Summary:

- J&J reported its Q4 results with EPS beating expectations.

- The company is proving capable of maintaining organic sales growth while supporting margins through cost savings initiatives.

- We like the stock following the recent selloff and highlight the compelling value for a high-quality market leader.

AaronP/Bauer-Griffin/GC Images via Getty Images

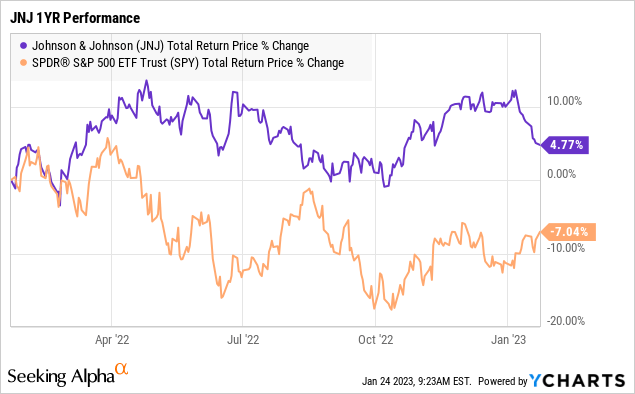

Johnson & Johnson (NYSE:JNJ) just released its fourth quarter and full-year financial results, capping off a resilient 2022 despite macro headwinds. The takeaway from the report is that the company was able to drive earnings higher largely through price hikes, balancing out ongoing cost pressures and softer sales momentum compared to the stronger 2021. Indeed, the stock is up over the past year, outperforming the broader market and highlighting JNJ’s position as a “blue-chip” leader.

In many ways, JNJ serves as a good proxy for other global mega-cap corporations by laying out a roadmap for how to maintain profitability amid a more challenging economic scenario. Notably, management offered positive guidance for the year ahead, which helps to brush aside concerns of a possible deterioration in the operating environment at the start of the year. The stock looks good at the current level and is well-positioned to rebound following a recent pullback.

JNJ Earnings Recap

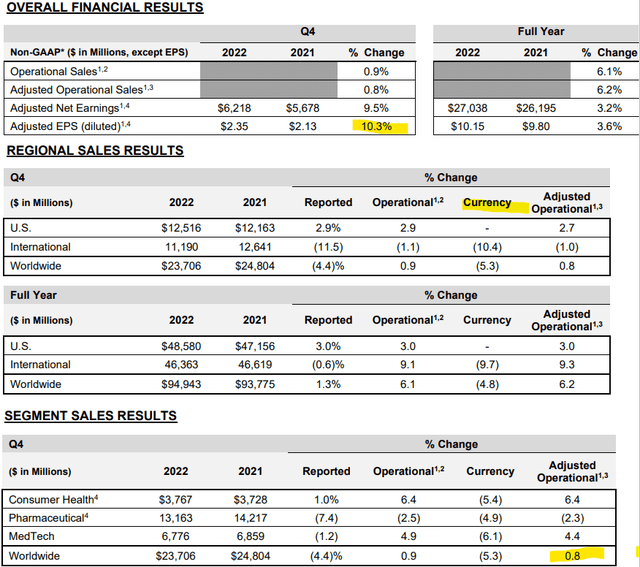

Looking through the Q4 results, adjusted EPS at $2.35 climbed by 10.3% year-over-year, coming in $0.11 above the consensus. The full-year figure at $10.15 was also 4% higher than in 2021.

On the top line, total sales at $23.7 billion declined by -4.4% y/y, recognizing that a large component of that downside was the reduced level of Covid-19 vaccines compared to the period in 2021 at the height of the “Omicron-Covid” surge at the time. Another key factor is the significant foreign exchange volatility through a historically strong Dollar in 2022 which resulted in a -5.3% hit to revenues. By this measure, an “adjusted operational” sales figure excluding both the vaccine and currency impact was up by a positive 0.8% y/y.

