Summary:

- I am bullish on Google stock heading into Q4 earnings, as I believe that the market may be too pessimistic regarding the search giant’s potential to top expectations.

- Although I understand that the market for digital advertising continues to be under-pressured, I see upside coming from three major tailwinds.

- As compared to Q3, (1) global macro conditions have improved, (2) FX headwinds from a strong Dollar have eased, (3) and OPEX spending has likely been more disciplined.

- Moreover, any comment hinting that Google is working on a competitive platform similar to ChatGPT could likely catalyze a share explosion independent of Q4 results.

- Going into Q4, I suggest investors consider 105/115 %-moneyness call spreads with a February 10th expiration date.

Justin Sullivan

Thesis

All eyes are now on Google’s (NASDAQ:GOOG) Q4 results, which are set to be released on February 2nd after the market closes. Due to a decline in digital ad spending, market expectations are low, and analysts believe the company may see only a 2% year-over-year increase in revenue for 2022 compared to 2021 – despite inflationary pressures. However, as compared to Q3, (1) global macro conditions have improved, (2) FX headwinds from a strong Dollar have eased, (3) and Google’s OPEX spending has likely been more disciplined. Moreover, any comment hinting that Google is working on a competitive platform similar to ChatGPT could likely catalyze a share explosion independent of Q4 results.

For reference, Google stock is a relative underperformer: shares are down approximately 24% for the past twelve months, as compared to a loss of about 10% for the S&P 500 (SPY).

Earnings Preview

According to data from Seeking Alpha, as of January 25th, 35 analysts have provided their estimates for Google’s Q4 results. They expect total sales to be between $73.36 billion and $80.52 billion, with an average estimate of $76.3 billion. Assuming the average analyst consensus estimate as a benchmark, it is suggested that Google’s Q4 sales may increase by around 2% only, compared to the same quarter in 2021. Additionally, analysts have provided EPS estimates ranging from $0.99 to $1.40, with an average of $1.21, which would indicate a year-over-year decline of more than 20%!

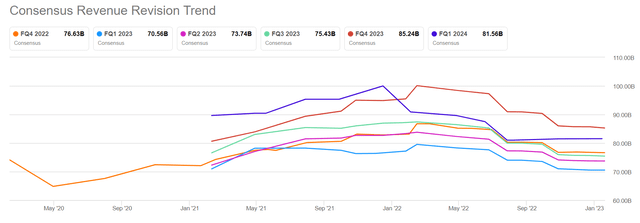

Referencing consensus analyst expectations, I would like to point out that revenue estimates have steadily deteriorated during the past 12 – 14 months, with sales expectations now being approximately 20% below September 2021 estimates.

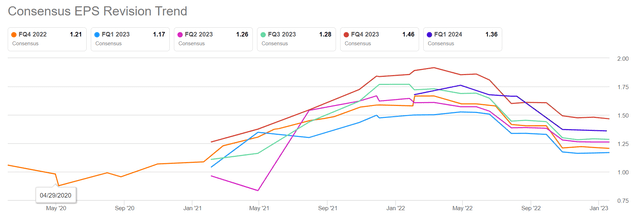

Similarly, EPS expectations for Q4 2022 have slumped. As compared to EPS of close to $1.75 predicted in early 2021, analysts now expect only $1.25.

Why Expectations Might Be Too Pessimistic

Personally, I believe expectations for Google’s December quarter are likely a bit too pessimistic. Although I understand that the market for digital advertising continues to be under pressure – given a slowing global economy and increasing competition for advertising budgets amongst platforms such as Netflix (NFLX), Meta (META), Amazon (AMZN), etc. – I see upside coming from three major tailwinds.

First, global macro conditions have improved in the last quarter of 2022 compared to the previous quarter, and major banks like JPMorgan (JPM) are already predicting a mild recovery. During the second and third quarters of 2022, some advertising companies, like Snap (SNAP), warned of a decline in the advertising market, but there have been no similar warnings in the fourth quarter. Additionally, the reopening of China could have a positive impact on the global economy and advertising that should not be underestimated. In that context, Sir Martin Sorrell, the executive chairman of S4 Capital commented:

I think that is the big thing here [the reopening of China]. And remember … Alphabet/ Google, Amazon, Meta, there second biggest profit centers have historically been outbound Chinese — Chinese companies targeting business abroad.

Second, investors should also take into account that the impact of currency exchange rates on revenue will be less severe in the fourth quarter compared to the third quarter. According to estimates from Google, the negative effect of foreign currency on overall revenue growth for the fourth quarter is estimated to be around 5 percentage points. However, since these projections were made, the value of the US Dollar has decreased significantly, by almost 8%.

Third, Google’s Q4 performance, or guidance going into 2023, may exceed expectations on the backdrop of aggressive OPEX discipline. Notably, Google has already announced ambitions to lay off approximately 12,000 of its employees. While the effect of most Google’s cost-cutting initiatives will likely only materialize in 2023, these actions could potentially expand Google’s 2023 profitability by as much as $1.3 billion to $2 billion in 2023, assuming an average annual salary per let-go employee of about $110,000-$130,000.

Personally, I model Google’s Q4 sales to come in between $77-80 billion, squeezing out the FX headwind from Google’s Q3 results and also modelling a 75 basis point tailwind from the sharper-than-expected reopening in China. Accordingly, accounting for the higher topline, my EPS expectations are between $1.30 and $1.50.

Will Investors Learn Anything About Google’s Counteroffensive Against ChatGPT?

It is arguably no understatement to say that the super successful launch of ChatGPT, and its continuing rise in popularity, got Google investors worried. So far, there has been little response from Google management, except that the company reportedly issued a ‘Code Red’ and CEO Sundar Pichai redirected some teams to focus on building out (competitive) AI products. Rumors also build that ‘Larry Page and Sergey Brin have discussed Google’s response to ChatGPT, with plans to launch over 20 AI products this year, including a demo of its own search chatbot’. In the conference call following Q4 reporting, I expect many analysts will likely focus their question on how Google management sees the threat coming from the new AI platform from OpenAI, and how the company plans to respond to the building threat. Any implicit confirmation from Google management that the search giant is indeed working on a competitive platform similar to ChatGPT could likely catalyse a share explosion independent of the actual Q4 performance.

Conclusion

I am bullish on Google stock heading into Q4 earnings, as I believe that the market may be too pessimistic regarding the search giant’s potential to top expectations. And at a TTM EV/EBIT of approximately x15, the stock looks undervalued.

Personally, I believe Google will exceed analyst Q4 expectations, which could lead to a significant increase in the company’s share price–especially considering the still depressed sentiment. That said, I am increasing my investment in Google stock and buying time-sensitive call options as a short-term strategy. I suggest investors consider 105/115 %-moneyness call spreads with a February 10th expiration date, as they have the potential for a 4:1 payoff if the stock closes at $115/share.

Disclosure: I/we have a beneficial long position in the shares of GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.