Summary:

- Micron’s fundamentals are improving, with promising new product releases and significant growth in R&D spending, supporting a ‘Strong buy’ recommendation.

- Wall Street analysts forecast aggressive revenue and EPS growth, with FY2025 revenue expected to be 24% higher than FY2022.

- Micron is capitalizing on favorable trends in data centers, mobile, and automotive markets, with significant CapEx and R&D investments.

- The valuation is highly attractive, with upside potential that significantly outweighs the risks.

JHVEPhoto/iStock Editorial via Getty Images

Introduction

Micron (NASDAQ:MU) performs decently so far since late August when I shared a ‘Strong buy’ recommendation. A 6% total return was behind the increase in the S&P 500 index, but it is still a solid gain for the three-month horizon. I remain bullish as fundamentals keep improving and the valuation still provides a strong buying opportunity.

The new product releases look promising and significant growth in R&D spending suggests that the pipeline is likely very strong. Apart from robust demand from data centers, the management sees growth potential in mobile and automotive end markets. This optimism is bolstered by a rebounding global smartphone market. Easing monetary policies across the developed world will highly likely be favorable for the automotive industry. The management looks confident in the company’s prospects as a significant growth in FY2025 CapEx is expected. The valuation still looks good, and I am inclined to confirm my ‘Strong buy’ recommendation.

Fundamental analysis

According to quarterly earnings estimates, Wall Street analysts forecast that Micron will deliver aggressive revenue and EPS growth over the next several quarters. The last quarter’s non-GAAP EPS was at $1.18, and this figure is expected to double over the next three quarters.

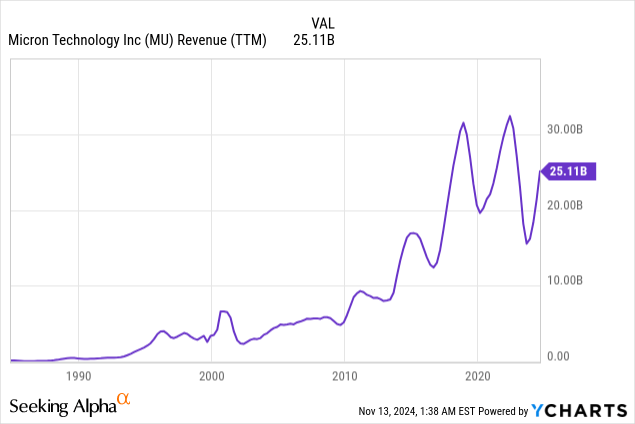

The TTM revenue is on track to recover to its peaks which were achieved before big China-related headwinds. Over the next four quarters (which will be the entire FY2025) Wall Street analysts expect MU to generate total revenue of $38.2 billion. This will be around 24% higher than the company’s record FY 2022 revenue of $30.8 billion.

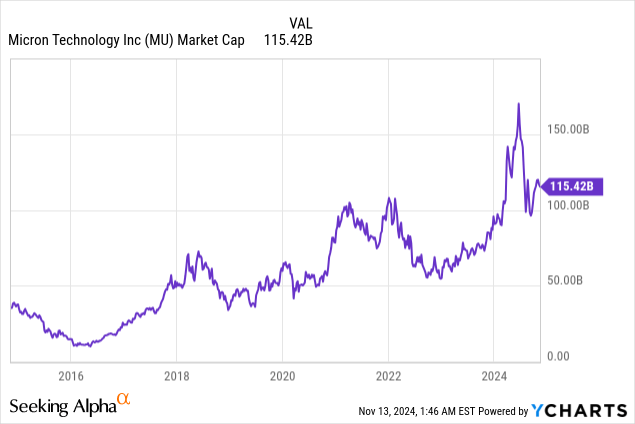

Despite aggressive revenue and EPS growth projections from consensus, the stock’s market cap is significantly lower than its previous peak. I will focus on the valuation analysis and fair value calculation in a separate section. However, for the purposes of my fundamental analysis I just wanted to emphasize this setup, which looks bullish for me.

The company continues capitalizing on favorable trends in data centers as mega-scale corporations boost their AI infrastructure spending. In my previous article I already mentioned that Micron has sold out its HBM capacity up to 2025. Despite this success, the company is not standing still and continues to actively invest in the development of new products.

The latest press-release informs us that the company introduced the world’s fastest and most energy efficient 60TB SSD. According to the company, “Micron ION 6550 delivers best-in-class energy efficiency and up to 67% more density per rack for exascale data centers.”

