Summary:

- PayPal’s earnings were better than expected, but primarily due to a change in reporting methodology.

- The fintech failed to improve its active account numbers, leading to a soft profit outlook for 2024.

- PayPal’s competitive valuation justifies a ‘Hold’ stock classification, but it lacks a clear catalyst for a re-rating.

JasonDoiy

PayPal Holdings, Inc. (NASDAQ:PYPL) reported earnings a week ago that were better-than-expected, but primarily because of a change in the fintech’s reporting methodology, in my view.

PayPal failed to make any substantial improvements on the active account front, which is where the fintech is facing its most ardent challenge. The outlook for 2024 overall remained soft and with PayPal lacking a clear catalyst for a re-rating, I think PayPal’s stock will continue to face considerable headwinds this year.

The biggest advantage that I see for PayPal is the fintech’s competitive valuation based on earnings, which justifies a ‘Hold’ stock classification, in my view.

My Rating History

A soft profit outlook for 2024 and weak growth were two reasons in February why I adjusted my expectations for PayPal’s stock. I slapped a Hold stock classification on PayPal at the time, which I think is still justified after the fintech’s 1Q24, which showed an ongoing struggle with respect to the company’s active accounts.

Since PayPal continued to report weak account numbers, I think PayPal’s stock faces an uphill climb in 2024.

Ongoing Account Issues

PayPal released earnings for its 1Q24 on April 30, 2024, which were reported as $1.08 per share (adjusted), up from $0.85 per share in 1Q23, reflecting a rise of 27% YoY. However, the fintech’s quarterly profits are not fully comparable since PayPal adjusted its reporting methodology, which means that PayPal’s profit figures now include the impact of stock-based compensation expenses and related employer payroll taxes.

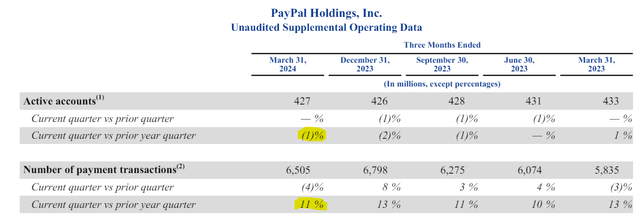

The most disappointing facet of PayPal’s 1Q24 earnings was that the fintech continues to fail to make any kind of substantial improvements in terms of its account growth. PayPal had 427 million customers using its platform in 1Q24, which was only a slight improvement over the 426 million customers in the prior quarter. In the year ago period, PayPal had 433 million customers using its products and services, so the fintech is not exactly in growth mode.

Payment transactions, however, rose 11% in the most recent quarter, suggesting that the fintech can at least somewhat offset pressure on its account base with payment growth.

Unaudited Supplemental Operating Data (PayPal Holdings)

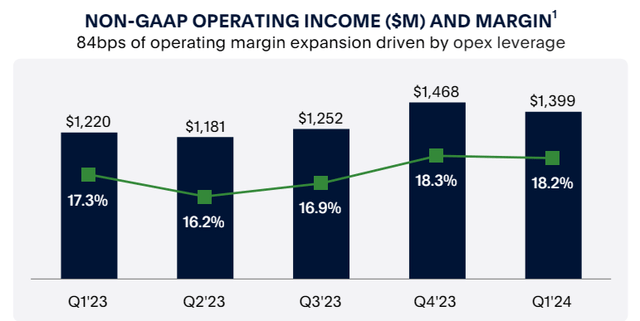

What also likely prevented a more positive reaction to the fintech’s results was that PayPal did not see meaningful growth in its operating margins. As a matter of fact, PayPal’s operating income margin declined 0.1 percentage points QoQ and the company’s operating income fell $69 million to $1.4 billion. This is still a good chunk of money, but PayPal needs stronger growth in core metrics in order to justify a re-rating of its stock.

With operating income and net account growth disappointing, I think that a ‘Buy’ rating at this point would be premature.

Non-GAAP Operating Income And Margin (PayPal Holdings)

Inconclusive Technical Profile

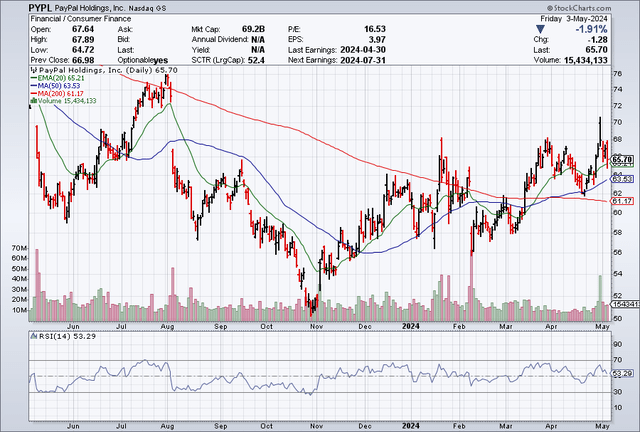

PayPal enjoyed short-lived momentum around its earnings date last week, but the stock was incapable of sustaining its upside drive. The short-term picture is rather inconclusive at the moment, with PayPal’s stock still holding its ground above both the 20-day and 50-day moving average lines, but with a lack of a catalyst, PayPal’s stock may remain in a sideways movement in the near future.

PayPal has also failed, so far, to close the gap that opened up after the fintech’s August results. A gap close at $72 would improve the technical situation considerably and indicate some bullish upside momentum.

Moving Averages (Stockcharts.com)

Low P/E Reflects High Margin Of Safety

The market models $4.37 per share in profits this year and $4.86 per share next year, which implies a leading earnings multiple of 14x. PayPal is very solidly profitable (and produced $1.4 billion in operating income last quarter), so an earnings multiple of 14x does not overvalue the fintech, in my view.

PayPal also produced solid free cash flow of $1.76 billion in 1Q24, which gives the fintech firepower to repurchase its shares in the open market (PayPal guided for at least $5.0 billion in share repurchases in 2024).

A core competitor in the field is Block, Inc. (SQ) which is selling for a 16x earnings multiple, but also anticipated to grow faster than PayPal, partially because Block has momentum with one of its main products, the Cash App.

From a valuation angle, I think PayPal offers investors a relatively high margin of safety, which of course needs to be balanced against the fintech’s overall weaker growth prospects.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Could Disappoint

PayPal’s performance in terms of active accounts will either lead the stock higher or lower. PayPal has lost a good amount of accounts since last year, partially because the company closed fake/inactive accounts.

This doesn’t change the fact, however, that PayPal is presently not really growing its customer base which is, sooner or later, going to be a problem for any company. If PayPal were to turn this trend around and started to grow its active accounts again, then the fintech would have a catalyst for a re-rating.

On the flipside, an ongoing trend of dwindling customer accounts would probably put PayPal into an even weaker competitive position.

My Conclusion

I don’t think that PayPal is well-positioned for growth at the present time. PayPal’s services remain in demand for now, but the rise of various instant-pay apps like Block’s Cash App and others provide a strong alternative to using PayPal’s expensive platform.

While it made sense for PayPal to remove fake/inactive accounts from its ledgers, the fintech can’t escape the fact that customers are much less willing to open an account on the platform than they were just a few years ago.

The main redeeming quality for PayPal here is that the fintech is selling for a competitive earnings multiple. The chart picture, as far as I am concerned, is presently inconclusive and together with a lack of growth catalysts in the business, I think PayPal can only qualify for a ‘Hold’ stock classification at the present time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.