Summary:

- Bitfarms remains independent after settling with Riot, stabilizing its leadership team.

- Q3 results showed 8% revenue growth, but increased costs per BTC due to April’s halving and higher energy expenses.

- The company raised $240M YTD through share sales, with liquidity at $145M, but continued share dilution is expected to fund operations.

- Future plans include upgrading mining equipment and exploring HPC/AI opportunities, but I maintain a Hold rating on BITF stock due to ongoing financial challenges.

Klaus Vedfelt/DigitalVision via Getty Images

I’ve covered Bitfarms (NASDAQ:BITF) a few time already. As Bitcoin (BTC-USD) mining company, it’s one of the best, enjoying better cash flow history than many other. During my previous coverage, I noted how its operating cash flows were almost growing enough to generate positive free cash flow. I also discussed an ongoing takeover attempt by Riot Platforms (RIOT), which had caused the company leadership to shuffle.

With their Q3 earnings call out Wednesday morning, valuable updates came in that provide more light on the company. I feel a bit better than I did last quarter, but BITF still has a long way to go before it’s buyable, and I maintain my Hold rating.

Bitfarms’ Settlement With Riot

Bitfarms finally reached a settlement with Riot in court. Amid its previous takeover attempts, Riot had acquired almost 20% of the company. In essence, Riot will no longer attempt to take it over, but it will retain its position. This has allowed for a lot more certainty about Bitfarms’s status as an independent company and allowed its leadership team to stabilize.

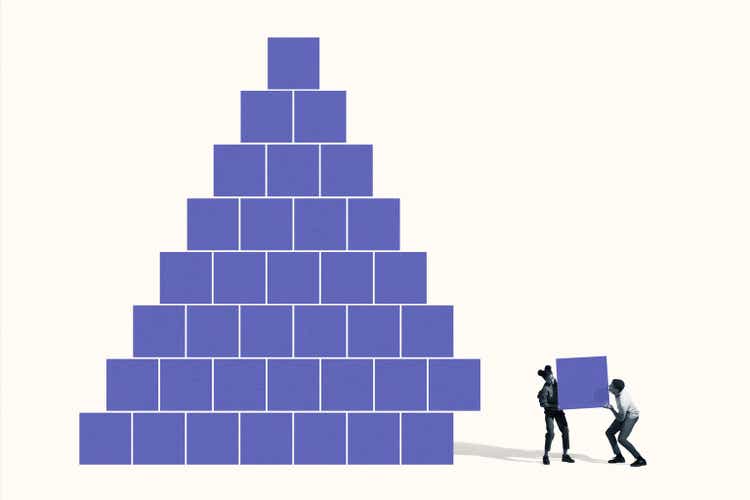

Q3 2024 Company Presentation

The management team has been filled with new positions, to support the new CEO’s (Ben Gagnon) vision for the company. There are also new independent directors on the Board now. With the settlement in place, these should be biggest changes to leadership for a long time.

Bitfarms Q3 Financial Results

Overall, I wouldn’t call Q3’s results an improvement or a decline from the previous quarter.

Q3 2024 Company Presentation

The company managed to grow its revenue by 8%, quarter over quarter, even though all of Q3 is post-halving and therefore would have halved BTC production with the same assets. Unsurprisingly, their gross mining margin contracted between the two quarters.

Management expressed this in terms of total cash cost per BTC in their earnings release:

Total cash cost of production per BTC* was $52,400 in Q3 2024, up from $47,300 in Q2 2024 due to higher energy cost, increased network difficulty and lower transaction fees.

As the halving occurred in April, Q2’s BTC production was mixed with some pre-halving benefits. Q1’s cash cost per BTC was $27,900, very nearly half that of Q3, showing the impact of the halving event. Thankfully, it will be a few years before another occurs.

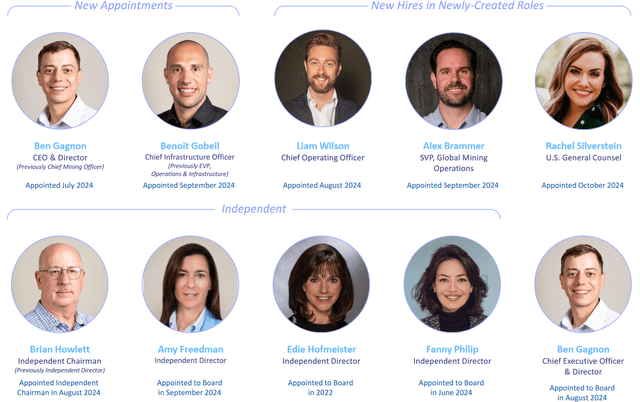

Cash Flow Statement (Q3 2024 Form 6K)

When we look to the cash flows, we can see that YTD operating cash flows not only remained positive but grew 40%, year-over-year. Crucially, however, significantly more has been spent on capex (through PP&E and equipment prepayments). Between Q2 and Q3, this accounted for over $100M in additional capex.

