Summary:

- Semiconductor investors who had invested in TXN avoided severe losses from the widespread semiconductor industry downturn, particularly in the personal consumer electronics market.

- Texas Instruments’ dominance in the analog integrated device manufacturing market not only solidified its position but also reduced risks associated with downstream inventory adjustments.

- Despite being well-positioned to capitalize on the long-term growth in the automotive market, investors should be aware that a market correction in auto cannot be ruled out.

bunhill

Boring is good. Semi investors focusing on the most advanced chip designers from leading players like AMD (AMD), Intel (INTC), and Nvidia (NVDA) got caught up in the significant inventory digestion that beset the personal consumer electronics (PCE) segment.

Even the stock of TSMC (TSM), the dominant pure-play foundry for the leading fabless chipmakers, took a significant tumble over the past year, down more than 23%, despite the recent recovery.

As such, as one of the leading integrated device manufacturers (IDM) for Analog and embedded processing chips, Texas Instruments (NASDAQ:TXN) isn’t too concerned with building up inventory, unlike its advanced nodes peers.

Texas Instruments reported an inventory of $2.8B at its FQ4 earnings release yesterday (January 24), up nearly 14.5% from FQ3. Yet, management articulated that its inventory management is strategic and is aimed to “[maintain] high levels of customer service, keeping stable lead times, and minimizing inventory obsolescence.”

Keen TXN investors should be familiar with “inventory obsolescence.” That’s one of the critical reasons why leading-edge fabless designers and their downstream players in the PCE segment are so concerned with sell-in and sell-through metrics.

They cannot afford to hold on to such inventory that could compel them to take significant inventory charges before the following product launch sequence is in play. However, TXN is not unduly concerned with such challenges, as its inventory is considered “low risk,” with the potential of adding another $1B to $2B of additional inventory to its balance sheet.

Notwithstanding, Texas Instruments is not immune to downstream inventory adjustments, as seen in its Q4 performance. Accordingly, the company reported a revenue decline of 11% QoQ, as it also suffered from the broad weakness across the market, sans automotive.

Texas Instruments reported a revenue decline in its Analog segment of 5% YoY in Q4, even though Embedded Processing was up 10%. Auto revenue was up about 5%, but the PCE downturn affected the company’s performance, as segment revenue fell nearly 15%. TXN’s Industrial market also fell 10% YoY, compounding the company’s tepid performance in Q4.

Therefore, investors are likely keen to know whether the company’s automotive drivers could help lift the doldrums in the semi market in the medium term.

Management is confident about the automotive drivers (such as increased semi content and mix) but also cautioned investors to expect a correction articulating: “We believe that we will see a correction in automotive. But we don’t — we just don’t know [the timing and duration.].”

Auto revenue accounted for about 25% of Texas Instruments’ FY22 revenue base. Hence, we believe that a correction from the auto segment would likely cause further headwinds to TXN’s growth cadence.

Despite that, signs of an improvement in the PCE segment could be in the works. Notably, Quanta Computer management highlighted in a recent interview that “notebook demand should recover in the second half of 2023.” However, the recovery is still expected to remain tepid.

As such, it’s still too early to assess whether the recovery in the battered industrial and PCE segments could help mitigate the potential correction in the auto segment when it hits.

Hence, we urge investors to carefully monitor the other analog IDMs’ developments in their upcoming earnings.

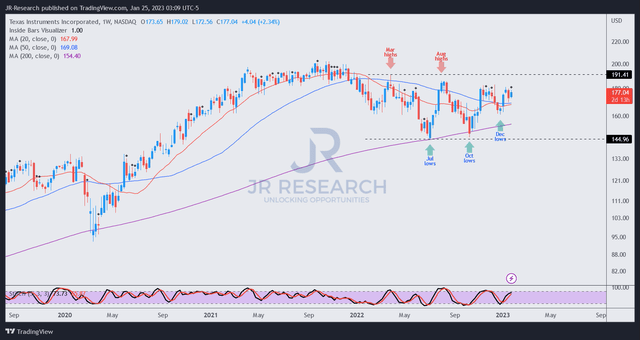

TXN price chart (weekly) (TradingView)

TXN last traded at an NTM EBITDA multiple of 16.1x, well above its 10Y average of 14.1x. It’s also above its peers’ median of 11.8x, according to S&P Cap IQ data.

Therefore, Texas Instruments needs to maintain its market leadership and confidence among its long-term buyers to sustain its uptrend.

Despite its valuation premium relative to its peers, TXN remains in a long-term uptrend. We also gleaned robust support from dip buyers at its lows in July and October, which could help TXN recover its medium-term upward momentum.

However, a critical resistance zone remains in play, which could affect the upward recovery from the current levels.

But, we think investors looking to add exposure can consider its next deeper pullback, as TXN seems primed for a medium-term recovery.

Rating: Hold (On watch for a rating change)

Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!