Summary:

- ROIC is on the rise, suggesting the potential for strong growth in net income and the stock price, with EPS projected to peak at $12.86 in 2026.

- Micron’s balance sheet is relatively secure despite debt, with manageable payments due and potential for high net income in favorable market conditions.

- The main risk is timing the exit point correctly, as Micron’s stock tends to peak with ROIC and EPS, making market timing crucial.

vzphotos

The Micron Investment Thesis

During the COVID lockdown in 2020, I spent a lot of time studying machine learning, and as a result, I spent a lot of time with Python, Tensorflow, or PyTorch. And that is why I wrote a lot about AI stocks last year and this year. But one segment of the market that I have not yet covered is memory manufacturers like Micron Technology, Inc (NASDAQ:MU). And I think these memory vendors are going to have a big impact on how fast and how strong the AI/LLM capabilities are going to develop. Because more memory usually means that the LLMs become more powerful.

And with the current slowdown in demand in the mobile and PC markets, the Data Center segment is currently one of the key growth drivers for Micron. While it is likely that smart factories, robotics, or drones will play a bigger role in the future, these are markets that are still some time away in the future.

Therefore, it is important to know how long the incredibly strong demand in the datacenter space will continue and where Micron is in the cycle. And here I think the top is yet to come as Micron is still in an uptrend, which makes the stock very attractive to me as a short to intermediate term trade.

Micron’s Competitive Position

Micron primarily sells memory and storage products. The memory sector consists mainly of DRAM, which is expected to see its first production using EUV lithography in 2025 which will be called 1y, and there are also NAND and NOR. NAND is primarily used to store data, while NOR is used to store code. In addition, NAND tends to be less expensive, while NOR is faster and more reliable.

The RAM chip market is dominated by Samsung (OTCPK:SSNLF), SK Hynix (OTCPK:HXSCF) and Micron, who together control almost the entire market. And the companies that sell RAM take the modules from the big three and put them in their own PCB sticks. In the gaming sector, for example, Corsair and G.Skill are the companies that score particularly well and stand for high-quality products.

The business segments that Micron serves include data centers, which is one of the most used terms right now along with AI, the PC market, the graphics market, mobile, and the embedded business segment, which includes automotive and industrial. Micron’s main competitors are the previously mentioned Samsung and SK Hynix, as well as Western Digital (WDC) and Kioxia Holdings.

Since HBM is currently in high demand, Micron’s HBM capacity appears to be tapped out for an extended period of time as NVIDIA (NVDA) and Advanced Micro Devices (AMD) need to meet the huge demand for their products that use Micron’s chips. However, Micron still appears to lag behind Samsung and SK Hynix in terms of market share, with SK Hynix currently dominating with nearly 50% of the market. In general, I would say that the memory market is commodity like, but SK Hynix still has an advantage over its competitors in terms of products.

It will be interesting to see if HBM4 will change the market dynamics, as Micron’s HBM3E 12-high with 36GB has received good reviews. At first glance, however, I believe that SK Hynix will continue to maintain its dominant position.

Micron’s Metrics and Balance Sheet

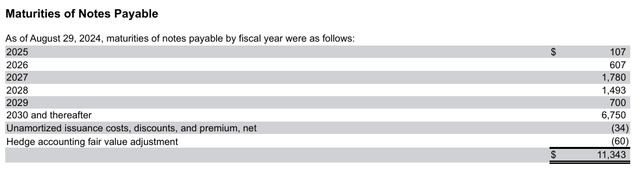

Micron has $8.1 billion in cash, cash equivalents and short-term investments. Facing $11.2 billion in long-term debt and $2.3 billion in capital leases. This means that debt is slightly higher than cash and cash equivalents. But combined with the ability to generate high net income in good market times, the balance sheet should still be relatively secure. But I still think deleveraging is not a bad idea.

However, with no large payments due on the notes in the next few years, they should be easy to service. The $107 million in 2025 and $607 million in 2026 could easily be paid from the current cash on hand. The 2026 and 2027 Term Loans, which are repaid quarterly at 1.25% of principal, are also unlikely to threaten liquidity in my opinion.

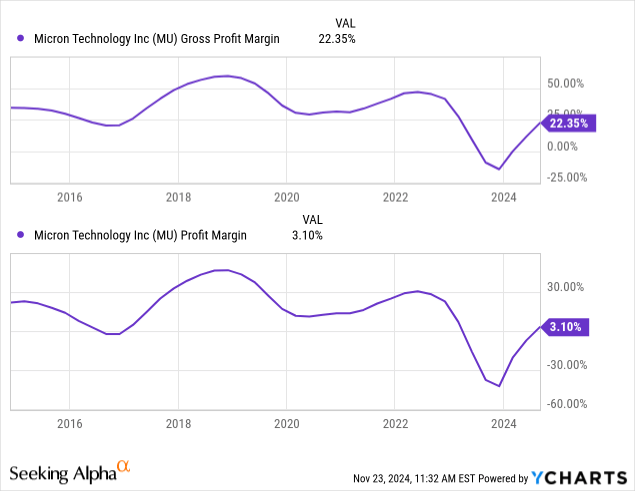

The long-term chart of gross margins and profit margins shows us that Micron is still off its peak in this regard. As a result, we may soon return to a time when Micron can capitalize on its investments and generate substantial cash flow to pay down debt and make new investments.

