Summary:

- AT&T Inc. just reported Q4 2022 results.

- AT&T’s stock price jumped on the upbeat report.

- However, we do not share the market’s enthusiasm about the AT&T Inc. earnings report and share three reasons why.

STEFANI REYNOLDS/AFP via Getty Images

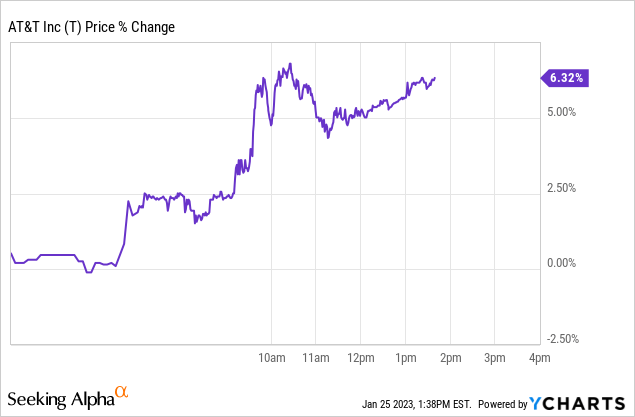

AT&T Inc. (NYSE:T) just reported Q4 results, and the stock price jumped on the upbeat results, up 6.32% as of this writing:

While bulls may be heralding this report as clear evidence that AT&T Inc. is successfully executing its turnaround, we do not share the market’s enthusiasm. In this article, we discuss three reasons why we do not think it is prudent to buy the stock following the latest earnings report.

Breaking Down AT&T’s Q4 Report

First and foremost, T delivered some good news:

- beating consensus estimates by $0.04 with its non-GAAP earnings-per-share of $0.61.

- Achieving a net gain of 6.4 million wireless subscribers, increasing the full year net gain to 15.6 million.

- Added 656,000 postpaid phone subscribers, beating analyst estimates by 11,200.

- Added 280,000 Fiber customers during Q4 and 2.9 million during 2022.

It also delivered some positive guidance for 2023:

- Wireless service revenue growth of 4% or higher

- Broadband revenue growth of 5% or higher

- Adjusted EBITDA growth of 3% or higher

- Free cash flow of $16 billion or better, up $2 billion from 2022.

Based on these numbers there is very real cause for optimism that T may finally have turned the corner and its aggressive investments are finally beginning to generate meaningful growth for the business. Given these positives, it makes sense why the market is rewarding T with a meaningfully higher stock price today.

That said, there were also some major negatives in the quarterly report that keep us from jumping on the T bull bandwagon:

- Revenue growth in Q4 was still anemic at just 0.7% year-over-year. In fact, it missed consensus estimates by $70 million, so it was hardly anything to celebrate and reflects the fact that the company still needs to prove to the market that it can reignite the growth engine.

- The GAAP earnings-per-share number was terrible at -$3.20. While it is true that this loss was driven by non-cash related factors, the fact remains that it reflects continued weakness and declines in the underlying value of the business. The company lost a whopping $3.57 per share in impairment, restructuring, and abandonment charges and it lost $0.19 per share in actuarial charges due to a re-measurement of its pension and postemployment plan obligations.

- The Consumer Wireline business had zero year-over-year broadband subscriber growth and total broadband and DSL connections were down by 0.2 million year-over-year.

Given these cons, along with some other lingering concerns, we have three major reasons for staying on the sidelines of T stock:

#1. AT&T Growth Remains Very Elusive

Yes, management guided for some of its businesses to see strong revenue growth in 2023. However, the adjusted earnings guidance was quite weak, coming in at a midpoint of $2.40 per share. Not only was this well below the $2.56 per share that was the consensus analyst estimate, but it is down 6.6% from their full year adjusted earnings-per-share in 2022 and down a whopping 29.4% from their adjusted earnings-per-share in 2021. If the positive takeaway here is that adjusted earnings-per-share declines are decelerating, we are not exactly getting excited.

Furthermore, if investors thought that perhaps T’s management was sandbagging EPS guidance in order to set the stage for upside surprises later this year in a bid to recover some of their lost credibility, one need only look at the weak guidance issued by peer competitor Verizon (VZ) to see that this is likely not the case. Meanwhile, business revenue continues to erode as well.

Yes, T is expecting a meaningful increase in free cash flow in 2023 which is great, but if adjusted earnings per share do not turn around soon, this really does not matter much.

