Summary:

- Intel reported quarterly results that were abysmal.

- The company is losing market share, margins keep declining, and Intel is burning through billions of dollars.

- The dividend is at risk, although it is not a sure bet that the dividend will get cut.

Lemon_tm

Article Thesis

Intel (NASDAQ:INTC) reported quarterly results that were pretty bad. Intel continues to lose market share in important areas such as data centers, and profitability remains under pressure. Since the cash flow picture continues to worsen as well, while Intel will be spending massively on growth in the foreseeable future, the dividend could be at risk. For now, Intel has maintained the payout, but investors should consider that the dividend may not be safe when things don’t improve meaningfully in the near term.

What Happened?

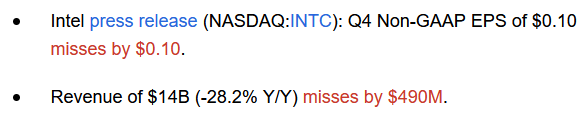

Intel reported its fourth-quarter results that widely missed the consensus estimate on both lines:

Seeking Alpha

Intel’s revenue was down by a hefty 28% year over year, several percentage points below what analysts had predicted. Even worse, earnings per share missed the consensus estimate by 50% — and that did happen despite the fact that analysts were already looking for a huge earnings decline versus the previous year’s period. In fact, Intel’s earnings per share declined from $1.15 in the fourth quarter of 2021 to just $0.10 in Q4 of 2022 — a decline of more than 90%. Seldom has something like this been seen in a company as large as Intel.

Intel’s Many Issues

The semiconductor industry is experiencing some headwinds right now, as the supply-demand picture is shifting in the favor of chip buyers and against chip sellers. There are some other chip companies that experience some macro headwinds right now, such as Texas Instruments (TXN), which also reported a revenue decline for the most recent quarter. But TXN reported a pretty benign revenue decline of 3% year over year, whilst Intel’s top line got absolutely devastated — that’s not explained by market movements alone. Instead, Intel is experiencing a range of major issues, such as the fact that it continues to lose market share in one of the most important semiconductor markets, data centers.

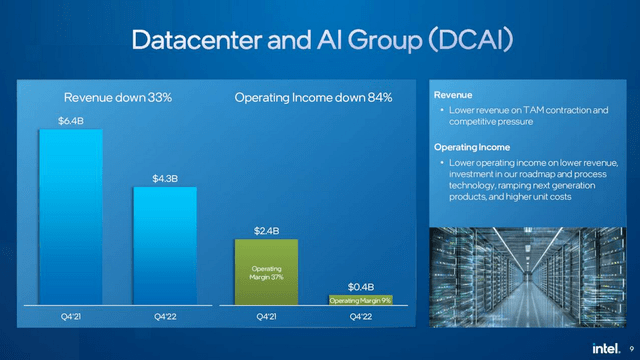

AMD (AMD) reported a 45% increase in its data center sales during the most recent quarter.

INTC presentation

Intel, however, reported a data center revenue of $4.3 billion, which was down by one-third versus the previous year’s quarter. When a core competitor such as AMD is growing its data center by almost half while Intel’s data center revenue shrinks drastically, then the best explanation for that is that Intel’s products must be pretty bad. Otherwise, the large number of willing data center chip buyers (evidenced by AMD’s huge growth in this area) would continue to buy from Intel. But many of the company’s customers must have moved over to AMD, and, to a lesser extent, to NVIDIA (NVDA), in the recent past. The fact that AMD’s chips are more energy-efficient compared to those offered by Intel could play a role in that. Energy has become more expensive in 2022, which increases the relative benefit of AMD’s more efficient chips, as data center operators can save more money at times when energy is costly. On top of that, major tech companies have gotten under pressure in recent quarters as well due to profitability issues, which incentivizes them to focus more on cutting costs. In combination, these factors make AMD a winner in the current environment thanks to the energy efficiency of its products, whereas Intel is losing out. But performance and AI-optimized technologies also play a role, as Intel isn’t the leader in these areas, either.

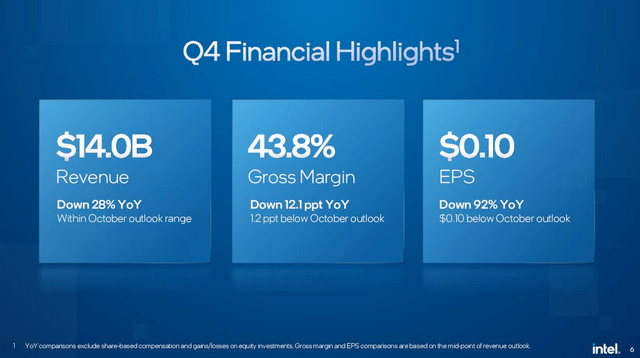

Dropping market share in important areas naturally is a major headwind for Intel, but so is the company’s margin development. In short, everything on the margin front is moving in the wrong direction — gross margins are slumping and continue to underperform Intel’s guidance, operating leverage is working against the company due to sales declines and market share losses, and all in all, this makes for an abysmally weak net profit margin:

INTC presentation

Intel’s gross margin came in at just 44% for the quarter, which was down by a hefty 1,200 base points versus the previous year’s period. That was considerably worse than what management has been guiding for in October. This is an issue due to two reasons — first, it means that investors can’t put too much value on guidance in the future, as INTC has recently been “overpromising and underdelivering”. Second, the fact that Intel underperformed management’s guidance indicates that Intel’s management was surprised by how weak the company performed. This suggests that either things must have gotten significantly worse throughout the quarter, which would spell trouble for Q1, or that Intel isn’t good at deciphering trends and collecting data, which wouldn’t be encouraging for investors, either.

