Summary:

- Wafer Fab Equipment faces multiple tailwinds as semiconductor demand and complexity are bound to increase over the medium to long-term.

- Both, ASML’s and KLA’s, dominant market position and strategic advancements make it a compelling investment proposition in the semiconductor sector.

- While a multitude of risks remain, I rate KLA a “Strong Buy” and ASML a “Buy”.

SweetBunFactory

After comparing the three Generalists Applied Materials (AMAT), Lam Research (LRCX), and Tokyo Electron (OTCPK:TOELY) in a previous article, I found it appropriate to also compare the two Specialists, ASML (NASDAQ:ASML) and KLA Corporation (NASDAQ:KLAC).

Investment thesis

ASML dominates the lithography process. KLA is the undisputed leader in semiconductor metrology and inspection.

As semiconductor demand and complexity increase rapidly and yet face a long runway, WFE demand is bound to increase over the long term. In the endless struggle to achieve higher performance from smaller chips, both are uniquely positioned to benefit from this in their own way.

While risks remain, I believe KLA to be the better deal at the current valuation. That is, despite ASML also seemingly trading around fair value.

Sector and Company Overview

Semiconductors are small “chips” that enable complex tasks inside our phones, cars, and communication hardware but also less prominent places like defense and medical technologies.

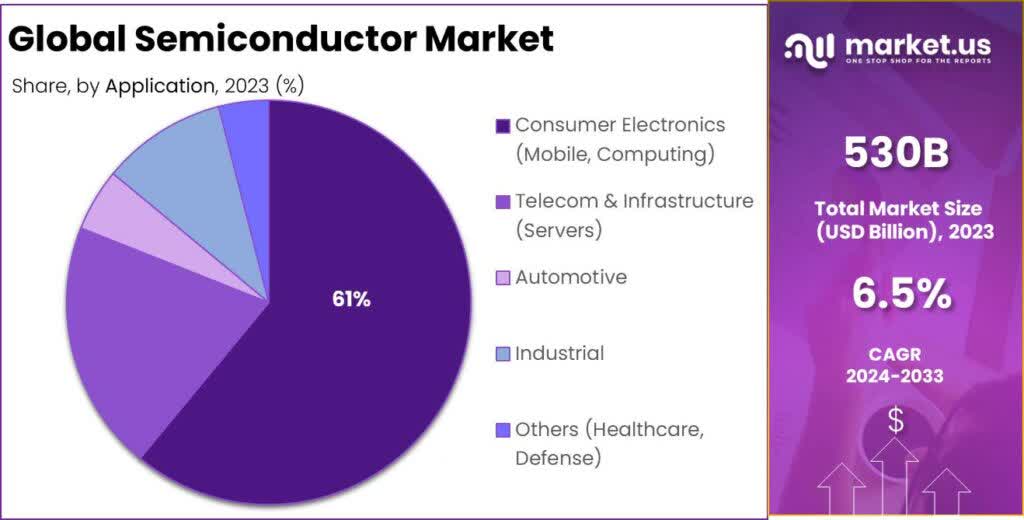

Semiconductor Market By Applications (market.us)

Affected by end-consumer spending, economic cycles, and often low visibility into future demand, the semiconductor industry is generally cyclical. Yet it faces long-term tailwinds as a) volume grows through a growing amount of technological applications (i.e. Apple Vision, EVs, Robotics) and b) complexity increases with a growing need for higher performance on less space (i.e. computers/phones processing faster without growing in size).

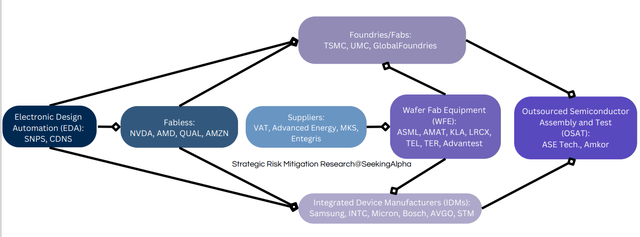

To make a single semiconductor, dozens of companies have to perform highly complex tasks with extreme precision, often quite literally pushing what is possible physically. The, for me, heart of the semiconductor supply chain, is the mission-critical Wafer Fab Equipment (WFE) sector.

Semiconductor Industry Overview (Author)

These large machines are installed at customer “Fabs”, the factories in which semiconductors are manufactured, and are essential to making semiconductors. Yet, this also means the WFE sector is reliant on Fab building, expansions, and customers upgrading their equipment. In other words, Foundry and IDM capex.