On October 29 the company announced that it releases its Crucial DDR5 Pro Overclocking gaming memory with new speeds of 6,400 megatransfers per second. The new product enables gaming at higher frame rates per second, accelerates multitasking and boosts productivity. Grand View Research forecasts the global gaming PC market to observe a 12.9% CAGR by 2030.

Another important piece of information regarding Micron’s products is the October 23 release about Micron’s 9550 PCIe Gen5 data center SSD. The product was qualified for recommended vendor list on NVIDIA GB200 NVL72 system and its derivatives. This system deploys Nvidia’s largely anticipated revolutionary Blackwell chip, and the recognition of Micron’s SSD product appears to be a very bullish sign.

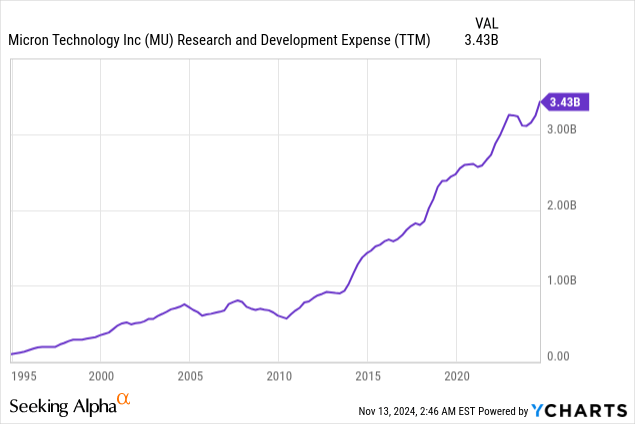

Micron appears to be aggressively preparing to roll out new compelling products. The $3.43 billion TTM R&D expense is much higher than it was five years ago. The management believes that there is potential to benefit not only from data center tailwinds, but also from positive trends in the mobile and automotive end markets. This optimism is fair considering the 2024 rebound in the global smartphone shipments. The global automotive industry is also poised to benefit as central banks across developed economies are easing their monetary policies.

Micron’s latest presentation

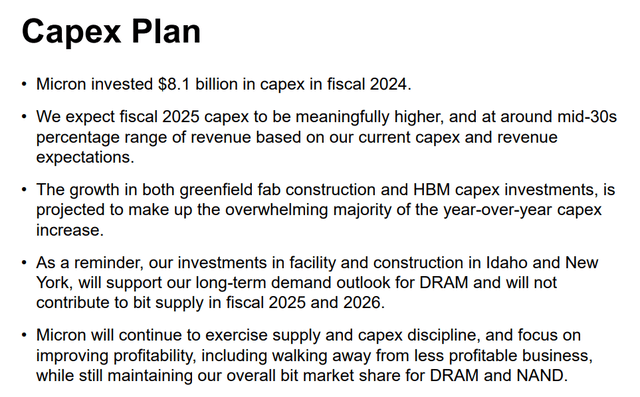

As a result of expected tailwinds across various end markets, MU also boosts its capital expenditure. The FY2024 CapEx was almost 10% higher compared to FY2023. Since the management expects the FY2025 CapEx to be around 35% of the topline which is forecasted by consensus to be at $38.2, we can expect that CapEx will grow YoY by 61% to $13.4 billion. Given Micron’s strong record of success and robust positive recent developments around its products, such an aggressive increase in R&D and CapEx spending will highly likely create more value for shareholders over the long term.

Valuation analysis

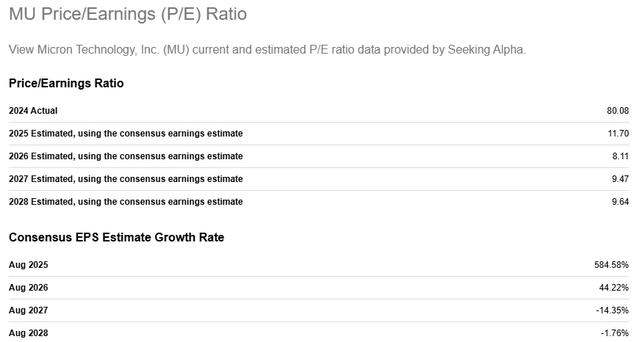

A rapid contraction of the P/E ratio is expected over the next five years, meaning that the high 2024 actual P/E multiple is explainable. The forward FY2025 P/E ratio of 11.7 is low for a company that experiences AI and data center tailwinds.