For reference, AMD expanded its gross margin by 150 base points in the most recent quarter — again, Intel’s issues are company-specific and not explainable by overall market forces.

Intel missed management’s own guidance by half when it comes to earnings per share, which is a huge miss and a major reason for concern. Future guidance should thus be taken with a grain of salt — but even if INTC manages to hit its guidance numbers, that would still be a mid-sized disaster: The company is guiding for a massive 40% revenue decline in the current quarter, and Intel is also guiding for a net loss of $0.15 per share for Q1, as gross margins are forecasted to fall to the high 30s — not too long ago, they were in the 50s.

Cash Flow Problems And A Risky Dividend

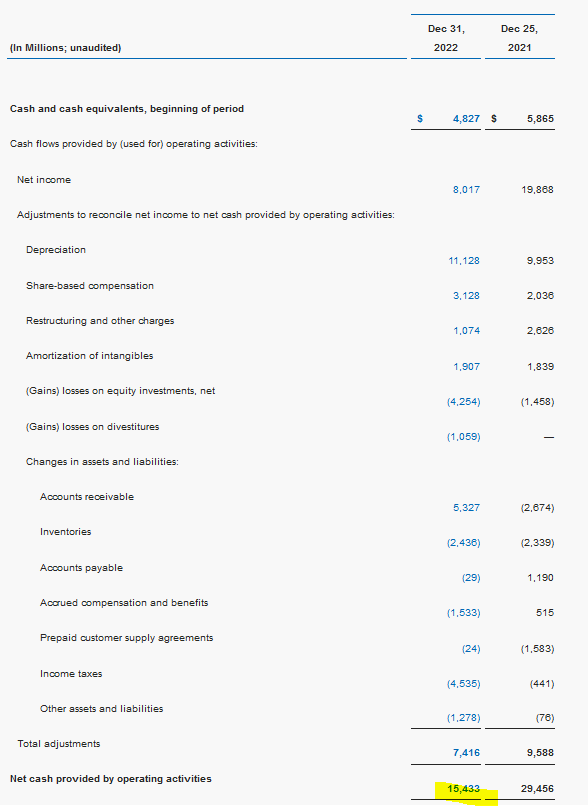

With revenue and profits falling at a hefty pace, it’s not surprising to see that Intel’s cash flow is coming under pressure as well. In fact, it would have been quite surprising if cash flow had held up well under these conditions. Intel decided to not include a cash flow overview in its earnings slides, unlike in past presentations, which is telling. Its earnings release includes a cash flow statement, however:

Intel earnings release

We see that cash flow during 2022 totaled $15 billion, down by close to 50% year over year. That alone would be bad enough, but unfortunately, Intel is currently ramping up its capital expenditures due to investing heavily in new production facilities, e.g. in order to grow its foundry business.

Capital expenditures totaled $25 billion in 2022, which equates to a free cash burn of $10 billion. That does not yet include dividends, however. At the current level, the dividend costs $6 billion per year, which means that Intel burned through $16 billion in 2022 alone. Things will not necessarily improve in 2023 — capital expenditures could be even higher due to ramped-up growth spending, and at the same time, the forecasted huge decline in revenues and profits in Q1 indicates that profits and operating cash flows in 2023 could easily be worse than those from 2023. After all, Q1 2023 alone will be worse than the worst quarter of 2022, and Q1 may not yet be the worst quarter of 2023.

Intel does not have a weak balance sheet yet, but even a company like Intel can’t burn through $16 billion or more per year forever. In fact, one or two more years like that would have a huge negative impact on Intel’s balance sheet already — debt stands at $42 billion already, even before any new debt is added in 2023.

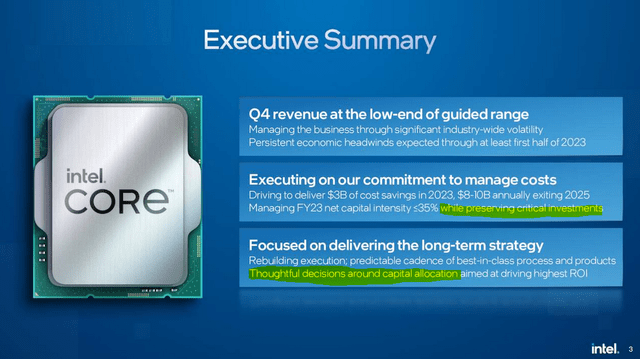

I thus believe that Intel’s dividend is at risk — this does not mean that the company will necessarily cut the dividend, but the dividend is not covered at all in the near term, and investors should not see Intel’s dividend as a sure thing. It may be kept in place if Intel decides to add to its debt position meaningfully in order to finance the dividend, but that is far from guaranteed. Looking at the cash flow situation, a cut could make sense. There are also two noteworthy statements in the earnings slides:

Intel presentation

“Preserving critical investments” likely doesn’t mean the dividend, but rather INTC’s capital expenditures. When those will be preserved, will the dividend be preserved as well?

“Thoughtful decisions around capital allocation” could mean a lot of things — but it surely doesn’t sound like a 100% commitment to the dividend.

Takeaway

Intel continues to struggle way more than the overall semiconductor industry. Revenues are falling, margins are squeezed, profits are waning, and the company is burning billions of dollars of cash per quarter. In contrast with a peer such as AMD, Intel’s results look abysmal. Based on management’s guidance for the current quarter, things will get even worse in the near term.

While a dividend cut is far from guaranteed, investors should not consider the dividend safe — there are major question marks. Those willing to own INTC no matter what will likely not mind these question marks, but income investors may want to reconsider their position in INTC, as it looks far from certain that the dividend will remain in place forever.

Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!