Summary:

- Rivian paused its partnership with Mercedes, which was just concluded in September.

- We analyze why Rivian could have made such a decision.

- We explain what it means for Rivian and its shareholders.

hapabapa

What happened?

In early September, Rivian (NASDAQ:RIVN) announced its partnership with Mercedes (OTCPK:MBGAF). Thanks to the joint venture, the companies planned to produce “bespoke large electric vans.” They were going to benefit greatly from shared investments and costs. Plus, they even hoped to expand electric vehicle production. The partnership announcement was a very strong catalyst for Rivian’s stock, as its share price increased by around 15% over the next week. Surprisingly for both the market and myself, just several months later on December 12th, Rivian paused its discussions with Mercedes-Benz vans. On that day, Rivian’s stock price decreased by over 6%, while S&P increased by 1.4%.

Why did Rivian pause its partnership?

Rivian explained the step in truly “beautiful” corporate language:

We evaluate growth opportunities, we pursue the best risk-adjusted returns on our capital investments. At this point in time, we believe focusing on our consumer business, as well as our existing commercial business, represent the most attractive near-term opportunities to maximize value for Rivian.

In more simple language, it likely means that Rivian believes that a partnership with Mercedes could bear fruit, but only in a too-distant future. Instead, it looks like the company wants to focus on projects that can bring money now. Rivian’s strategy seems to be a proper one given the current bearish market environment. But the devil, as usual, lies in details. After all, why was the decision to pause made just several months after the partnership was announced? What has changed since September? I’d like to consider two possibilities.

Hypothesis #1

The market outlook deteriorated significantly compared with September, so Rivian wants to conserve more cash for hard times.

Theoretically, the current price takes all future public information into consideration. Following this classical corporate finance theory, the decrease in S&P 500 would mean that the market expects a worse economic situation in the future. Since the current S&P 500 is in line with September levels, we’ll conclude that current expectations are in line with the September ones.

You may say that the theory about efficient markets is wrong. And I’d have to agree with you. Otherwise, we wouldn’t try so hard in seeking market Alpha. Rivian may not believe in the market consensus either and may be worried about a looming recession, which could result in a prolonged bear market. This would push Rivian’s share price even lower.

Hypothesis #2

It’s also possible that Rivian foresaw more serious profitability issues than expected in September, and became eager to conserve cash before it reaches sustainable performance.

Rivian’s cash burn depends a lot on the raw material prices, production process efficiency, and the number of vehicles produced. Theoretically, its gross margin should increase along with a higher vehicle roll-out. In my recent article, I showed that Rivian’s gross margin development looks much worse than I expected it earlier. I explained it as a result of higher labor costs per unit produced as the second shift has just been implemented. As soon as the maximum capacity is reached, the costs per vehicle should go down. Economies of scale should definitely apply. The question is how quickly the maximum capacity will be reached. Rivian’s management probably knows much better than outsiders like me. It can be the case that the company experiences some manufacturing or supply-chain issues and therefore does not expect a quick roll-out acceleration. If this is the case, then it’s clear why the management is willing to conserve cash. Of course, it would also push the stock lower.

In the end, it doesn’t matter what was the reasoning behind the decision, both scenarios seem really bad for Rivian’s stock in the short term. Plus, a pause in partnership is bad for Rivian in the long term. And what is even more concerning: this is again a decision that is made and withdrawn within a short time period. You just need to remember a price increase disaster earlier this year.

Why is the pause in partnership bad for Rivian in the long term?

There are three reasons:

Global expansion at a discount

Mercedes is a widely recognized luxury car brand. It is known everywhere in the world, unlike Rivian, which is less known outside the US. Plus, Mercedes has a distribution and logistics chain that could support Rivian’s sales. All in all, such a partnership would significantly reduce Rivian’s SG&A costs.

Mercedes’ advanced self-driving technology

Although everybody is talking about Tesla’s (TSLA) self-driving capability, Mercedes achieved level 3 of autonomous driving while Tesla only got a certification for level 2. The partnership could provide Rivian with very advanced technology that could position it really well against Tesla in the American market.

Long-term manufacturing savings

Sharing production facilities would allow Rivian to save not only on Opex but also on Capex. Mercedes has a strong production base that can be upgraded for the production of electric vehicles. It would be much cheaper than building factories from scratch. For example, Polestar (PSNY) accelerated its vehicle roll-out significantly by following such an approach and sharing production facilities with Geely (OTCPK:GELYF) and Volvo (OTCPK:VOLAF).

Valuation

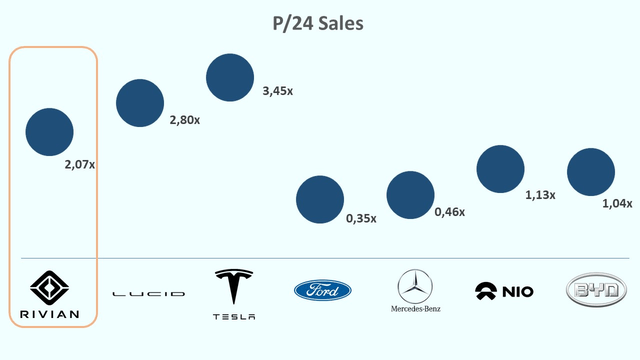

Despite the recent sell-off, Rivian’s EV/2024 Sales is at around 2.5x, lower than other EV companies, so I was previously inclined to consider Rivian a Hold. But the partnership news changed my outlook towards Rivian, despite its relatively moderate valuation.

Bulls say

Bulls would likely suggest that the focus on the existing business is the only right decision for Rivian. It allows the company to concentrate on the optimization of its manufacturing process and achieve gross margin improvements. Plus, a partnership with Mercedes could have led to the clash of different cultures: American vs. European or the start-up vs a mature company. Therefore, such cooperation could have resulted in many pitfalls that would have negatively affected both companies at a later stage. Some investors will think it was better to stop the cooperation now while the money had not yet been invested.

Bulls may also say that Rivian is on track to increase the vehicle roll-out. Otherwise, it would not have hired the second shift. The accelerated production will decrease costs per vehicle and help to achieve stronger revenue and gross margin. Investors will appreciate such a development a lot and can quickly forget any bad news associated with the partnership pausing.

Conclusion

I believe that the pause in the partnership is a negative catalyst for Rivian. Rivian’s stock decreased significantly before late summer, when the company achieved meaningful production and concluded the partnership with Mercedes. Now the partnership is on hold. It can be a sign that Rivian’s vehicle roll-out will slow down too. In this case, the stock will only continue to decrease.

Of course, you should do your own due diligence. But if I had Rivian shares, I’d sell them. Now. I wouldn’t open a Short position, however.

There are much better candidates in the EV space for investors. You can read my other recent coverage on Lucid and Rivian here.

In the meanwhile, keep riding the cycle.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.