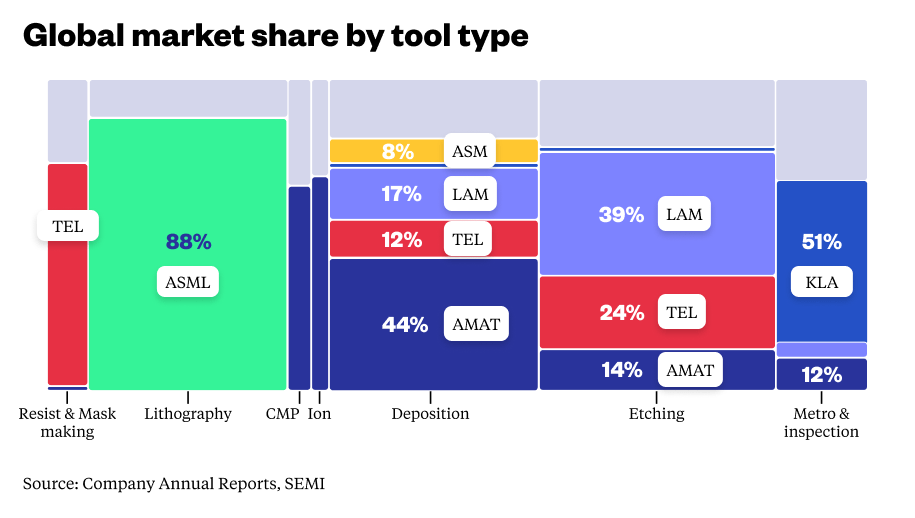

The “big 5” (ASML, AMAT, KLA, LRCX, TEL) dominate this sector:

WFE marketshare by company (thechinaproject.com)

AMAT, LRCX, and TEL, which I covered in a past article, are rather diversified, hence I consider them the Generalists.

ASML and KLA on the other side have carved out niches in very specific sectors, thus I consider them the Specialists of the quintet.

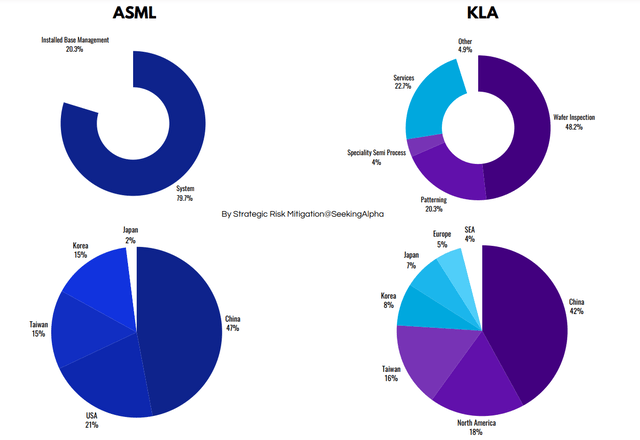

Revenue by segment and geography (Author with company data; last reported quarter)

ASML

ASML, with a market share of ~90%, towers over the lithography sub-sector. Lithography is critical to semiconductor production as we know it. Lithography, put simply, is the process of drawing a specific pattern on the wafer. This is necessary to later be able to etch the pattern into the wafer, which is a disc cut from a large ingot usually made out of silicon. Making these, increasingly small, patterns as precise as possible is what enables advancements in semiconductor designs. This part of ASML’s business is the “System” segment, where the company sells large machines (see picture below) to customers.

ASML’s Installed Base Management (IBM) made up 20.3% of revenue in the latest quarter and provides a largely recurring revenue profile by supplying customers with spare parts, as well as software, services, and training.

As is visible above, a large part of ASML’s revenue comes from China and generally Asia. Although China’s revenue share is expected to fall to ~20% next year, depending on the downside scenario, this potentially still carries significant risks as I will cover later. Besides China, it is unlikely the geographic allocation will change much in the medium term, as most Fabs are located and being built in Taiwan, China, and Korea.

At its recent Investor Day, the company reaffirmed its 2030 medium-term guidance of revenue between $44B and $60B (13.2% CAGR at midpoint). Unfortunately for the stock performance, besides reiterating the growth story, it was a relatively unexciting event.

ASML equipment in a Fab (Intel)

KLA

KLA manufactures equipment used to inspect semiconductors throughout and after production. These machines, a picture below, are bought by customers like Intel (INTC), Micron (MU), or TSMC (TSM) to increase their production yield and ensure quality.

