Summary:

- Lowe’s Companies has seen significant stock growth, but recent revenue and profitability declines prompt a downgrade from ‘buy’ to ‘hold.’.

- Despite strong historical performance, recent economic conditions and the sale of its Canadian business have negatively impacted Lowe’s financials.

- Analysts predict further revenue and earnings declines for Q3 2024, reinforcing the cautious outlook.

- While still returning capital to shareholders, Lowe’s current valuation and economic uncertainty justify a ‘hold’ rating.

JHVEPhoto

With a market capitalization of $153.4 billion as of this writing, home improvement retailer Lowe’s Companies (NYSE:LOW) is a giant in its space. In fact, with the exception of The Home Depot (HD), which boasts a $403 billion market capitalization, Lowe’s Companies is the largest player in its industry. In recent years, I have been bullish about the business. And that bullishness has paid off. Since I last wrote about the company in November of 2023, in an article in which I reaffirmed it as a ‘buy’ candidate, the stock has risen by 38.3%. That’s comfortably above the 28.9% increase experienced by the S&P 500 over the same window of time. And since I first rated it a ‘buy’ in May of 2020, shares are up 145.3%. That dwarfs the 97.7% increase experienced by the S&P 500.

Recently, the business has experienced some weakness. In fact, it would be more appropriate to say that it has been experiencing it since the end of 2022. Revenue and cash flows have been declining. Profitability has as well. In addition to this, the company has gotten more expensive. I have no doubt that the issues the company is experiencing are transitory in nature. At some point, they will end. But even keeping that in mind, I believe that now might be a good time to finally downgrade the business to a ‘hold’.

Of course, my opinion on the matter could change. But that’s unlikely in the near term. The fact of the matter is that analysts are even somewhat pessimistic. Consider their expectations for the third quarter of the 2024 fiscal year. Before the market opens on November 19th, management will be reporting results for that quarter. At present, they expect revenue, profits, and earnings per share, all to decline. Absent some major change to the contrary, I don’t see a reason not to downgrade the business to a ‘hold’.

A look at recent results

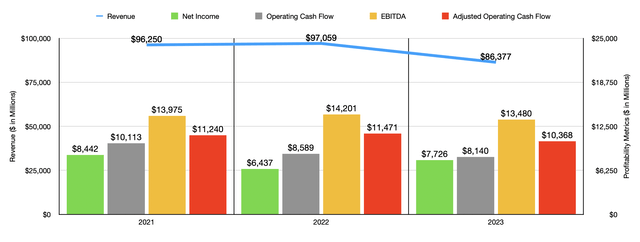

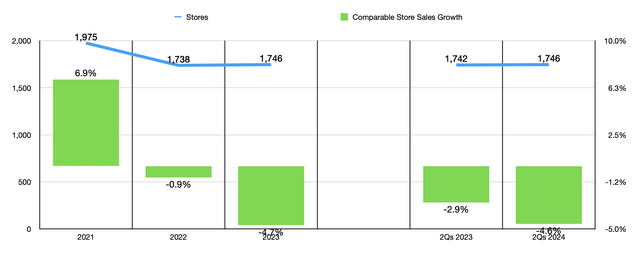

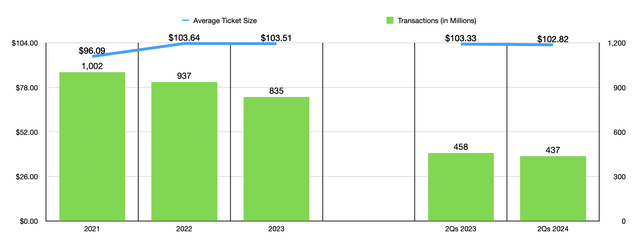

Fundamentally speaking, Lowe’s Companies has done very well for a very long window of time. From its humble founding back in 1952, the business has exploded into a behemoth in its market. Unfortunately, recent results have been less than ideal. After seeing revenue hit $97.06 billion in 2022, sales plummeted in 2023 to $86.38 billion. This drop in revenue came about even in spite of the fact that the number of stores that the business has in operation rose slightly from 1,738 to 1,746. Some of the pain, then, was driven by a 4.7% decline in comparable store sales. Part of this was because of a drop in the average price per transaction from $103.64 to $103.51. But a bigger part came from a decline in the number of transactions from 937 million to 835 million.