source: company IR

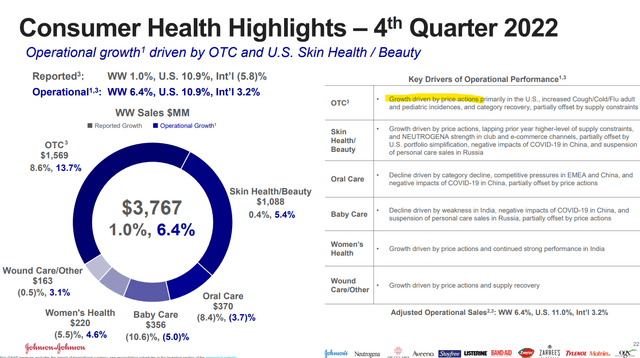

By segment, Consumer Health was a strong point, with reported sales up 1% y/y or 6.4% worldwide on the adjusted basis. Management noted that “price actions” in various product categories added to the momentum against negative impacts in certain markets like China which saw limited sales due to rolling Covid lockdowns over the year. Improved supply chain conditions are also encouraging into 2023.

MedTech also delivered a solid result with adjusted operational sales up 4.4% y/y. The effort was driven by a recovery in major surgical procedures being performed worldwide following the pandemic.

The Pharmaceutical group, which represents nearly 50% of the business, reported sales declined by -7.4% y/y with the segment dragged lower by the decline in Covid vaccine sales. On the other hand, management noted more positive trends in other key drug brands including ongoing market share gains.

source: company IOR

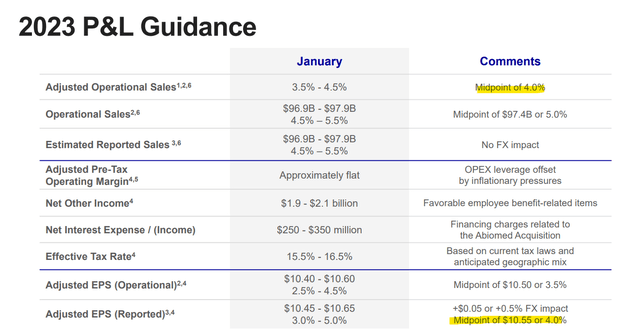

Looking ahead, management offered a positive outlook for 2023, guiding for full-year reported sales between $96.9 and $97.9 billion, representing an annual growth rate of 5% at the midpoint. This figure was roughly in line with the prior market consensus for the year ahead.

More favorable was the target for 2023 adjusted EPS at a midpoint estimate of $10.55. This was a positive surprise compared to the $10.33 market consensus. Separately, the sense is that the trends in early January have been stable. The expectation from the company is to capture some operating leverage and financial efficiencies assuming no FX impact that will be accretive to the bottom line.

source: company IR

What’s Next For JNJ?

The bullish case for JNJ is that the company can benefit from improving macro conditions opening the door to continue outperforming earnings expectations. Even from the latest guidance, a view that inflationary pressures will ease further and the potential for a positive FX impact as the Dollar weakens as a continuation of trends in recent months would directly translate into higher margins, allowing JNJ to approach or exceed the upper-end range of its full-year EPS target.

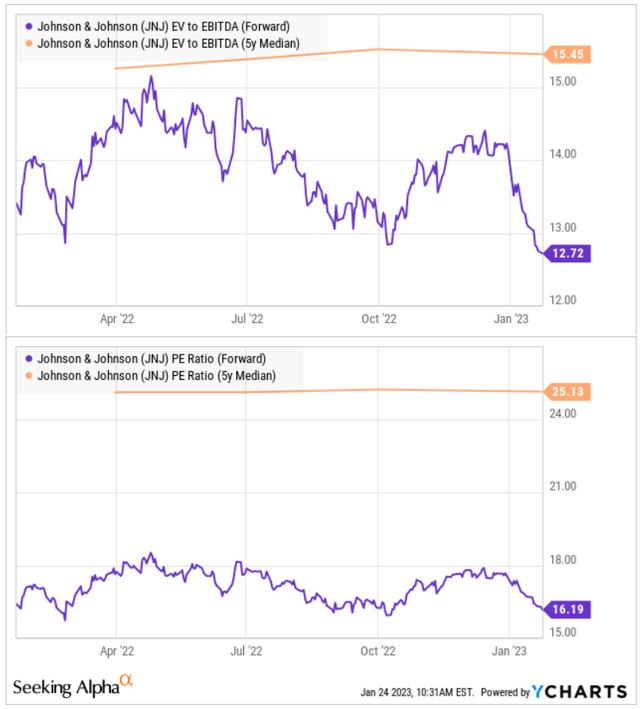

All this is in the context of shares that appear undervalued relative to historical valuation multiples. Considering the 2023 EPS forecast, JNJ is trading at a forward P/E of 16x, which is well below the 5-year average closer to 25x. The spread is similar to other metrics like its discounted EV to forward EBITDA ratio at 13x.