To understand the relevance of production yield we need to understand how Fabs operate. Fabs require astronomical amounts of capital to set up, often in the 10 to 11-digit range. Additionally, they require a lot of power and water, which can mean quite high fixed costs. All of this means that Fabs are required to constantly run (most operate 24/7) to be profitable and generate a return for their operators. This makes efficient production mission-critical – and that is what KLA makes possible with its inspection and metrology equipment. As semiconductors become smaller and more complex, controlling their quality and achieving high production yields becomes increasingly harder. Through their leading inspection and quality control equipment KLA is indispensable to any Fab that desires to be competitive.

Similar to what Applied Materials and Lam Research focus on, KLA also provides deposition and etch equipment through its “Speciality Semiconductor Process” segment.

Although not its own reported segment yet, recent strides into semiconductor packaging, due to customer demand, provide further runway. I am positive about this development as it further deepens customer relationships with the broader offering.

Beyond that, KLA also offers “Services”. This segment, similar to ASMLs “IBM”, provides spare parts, services, and software, and provides downside protection and insulation against the cycle.

Similar to ASML, KLA’s geographical revenue distribution is heavily influenced by Asia and especially China, although Europe has a higher share of revenue. As explained in ASML’s paragraph, I don’t expect this to change materially.

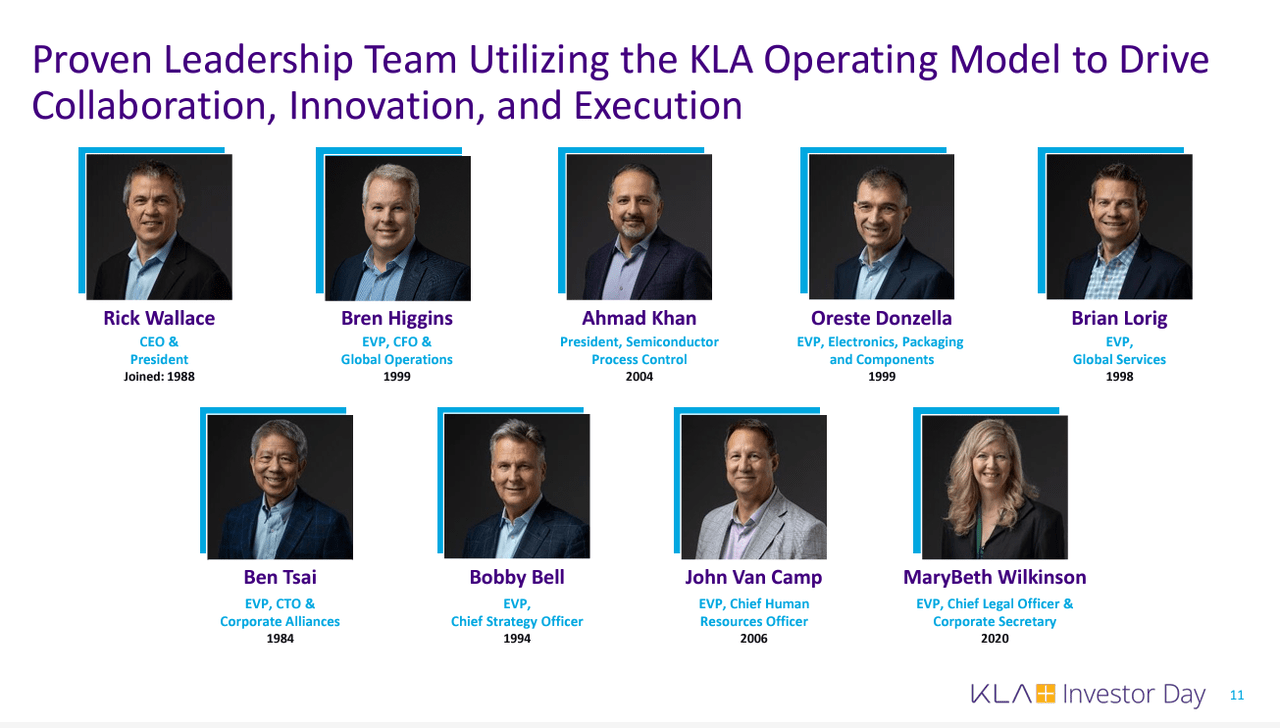

While the picture below is now outdated (as Mrs. Polanich joined as CCO), it shows an, in my opinion, very important part of KLA. The majority of management active today is responsible for making KLA the industry leader it has become over the last 20-30 years:

KLA Management Team (KLA Investor Day presentation) KLA equipment in photomontage (kla.com)

Moats

Scale

By investing billions into research and development annually, the barriers to entry have become immensely high, effectively making it impossible for new competitors to enter the field from a financial perspective.

