Summary:

- Micron is pivoting towards high-margin memory products like DDR5 and HBM, capitalizing on the surging demand from AI and data centers.

- Despite a 30% pullback from all-time highs in June, Micron’s valuation ratios have cooled off, making it an attractive buy compared to industry peers.

- New 12-high HBM stacks use 20% less power than competitors’ 8-stack and are set for mass production in FY25, targeting huge market growth.

- Rising inventories and changes to US manufacturing incentives are risks to monitor, but I still see the upsides outweighing the downsides.

- My rating for Micron is a buy. Depending on Q1 FY25 results, I may consider upgrading to a strong buy.

vzphotos

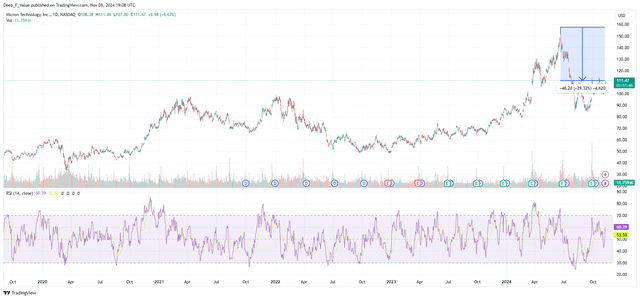

Micron Technology, Inc. (NASDAQ:MU) (NEOE:MU:CA) has been on a pullback since reaching all-time highs in June this year.

Since then, the share price has declined by over 30%, and most valuation ratios have cooled off to healthier levels.

The company is making big moves to stay ahead in the booming AI and data center markets. They are undergoing a pivot, shifting their focus towards high-margin memory products, like DDR5, LP5, and high bandwidth memory.

In this article, I will explore why this pivot could unlock significant shareholder value. I will cover the company’s advancements in HBM, its financial fundamentals, and valuation metrics.

Additionally, I will cover some of the risks, including rising inventory levels and potential changes to US manufacturing incentives under the new administration.

In my opinion, and considering the current pullback, this could be a good opportunity to start a long position in this stock.

Below, I provide the rationale behind my buy rating, starting with the company’s product evolution.

A Shift Towards Advanced Memory Technologies

Considering the high demand for AI and high-performance computing, the company has been aggressively pivoting its production capacity towards high-margin products like DDR5, LP5, and high bandwidth memory products.

As a matter of fact, management stated in the last earnings call that the company is now converting manufacturing lines for older nodes to newer nodes like the 1-beta.

As a side note, 1-beta is the latest technology for making fast-speed DRAMs, a type of memory chip used in computers, servers, and smartphones. To be specific, the total system bandwidth with 1-beta is over 1.5 TB/s, with a 32 Gb/s data rate.

It seems that DDR4 and LP4 are becoming a smaller part of the mix because they serve markets with lower profit margins and slower growth.

Micron didn’t provide any specific revenue figures for these legacy products. However, management confirmed during the last earnings call that DDR4 shipments, as a percentage of total DRAM shipments, are steadily declining

“DDR4 shipments continue to fall as a percent of our overall DRAM bit shipments over the last year and looking ahead will again fall into next year because more and more of our mix is shifting towards DDR5 over time. It’s shifting towards LP5 that we are now shipping to the data center.” – Sumit Sadana, Chief Business Officer

High Bandwidth Memory (HBM)

In my view, this is one of the segments with the highest growth potential due to the high demand for AI and data center applications.

Micron is ramping up production of the HBM3E and is planning to launch HBM4, a product specifically tailored to AI and data center applications.

Additionally, the company is advancing towards more complex memory stacks like the 12-high, which require 20% less power consumption than competitors’ 8-high stacks.

According to the last earnings call, Micron has already started sampling production-ready 12-high HBM products with customers, and they are on track for volume production in early FY25.

Considering the 20% improvement in power consumption of their new HBP product, and the IEA’s projection that electricity consumption from data centers, AI, and cryptocurrency could double by 2026, I believe the company is (very) well-positioned for future growth.

Speaking of growth, let’s have a closer look at the fundamentals of the company.

Fundamentals

A closer look at the income statement shows an impressive double-digit revenue growth in the last 4 quarters.

What’s even more encouraging is the inflection in Q2 FY24, when operating and net income finally turned to positive values.

Moving on to the balance sheet, the net debt of the company is quite high, with $4.93 billion at the end of last quarter.

Cash per share has been declining since March last year, however, considering the high capex and R&D costs, I am not overly concerned about this decline.

Another reason I am not concerned about the decline in cash reserves is due to decent liquidity ratios.

| Ratio | Value |

|---|---|

| Current | 2.63 |

| Quick | 1.67 |

| Cash | 1.08 |

Additionally, most of the company’s publicly traded bonds (this is one of them) look quite attractive.

