Summary:

- High-bandwidth memory (HBM) demand is skyrocketing, projected to grow from $4B in 2023 to over $25B by 2025, positioning Micron as a critical AI enabler.

- FY2024 revenue rose 62% YoY, driven by AI-driven demand, with expanding margins and sold-out HBM production through 2025.

- Reduced industry capacity and AI-driven demand are stabilizing a traditionally cyclical market, creating sustainable growth opportunities.

- Micron’s deep valuation discount and projected 51% EPS growth make it a compelling AI infrastructure investment.

mesh cube

Last week during my research of the AI infrastructure supply chain. While everyone’s been obsessing over GPUs and AI chips, I’ve found what, I believe, is the real unsung hero of the AI revolution: high-bandwidth memory (HBM). I was surprised too when I first realized just how critical this component is.

Think about it this way, it doesn’t matter how powerful your GPU is if you can’t feed it data fast enough. It’s like having a Formula 1 car stuck in traffic. During my research, I kept coming back to this fundamental: the speed at which data moves between processors and memory.

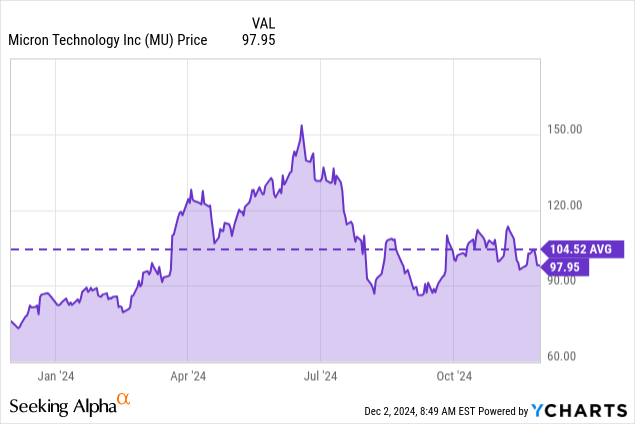

This is where Micron (NASDAQ:MU) caught my eye. While everyone’s paying premium prices for obvious AI plays like NVIDIA (NVDA) and AMD (AMD), Micron’s trading at a fraction of those valuations despite its critical role in the AI supply chain.

Here’s what I think most investors are missing: the memory market is undergoing a fundamental change due to AI. These workloads need specialized high-performance memory that only a few companies can make. Let me walk you through exactly why I believe Micron represents such a unique opportunity due to its impressive growth profile and demand for its HBM technology.

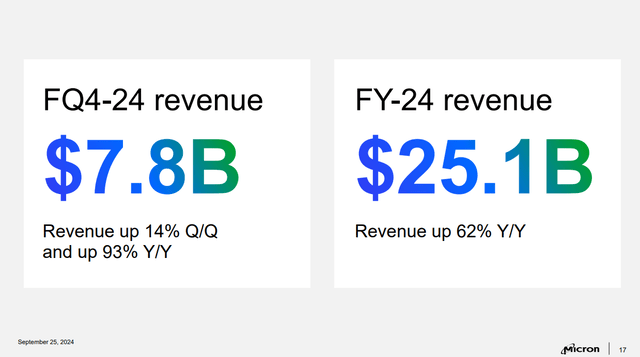

In FY2024 Micron delivered remarkable financial results with revenue growing 62% YoY to $25.1 billion, while expanding gross margins to 23.7% by 30 percentage points. This strong performance is just the beginning of what, I believe, will be a transformative growth cycle driven by AI infrastructure demands.

Micron Q4 Earning Deck

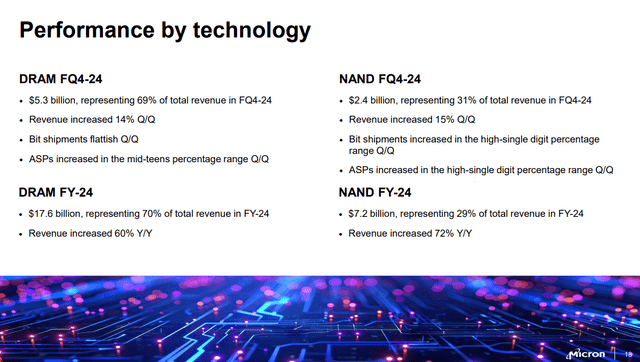

The company’s technological leadership is evident in their successful ramp of 1-beta DRAM and G8/G9 NAND nodes, which will become an increasing portion of their mix through fiscal 2025. Their 1-gamma DRAM pilot production using EUV lithography is progressing well, with volume production on track for 2025. These technological advancement positions them at the forefront of the memory industry just as AI infrastructure demand is accelerating.

Micron Q4 Earning Deck

What’s particularly interesting is the structural change occurring in the memory market. Historically, memory has been a highly cyclical industry but now I see a more sustainable demand environment emerging. The combination of reduced industry wafer capacity (below 2022 peak levels) and increasing HBM mix is creating a healthier supply and demand balance. Moreover, Micron’s data center revenue reached record levels in fiscal 2024 and is expected to grow significantly in 2025, with each of their three main data center product categories – HBM, high capacity D5/LP5 solutions and data center SSDs projected to deliver multiple billions in revenue.

