Summary:

- Rivian Automotive is starting to scale up production.

- The EV company produced 10,020 electric vehicles just in Q4-22.

- Rivian should be able to pump out at least 50K electric vehicles in 2023, reflecting 25% YoY production growth.

hapabapa

Now is the time to increase your stake in Rivian Automotive Inc. (NASDAQ:RIVN).

While I have previously been bullish on the EV company, I believe that Rivian Automotive’s progress in scaling up production towards the end of last year makes RIVN a compelling stock to own now more than ever.

The EV company is on a 40K electric-vehicle annual production run-rate (based on Q4-22 volumes) and could double production in 2023. Despite the fact that an investment in Rivian Automotive has lost 75% of its value in the last year, I believe the EV company’s long-term potential for production scaling is undervalued.

I’m currently bottom-fishing and believe the valuation is extremely compelling for long-term investors.

Time To Go Bottom Fishing

Rivian Automotive was not a good investment in the last year: a $10,000 investment in Rivian Automotive a year ago would now be worth $2.5K, representing a soul-crushing 75% paper loss.

You and I would both be in the red if we had bought the EV company’s stock at any point during 2022. With that said, I believe RIVN’s poor stock performance is due to bearish sentiment toward the entire EV sector rather than Rivian Automotive’s potential.

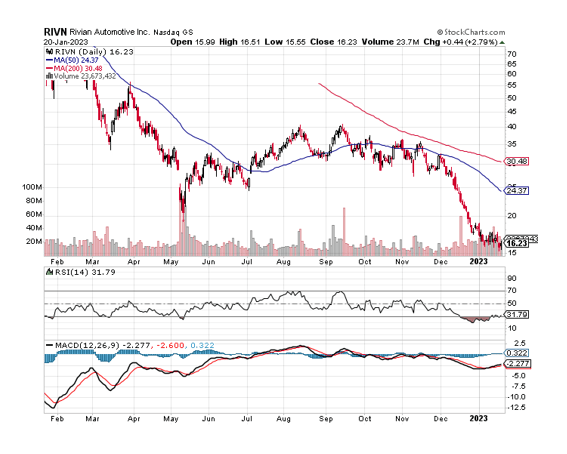

Technically, Rivian Automotive is not in as bad a situation as the stock price trend over the last year would suggest. RIVN is currently completing a downtrend that has brought the stock to a low of $15.28, but a support level has emerged between $16-17. I bought at the recent lows for an average of $16.53 per share.

RIVN Stock Price (Stockcharts.com)

Production Is Scaling Up

Rivian Automotive fell short of its 2022 production target, reporting total unit production of 24,337, less than the 25,000 production figure the company touted for much of the second half of 2022.

The production tally, however, is not a big deal in my opinion, because Rivian Automotive only missed its forecast by 663 electric-vehicles.

What is far more important for investors is that Rivian Automotive is rapidly ramping up production and expanding into a manufacturing footprint that will allow for significantly higher production tallies in the future.

Rivian Automotive produced 10,020 vehicles in the fourth quarter at its Illinois manufacturing plant and delivered 8,054 electric-vehicles. Rivian Automotive produced 7,363 electric-vehicles in the third quarter, representing a 36% increase over the previous quarter.

All in all, I believe Rivian Automotive is on the right track. Given that the supply chain remains a challenge not only for Rivian Automotive but for the entire EV industry, I believe the company will be able to produce at least 50K electric-vehicles by 2023.

Rivian Automotive is on track to produce at least 40K electric-vehicles in 2023 based on a Q4-22 production run-rate, and this calculation assumes no scaling in R1T and R1S production. A total of 50K units produced would imply a 25% increase over the previous year, which Rivian Automotive should be able to achieve.

Rivian Automotive Is Undervalued

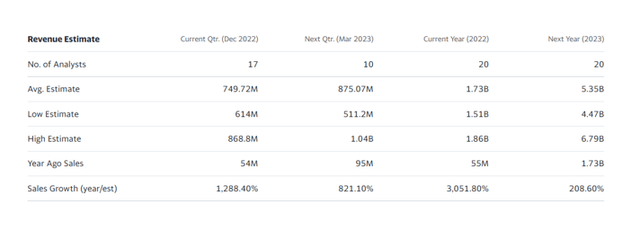

Rivian is expected to generate $5.35 billion in sales on average in 2023, representing a 209% increase YoY. The market was slightly more optimistic about Rivian Automotive’s sales expectations a month ago, forecasting total sales of $5.62 billion.

The average sales estimate has thus been reduced by $270 million, most likely as a result of Rivian Automotive slightly missing its production target for 2022. Rivian Automotive’s stock is valued at 2.7x 2023 sales based on the new average sales estimate.

Revenue Estimate (Yahoo Finance)

Things That Could Go Wrong

A steady flow of new reservations from prospective R1T and R1S buyers is critical to Rivian Automotive’s stock market turnaround. As long as EV buyers visit Rivian Automotive and place an order for one of the company’s electric-vehicles, I believe Rivian Automotive has the potential to surprise positively in 2023, especially since the company’s stock price has washed out many shaky hands and short-term speculators.

However, slowing reservation growth or a less-than-impressive 2023 production forecast could create new headwinds for Rivian Automotive’s stock.

My Conclusion

I’m aggressively bottom-fishing for Rivian Automotive here because I believe the company’s potential is undervalued.

The company had legitimate difficulties scaling its production in 2022 due to ongoing supply-chain issues, but the successful scaling of production in Q4 is a hugely positive sign that Rivian Automotive is gaining control of its situation and moving in the right direction.

At just 2.7x 2023 sales, a full reservation book, and production scaling nicely, I believe the upside for this growth stock in 2023 could be quite compelling.

Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.