yCharts

JNJ as a Market Bellwether

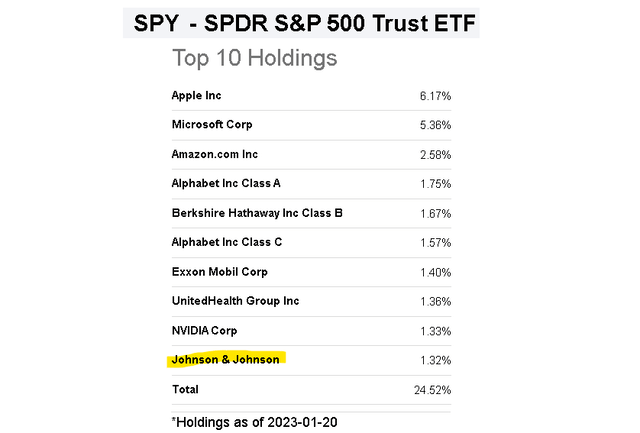

We can circle back to the original thesis that JNJ is a good bellwether for the broader market. The company is a component of the Dow Jones Industrial Average (DIA) and among the top 10 constituents of the S&P 500 (SPY). This is key because, if JNJ is proving capable of beating EPS estimates and delivering positive earnings growth into 2023, the read is positive for other major companies facing similar macro themes.

The “blueprint” or roadmap we’re referring to is based on the dynamic of companies benefiting from price hikes initiated in 2022 while margins gain as supply chain disruptions and cost pressures ease. We’re not suggesting every company is going to smash earnings, but the latest result from JNJ goes a long way to provide a sense of stability to the market.

In the still early stage of the Q4 earnings season, we have already seen some other high-profile names like JPMorgan Chase & Co. (JPM) beat estimates which is adding up to a good trend for the large-cap index. This compares to bearish calls for collapsing earnings that would work to push the broader stock market significantly lower. I’m not seeing that.

Seeking Alpha

Final Thoughts

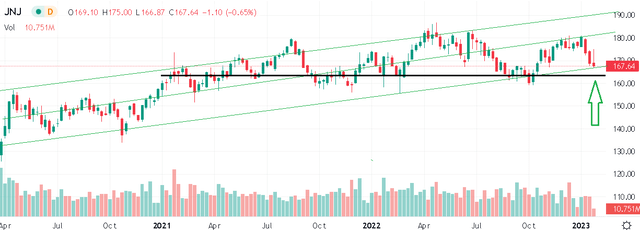

Putting it all together, JNJ is a high-quality stock that maintains a positive long-term outlook beyond the near-term macro noise. From the stock price chart, shares have been trading in a relatively tight range over the past two years even as earnings have climbed and are set to increase again in 2023.

I’m rating JNJ as a buy with a price target for the year ahead at $200 representing a 19x multiple on the current consensus EPS Estimate. The way it could play out is that a series of solid quarterly reports through the first half of the year drive revisions to market estimates higher making the stock appear increasingly attractive.

Investors can even start to expect the next dividend increase which the company traditionally declares in early Q2. We forecast there is room for a 5% hike to the quarterly rate in line with the earnings trend.

As it relates to risks, we love the stock, but it wouldn’t be immune to a deeper deterioration of the economic environment in the possibility of a deepening recession. An unexpected surge in global unemployment or a resurgence of inflationary pressures would undermine the bullish thesis. It will also be important for the stock to hold the $155 share price level as near-term technical support.

Seeking Alpha

Disclosure: I/we have a beneficial long position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.