Summary:

- MARA is undervalued with a P/S ratio of 6, offering a prime buying opportunity before an anticipated bullish Q4 2024 period.

- Key Q4 catalysts: interest rate cuts, CZ’s release, Uptober, and U.S. elections, all expected to boost MARA shares.

- Despite risks like share dilution and environmental concerns, MARA’s massive BTC holdings and future revenue potential make it a strong long-term investment.

- A potential short squeeze due to high short interest could lead to significant price swings, presenting profitable trading opportunities.

South_agency

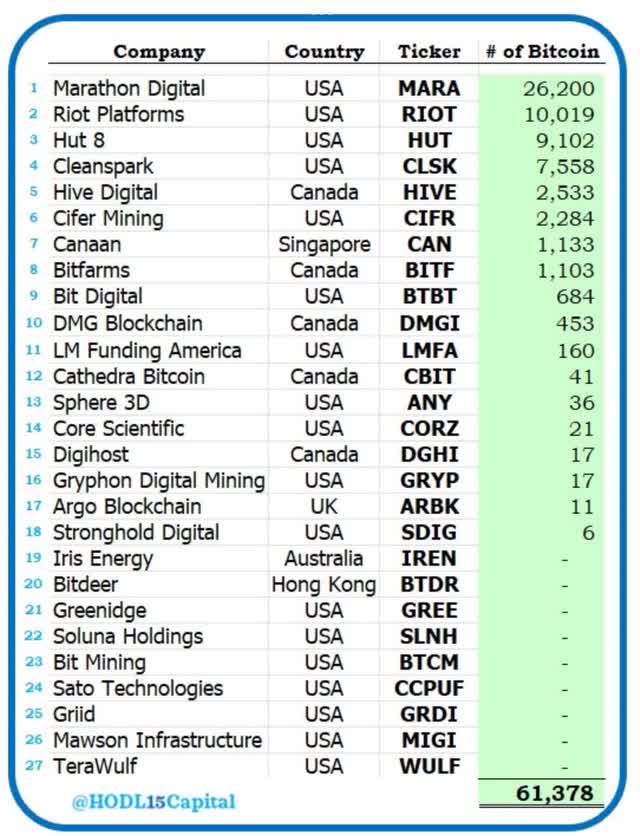

MARA Holdings (NASDAQ:MARA) is one of the largest Bitcoin mining companies in the world, with a massive BTC HODL stash of 26,200.

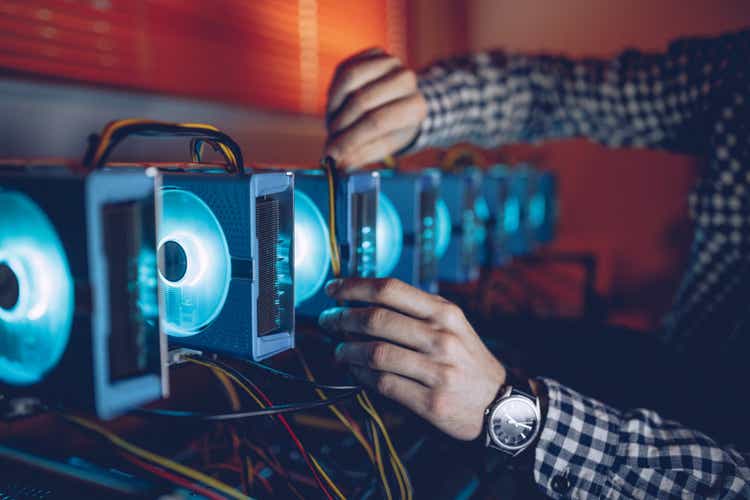

According to CompaniesMarketCap, the Bitcoin mining industry is still in its infancy with a total market cap of $24 billion compared to the global $2.09 trillion crypto market cap.