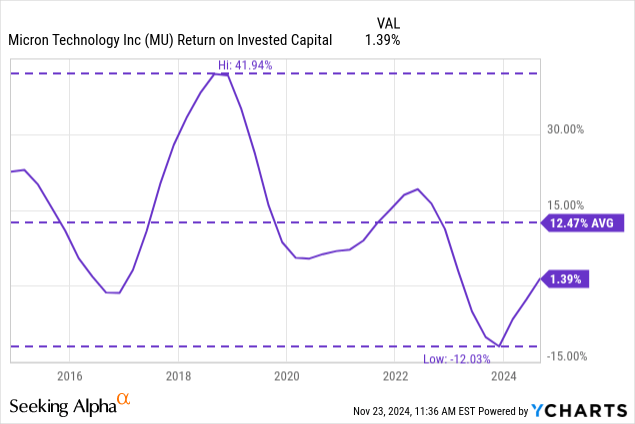

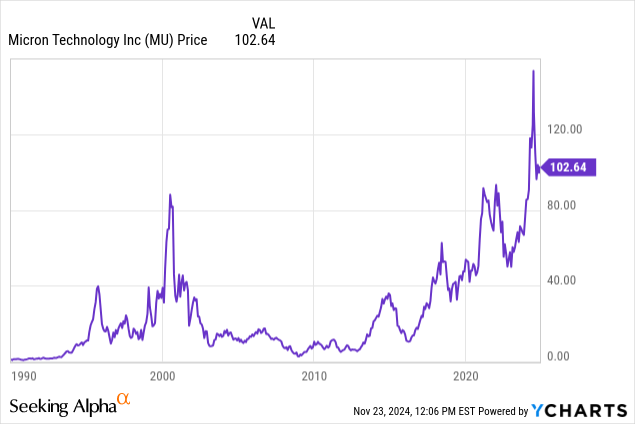

MU’s ROIC And Capital Allocation

This cyclical behavior is also reflected in the return on invested capital, which is currently well below the average of the last 10 years. But ROIC is on the rise, and companies that are in the process of increasing their ROIC often see strong growth in both net income and stock price. When Micron’s ROIC was very low in 2016, the stock price was around $10, and in 2018, when ROIC was sky high, the stock reached a high of ~$60. And then, from that high, the stock fell back to $30 a share.

And I think something like that could happen again, where the ROIC keeps going up and up and up to an above-average level, and then when it peaks, the stock goes down. That is why I think it is important to keep an eye on ROIC and estimate when it will peak again.

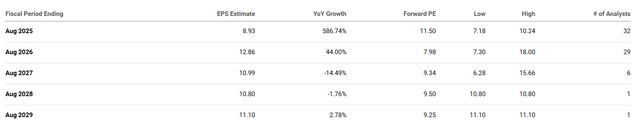

What Could EPS Look Like In The Future?

Analysts also expect very strong growth from the current EPS of $0.7 to $8.93 in 2025, peaking at $12.86 in 2026 and declining slightly thereafter. This would mean that ROIC is likely to increase until the end of 2025 or possibly mid-2026 and then decline. Using the historical development of ROIC as a measure, Micron could be an interesting investment between now and then to take advantage of rising ROIC, EPS, and hopefully a rising stock price.

With EPS of $12.86 and a multiple of 12, the stock would have a price of about $150 in August 2026, or 50% upside in 2 years. An attractive opportunity, I think.

Risks

I think the biggest risk is not finding the right exit point. And finding the right point in real time is always very difficult, even if it looks so clear on the charts afterwards. Because If we look at the chart above, we can see that Micron is always hitting peaks, which often correlate with peak earnings and peak ROIC, and then the stock corrects. The tricky part is that we still do not know when A.I. will peak, so it could be 2026, but it could just as easily be 2025 or 2027.

Personally, I think that 2025 will not be the peak of AI, but it could be that certain events will cause me to change my mind quickly. After all, complex markets require that people be prepared to change their minds quickly as the environment changes.

Conclusion

In summary, I think there is a lot of upside potential over the next 1 to 3 years to take advantage of the strong demand. At the moment I see no signs of when the top will be reached, but unfortunately things often happen faster than you think, so it is always wise to be on guard. For example, I am in the process of increasing my cash ratio to hedge my relatively high AI exposure. But I think the odds are relatively high that I will go long Micron and build a position in a few weeks. Long term, Micron does not fit my strategy, but I see a lot of potential for a short or mid-term trade.

I also think that we are still very much in the early days of AI, which could make the memory cycle even longer because memory is so critical to AI. So it is also possible that my time horizon of 1 to 3 years is too short. Therefore, since I cannot see into the future, I have to try to figure out where things stand from time to time in order to find the right time to exit. And the clues I will use are Micron’s ROIC, the earnings reports and earnings calls of other AI-related companies, and trends in the storage industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.