In order to fund this, almost $240M has been raised YTD through the sale of common shares. Between Q2 and Q3, common shares outstanding grew from 451.3M to 472.5M.

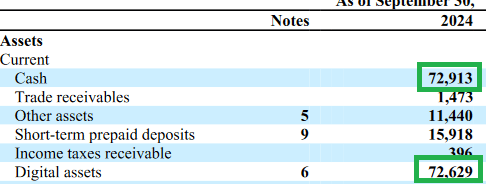

Balance Sheet (Q3 2024 Form 6K)

The company currently has about $145M in liquidity, from its cash and BTC holdings. This is about $65M less cash than last quarter (concurrent with the cash burn on capex). The company still has decent liquidity for the near-term, but with this level of outflow, I expect share dilution to continue.

Future Outlook

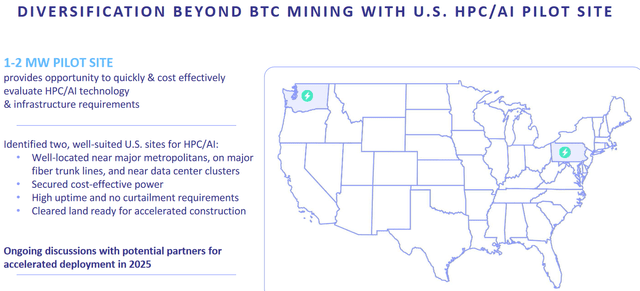

With the new leadership in place and plans in motion, the company has two main focuses for the future: its BTC mining and the budding HPC/AI opportunity.

Q3 2024 Company Presentation

First, the company is looking to upgrade its sites with the Bitmain T21 miner, which they project will allow for a 75% increase in their hash rate and provide a 10% efficiency on electrical costs. This will be very important, after the halving event.

Q3 2024 Form 10Q

On the HPC/AI front, management has located two prospective sites for a pilot program of this new business.

Q3 2024 Company Presentation

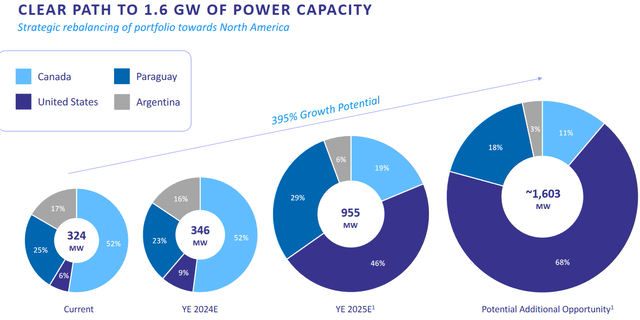

Initially announced at the last earnings call, the idea here is to use the electrical expertise that they’ve developed for BTC mining and offer megawatt capacity to data centers as an additional revenue source. While most of this is outside of the U.S., Bitfarms aims to grow its U.S. megawatt capacity to be its largest source.

This could very well play an important role in making positive cash flows a reality. During the earnings call, however, management remained positive about its BTC mining business, guiding for higher returns on capital in this business than the HPC/AI segment will. This is predicated on their assumptions that a BTC bull run is around the corner.

For my part, I take the HPC/AI business more seriously, as contributing to the electrical infrastructure of data centers strikes me as a much more tangible need, with more certain cost and revenue projections than a cryptocurrency can currently offer.

Conclusion

Bitfarms navigated the Riot takeover attempt, and it remains independent. With that done, attention can return solely to the business itself. That business is one that makes continued improvements but is challenged by a lack of positive cash flows. As a yet-to-come BTC bull run will be the best near-term boon to this, the company must continue to sell more shares to fund operations until its newer business and launches and earn revenues.

BITF’s $1.2B market cap likely fairly values the financial potential of the company, but with more dilution likely, I’m hesitant to rate this a Buy just yet, and I maintain my Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.