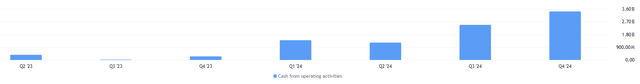

Moving on to the cash flow statement, I am highly encouraged by the positive free cash flow of the company in the past two quarters. Q1 this year was the first time since June 2022 that the company managed to achieve a positive free cash flow.

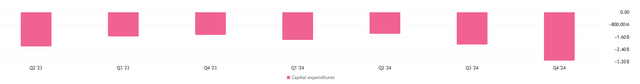

If we have a closer look at capital expenditures, we can see a sharp increase since Q2 FY24.

However, operating cash flows have increased drastically in the last 4 quarters.

Valuation

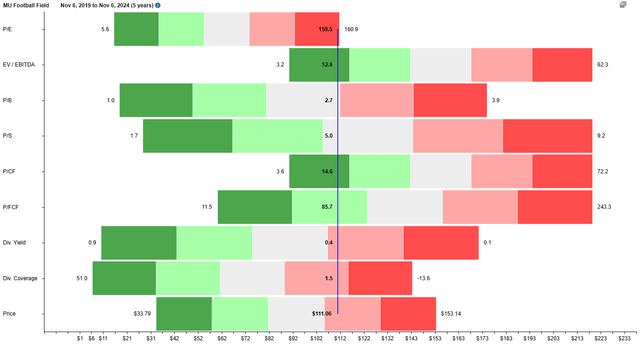

A quick look at the chart below shows some valuation ratios, like EV/EBITDA and P/CF trading close to the 5-year minimum. While others, like P/E and P/B, are closer to their 5-year maximum range.

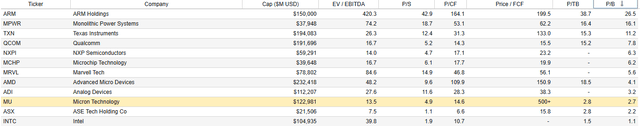

Let’s use P/B to compare the company against its industry peers (please notice, not all of them are competitors).

The table below has been arranged in descending order by P/B.

As a side note, if we use P/CF or P/S, the results are similar to the above.

Therefore, after seeing the company in the lower half of the table, I have good reasons to believe it is not overvalued when compared to its industry peers.

Insider And Institutional Activity

A quick look at the recent insider transactions shows several vice presidents selling shares in the past 6 months, with the most recent selling activity by Bokan Michael, who reduced his ownership by 5% in October.

In my view, the selling activity doesn’t show any signs of concern, as I don’t see a large group of executives drastically cutting their ownership by double digits in a short period of time.

As a side note, if I see that during a bull run (in any company, not just Micron), I would be highly concerned.

Moving on to activist investor activity, there have been no transactions since February this year.

Finally, a closer look at the latest 13Fs shows 2.5 million shares purchased by Van Eck Associates in Q3 this year.

The biggest selling in Q3 was done by SG Americas Securities, which sold 1.1 million shares.

Earlier this year, during the second quarter, there was a 21% increase in positions by 13F filers, showing that current shareholders are optimistic about the future of the company.

Risks

I have to admit that seeing inventories rising by $300 million in the last quarter, bringing total inventory to $8.88 billion, is not very encouraging.

The main risk here is a potential write-down, especially as demand for lower margin products like DDR4 continues to decline.

In my view, the remaining exposure of the company to DDR4 and LPDDR4 markets weighs on its overall performance. I would be glad to see a more effective ramp-down in their legacy products, even if this implies a slowdown in revenue growth.

Finally, another risk could arise from changes by the new president, Donald Trump, to programs that support domestic manufacturing, like the CHIPS and Science Act. Micron benefited from this initiative, announcing significant investments in US manufacturing facilities.

Conclusion

To wrap up, I believe Micron is making the right move by pivoting towards advanced memory products like DDR5, LP5, and high bandwidth memory. These products offer higher margins compared to the older DDR4 and are in high demand thanks to the AI and data center boom.

With HBM3E in production and HBM4 on the horizon, I believe Micron is well-positioned to capitalize on the growing demand for energy-efficient, high-performance memory products.

Their 12-high memory stacks use 20% less power than competitors’ 8-high stacks. Given the IEA’s forecast that electricity consumption from data centers, AI, and cryptocurrency could double by 2026, I have solid reasons to believe the company is well-positioned for future growth.

On valuation, Micron doesn’t seem to be overpriced when compared to its peers. It seems that the pullback from all-time highs in June this year has cooled off some of its valuation ratios.

That said, there are risks that can’t be ignored. Inventory levels are rising, which could lead to write-downs if demand for older products like DDR4 drops too quickly.

Additionally, changes in US policy under the current republican administration could impact future manufacturing incentives, which Micron has relied on.

To conclude, after considering all these factors, I rate Micron as a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.