The market appears to be pricing Micron based on historical memory industry dynamics, failing to recognize the structural changes brought about by AI infrastructure demands and the company’s strengthened competitive position. As these factors become more apparent in coming quarters, I expect a significant re-rating of the stock to better reflect its growth potential and strategic importance in the AI revolution.

The AI Memory Opportunity

Memory, particularly high-bandwidth memory (HBM) represents a critical bottleneck in AI infrastructure that’s becoming increasingly important as AI workloads grow more complex and demanding.

According to Micron’s management the HBM market is projected to expand from approximately $4 billion in calendar 2023 to over $25 billion in calendar 2025.

This growth trajectory is being driven by multiple vectors that are fundamentally reshaping AI memory demand: growing model sizes, increasing input token requirements, the emergence of multi-modality applications, multi-agent solutions, continuous training needs and the proliferation of inference workloads from cloud to the edge.

What makes this opportunity particularly compelling from an investment perspective is Micron’s strong execution in this space. Their HBM3E 12-high 36GB solution demonstrates clear technological leadership, delivering 20% lower power consumption than competitors’ HBM3E 8-high 24GB solutions while providing 50% higher DRAM capacity. This technical advantage is crucial for data center customers where power efficiency directly impacts operating costs and performance capabilities.

The financial impact of this shift is already becoming visible. In Q4 2024 Micron’s HBM gross margins were accretive to both company and DRAM gross margins, even as overall DRAM margins improved. This margin expansion occurred during the early stages of HBM adoption, suggesting potential for further improvement as volumes scale up. The company’s HBM production is sold out for both calendar 2024 and 2025.

The demand environment for AI memory extends beyond just HBM. Micron is seeing strong demand for their high capacity DDR5 and LPDDR5 solutions with increasing adoption of their high capacity mono-die-based 128GB DDR5 DIMM products. They’re also pioneering the adoption of low-power DRAM for servers in the data center, offering unique features for enhanced reliability, availability and serviceability in server platforms. Their data center SSD revenue alone exceeded $1 billion in Q4 2024 with fiscal 2024 data center SSD revenues more than tripling YoY.

Looking ahead, I see this momentum accelerating. The company’s strategic investments in manufacturing capacity, including new fabs in Idaho and New York, position them well to meet growing demand. The combination of technological leadership, strong execution and expanding market opportunity creates a compelling growth story that I believe is not fully reflected in current market valuations.

Market Opportunity Timeline

The artificial intelligence revolution is unfolding in distinct phases that create an expanding opportunity for Micron’s memory solutions. In the current landscape, I see two critical phases that will drive sustained demand for high-performance memory products, particularly HBM.

The initial phase, spanning 2024 to 2030, centers on training large language models. This period is characterized by massive computational requirements for developing foundational AI models. During this phase, I expect to see extraordinary demand growth for High Bandwidth Memory, supported by Micron’s recent projection that the HBM total addressable market will expand from $4 billion in 2023 to over $25 billion by 2025. This represents a compound annual growth rate of over 150% in just two years.

The next phase (2030-2035) will focus on reinforcement learning applications, where AI models are refined for specific tasks. This phase is particularly promising for Micron’s advanced memory solutions, as reinforcement learning requires both high bandwidth for real-time processing and increased memory capacity for storing complex decision trees and model parameters. Micron is already positioning for this future with their HBM3E 12-high 36GB solution, which delivers 50% higher capacity than competing solutions while consuming 20% less power.

The financial implications of this evolution are substantial. Based on the company’s latest guidance, I am expecting a forward revenue CAGR of 43.71% for the next three years supported by several key factors. First, Micron’s data center revenue reached record levels in FY2024 with their data center SSD business alone generating over $1 billion in quarterly revenue. Second, the company’s HBM products are sold out through 2025 providing excellent visibility into future growth.

Multiple Vectors Driving Micron’s Growth

The convergence of AI infrastructure build out, data center expansion, margin improvements, and recovery in traditional markets creates a powerful growth narrative that is underappreciated by the market.

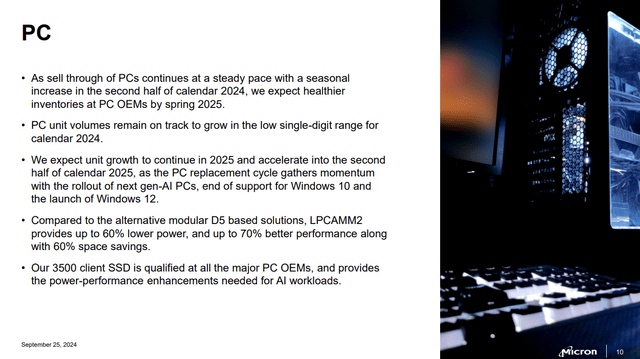

Beyond AI and data center markets I see substantial opportunity in the recovery of traditional PC markets. PC unit volumes expected to accelerate into the second half of FY2025. This acceleration will be driven by several factors: the rollout of next gen AI PCs, end of support for Windows 10 and the expected launch of Windows 12.