Switching Costs and Customer Relationships

Due to both companies’ large installed bases, combined worth hundreds of billions, it would be financially impossible for customers to replace their equipment with a competitor’s solution. This is more so true as both company’s equipment has a useful life of up to two decades. In line with their customers’ large investments into their Fabs, customers have close ties with all large WFE companies to coordinate fab building and expansions, often planning together with them. This creates significant relative visibility into demand as well as very high barriers to entry for potential new competitors.

The services and support the companies provide for its machines further increase switching costs as, with these machines costing 7 to 9 digits and downtime being extremely costly for Fabs, customers want to make sure trained technicians service the machines. Further both companies of course supply spare parts and even software for their machines.

Technology

Both KLA and ASML are the technology leaders in their subsectors. As explained in the KLA paragraph, Fabs require remarkably efficient operations to be profitable. A key advantage that makes them incredibly valuable to their customers is maximum throughput and high repeatability, as well as unmatched precision:

…the accuracy of EUV lithography is like shooting a laser gun from the moon to hit a coin on the planet earth.

Technological dominance is further evidenced by them being the only players in their spaces who are and have been experiencing a growing market share and the only “pure-plays” in their sectors.

As technological and scale advantages go hand in hand and enable switching costs and sticky customer relationships, these moat sources reduce effective competitive risks to a minimum. Making it close to impossible for new competition to enter, let alone displace, the incumbents. Additionally, customers depend on them and can not afford to switch from their installed equipment even if a competitor or peer were to out-compete them in technology, which, in turn, is unlikely due to scale. This combination of moats provides tremendous operational downside protection over the medium and long term, despite cycles making operations appear unpredictable at times. I therefore rate both a very wide moat.

Financials

I will use $ for all numbers, except for the company’s guidance which is reported in €.

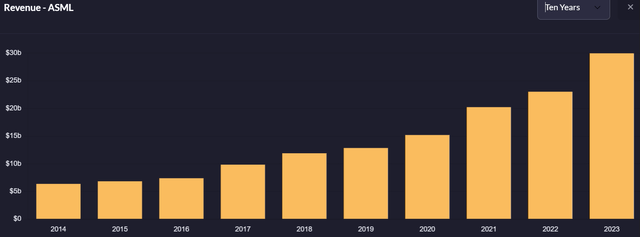

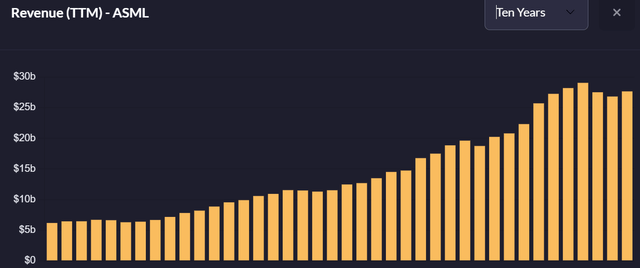

Despite its sector, ASML had seemingly defeated the cycles, growing each of the past 10 years at a 10y CAGR of 17.4% (when assuming the last quarter’s revenue).

ASML annual revenue over the last decade (Qualtrim)

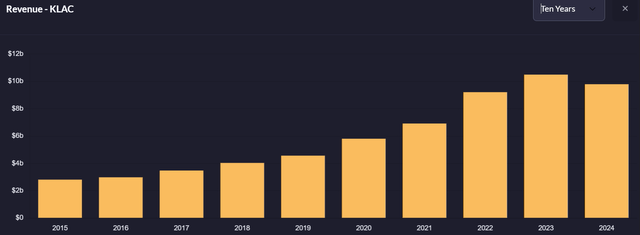

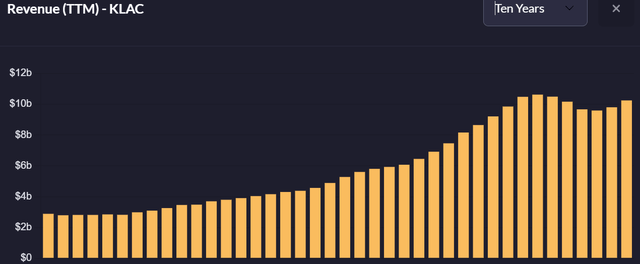

Similar to ASML, KLA had seemingly defeated the cyclicality, but, has also experienced a very normal, cyclical revenue drop-off recently. The reason we see this in the graph this pronouncedly is that KLA’s fiscal year 2024 has already been reported. Yet, KLA grew at a 15.4% CAGR over the last decade. ASML’s revenue for the year, at the midpoint of guidance, will be €28B (~1.5% higher than 2023 revenue).

