Summary:

- Accenture is a global consulting company which works with over 75% of the Fortune 500.

- The company reported strong financial results for Q4 FY22, beating both revenue and earnings growth forecasts.

- Accenture is building out its Metaverse solutions and helping companies to develop “Digital Twins” of factories.

Justin Sullivan/Getty Images News

Accenture (NYSE:ACN) is a global consulting company that specializes in I.T. and professional services. The company is poised to benefit from the secular growth across Digital, I.T., Cybersecurity, and even the Metaverse. Management has been executing its strategy well and the business has generated strong growth across all industries and geographies. In this post, I’m going to break down the business model, financials and valuation, let’s dive in.

Business Model

Accenture is one of the largest consulting firms in the world and a specialist in I.T. and technology. The business even has ~8,200 patents under its name which could give them a competitive advantage in certain sectors. Its five main customer sectors include; Communications, Technology, Financial Services, Public Services, Products & Resources.

The company operates four main services to these sectors which include;

-

Strategy & Consulting

-

Interactive

-

Technology

-

Operations

Accenture’s strategy focuses on developing a “360′ Value model” which creates an ROI-focused business case for increased client revenue or improving operational efficiencies. As a consultancy, the business effectively sells the time, of its army of 721,000 employees across over 120 countries.

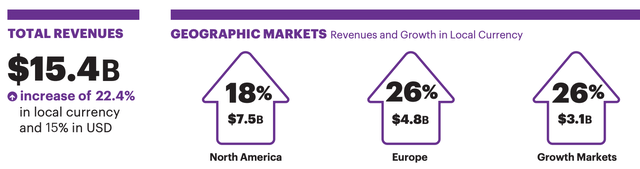

Growing Financials

Accenture reported strong financial results for the fourth quarter of fiscal year 2022. Revenue was $15.42 billion, which beat analyst estimates by $18.32 million and increased by a rapid 22.4% year over year. This was driven by solid double-digit growth across all markets and sectors. Its largest market North America increased its revenue by a solid 18% year over year to $7.5 billion. This was followed by Europe which increased its revenue by a rapid 26% to $4.8 billion. This was further driven its banking, industrial, retail, and even travel customers. The far east of Europe is going through a period of volatility due to the Russia-Ukraine war. However, these results were driven by strong growth in Germany, the U.K., Italy, and France.

Accenture’s “growth markets” also reported strong growth of $3.1 billion, which increased by 26% year over year. This was driven by strong growth from new business in Japan and Australia.

Taking a step back, total New Bookings “Contract value” increased by 22% year over year to $18.4 billion in the fourth quarter, the second highest level the business has achieved. This was driven by $8.4 billion in consulting billings and outsourcing bookings of $9.9 billion.

By industry, Accenture is well diversified across its five key business segments. The company reported strong growth across all industries with Communications, Media & Technology increasing revenue by a rapid 23% to $3.1 billion. Financial services revenue increased revenue by 22% to $2.9 billion. Product revenue also generated strong revenue growth of 25% to $4.5 billion.

Industry growth was driven by the “five key forces of change” Accenture has highlighted. These include; Total Enterprise Reinvention, Talent, Sustainability, the Metaverse, and the “tech” revolution.

Accenture is a key partner for enterprises that are going through a digital transformation or a “total enterprise reinvention”. For example, one of the largest consumer goods companies in the world, Unilever (UL) is working with Accenture as it migrates its resources to the cloud.

Accenture has also helped with developing a new business model for the company, which has changed from a matrix structure to five business groups. In larger organizations, teams can often get complacent or find it difficult to make changes on a large scale. However, with this new model, each business group is fully accountable for its strategy and profit delivery. The company is also helping Unilever build a B2B marketplace, for small business retailers in a model it calls “shared prosperity”.

Another notable customer is Lupin Limited, a pharmaceuticals giant which has partnered with Accenture to “unlock” its enterprise data and create a consolidated view of global business operations. In the energy sector, Accenture is helping the multinational utility company EDF, “digitize” the construction of a nuclear power station.

Cybersecurity is also a key growth industry Accenture is attacking. The company is working with a large Asia-based conglomerate to develop a managed security operating center for the business.

The “Metaverse” has become more than a buzzword for Accenture as it has helped companies such as Tokyo Land Corporation, with the development of Digital Twin technology for walkthroughs of its new condos. The Metaverse industry was valued at $22.79 billion in 2021 and is forecasted to growth at a blistering 39.9% compounded annual growth rate up until 2030.

Profitability and Balance Sheet

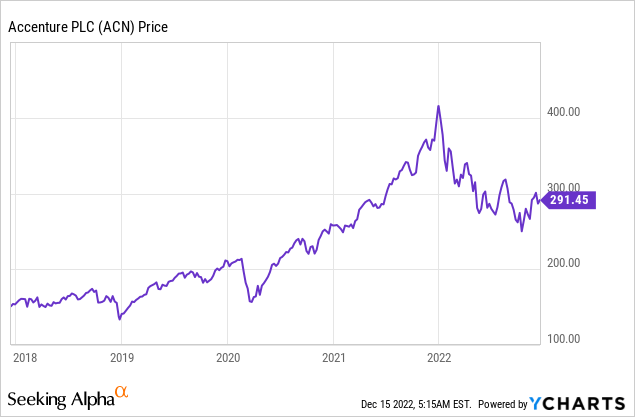

In Q4, FY22, Accenture reported a Gross margin of 32.1% which was down slightly from the 33.3% in the equivalent quarter last year. Operating income was $2.3 billion at a 14.7% operating margin, which increased by 10 basis points year over year.