Largest Bitcoin miners by market capitalization (companiesmarketcap.com)

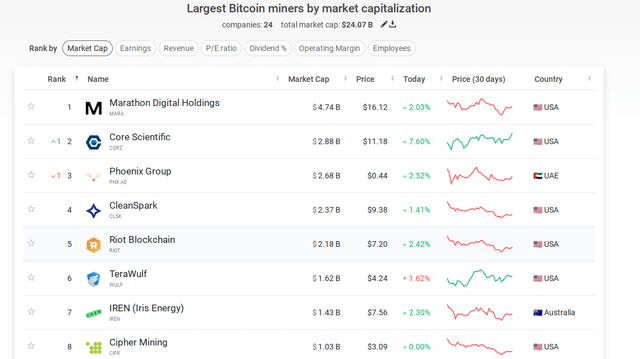

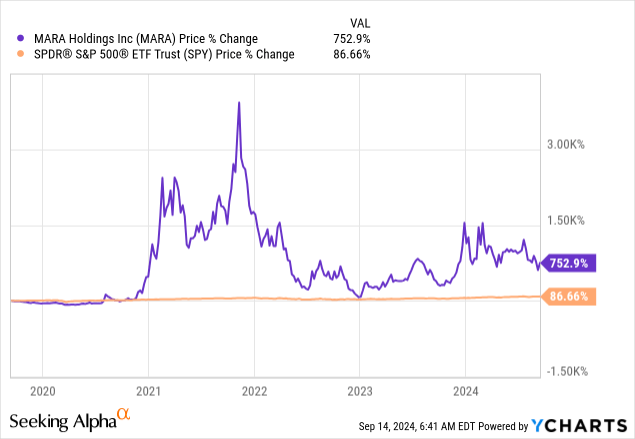

I first invested in MARA stock back in the summer of 2020 when MARA was under $5. The company began mining Bitcoin right after the 3rd Bitcoin halving, causing MARA stock to go parabolic during the 2020-21 crypto bull run.

MARA shares soared from as low as $2 in October 2020 to $48 by the end of March 2021.

After some consolidation, MARA began pumping to $75 in November 2021 before interest rate hikes and the upcoming Bitcoin bearish cycle tanked the stock price.

Despite all of the crazy volatility, MARA shares are still up 752% over the last 5 years, compared to only 86% for the S&P 500 Index (SPY).

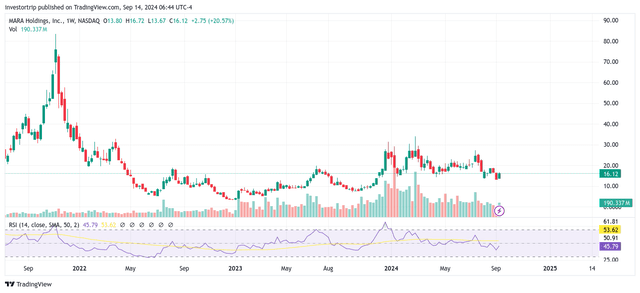

Fast forward today, MARA shares are sitting near the bottom end of the weekly RSI range, which signals a good dip buying opportunity before we enter an extremely bullish Q4 period.

MARA Weekly RSI Chart (tradingview.com)

Here are the 4 major upcoming catalysts in Q4 2024 for MARA:

- Interest Rate Cuts: A potential 25 to 50 basis interest rate cut during the September 18th FOMC meeting at 2pm EST

- CZ’s Prison Release: The September 28th release of former Binance CEO CZ from prison

- Uptober: The beginning of the historically bullish Q4 during a halving year

- U.S. Elections: The U.S. Presidential election on November 5th

I’m extremely bullish on MARA shares right now and will cover everything you need to know right now before the upcoming crypto bull run happens.

MARA Q2 2024 Results Were Promising

In Q2 2024, MARA revenue hit $145.1 million (Up 78% YoY) but suffered a quarterly loss of $199.7 million (mostly due to decreased fair value of its Bitcoin).

The company produced 2,058 BTC (Down 30% YoY) but plans to expand its hash rate to 50 EH/s by the end of 2024. MARA’s current hash rate is around 31 EH/s.

Bitcoin prices were down 12% in Q2 2024, so it’s nice to see MARA focus on higher hash rate during a temporary decline in Bitcoin prices. Historically, Bitcoin soars 160 days after the halving, which would be September 28th, 2024.

Why I’m Bullish on MARA Shares

After watching MARA crash from $26 in July 2024, I believe MARA shares are undervalued and extremely attractive from a fundamental as well as speculative standpoint.

First off, MARA is in a class of its own when it comes to Bitcoin mining. MARA has more BTC than everyone else!

