Tesla Q4: Mixed Quarter, Stock Jumps As Musk Dismisses Inventory Concerns

Summary:

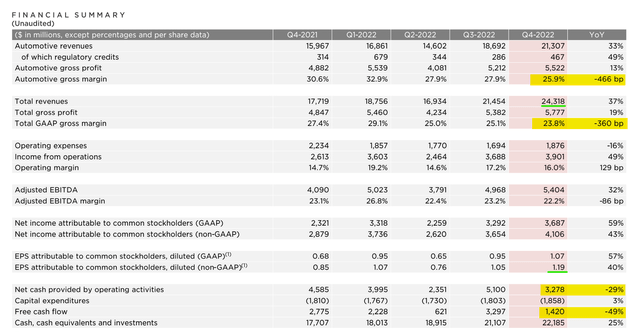

- Tesla’s Q4 report proved to be less worse than feared, with a slight beat on revenue ($24.32B vs. est. $24.15B) and EPS ($1.19 vs. est. $1.13).

- Just like the Q3 ER call, Elon Musk once again provided a lot of hopium and reiterated his claim that “Tesla will be the most valuable company on this planet”.

- Unlike the last quarterly report, Mr. Market seems to be buying into Musk’s hopium, with Tesla’s stock up ~5.5% in the after-hours session.

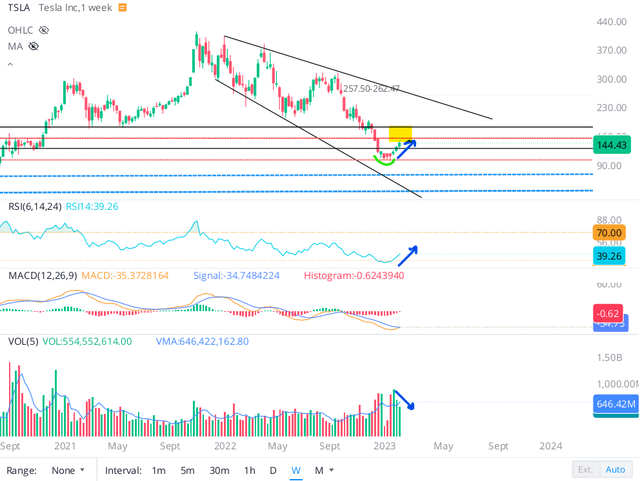

- While Tesla’s stock has now rebounded by ~50% off its recent lows, it is still undervalued. Technically, Tesla is heading into resistance, and this is why the rally may end soon.

- Considering the risk/reward on offer, I rate Tesla a buy at $152, with a strong preference for slow accumulation via a 6-12 month DCA plan.

Justin Sullivan

Brief Overview Of Tesla’s Q4 Report

After posting yet another mixed quarterly report, Tesla’s (NASDAQ:TSLA) shares closed at $152.35 (up ~5.48%) in the after-hours session. In Q4, Tesla’s revenue of $24.32B and non-GAAP EPS of $1.19 came in slightly ahead of street estimates; however, its automotive gross margin of 25.9% fell short of expectations. Further, Tesla reported an operating margin of 16% for Q4 (down from 17.2% in Q3), along with a lower-than-expected free cash flow figure of $1.4B (down -49% y/y).

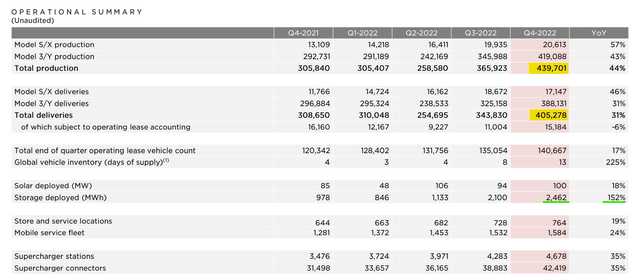

The Production and Delivery report released on 2nd January had already led to a lowering of estimates on Wall Street, and so, the slight beats on revenue and EPS are somewhat inconsequential. Now, despite Tesla’s aggressive pricing moves in Q4 (especially in China), the differential between production and deliveries is increasing rapidly, i.e., inventories continue to climb higher! And heading into a potential recession, an inventory build-up of such magnitude is a little frightening.

