Summary:

- The fourth quarter report clearly surprised to the upside.

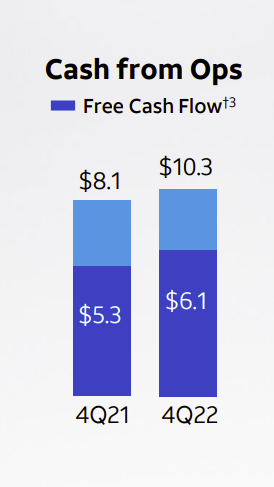

- Clearly, cash flow and free cash flow appear to be back-end loaded.

- Both cash flow and free cash flow grew at a 20% rate (roughly) in the fourth quarter comparison.

- It would appear that AT&T is moving from strictly income to income and growth. That makes the investment far more valuable than it is now.

- Cash flow grew impressively despite the drop in cash received from DIRECTV.

Brandon Bell

Back in the day of Esso (before Exxon Mobil (XOM)), putting a “tiger in the tank” showed a lot of determination and focus. It was a campaign by Esso at the time to sell gas. The advertising campaign became a common expression back in the 1960s or so. It looks to me like AT&T (NYSE:T) put a “tiger in the tank” with its latest quarterly announcement. That should mean the future is going to be a lot better for shareholders than the past. So, throw away about a decade of history and get ready for a very different experience going forward. That experience will also likely lead to a better stock value as well.

Cash Flow

Probably the biggest surprise by far was the growth in free cash flow.

AT&T Free Cash Flow Comparison Fourth Quarter And Annual (AT&T Fourth Quarter 2022 Earnings Conference Call Slides)

There was a lot of worries about cash flow being able to sustain the dividend. So far, the pattern appears to be that cash flow is “end loaded” as the fourth quarter in both years represented a disproportionate amount of cash flow (as shown above). Therefore, if “worries” about the dividend appear early in the fiscal year, all you or any investor needs to do is point to the fact that the fourth quarter appears to have an inordinate amount of free cash flow. One would therefore expect that pattern to continue unless a reason is given for a material pattern change.

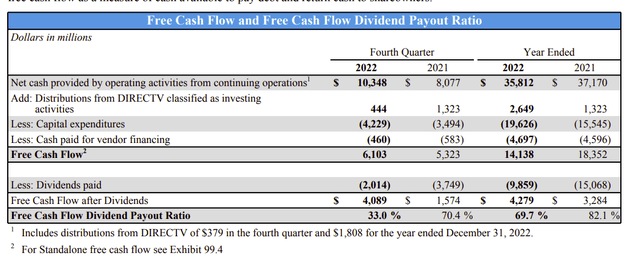

AT&T Free Cash Flow Calculation (AT&T Fourth Quarter 2022 Supplemental Materials And Non-GAAP Reconciliations)

The interesting thing about cash flow and free cash flow is that both climbed despite the relatively small contribution this quarter from DIRECTV. To me, that makes the climb in free cash flow all the more impressive.

What did help is that it appears that capital expenditures ran on the light side in the fourth quarters compared. The fourth quarter capital expenditures in both cases are under 25% of the total budget.

Free cash flow after dividends was substantial. Now management mentioned in several places that most of the original $6 billion in cost savings has been achieved. That cost savings should increase cash flow in excess of business growth to provide a way to repay debt at a decent rate in the future.

One of the things that the market was impatient about was the lack of cash flow right after the spinoff of the division for the merger. But anything with a large company takes time. Nonetheless, Mr. Market worried about half the year that another dividend cut would occur. The growth of the business combined with the cost savings apparently reaching the original goal make such a future scenario less likely.

Going Forward

Management did guide to free cash flow of $16 billion or more in the current fiscal year. Thanks to the wonderful fourth quarter report, that free cash flow level now appears conservative. Cash flow in the fourth quarter jumped roughly 20% as did free cash flow. If management can keep that pace up for another fiscal year, then yes, free cash flow will be at least $16 billion.

What is also likely to happen is the focus of the company post spinoff (and merger) is likely to result in more cost saving opportunities that should keep cash flow growing in the teens for at least 5 years anyway. There is a very good chance that total debt will dip below $100 million by the beginning of the next fiscal year (second quarter at the latest). The outlook is improving at a rapid rate.

Right now, the possibility of a dividend cut is probably heading towards low-single-digit percentages. A future dividend increase is probably now a possibility in later fiscal year 2024.

What Has Changed

The relatively new CEO has focused the company on what AT&T does best while getting rid of things it did not do well. This company was on an acquisition binge for what seemed like ages. That appears to be over for at least the time being. There may be a bolt-on acquisition or acquisition of some new relevant technology. But the days of making “one acquisition after another” are gone.

Instead, the business is going to grow organically. Currently, that organic growth is in the lower-single-digits. But that growth rate could rise to potentially 8% as this company further refines the strategy. The remaining businesses have a fair amount of future growth potential.

That should lead to a combined return of some capital appreciation and the dividend yield in the low teens for the foreseeable future. This big company is moving from a dividend play to a growth and income play. That should be good news for retirees because the current dividend yield alone is what many investors report as a long-term return in stock market investments.

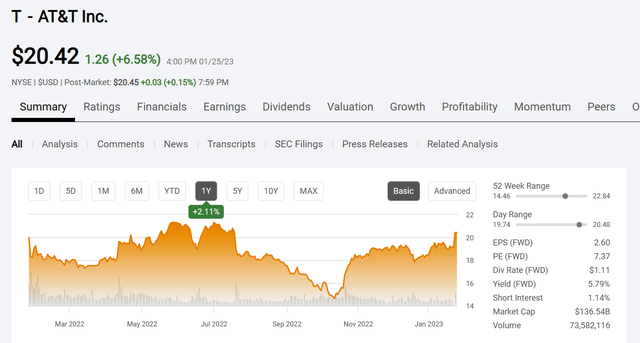

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website January 25, 2023)

Clearly, the market liked the news of the fourth quarter results enough to send the stock higher and then hold the gain in the aftermarket trading. Traditionally, most stock market investors report an 8% annual gain long-term (over the years). Therefore, the current yield almost satisfies the long-term results all by itself before any stock price consideration (of appreciation potential).

The current yield does represent some dividend level risk that is likely to go away as some more improved quarters are reported. Management has been working on the current results for about 3 years. To me, that means that more improvements are on the way because this kind of refocusing a large company can take at least 5 years (and sometimes longer). Yet very little, if any, potential improvement is priced into the stock. If anything, the dividend yield indicates a market feeling in the other (negative) direction.

To me, that is just fine because then the downside is priced into the stock price while the good news is just getting started. That is just the kind of asymmetric return I like on my growth and income stocks.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.