KLAs annual revenue over the last decade (Qualtrim)

When looking closer, by looking at trailing twelve-month revenue, both seem to just be rebounding in line with the up-cycle and their Generalist peers:

ASMLs trailing twelve month revenue over the last decade (Qualtrim) KLAs trailing twelve month revenue over the last decade (Qualtrim)

When taking into account ASML’s guidance for FY25 being below previous revenue estimates (€30-35B vs ~€36B), this implies the upcycle is not as explosive for ASML. This is what likely led to the recent sell-off of ASML’s stock. That is not necessarily a bad thing for ASML, as it will still grow while its peers are experiencing contracting revenues or stagnation. But it was likely unexpected (and not priced for) by the market, which had seemingly forgotten that the WFE sector is cyclical and hardly predictable by nature.

I also want to note that, historically, the two specialists have been growing faster and with less volatility than AMAT, LRCX, or TEL, which I had a look at in my last article. However, I would not rely on this being the case for the next decade, despite the market being more confident in the two companies – expressed by a higher valuation.

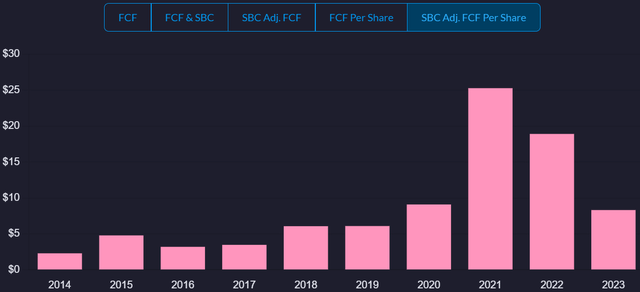

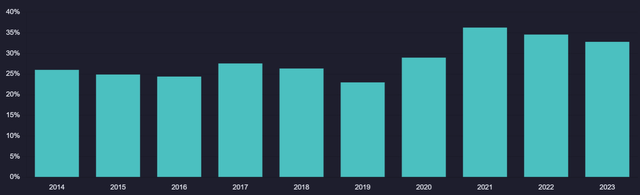

When looking at (stock-based compensation adjusted) free cash flow per share and earnings per share metrics, it becomes apparent that ASML has either lost much of its profitability or invested a lot through capital expenditures. The latter is the case. To expand capacity, ASML has invested billions into new facilities in the Netherlands. I expect this to normalize over the medium term and follow a growth path similar to revenue and EPS.

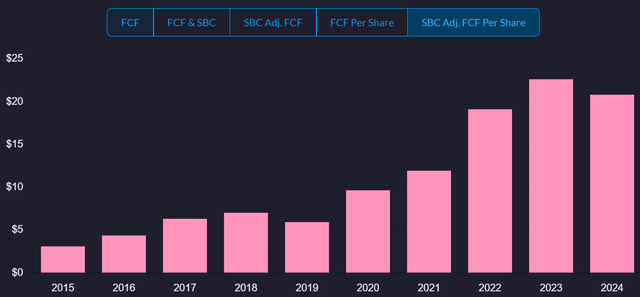

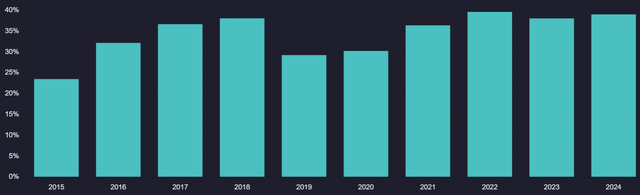

ASML sbc-adjusted FCF per share 2014-2023 (Qualtrim) KLA sbc-adjusted FCF per share 2015-2024 (Qualtrim)

KLA on the other hand has had much less capex in the last years. Subsequently, its FCF/share has, within the volatility of the cycle, consistently grown.

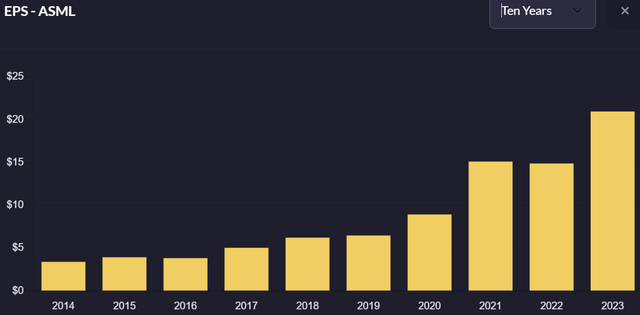

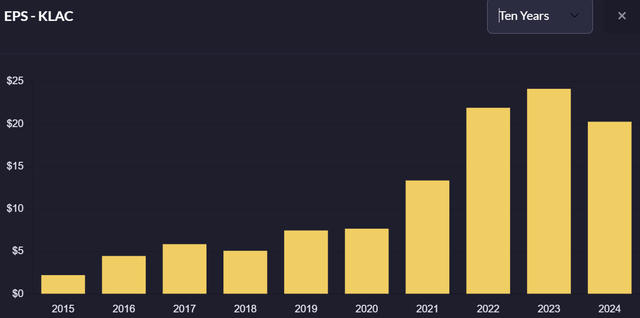

ASML’s EPS have seen a constant increase, compared to its volatile FCF/share, and grew at a compounded annual growth rate of 19.9%.

