Summary:

- Microsoft is navigating a monumental transition towards an Azure-first cloud computing platform, but most revenue is still from other products.

- Microsoft posted solid Q2 results by topping guidance in nearly each segment, and restoring faith in Wall Street’s visibility of Azure.

- Satya Nadella’s vision and execution have been second-to-none, and while AI is in its infancy, early practical use cases are emerging.

- Despite this success, cloud is expensive to build with a highly uncertain TAM, and Microsoft’s pace of returning capital is average.

- Investors should be looking forward to what Microsoft builds next, but gain exposure through owning the indices.

lcva2

Microsoft (NASDAQ:MSFT) is the gold standard of the software industry, and as the first to report earnings, all eyes are on their numbers to get a read across the sector. Thus far, software has proven resilient to recession fears. But as more layoff announcements cross the wires, enterprises are looking at ways to save and nonessential IT spending is on the chopping block.

Deflating asset prices have renewed investor focus on tangible cash returns. Investors want to see capital returned and lean cost structures from mega-cap tech companies like Microsoft. Despite robust free cash flow margins, CapEx is becoming a larger percent of revenue as Microsoft navigates a monumental shift towards becoming an Azure-first cloud computing platform.

Microsoft is building the enterprise tools of the future. But, with a slowing economy and highly uncertain forward growth rates, investors must be cautious with this $1.8T behemoth.

Slicing & Dicing Segments

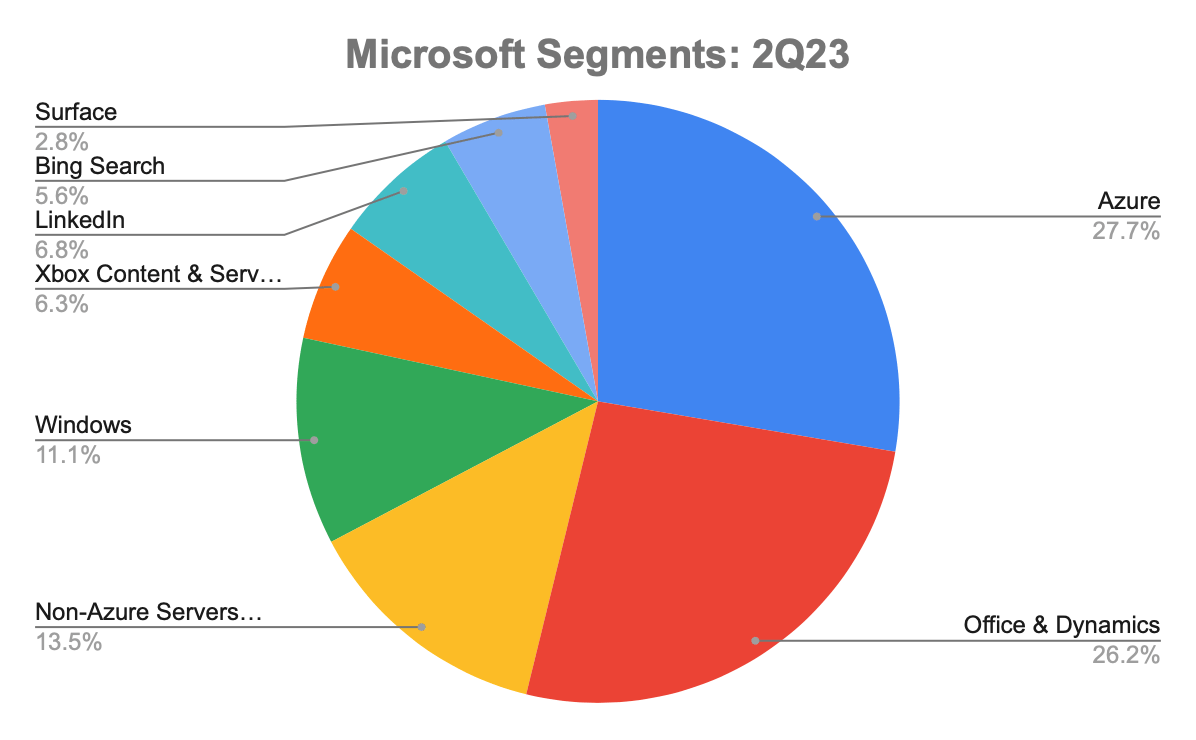

Microsoft reports revenue dollars in 3 segments: Intelligent Cloud, Productivity and Business Processes, and More Personal Computing. With a bit of digging and estimating, the business can be further divided into 8 more digestible segments: Azure, Office & Dynamics, Non-Azure Servers and Services, Windows, Xbox, LinkedIn, Bing, and Surface.

