Summary:

- Hudson Technologies shares dropped 13% after disappointing Q1 2024 financial results.

- The company’s revenue was down, as well as its gross margin.

- Looking at Hudson’s inventory, we don’t see a troubling situation, but we actually may be before a golden opportunity for Hudson’s future profits.

john_99

Hudson Shares Drop

Hudson Technologies (NASDAQ:HDSN) reported Q1 2024 results and all eyes were on the Company’s DLA contract revenue. So far, this year has not been fun for Hudson shareholders, with HDSN shares dropping 30%. More downside was added after the report, with the share price falling from $9.80 to $8.53 (-13%). Many investors are wondering what is going on, since 2024 should have been the year of Hudson’s explosion, thanks to the strong tailwinds created by the AIM Act.

This is not the first time Hudson has seen a sell-off. After all, the stock’s market cap is just $415 million, making it more volatile. And yet, in recent years, these sell-offs have created rewarding opportunities.

Strikingly, not later than January 2023, Hudson was ranked among the best-rated stocks by Seeking Alpha’s Quant rating system, Hudson is now rated at an opposite valuation, with a “sell” that is coming closer and closer to a “strong sell”. However, while in other cases I have seen Quant ratings as very helpful, the 3-yr rating history for Hudson has only partially worked.

Seeking Alpha

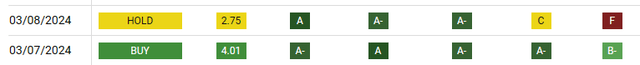

Moreover, just two months ago, the stock still had a “buy” rating and a score of 4 out of 5. Then, on March 8, the stock lost 1.76 points because of two changes: momentum was downgraded from an A- to a C, and EPS revisions plunged from a B- to an F.

Seeking Alpha

While the downward EPS revisions may make sense, as far as I see it, given the volatility of the stock, the Quant system has some trouble balancing the impact of momentum, which can quickly change.

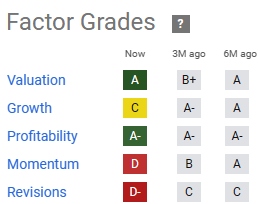

In any case, the “sell” rating doesn’t come completely out of the blue. While the company’s valuation remains very cheap, its growth prospects, together with its EPS revisions paint a more troublesome picture ahead of the company than previously anticipated by the market.

Seeking Alpha

So, what is happening, and why isn’t Hudson taking off? In this article, I will share my take and what I am expecting down the road.

Hudson’s Q1 2024 Financials

Hudson reported revenues of $65.3 million, down 15% YoY.

Gross profit was $21.4 million, which means gross margins were 33%, compared to 39% a year ago.

Hudson’s operating income was $12.8 million, down 43.6% YoY. However, interest expense was almost completely reduced, moving from $1.85 million to just $214,000, as a consequence of the company’s recently achieved zero-LT debt status.

Net income recorded was $9.6 million, -38.4% YoY. As a result, diluted EPS was $0.21 vs. $0.33 a year ago.

Hudson’s balance sheet, however, is healthy. No LT debt, over $10.5 million in cash, and inventories down from $154 million to $148 million. This, in particular, is quite important to understand how the company may perform in the next few quarters. I have gone thoroughly over Hudson’s inventory management, explaining why it is a key indicator of the company’s future results. To summarize a bit, Hudson uses a FIFO approach, which means it sells first the inventory that was bought before the rest. This approach has the advantage of reporting an inventory valuation on the balance sheet closer to its current market value. At the same time, this approach matches the revenue from inventory sales with older and, at times, outdated costs.

In its reports, Hudson always writes that its inventories of refrigerant products available for sale:

… are stated at the lower of cost, on a first-in first-out basis, or net realizable value. Where the market price of inventory is less than the related cost, the Company may be required to write down its inventory through a lower cost or net realizable value adjustment, the impact of which would be reflected in the cost of sales on the Consolidated Statements of Operations.

Because of this, we always find an adjustment on the income statement.

At the end of Q1 2024, Hudson’s inventories were $147.76 million, while a quarter ago they were $154.45 million. If the company’s sales were down, we can’t interpret the decrease in inventories as some type of clearance going on. The real explanation is that Hudson is replenishing its stock, but the current market price of used refrigerants is going down, making Hudson’s inventories worth a bit less because higher-priced inventory is being sold while it is being replaced with inventory at a lower cost.

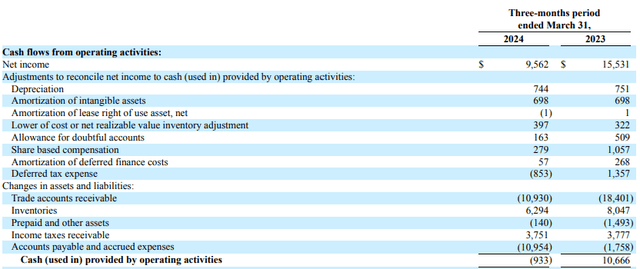

Hudson’s income statement is quite simple, but on the company’s cash flow statements we always find the item “Lower of cost or net realizable value inventory adjustment” (LCNRV) in the operating cash build-up.

Hudson’s Q1 2024 Report

We see that the LCNRV adjustment is $397,000, while a year ago it was $322,000. Since we see a positive number in the cash flow statement, it means this adjustment is being added to the net income to reach the cash provided by operating activities. Hudson’s income statement is quite simple and it doesn’t report this adjustment. But we can use the cash flow statement to understand that the $397k reported as LCNRV needs to be subtracted from Hudson’s gross profit. In other words, this was an inventory write-down to show that it has lost a little value due to lower refrigerant prices. However, the amount is almost meaningless.