Meanwhile, KLA grew its EPS at a CAGR of 24.6% over the last decade.

ASML’s and KLA’s operating margins, despite the cycles likely weighing on pricing and operating leverage, have reliably increased, with ASML’s margins only slightly behind KLA’s.

ASML annual operating margin 2014- 2023 (Qualtrim) KLA annual operating margin 2015-2024 (Qualtrim)

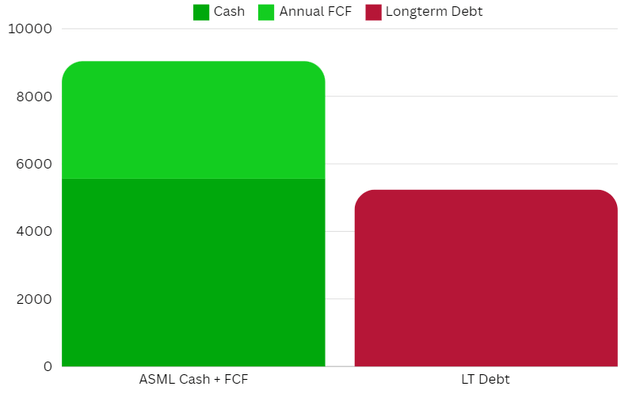

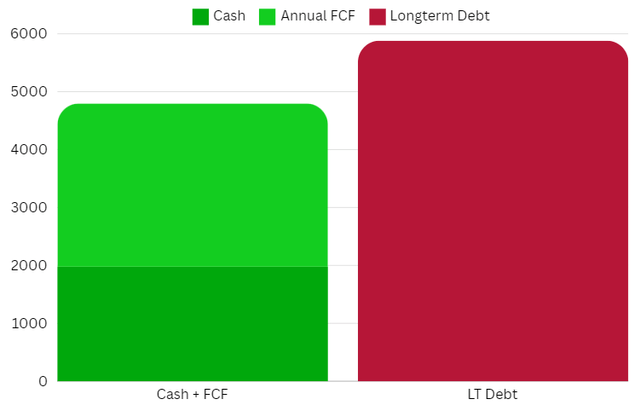

Even with much higher debt than ASML, I think KLA’s balance sheet is fine. I don’t consider debt a relevant risk for either company, due to extreme stickiness and their mission-critical offerings. Beyond that, both generate more than enough cash flow, even in a downcycle, to service their debt.

ASMLs cash + annual FCF vs Longterm Debt (Author with SeekingAlpha data) KLAs cash + annual FCF vs Longterm Debt (Author with SeekingAlpha data)

Shareholder Returns

| Company | ASML | KLA |

| 5y Share Buyback CAGR | 1.56% | 2.8% |

| Dividend Yield | 0.97% | 1.05% |

| 5y Dividend CAGR | 23% | 14% |

With an average of 2.5% and 3.8% in annual shareholder returns, despite heavy reinvestment into R&D and capacity expansion, I believe both companies distribute adequate amounts of capital to their shareholders. This should support strong stock returns, as both face a stellar long-term outlook and are valued fairly reasonably.

Valuation

| Company | KLA | ASML | Generalist average |

| TTM P/E-ratio | 25.88x | 30.4x | 23.68x |

| 3y EPS CAGR estimates | 16.78% | 14.16% | 17.81% |

| 3yPEG-ratio | 1.54x | 2.15x | 1.33x |

Calculated with prices and analyst estimates as of the closing of 11/15/24. For the Generalist average, I used the average ratios of AMAT, LRCX, and TEL.

When looking at the past performance of these companies, and the sector, those estimates are not unrealistic. Although the cycles can be very hard to forecast for anyone, including analysts.

This is why, as part of my relative valuation analysis, I like to look at a company’s track record of meeting the market estimates, as it provides an additional data point for how predictable the company might behave in the future.