In response to rising inventory levels, Tesla’s management recently announced deep price cuts across different models. And these price cuts were broadly seen as a potential demand crunch. However, Musk was quick to dismiss any such issues in his prepared remarks:

The most common question we’ve been getting from investors is about demand. Thus far — so I want to put that concern to rest. Thus far in January, we’ve seen the strongest orders year-to-date than ever in our history. We currently are seeing orders at almost twice the rate of production. So, I mean, that — it’s not to say whether that will continue twice the rate of production, but the orders are high. And we’ve actually raised the Model Y price a little bit in response to that.

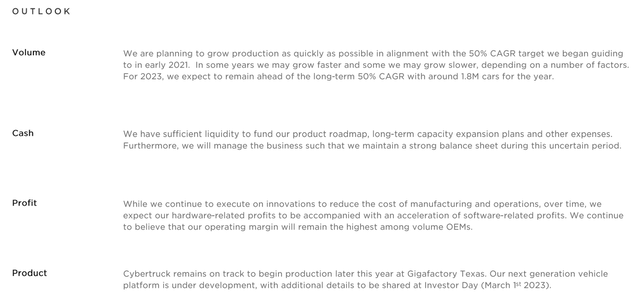

And Tesla’s outlook for production of 1.8M cars in 2023 keeps the EV-giant on track to hit its 50% annual CAGR growth target set in early 2021. Given the uncertain macroeconomic environment, I think Tesla’s guidance is a bit audacious; however, with a production capacity of 2M vehicles and best-in-class operating margins, Tesla has what it takes to deliver on its growth objectives in 2023.

Tesla’s management reiterated their strategy to prioritize unit volumes sales over near-term margins, and Musk defended this tact by saying:

Something that I think some of these smart retail investors understand, but I think a lot of others maybe don’t is that the — every time we sell a car, it has the ability, just from uploading software to have full self-driving enabled and full self-driving is obviously getting better very rapidly.

So that’s actually a tremendous upside potential because all of those cars, with a few exceptions — I mean, only a small percentage of cars don’t have Hardware 3. So that means that there’s millions of cars were full self-driving can be sold at essentially 100% gross margin. And the value of it grows as the autonomous capability grows. And then when it becomes fully autonomous, that is a value increase in the fleet. That might be the biggest asset value increase of anything in history.

In one of my recent articles – Tesla Stock: An Asymmetric Buying Opportunity Arises Out Of Insider Selling, Demand Concerns, And A Scary Recession Playbook – we discussed the potential dangers of Musk’s recession playbook and the primary concern here is margin compression. Based on current prices, Tesla’s CFO, Zach Kirkhorn, believes that Tesla’s ASPs should stay above 47K and auto gross margins should hold above 20% in 2023, with operating margins staying best-in-class in the auto industry (>8%).

Furthermore, Elon Musk waxed lyrical about Tesla’s EV product roadmap and additional business lines like autonomous vehicles (robotaxis), Optimus (humanoid bot), Dojo AI chips, and energy storage. And unlike Q3, Musk’s pump seemed to boost shares, with TSLA moving up 5%+ during the earnings conference call. The change in Mr. Market’s behavior is noteworthy, and in my view, the bullish sentiment on Wall Street could propel Tesla higher in the upcoming days. Before we review Tesla’s technical chart, let’s re-evaluate its fair value and expected returns in light of Q4 earnings.