While the company did see strength in two of its 14 product categories, namely its Building Materials and Lawn & Garden categories, strength that was driven by robust demand from Pro customers in the former and attractive seasonal demand in the latter, the rest of the company experienced weakness. Lower discretionary demand for DIY products, caused by a difficult macroeconomic environment, as well as commodity deflation, hit sales quite a bit. To be clear, however, the biggest decline for the company’s revenue actually stemmed from the company’s decision to sell its Canadian retail business back in 2022. This brought shareholders $2.5 billion.

Even though revenue took a hit from 2022 to 2023, profitability increased. Net income jumped from $6.44 billion to $7.73 billion. This was largely the result of a decline in selling, general, and administrative costs from 20.94% of sales to 18.02%. Favorable legal settlements this year, combined with asset impairments, the loss on the sale of its Canadian business, as well as closing costs associated with that sale, all negatively impacted profitability in 2022. Other profitability metrics, however, experienced declines. Operating cash flow fell from $8.59 billion to $8.14 billion. If we adjust for changes in working capital, we get a drop from $11.47 billion to $10.37 billion. And finally, EBITDA for the company declined from $14.20 billion to $13.48 billion.

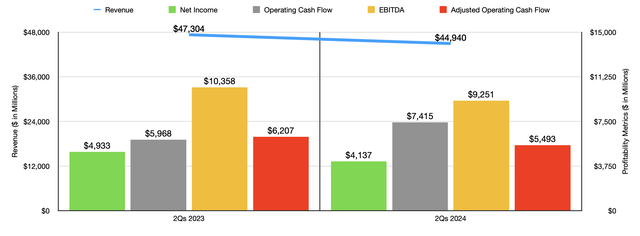

For the 2024 fiscal year, we currently only have results for the first half of the year. During this time, however, financial performance for the business weakened quite a bit. Revenue dropped by 5% from $47.30 billion to $44.95 billion. Some of the weakness was offset by a slight uptick in the number of locations in operation from 1,742 to 1,746. However, this was not enough to completely offset the 4.6% drop in comparable store sales. A year-over-year decline in the average price per transaction from $103.33 to $102.82 hit the top line. But also problematic was a decline in the number of transactions from 458 million to 437 million. Management described the company as suffering from ‘prolonged sales pressure’ that they attributed to uncertain economic conditions. This makes a lot of sense. A lot of the company’s revenue comes from residential construction, repair and remodeling work, and general construction. As I detailed in a prior article that touched briefly on Lowe’s Companies, these areas have experienced weakness because of tight consumer budgets and worries about a potential recession. High interest rates aimed at combating inflation also have proven painful.

With revenue falling, it’s not surprising to see that profitability would take a hit as well. Net income for the company declined from $4.93 billion to $4.14 billion. Other profitability metrics largely followed suit. The one exception to this was operating cash flow, which popped from $5.97 billion to $7.42 billion. If we adjust for changes in working capital, on the other hand, we get a decline from $6.21 billion to $5.49 billion. Lastly, EBITDA for the business dropped from $10.36 billion to $9.25 billion.

Recent conditions have been so unpleasant for the company that management has even decided to reduce guidance for the 2024 fiscal year as a whole. Earlier this year, they forecasted revenue of between $84 billion and $85 billion. But in the second quarter earnings release, management decreased this range to between $82.7 billion and $83.2 billion. Comparable store sales declines of between 3.5% and 4% will be responsible for this. This compares to previous comparable store sales declines forecasted by management of between 2% and 3%. On the bottom line, the expectation is for adjusted earnings per share of between $11.70 and $11.90. This is an unfavorable adjustment compared to the $12 to $12.30 per share previously anticipated. At the midpoint, this would imply net income of $6.73 billion. And if we annualize the results we have seen throughout the first half of this year for the other profitability metrics, we would get adjusted operating cash flow of $9.18 billion and EBITDA of $12.04 billion.