#2. The AT&T Balance Sheet Is Still Cumbersome

T’s balance sheet – while getting gradually better given its focus on debt reduction – remains a major overhang on the business, especially with interest rates rising like they are. When combined with its declining legacy businesses, management was forced to take another massive $29.4B pre-tax write down from rising interest rates and asset impairment charges during Q4.

This reflects very badly on the business and it is hard to know just when the bleeding will stop.

#3. AT&T Stock Is Unattractively Valued

Last, but not least, the fact remains that T stock is stubbornly overvalued. Despite interest rates (and therefore discount rates applied to valuations of equities) soaring over the past year, T’s EV/EBITDA remains significantly elevated relative to its historical averages. For example, its 10-year average EV/EBITDA is 6.82x, but its current EV/EBITDA multiple is 7.31x, roughly half a turn higher. Given how leveraged T is, this represents considerably downside risk for the stock if it were to reprice back towards its historical average.

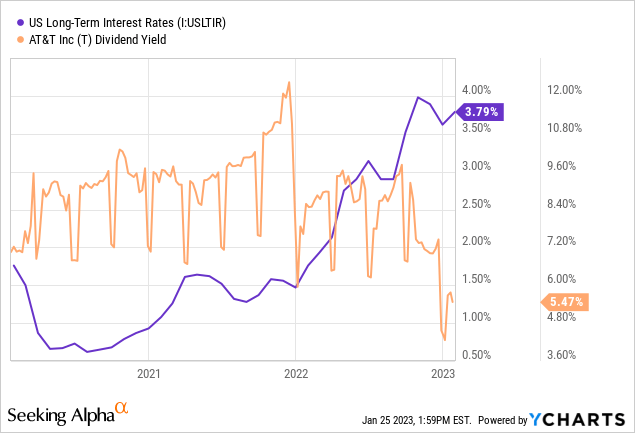

The dividend yield is also below its 10-year average at 5.84% at present compared to tis 10-year average of 5.95%. Given that T offers little to nothing in the way of growth, it is viewed primarily as a bond-substitute for income investors. Given that interest rates have soared lately, T’s dividend yield looks less attractive than it has in quite some time relative to the risk-free rate:

Investor Takeaway

Congratulations to AT&T Inc. for providing some positive 2023 revenue guidance for some of its business segments and for expecting to see a meaningful jump in free cash flow this year.

However, AT&T Inc. remains plagued by anemic revenue growth, significant adjusted earnings per share declines, a bloated valuation relative to interest rates, and cumbersome interest expenses and asset write-downs that reflect the ongoing overhang of T’s horrific past capital allocation decisions.

CEO John Stankey did little to inspire confidence in the stock either, stating:

Turning to 2023, what’s our strategy? Well, it’s simple. Do it again. What exactly does that mean? It means we’re focused on the same three operational and business priorities we set in place 2.5 years ago.

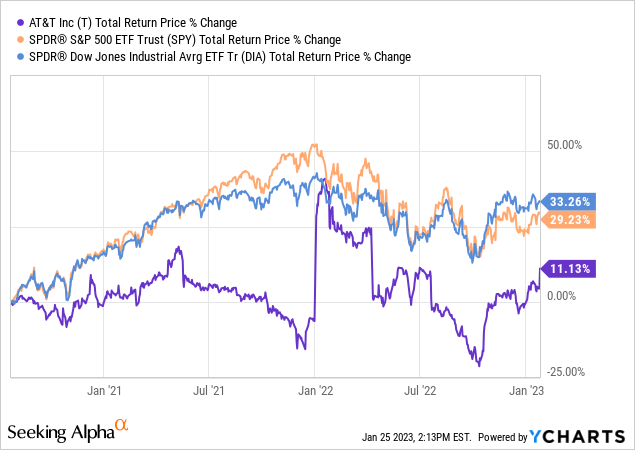

A look at how AT&T stock has performed over that time frame says a lot about what to expect from this management team moving forward:

We continue to rate AT&T Inc. a Hold and would like to see a significant downward repricing of T stock or a significant acceleration in both the top and bottom line growth rates to get us at all interested. For now, we are finding significantly superior opportunities elsewhere in the telecom sector.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Our 2023 Blowout Sale of the Year is Here!

For a Limited-Time – You can join Seeking Alpha’s #1 rated community of high-yield investors at a steep discount!

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have over 150 five-star reviews from happy members who are already profiting from our high-yield strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.