Updated Valuation For Tesla

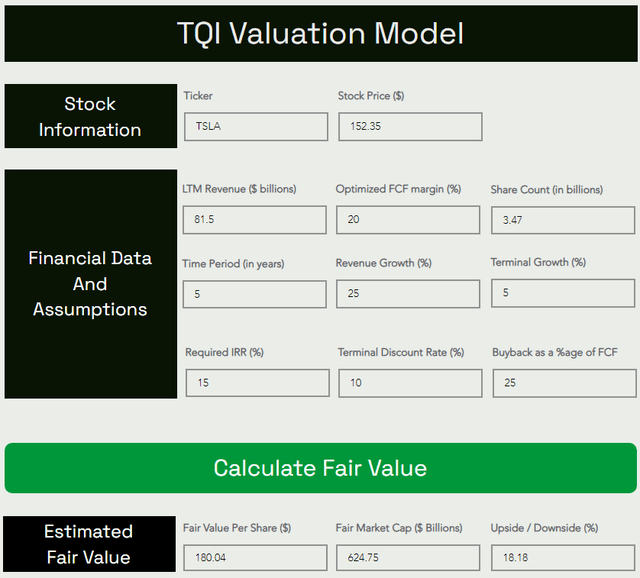

TQI Valuation Model (TQIG.org)

According to my analysis, Tesla’s intrinsic value is ~$180 per share. This means Tesla is now undervalued by ~15%. Assuming a base case P/FCF exit multiple of 25x, I see Tesla hitting $375 per share by 2027.

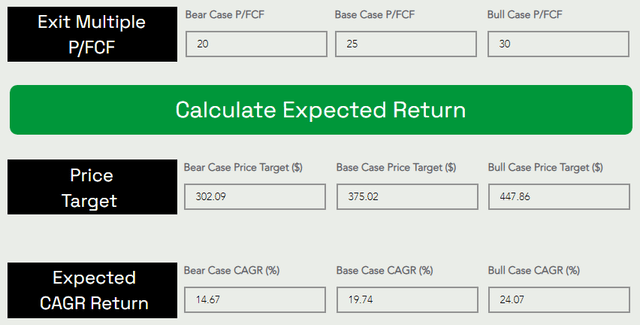

TQI Valuation Model (TQIG.org)

As can be seen above, Tesla is projected to deliver CAGR returns of 19.74% for the next five years, which beats my required IRR of 15%. Hence, I continue to view Tesla as a solid long-term buy at $152 per share.

TSLA Stock Is Heading Into Resistance

If you have followed my work on Tesla, you know that I have been harping about the need for slow accumulation in this counter. For those looking for an explanation, please refer to the technical analysis section of Tesla Stock: Q4 Delivery Disappointment, Reverse DCF Analysis, Technical Typhoon, And More

For brevity, I will not repeat the entire technical analysis again, but let’s review some recent price-volume action in Tesla’s stock. As you may know, Tesla has rebounded by more than 50% since hitting a 52-week low of $101.81 earlier this month.

After a capitulatory sell-off in Q4, Tesla’s stock has bounced by +50% off of the ~$100 level, rising up in a series of higher highs and higher lows at a nice 45-degree angle. With RSI still close to oversold territory on the weekly, I think Tesla could have more upside from here. The stock is heading into a resistance zone in the $155-160 range; however, if TSLA can get above that level, we could be headed up to $185-190.

On the flip side, the recent rally has materialized on decreasing volumes, which means a reversal could be in order soon. On the downside, the first key level of support is ~$120. Technically, Tesla’s stock is finely poised.

Final Thoughts

Overall, Tesla’s Q4 report was mixed – (lowered) revenues & EPS: beat, auto gross margins: missed. However, the guidance for 2023 should calm all growing investor fears around the demand for Tesla vehicles. Despite a ~50% rebound in Tesla’s stock since the price cut announcement from a couple of weeks ago, I think Tesla’s recession playbook is dangerous, and the stock could have more downside in the near term.

From a long-term standpoint, strong business fundamentals and reasonable valuation make Tesla a lucrative investment idea at current levels. And Elon Musk seems to agree with me:

We will likely have a difficult recession this year. And prices of stocks can drop to surprisingly low levels in the short term, but I believe Tesla will be the most valuable company in the world in the long run.”

– Elon Musk on Tesla’s Q4 earnings call

Despite near-term downside risk, Tesla is a high-quality business that I want to own for the long haul. And I will continue to accumulate more shares slowly in the upcoming weeks and months.

Key Takeaway: I rate Tesla a “Buy” at $152 per share, with a strong preference for slow accumulation using 6-12 month DCA plans.

As always, thank you for reading, and happy investing. Please feel free to share any questions, concerns, or thoughts in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.