SA

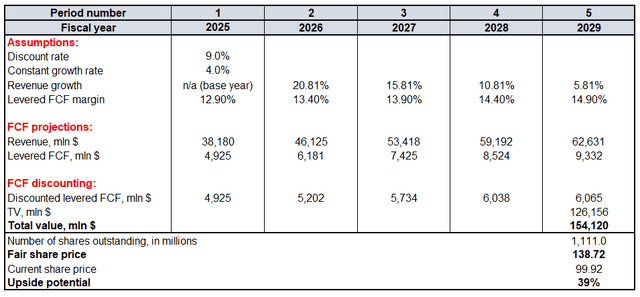

The discounted cash flow (‘DCF’) also will give additional answers about MU’s valuation. Future cash flows will be discounted using a 9% WACC. Revenue forecast for the next two years from consensus are based on the opinions of more than 30 Wall Street analysts. This is a sufficiently representative sample, in my opinion. Starting from FY2027 and beyond, I am very conservative as I incorporate a five-percentage-point revenue deceleration annually. Given solid AI and data center exposure, Micron deserves a 4% constant growth rate. This one will be used to calculate the terminal value (“TV”).

Despite Micron’s TTM levered FCF margin is only 1.45%, my assumptions will be slightly different. The reason is explained by the forecasted $8.9 adjusted EPS for the FY2025, which will be 585% higher compared to FY2024 (which is TTM at this point). The last time the company demonstrated a comparable EPS was in FY2018, when the company achieved a 12.9% levered FCF margin. Therefore, I’ve incorporated this margin for FY 2025. To balance out this aggressive base-year FCF margin assumption, I factor in a very modest 0.5 percentage point FCF improvement annually. There are currently 1.11 billion outstanding MU shares.

Calculated by the author

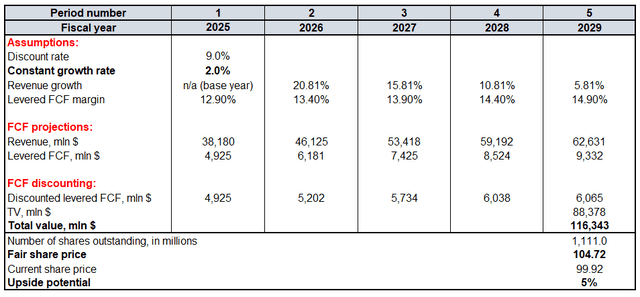

The fair share price recommended by my DCF model is $138.72. The fair value is 39% higher than the current share price, which is certainly a compelling upside potential. The estimated fair value is higher than the current share price even if an extremely pessimistic 2% constant growth rate is incorporated.

Calculated by the author

Mitigating factors

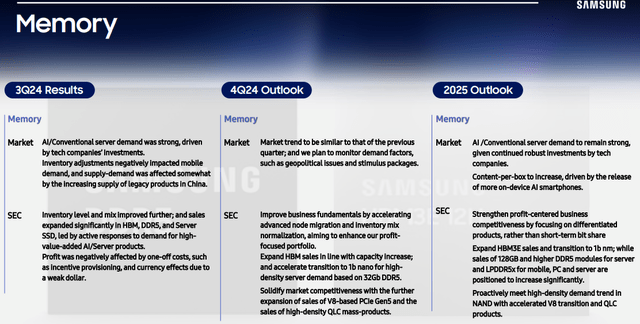

Micron’s main competitors is South Korean giant Samsung Electronics (OTCPK:SSNLF). Samsung has recently released its fresh earnings report, and its ‘Memory’ segment is soaring also. The segment demonstrated a 112% growth year-over-year, a very impressive performance. According to the below slide from the presentation, Samsung’s management also has quite aggressive plans to develop their Memory business. Therefore, the competition from Samsung is expected to remain fierce for the next few years, at least.

Samsung’s latest presentation

As I mentioned earlier and in my previous article, Micron’s financial performance deteriorated significantly in the last few years due to trade wars between the U.S. and China. Donald Trump has won the recent U.S. presidential election, who actually was the one who started these trade wars. Therefore, the fact that Donald Trump took over the White House for the next four years mean that geopolitical risks for Micron will not ease.

Conclusion

The stock is attractively valued, and the management is preparing the company to capitalize on tailwinds for its diversified revenue mix.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.