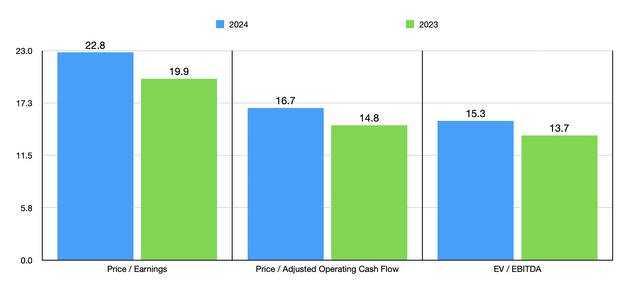

If we use these estimates, we can see in the chart above how the stock is currently priced. This is more expensive than when I last wrote about the company a year ago. And it is typical of the kind of company that I would end up rating a ‘hold’. This is not to say that shares are not cheap compared to similar businesses. In the table below, I compared Lowe’s Companies to two similar enterprises. In each case, it ended up being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Lowe’s Companies | 22.8 | 16.7 | 15.3 |

| The Home Depot | 27.7 | 20.4 | 18.3 |

| Floor & Decor Holdings (FND) | 57.1 | 18.4 | 23.3 |

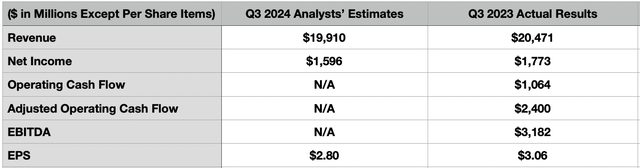

Even though I’m choosing to rate the company a ‘hold’ at this time, I could change my opinion as new data comes out. Unfortunately, even analysts seem to be cautious at this point in time. As I mentioned at the start of this article, management is expected to announce financial results for the third quarter of the 2024 fiscal year before the market opens on November 19th. Leading up to that time, analysts believe that revenue will come in at about $19.91 billion. Should this come to fruition, it would translate to a 2.7% decline compared to the $20.47 billion the company reported one year earlier. While this would be a better outcome than what was seen during the first half of the year, that is necessary if management’s forecast is to be accurate. For the first half of this year, revenue was down 5%. However, for the year in its entirety, management is forecasting a drop of 4% at the midpoint. In order for the company to hit this target, sales for the back half of this year have to be down about 2.7% compared to the same time last year.

Expectations are also a bit pessimistic on the bottom line. Analysts are currently expecting earnings per share of $2.80. That would be down from the $3.06 per share reported at the same time last year. This would translate to a decline in net income from $1.77 billion to $1.60 billion. In the table above, you can see some other profitability metrics for the third quarter of 2023. If net income is going to be down, then it’s likely that cash flows will also weaken to some extent. Despite this weakening, it is worth noting that the company continues to focus on things like rewarding shareholders. During the first half of this year, the business allocated $1.26 billion toward dividends. In addition to this, share buybacks totaled $1.76 billion. So while management might be concerned about the near term picture, they aren’t concerned enough to prevent returning capital to shareholders. That, on its own, is slightly bullish.

Takeaway

Based on the data provided, I do believe that Lowe’s Companies is an interesting prospect for investors. The company has a good track record. Of course, results the last couple of years have been affected to some extent because of the aforementioned sale of its Canadian retail business. More recently, however, revenue, profits, and cash flows, have all taken a hit because of weak consumer spending. I know that this is something that will eventually pass. So on that alone, I am not particularly concerned. However, the stock is no longer as cheap as it was. And when you add on top of that economic uncertainty, I believe that it’s prudent to downgrade it from a ‘buy’ to a ‘hold’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!