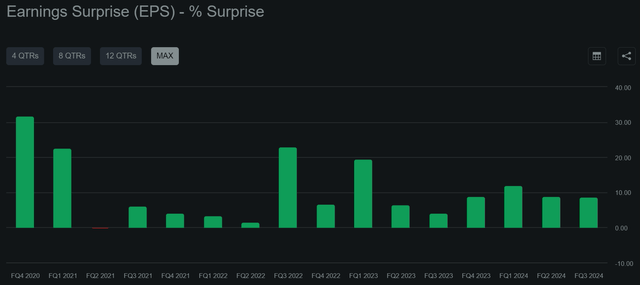

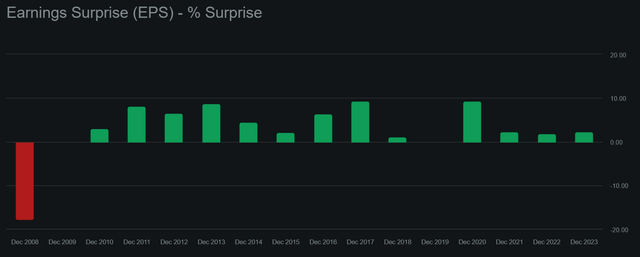

ASML has beaten 15/16 of the last quarter’s EPS estimates, and 13 of the last 16 annual estimates:

ASML quarterly EPS beats vs estimates last 16 Quarters (SeekingAlpha) ASML annual EPS beat vs estimates over the last 16 years (SeekingAlpha)

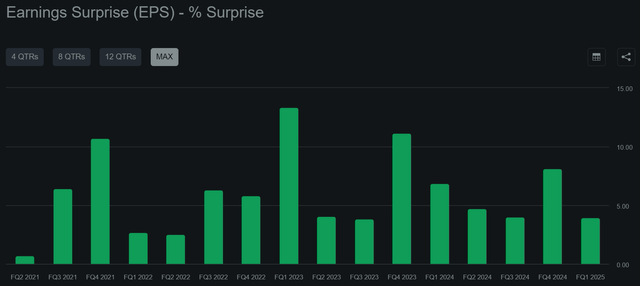

As for KLA, we can see that the company has consistently beaten the market EPS estimates over each of the last 16 Quarters:

KLA quarterly EPS beats vs estimates last 16 Quarters (SeekingAlpha)

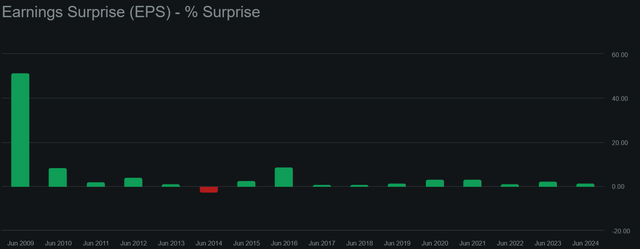

The same holds true when looking at the annual beats of the last 16 years, with the exception of 2014:

KLA annual EPS beats vs estimates over the last 16 years (SeekingAlpha)

With the amount of cyclicality given in their sectors and rather lumpy revenues, I consider both of their earnings track records as excellent.

When assuming a 1yPEG ratio of slightly above 2x for the S&P500 (SPY) (30P/E with expected growth of ambitious 14-15%), both seem fairly valued relative to the market. In the case of KLA, valuation even seems undemanding.

Yet, given the higher predictability and lower competitive pressures, investors need to pay a premium over the Generalists. I believe this to be warranted.

Risks

Endmarket Demand

For the vast majority of the semiconductor industry, personal electronics is the underlying end market. While this market is generally subject to broad economic woes, the long-term growth of electronics, communications, and automotive demand is critical to the entire semiconductor growth story.

China

As China aims to advance its own bleeding and leading-edge semiconductor production, the US has increasingly tried to limit China’s access to the advanced tools required for this. While ASML gets much more publicity regarding these trade restrictions, the same goes for KLA, limiting both companies’ potential customer bases.

While this has been ongoing for years, an increase in restrictions could further hurt the top and bottom lines of both companies. This is particularly true as non-EUV equipment has lower gross margins and China mainly buys less-advanced equipment (non-EUV), leading to possible margin compression.

As both companies’ supply chains are highly diversified across all geographies, tariffs could potentially also increase costs and shrink margins. However, it has to be noted that, at least in an upcycle, both companies wield pricing power.

Taiwan and Korea

Taiwan and South Korea are potential targets of invasions by China and North Korea.

Should their threats be made true, it would make shipments from and to Taiwan and South Korea impossible, leading to all WFE companies instantly losing a large part of their revenue.

AI

Much of the expected semiconductor demand (about 15% according to TSMC’s last numbers) is to come from massive AI adoption, this creates risk in the form of an unproven market, as many AI-focused companies yet have to generate meaningful revenue let alone realize profits.