Micron Q4 Earning Deck

The AI PC opportunity is particularly interesting as these devices require more memory content than traditional PCs. Leading PC OEMs have announced AI enabled PCs with a minimum of 16GB of DRAM for the value segment and between 32GB to 64GB for the mid and premium segments, compared to an average of around 12GB last year.

Industry supply dynamics further support these growth catalysts. Due to capital expenditure and supply reduction actions taken across the industry in 2023, industry wafer capacity in both DRAM and NAND in 2024 is expected to be below 2022 peak levels. The increasing mix of HBM wafers is reducing DRAM supply allocated to traditional products and contributing to a healthy industry supply and demand environment expected for calendar 2025. Given that HBM requires approximately three times more wafer capacity compared to traditional DRAM products this shift should support stronger pricing power and margins.

As these catalysts materialize over the coming quarters, I expect them to drive both revenue growth and margin expansion potentially leading to significant value appreciation for investors.

Financial Analysis and Valuation

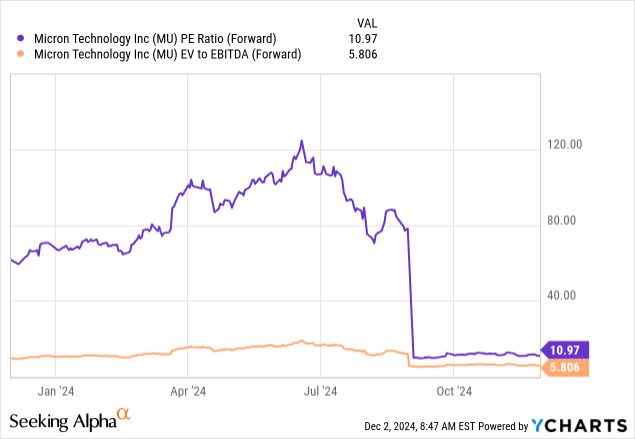

Despite this strong performance and promising outlook Micron’s valuation metrics suggest the market is undervaluing the company’s prospects. The forward P/E ratio of 10.97x represents a 56.7% discount to the semiconductor sector median of 25.37x. The EV/EBITDA multiple tells a similar story. Micron’s forward EV/EBITDA of 5.89x sits at a 62% discount to the sector median of 15.66x. This metric is particularly relevant as it accounts for different capital structures and provides a good basis for comparison across the semiconductor industry. I think this discount is mainly because the market is still pricing Micron based on historical memory industry dynamics rather than its strengthening competitive position and growing exposure to secular growth trends in AI and data center markets.

However, the most compelling valuation metric to me is the forward PEG ratio of 0.21x compared to the sector median of 1.9x – an 88.7% discount. This is particularly notable because the PEG ratio factors in growth rates, essentially measuring how much investors are paying for growth. A PEG ratio below 1.0 typically suggests undervaluation and Micron’s 0.21x is exceptionally low. For context, the company’s long term EPS growth rate is projected at 51.37%, yet this strong growth outlook isn’t reflected in the current valuation.

Looking ahead, management’s guidance for Q1 2025, with revenue expected to reach $8.7 billion and Non-GAAP gross margins projected to expand to 39.5%. These forecasts combined with the company’s deeply discounted valuation metrics create what, I believe, is an attractive entry point for long-term investors looking to participate in the AI infrastructure build-out at a reasonable valuation.

Risk Factors

The RAM chip market is dominated by three players Samsung Electronics, SK hynix and Micron, who together control almost the entire market. In the HBM segment, SK hynix currently dominates nearly 50% of the market, giving them scale advantages. Samsung’s potential entry as the third supplier of AI memory chips for Nvidia could further intensify competition.

The capital intensive nature of memory manufacturing poses ongoing challenges. In fiscal 2024, Micron invested $8.1 billion in capital expenditures and management expects fiscal 2025 capex to be meaningfully higher at around the mid-30s percentage range of revenue. While these investments are necessary to support future growth, they could pressure margins and free cash flow in the near term.

However, I believe these risks need to be weighed against several mitigating factors. The HBM market’s projected growth from $4 billion in 2023 to over $25 billion in 2025 represents a significant expansion that should support multiple successful competitors. The company’s financial strength provides some cushion against these risks. With $9.16 billion in cash and investments as of Q4 2024, Micron has substantial resources to weather industry cycles and fund necessary investments.

To Sum Up:

Micron represents a rare opportunity to invest in a critical AI infrastructure component at a significant discount to intrinsic value. While the memory industry has historically been cyclical, I believe we’re entering a new era where AI-driven demand will create a more sustainable growth trajectory. The combination of industry-leading technology, strategic manufacturing investments, and deeply discounted valuation makes Micron a compelling investment opportunity at current levels.

The company’s strategic positioning in high-growth segments like HBM, combined with broad exposure to AI infrastructure build-out I see significant upside potential as the AI revolution continues to accelerate. For investors looking to participate in the AI boom at a reasonable valuation, I believe Micron offers one of the most attractive risk-reward propositions in the market today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.