Reclaimed Refrigerant Prices

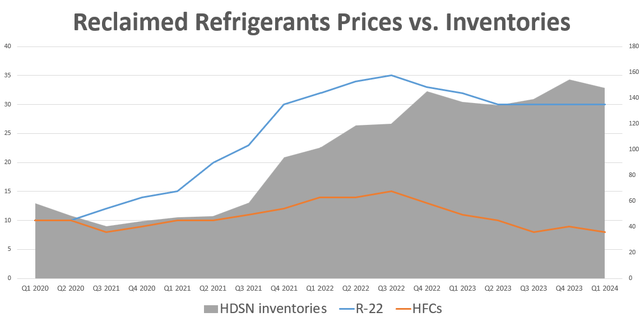

All those interested in Hudson know the issue we still haven’t solved. I have asked several times on SA for help, but, so far, no one has been able to offer a solution. We don’t have any place to find the current market price of reclaimed refrigerants and, in particular, R-22 and HFCs. The only available data comes from Hudson’s earnings calls, where we are updated on the average price seen during the quarter. Putting together these numbers, I started tracking these prices. We see in blue R-22 and orange HFCs. In HDSN’s last earnings call, the news was that in Q1, R-22 was stable at around $30/lb while HFCs – unexpectedly – continued dropping and fell to $8/lb.

This time, I added HDSN inventories, which are represented by the gray area. In this way, we can see that Hudson’s inventories are currently linked more to R-22, rather than HFCs. This makes sense because R-22 has already been phased out and scarcity is greater, thus incentivizing the need for reclaimed R-22. HFCs have not been scarce until the beginning of this year when the AIM Act ruled a 40% step-down in virgin production.

Author, with data from HDSN SEC Filings and Earnings Calls

So, why are reclaimed HFC prices going down? R-22 was completely banned in 2019. For a couple of quarters into 2020, its price hovered around $10, to then take off and triple. In any case, allowance holders had more than 12 years to build a stockpile of R-22. The HFC phase-down is a much faster process. The AIM Act was enacted in late 2020 and in 2024 it is already reducing HFC virgin production by 40%, with the target of an 85% phasedown of HFCs from historic baseline levels by 2036. This shows there was less time to build a huge stockpile.

As a result, there was a rush to HFCs during 2022 and most of 2023. This has cooled down reclaimed refrigerant demand in late 2023 and Q1 2024. Moreover, Q1 is usually the most unpredictable quarter, because weather conditions can greatly influence when the cooling season starts. Usually, Q2 and Q3 are far more stable.

As said, it is hard to track the reclaimed refrigerants market. So, it is even harder to understand what could happen in the next few quarters. However, Hudson has often talked about an estimated installed base of over 125 million HFC units, which won’t be replaced right away as the phasedown is enacted. As the stockpile that was built is used, I have a hard time imagining HFC prices won’t walk a similar trajectory as R-22’s. Perhaps we won’t see a 3x, but demand should soon be greater than the available virgin supply, turning customers towards reclamation.

What is even more important is that Hudson has the balance sheet to withstand the current trough in prices.

This is for two reasons. First, the company has no debt and is carrying over $10 million in cash. So, in case of need, it can borrow money. Moreover, though HFCs prices are around $8/lb, the company still reported a 33% gross margin. Considering the company’s target is 35%, we are still in highly profitable territory.

There is also an advantage. Lower prices mean Hudson can replenish its inventory, lowering its average cost to then profit from increasing prices down the road. This should not be overlooked. If we expect HFCs prices to regain strength, higher margins for Hudson are coming down the road.

However, the company’s management did inform investors that, if current market conditions continue, the company probably won’t be able to achieve its 2025 financial targets of over $400 million in revenue with a 35% gross margin.

The DLA Contract

At the end of Q4 2023, investors were concerned with Hudson’s contract with the Defense Logistics Agency serving the Department of Defense. The DLA Aviation awarded an industrial gas support contract to the company to supply industrial compressed gases to military and federal activities worldwide.

In 2023, this contract was worth $53 million in revenue. But Hudson’s CEO Brian Coleman said that about $20 million of the 2023 DLA revenue was linked to specific program activities that could not be repeated in 2024. In Q1 2024, Mr. Coleman did confirm the DLA contract generated lower revenue YoY.

This will be a headwind for 2024. However, once things normalize, 2025 should have easier and more regular comps that could once again be supportive of the stock.

Valuation

Let’s be conservative. Instead of forecasting $400 million in revenue by 2025, let’s slash this target by 25% and expect the company to post around $260 million in revenue this year and $300 million next year. We can then expect gross margins to come in as low as 30% this year and then increase a bit to 33% next year. Net income should then be around 14% this year and 16% next year.

Assuming no change in the share count (45.5 million currently), we have 2024 EPS of $0.80 vs the current consensus of $0.75. The 2025 EPS estimate would then be $1.05.

This translates into a 2024 fwd PE of 11.6 and a 2025 fwd PE of 8.9.

Considering the volatility of the stock, an 11.6 PE may be a bit high. But an 8.9 PE is far more reasonable. Moreover, these estimates come from a very conservative valuation which considers almost no growth and no price increases for reclaimed refrigerants. As I said, I have a hard time believing we won’t see any increase in HFCs. Therefore, the game right now stands at a crossroads. Investors who are bullish on refrigerant prices will see the bargain and will buy. Those who are uncertain about this trend should stay on the sidelines.

As far as my choice goes, I simply bought more shares just above $9.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HDSN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.