Earnings Per Share was $2.60, which increased from $2.20 in the prior year and beat analyst expectations by $0.03. These great results were driven by improved operating efficiency as General and Administrative expenses results from 7.4% last year to 7.1% of revenue. Sales and Marketing expenses also showed improved efficiency, declining to 10.2% from 11.3% in the prior year.

Profitability (Q4,FY22 report)

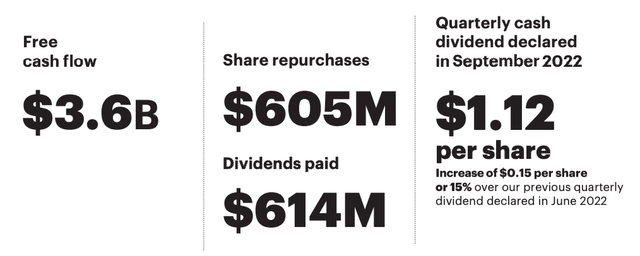

Accenture reported free cash flow of $3.6 billion which more than doubled year over year. In addition, the company has a solid balance sheet with cash and short-term investments of $7.9 billion.

The company bought back 2.1 million shares in Q4,FY22 for $605 million at an average price of $293.23 per share. The company also paid out $614 million in dividends at $1.12 per share.

Free Cash Flow and Cash (Q4,FY22)

Advanced Valuation

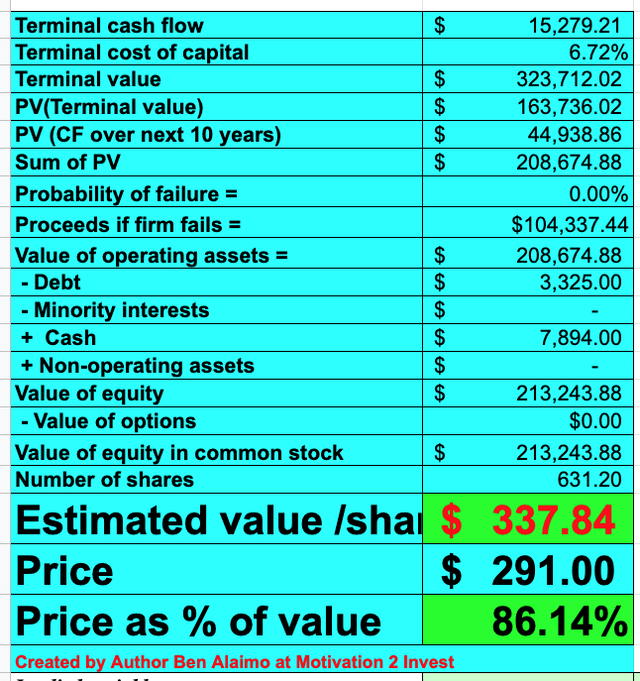

In order to value Accenture I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 10% revenue growth for next year, which is fairly conservative and driven by macroeconomic uncertainty. In years 2 to 5, I have forecasted a recovery in Accenture’s growth rate with 15% revenue growth per year.

Accenture stock valuation (created by author Ben at Motivation 2 Invest)

I have also forecasted Accenture’s operating margin to increase to 17% over the next 8 years. This is fairly conservative given the trend of increasing margins despite the high inflation environment.

Accenture stock valuation 2 (created by author at Motivation 2invest)

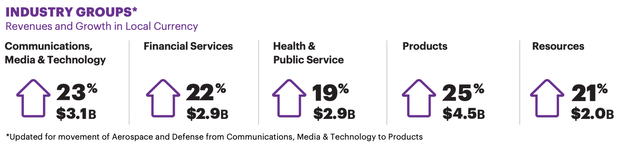

Given these factors I get a fair value of $337 per share, the stock is trading at $291 per share at the time of writing and thus is ~14% undervalued.

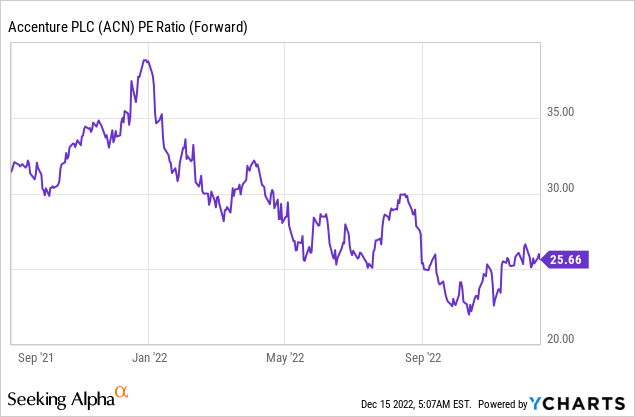

As an extra datapoint, Accenture trades at a Price to Earnings ratio = 25.6, which is 6% cheaper than its 5 year average.

Risks

Recession/Delayed Project Spending

Many larger organizations love to announce bold plans to “digitally transform” their operations. However, during a recessionary environment budgets can be tight and human nature can cause delayed spending. Accenture hasn’t been impacted by this yet, but in the future, they may start to notice longer sales cycles. In addition, foreign exchange headwinds from a strong U.S dollar are impacting the company.

Final Thoughts

Accenture is a fantastic company that doesn’t just “talk the talk”, but also walks the walk. The company had continued to execute strong and is poised to benefit from multiple growth trends from sustainability to security and the Metaverse. The stock is undervalued intrinsically and fairly valued relative to historic multiples at the time of writing. Therefore this could be a great long term investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.