Production Changes, Competiton, and Customer Concentration

Should the way semiconductors are built change on a fundamental level, it is possible for highly specialized companies, especially ASML, to become irrelevant. However, due to immense switching costs, I believe it to be in the Fab owner’s best interest to utilize existing equipment, providing at least some downside protection.

Yet, for example, TSMC has used older equipment to make advanced chips instead of buying new High NA EUV machines. While I don’t believe this has produced sufficient yields at scale, I view it as a warning towards ASML. In the words of the Vice President of Business Development at TSMC, Kevin Zhang:

I like the technology but I don’t like the sticker price.

This is significant because ASML’s (as all WFE companies) sales are highly concentrated into a few large customers, above all TSMC.

Competitors like Canon (OTCPK:CAJPY) and Nikon (OTCPK:NINOF) as well as all three Generalists (AMAT, LRCX, and TEL) are looking to profit from TSMC pushback by making equipment that helps reduce the workload of lithography equipment – essentially reducing medium-term demand for ASML.

So while it is very unlikely any company can directly displace ASML and its technology, reducing customer reliance on its new equipment still hurts the company as it misses out on possible revenue. A fitting analogy might be that; a castle has a deep and wide moat with sharks in it, making getting across impossible. But the besiegers have crossbows – potentially still becoming dangerous for the castle’s population.

As for KLA; both ASML as well as Applied Materials, among other, smaller competitors, have developed process control and metrology equipment, potentially increasing competition for KLA. When looking at market share development over the last decade, however, KLA was the only company in the sector to sustainably grow market share.

So while both do face competition of some kind, it’s everything but easy to compete with, let alone displace, either.

Mitigation

Defense

With geopolitical conflicts at a multi-decade-high, defense exposure is likely the best hedge against the risks Taiwan and South Korea face.

Position Sizing

The best hedge against most uncertainty is prudent diversification. Here, while confident about the future of semiconductors, I think it makes sense to monitor the total China, Taiwan, and South Korea portfolio exposure and allocate accordingly.

As I don’t see competition as a substantial risk I don’t think positioning against peers (by taking a position in them) makes any sense here, as most are so far behind technologically or in scale that they are more likely to underperform. Although, as laid out in my last article, I do believe TEL and LRCX to be a good buy at the moment. Both of these could help against possible risks from reduced lithography demand for ASML shareholders.

Selling

A continuous declining market share, pointing to an erosion of their competitive advantages, would cause me to sell either company. The same applies to abrupt changes in manufacturing processes, potentially making the equipment provided irrelevant, although this would have to be evaluated on a case-by-case basis. An invasion of Taiwan or South Korea would likely take the entire WFE sector multiple years to recover, create tremendous opportunity costs, and might make selling to Taiwan (and China) impossible over the long term. This would be the worst-case scenario for both companies and warrant a sale as well, in my opinion.

Trade restrictions would not necessarily be a reason to sell in my opinion. However, immense restrictions, to the point of making business in China impossible, would make even market returns unlikely at the current valuation.

Conclusion

As could be seen in my valuation comparison, investors would need to pay up for the increased dominance, lower operational volatility, and lower competitive threats compared to the Generalists (which is already a very high base). For investors focused on value, I suggest taking a look at Lam Research and Tokyo Electron, which I have covered and rated as “Buy” and “Strong Buy” here, together with Applied Materials.

As both ASML and KLA enjoy, in my opinion, equally (very) wide and deep moats, both being mission-critical and able to show higher, more resilient growth than the three Generalists, it is a very hard decision which company to pick.

One thing that I dislike about ASML, the stock not the company, is the high media coverage and subsequent crowding. This is likely the cause of a higher valuation – due to sentiment, instead of (prospects of) increasing fundamentals and moat.

In a situation where I perceive two companies that provide the same exposure as equally predictable, I generally pick the company with the lower valuation. This leaves more room for returns as multiple compression is less likely. Of course, the more growth is priced in/the higher it is valued the less likely it is investors can earn excess returns. Further, it has less volatility of earnings performance, though this can largely be attributed to less lumpiness from lower average prices per machine.

So, while I prefer (and am a shareholder of) KLA and rate it a “Strong Buy”, I also like ASML a lot and believe that, relative to an expensive market, it is approximately fairly valued. With such high-quality companies, expressed by immense dominance and medium-/longterm predictability, rarely being valued (relatively) reasonably, I also rate ASML a cautious “Buy”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KLAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Although I aim to always give actionable recommendations based on doing my research to the best of my abilities, this should never be seen as investment advice – please never skip doing your own research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.