Bitcoin HODL Balance for Publicly Traded Miners (x.com)

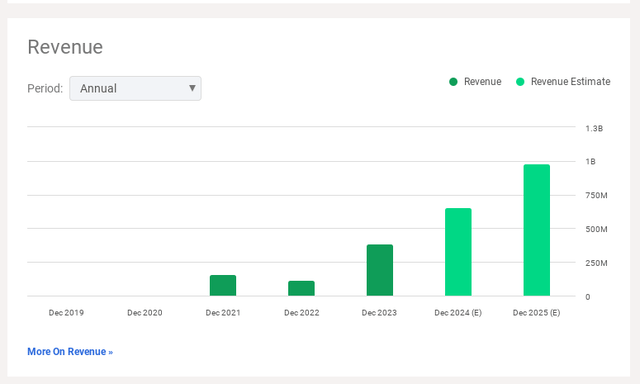

Secondly, MARA revenue is expected to hit ~$1 billion in 2025 and could continue increasing over time even though Bitcoin mining block rewards are going down every 4 years.

MARA Revenue (seekingalpha.com)

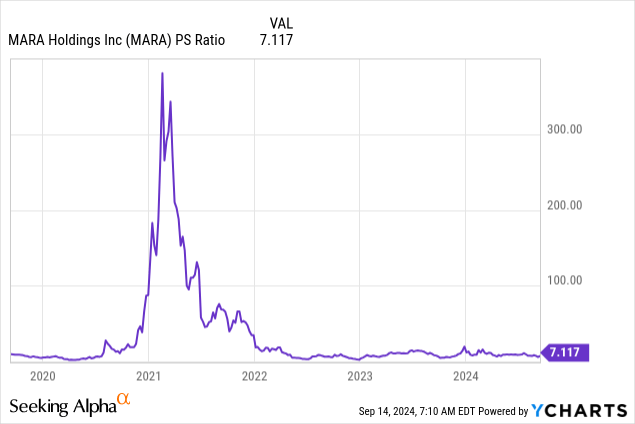

With a P/S ratio of around 6, MARA shares are cheaper than they have been for a long time. Ideally, investors should buy MARA when the P/S ratio is undervalued, then sell when the ratio becomes overvalued.

At the top of the 2021 crypto bull market, MARA shares were trading at a P/S ratio of over ~300! Conversely, MARA shares bottomed in December 2022 at a P/S ratio of just 3!

Tracking P/S ratios has been the only way I can maintain my sanity due to MARA’s extremely volatile nature!

MARA is Completely Misunderstood by Wall Street and Retail Investors

One of the most frustrating things I witness is how many Wall Street and Retail investors misunderstand why MARA is a valuable company moving forward.

Many analysts point to declining Bitcoin block rewards as a tailwind, but revenue is projected to increase over the next 2 years.

MARA is well positioned to become “The Visa of Crypto” and generated billions in revenue through transaction fees as the Bitcoin network grows in size.

Every transaction on the Bitcoin network must be confirmed by a miner to process. Miners receive transaction fee rewards in Bitcoin to complete transactions on the blockchain.

Right now, block rewards exceed transaction fees, but that won’t last forever. I think it’s important to see MARA as a Bitcoin payment processing & holdings company instead of just a Bitcoin miner.

Some investors warn against investing long term in companies like MARA because of its constant share dilution.

However, I think investors are thinking too short term in this assessment. Share dilution is key to early-stage growth as the company increases its hashrate and adds BTC to the balance sheet.

As Bitcoin prices rise over time, MARA doesn’t need to rely on share dilution to raise capital. MARA CEO Fred Thiel copied Michael Saylor’s strategy of selling convertible notes to buy more Bitcoin.

The company sold $300 million worth of convertible notes, then purchased 4,144 Bitcoin with the proceeds. When Saylor did the same thing, he helped MSTR shares outperform every company in the S&P 500 since Saylor adopted a Bitcoin strategy in August 2020.

It could be exciting to see if MARA can successfully become a Bitcoin miner and holdings company at the same time. No one has done this successfully before to my knowledge!

Be Prepared for a MARA Short Squeeze

Rising Bitcoin prices are great, but what’s even more exciting is the potential for a MARA short squeeze as shorts are forced to buy back MARA stock to close their position.

