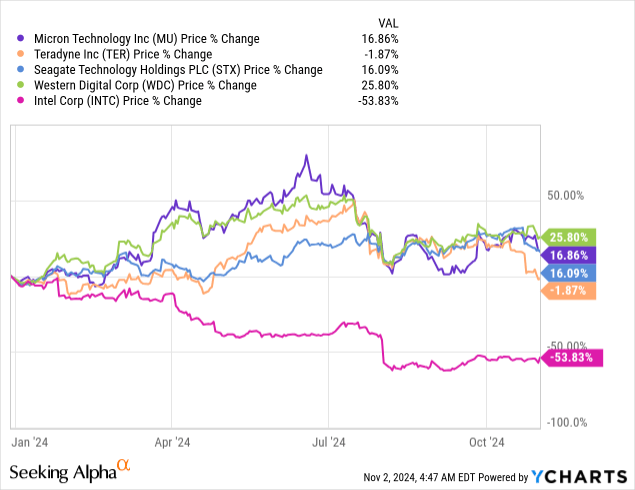

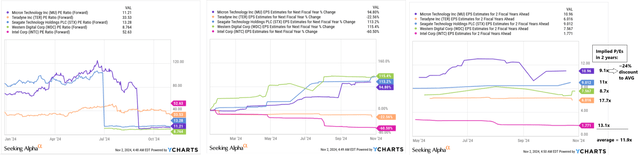

So I think Micron is taking all the right strategic steps – its large CapEx figures don’t scare me at all, as the growing addressable market for memory and data storage creates a favorable environment for the company to increase its net income. In this context, it’s interesting to see how the market is currently valuing Micron stock. It’s difficult to find direct competitors for Micron that are trading in the US stock market with sufficient liquidity and that accurately reflect actual market conditions. However, when we examine the closest competitors in neighboring sub-industry niches in which Micron operates, we find that Micron’s stock, despite being among the leaders in its group in terms of price action (on a YTD basis), is trading about 24% lower than its peers based on forwarding P/E. It’s also important to highlight that Micron’s EPS growth forecasts for next year and through 2026 are among the most promising in the sample.

YCharts, Seeking Alpha Premium, Oakoff’s notes

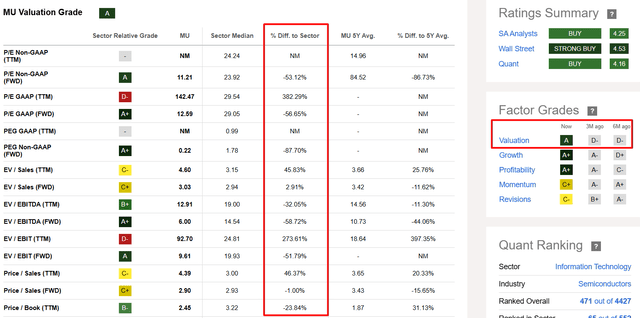

According to Argus Research (proprietary source, September 2024), the “peer-indicated value” for MU is in the $130s and is in a stable trend. That would mean a 30% upside potential to the current stock price, which is a nice upside, to be honest. But it’s difficult for me to comment on this because I’m not sure which peer group the analysts are referencing. However, I do see that Micron’s stock seems to have become cheaper in recent months: According to Seeking Alpha’s Quant Rating system, Micron was trading with a Valuation grade of “D” three months ago; now the stock has a solid “A”, trading at a discount based on certain multiples (particularly when looking at forwarding ratios, i.e. for the next year’s ratios). This discount ranges from 20% to 30% or more, so Argus Research may not be that far from the truth.

Seeking Alpha, MU’s Valuation, Oakoff’s notes added

So, an increase of around 30% on the current stock price would lead to a price/earnings ratio of around 14.5x by the end of the fiscal year 2025. I don’t believe that this is an unattainable target for Micron, especially as its EPS forecasts have increased recently.

For all these reasons, I’ve decided to initiate coverage of Micron Technology stock with a “Buy” rating.

Risks To My Thesis

Despite the upbeat sentiment, Micron still struggles in the very competitive memory space, where price wars can trigger dramatic stock price moves. Exposure of the company to cyclical demand in the consumer electronics and enterprise IT segments continues to be a challenge. But Micron’s broad product lineup and high penetration in automotive and industrial markets buffers such swings. Focusing on the profitable segments (AI, data center solutions) will likely lead to long-term growth and profitability, but again, investors should keep a close eye on the competitive landscape as MU may not have a moat.

Another risk is that the memory chip market is always unpredictable. The prices of DRAM and NAND flash memory can vary considerably depending on supply and demand, technological advancement, and competition. This volatility creates volatile revenue and profit margins for Micron, which in turn will influence the price of its shares. Also, the semiconductor space is competitive, and manufacturers such as Samsung or SK Hynix are constantly coming up with something new that could possibly take away Micron’s market share.

One more threat comes from the general economic conditions that can affect the market demand for Micron’s products. Economy contractions or stagnation in major industries including consumer electronics, data centers, and auto may also hinder demand for memory chips. Not only that, geopolitical issues, including trade wars or technology export embargoes, may short-circuit Micron’s supply chain or prevent it from accessing certain markets.

Your Takeaway

While memory remains a challenging market, I think Micron’s diverse product portfolio and healthy balance sheet will be key to long-term growth and profitability. So I expect the company to maintain its strategy execution, delivering robust financial performance and shareholder value in the coming years. Micron’s strong performance in fiscal Q4 2024 and promising outlook for fiscal 2025 demonstrates the firm’s commitment to cutting-edge technology and value-add applications.

In my opinion, the MU stock is currently undervalued by the market. The decline in the stock price since mid-summer has created a valuation discount. I believe that Micron Technology could easily trade at 30% above its current price without being overvalued. As Wall Street analysts continue to raise their EPS/sales forecasts, I expect market sentiment to improve eventually, leading to a continued rally in MU stock.

Therefore, MU stock deserves a “Buy” rating, as it is poised to rise significantly from here, in my view.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.