Intelligent Cloud is comprised of Azure and Non-Azure Servers and Services. Azure is now Microsoft’s largest and fastest growing segment. The street estimated Azure had quarterly revenue of $7.2-7.4B in 2Q21. Microsoft provides us with quarterly growth rates, in which we can carry that figure forward to arrive at $14.3B, or 27.7% of total revenue. Non-Azure Services and Services is ascribed the rest of the Intelligent Cloud Revenue.

Productivity and Business processes is comprised of Office and Dynamics and LinkedIn. LinkedIn was once a public company, so we can use similar carry forward math to estimate LinkedIn’s current revenue, which also provides us with Office and Dynamics revenue, which makes up the rest of this segment.

The third segment, More Personal Computing is made up of Windows, Xbox, Search, and Devices. It’s estimated Xbox did $15B in revenue in 2021, making their business about 60% of the size of PlayStation. Similarly, Search and Devices also make for a small portion of Microsoft’s revenue. These figures aren’t perfect, but give us a much cleaner picture of the business:

Author / Public Filings

The key takeaway is legacy products still make up the vast majority of Microsoft’s revenue. This is important when we put management’s commentary, Wall Street’s focus, and the current valuation in perspective.

Q4 Earnings Report

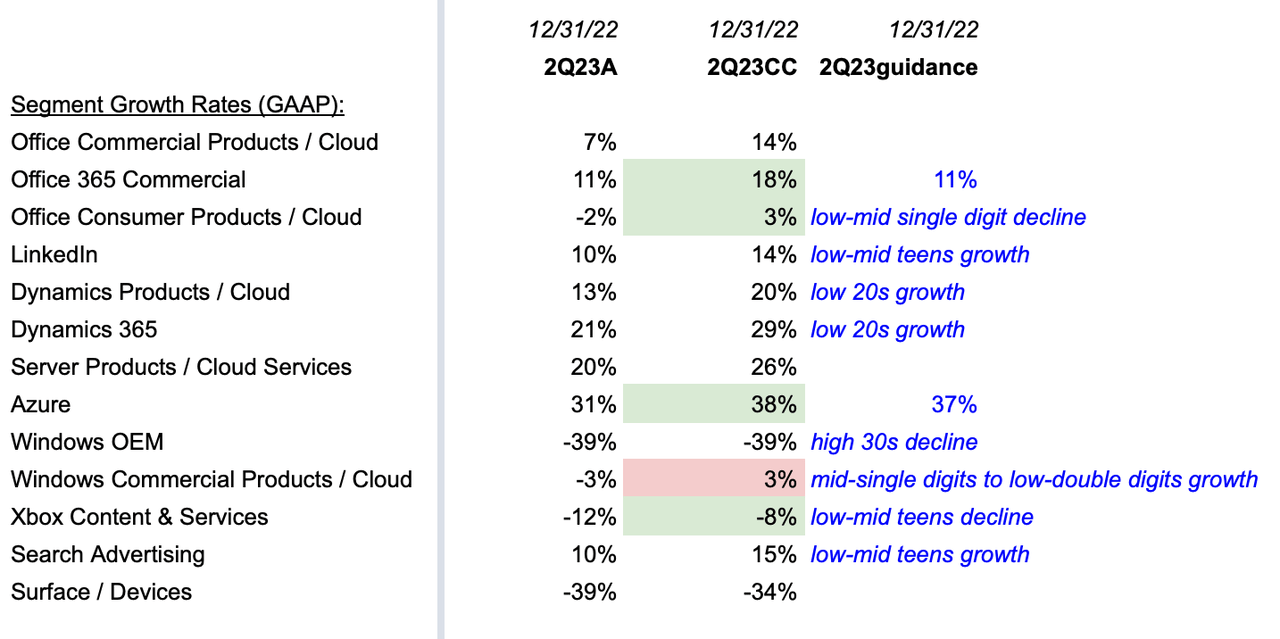

Strength in Intelligent Cloud and Productivity and Business Processes was offset by softness in More Personal Computing. This resulted in just 2% top-line growth, but Microsoft topped their guidance in nearly every reported segment:

Author / Public Filings

As the business mix continues to shift towards cloud, Azure becomes the driving narrative of the share price. Last quarter, Azure’s growth rate came in just below guidance, so Wall Street welcomed a slight beat this quarter. Notice the first question of the 1Q23 earnings call from Morgan Stanley’s Keith Weiss:

This is two quarters in a row now where Azure constant currency growth came in a bit below your guidance. I think investors are wondering about is the — is there an inherent volatility in that business that’s just harder to forecast? And on a go-forward basis, how should we think about that forecast? Have you applied more conservatism in it? And how should we think about Azure growth like the glide path for the whole year? If you could address those, I think it would put a lot of investor minds at ease.

While Wall Street frets over changes in growth rates, long-term investors should be focused on what Microsoft’s decades long transition towards becoming a cloud computing platform means for the share price:

This is an important time for Microsoft to work with our customers, helping them realize more value from their tech spend and building long-term loyalty, while internally aligning our own cost structure with our revenue growth. This sets us up to participate in the secular trend where digital spend as a percent of GDP is only going to increase. And lastly, we’re going to lead the AI era, knowing that maximum enterprise value gets created during platform shifts. -Satya Nadella

Growth rates ebb and flow. Long-term business owners can’t be rattled by volatility. To combat this, investors need a narrative to counteract worsening fundamentals. For Microsoft, Satya Nadella continuously expresses confidence that the long-term digital transformation of the enterprise will be a perpetual tailwind for Microsoft. With his track record, it’s hard not to believe.

Nadella has succeeded in competing with Amazon (AMZN) in the cloud, making high quality acquisitions such as LinkedIn, and rejuvenating Microsoft’s culture. As overhyped as the AI narrative appears to be, Microsoft has demonstrated practical success with developers overwhelmingly positive on GitHub Copilot and enthusiasm for Microsoft’s entanglement with OpenAI.

Looking Ahead

Microsoft is one of, if not the top enterprise software vendor for the large enterprise. Microsoft can flex this advantage by easily bundling new products and services. Despite Microsoft’s past success and positive forward looking narrative, investors must be cautious.

S&P Global calculates non-financial public companies spent ~$12T in OpEx in 2021. Other estimates show most companies spend ~5% of revenue on IT, equating to $700B. Total revenue of Azure, AWS, and GCP should top $160B for 2022, runway doesn’t extend forever and growth is slowing.

Meta Platforms’ (META) step function increase in CapEx to fund AI-intensive short form video is a warning to all of big tech. CapEx levels as a percent of revenue have risen across the board for each company building out cloud infrastructure.

Management wants investors focused on the future, but Microsoft’s business foundation is still heavily tied to the past. Plummeting demand for PCs was the main driver of Microsoft’s negligible year-over-year growth. Azure’s OpenAI infrastructure is only being used by 200 customers, it’s extremely challenging assessing how these advancements will translate to revenue and free cash flow for Microsoft.

Microsoft trades at 30x last twelve month’s free cash flow. Customers should be very excited about how Microsoft’s innovation will drive efficiency throughout the enterprise over the coming years. But, paying up for Microsoft right now doesn’t make much sense for investors.

Microsoft is an effective steward of capital, but by no means is the current pace of dividend payouts and share buybacks enough for value focused investors to feel like they’re getting more than they pay for.

Microsoft makes up a significant 5.4% weighting in the S&P 500, and 11.7% weight in the Nasdaq. Microsoft is a critical component of the US economy. But with uncertainty around the true TAM of cloud, investors would be better served owning the indexes.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.