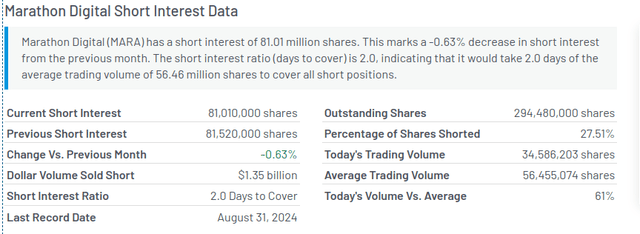

According to MarketBeat, MARA has a 27.51% short interest, with over 81 million shares sold short.

MARA Short Interest Data (marketbeat.com)

It’s shocking that so many short sellers are betting against MARA right before the Q4 2024 crypto bull run!

As short sellers scramble to cover their bets, I expect a huge price swing for MARA shares. However, don’t expect the pump to last forever because MARA swing traders are known to take profits at the top of massive rallies.

An interesting strategy is to buy MARA shares at lower prices, then sell into strength when others become greedy. You can roll your profits into Bitcoin or sit on cash and wait for another dip buying opportunity.

Risk Factors

- Declining Bitcoin Mining Profitability: Bitcoin miners struggle to generate profits during flat periods of Bitcoin price action. With hash rate and competition for each block increasing, MARA must find a way to increase shareholder value when Bitcoin isn’t soaring to the moon. MARA is extremely profitable during bullish Bitcoin movements, but BTC isn’t guaranteed to hit huge new highs. You could argue that the January 2024 Bitcoin ETF approvals accelerated this current Bitcoin bull cycle, which means more tough times for MARA in the future if Bitcoin doesn’t rip to $100k, $150k, and so on.

- Depressed Bitcoin Prices: Bitcoin is historically strong in Q4 thanks to the Uptober pump. MARA shares are positively correlated to rising Bitcoin prices but could also crash if Bitcoin sells off.

- Share Dilution: MARA has 279 million shares outstanding as of Q2, 2024. That number has increased dramatically from just 16 million shares outstanding in Q2 2020. Will MARA continue to dilute shareholders? It’s definitely something that could crash any major future bullish runs. Unexpected share offering is a major risk factor for retail investors who don’t buy puts for downside protection.

- Environmental Risks: A lot of people are becoming anti-Bitcoin due to potential health risks associated with too much exposure to Bitcoin mining facilities. Time magazine posted a controversial article titled “Inside the Nightmare Health Crisis of a Bitcoin Mining Town” that caused a big stir. Many residents became sick after MARA took over the Granbury, Texas BTC mining farm. Animals lost hair. Trees died. The company made plans to reduce the noise pollution by using immerse cooling (submerging BTC miners in oil) in its August 2024 Bitcoin mining update. It’s definitely made me think twice about investing in MARA shares if these claims are true.

- Natural Disasters: Hurricane, floods, and other natural disasters can put BTC miners offline for weeks until the damage is repaired. This would cause a massive drop in MARA’s hash rate and daily mining revenue.

My Gameplan for MARA Stock

I’ve been bullish on MARA for a very long time because they are the top dog in America’s Bitcoin mining industry. The biggest problem I have with the company is the negative environmental impact.

I would feel much better if MARA fixes the Granbury, Texas facility and gives the residents of Hood County their lives back. We should receive feedback on the Granbury facility repairs by the end of 2024.

Right now, I’m HODLing MARA shares and looking to add some bullish MARA call options to maximize my gains.

- October 25th $30 calls: These are my favorite cheap MARA call options right now that could explode in value if MARA pumps during Uptober. Bitcoin is up 28% historically in October, so expect MARA to bounce off its current local bottom to higher prices.

- December 20th $40 calls: MARA shares were up 458% in Q4 2020 during the previous crypto bull run. While I don’t expect another 5x, I do feel strong about a solid 2 to 3x at current price levels.

- March 21, 2025 $35 calls: Believe it or not, MARA shares skyrocketed from $2 on October 1st 2020 to $48 by March 31st, 2021! That’s a whopping 24x in just 6 months. I don’t expect the same ROI, but these calls options could really print if history repeats.

MARA is a big target for swing traders, so it’s important to take profits ASAP because sentiment changes quickly on these stocks.

Holding MARA long term does have risk, so I don’t want to sugarcoat things. You must have strong conviction to hold MARA over the long run, but I think patient investors will get rewarded once the masses understand the importance of miners in the Bitcoin ecosystem.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MARA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.