Summary:

- Amazon’s stock has surged nearly 50% YTD, with 25% of this increase in the last two months alone, driven by a Q3 earnings surprise.

- While net sales surprised on the upside and operating income came in higher than guidance, the EPS surprise was likely the biggest factor in boosting investor confidence.

- However, labor issues persist, with strikes and union pressures, which can make Amazon somewhat vulnerable as e-commerce’s contribution to profits rises.

- On the whole, though, Amazon’s strong financial performance and positive outlook for Q4 2024 support a Buy rating.

Daria Nipot

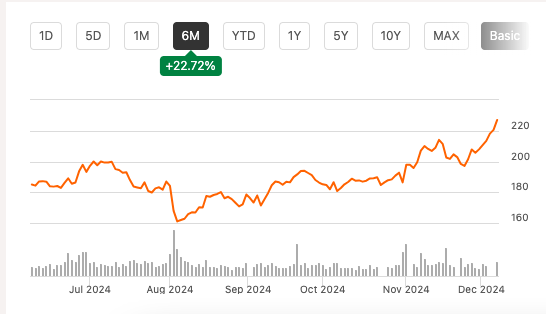

Amazon (NASDAQ:AMZN) (NEOE:AMZN:CA) has had a good year on the stock market, with a year-to-date [YTD] increase of almost 50%. But here’s the rub. Some 25% of this increase has happened in the last two months alone.

When I last wrote about the stock in early October, there was still a Buy case for the stock. But it appeared unlikely that a significant price rise was possible in the near-term unless the company saw an earnings surprise in the third quarter (Q3, 2024). That’s exactly what happened.

The day after their release, the stock jumped by 6%. AMZN hasn’t had a consistent rise since, but on the whole, it has clearly been on the up and up. But is an earnings rise enough to sustain its rise? That’s exactly what’s explored here.

Price Chart (Source: Seeking Alpha)

Multiple positives in earnings report

The fact that the stock saw an uptick on the earnings report is no surprise. As it happens, it offers far more than just better than expected profits. Here are the highlights of the positives from it:

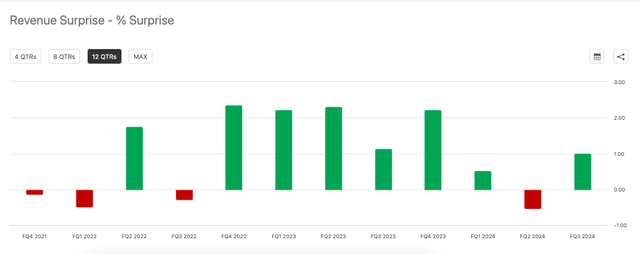

- Net sales growth of 11% YoY came in at the top-end of the company’s guidance range of 8-11% YoY. The figure was also 1% higher than analysts’ expectations on Seeking Alpha, which is a particularly pleasant surprise after a small miss in Q2 2024 (see Chart 1 below).

- The operating income came in at USD 17.4 billion, which was over 31% higher than the midpoint of the guidance range of USD 11.5-15 billion. The number also saw a substantial 55.4% YoY rise.

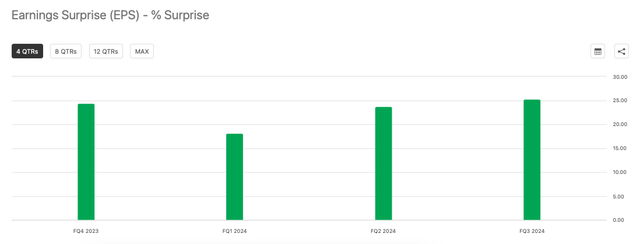

- But it was the diluted earnings per share [EPS] at USD 1.43 that threw up the biggest surprise. With a 52% YoY increase, it was also the biggest jump compared to analysts’ expectations in four quarters of 25.2% (see Chart 2 below).

Chart 1 (Source: Seeking Alpha) Chart 2 (Source: Seeking Alpha)

E-commerce’s contribution to operating profits rises

Much as the company continues to make financial gains, or likely as a result of it, its troubles with its labor force supporting e-commerce continue as well. The e-commerce segment is in any case the key contributor to the company’s sales, bringing in over 82% of the net sales for the first nine months of 2024 (9m 2024).

But the segment’s contribution to operating profits is rising, too, as the international e-commerce segment has turned profitable. It might have still added only a small ~6% to the total operating income for Amazon in 9m 2024, but it’s no longer a drag as it was during the same time last year.

The total e-commerce segment, which includes both the US and international operations, contributed to 40% of the operating income in Q3 2024, up from 37.4% in the first half of the year (H1 2024).

Labor stresses continue

With this as the backdrop, the company’s continued discord with the labor force is concerning. As e-commerce gains even further in significance for Amazon, this thread continues to remain important, especially as there are continued developments in its labor challenges.

The International Brotherhood of Teamsters [IBT], the biggest labor union in the US, recently gave Amazon a deadline of December 15 to bargain for better terms for workers. The backstory to this is that the Amazon Labor Union [ALU] had teamed up IBT earlier in the year.

In another development, late last month, workers across 20 countries went on a strike called “Make Amazon Pay”. This is the fifth consecutive year when the strike has happened on the important Black Friday event.

The company’s labor stresses have also caught political attention, specifically from Senator Bernie Sanders. A report by the Senate Health, Education, Labor and Pensions (HELP) Committee, which he chairs, pointed out earlier this year that workers’ injuries during the Prime Day week, were over twice the industry average in 2019.

It’s also worth highlighting here, that earlier this year, he along with US President Joe Biden, were critical of the high prices charged by pharmaceutical companies like Eli Lilly (LLY) and Novo Nordisk (NVO) for their hugely successful weight loss treatments. Eventually, Eli Lilly reduced prices for some of these treatments. In other words, the impact of political pressure can’t be overlooked, even though there will be a new government in charge in the US soon again.

Outlook and Market multiples

For now, though, the labor challenge is still a controlled risk. In Q4 2024, the company expects the operating income to come in the range of USD 16-20 billion. Assuming that it comes in at the midpoint of the guidance range, and the ratio of net income to operating income stays at the 9m 2024 level of 82.8%, the net income for the quarter would come in at USD 14.9 billion.

This would bring the full-year net income figure to USD 54.15 billion and the forward price-to-earnings (P/E) ratio to 44.1x. This is higher than the level of 41.6x two months ago. The number declines to 39.6x for 2025, as per analysts’ estimates.

Even then, the figure is far higher compared to other e-commerce stocks like Alibaba (BABA) at 8.9x and Temu owner PDD Holdings (PDD) at 7.8x. All else equal, this would make Amazon unattractive right now. But all else is hardly equal. Here are three reasons why:

- The e-commerce peers are China focused, whose economy isn’t getting the kind of growth spurt hoped for post-pandemic and with continued tensions between the US and China there are always risks to their international operations too.

- Moreover, Amazon has the advantage of having a solid web services segment, that brings in much of the profits and indicates potential stability for the company even if things go awry on the e-commerce front.

- Amazon’s five-year average P/E is still at 178.1x, which is 4x higher than the current levels. Even if current challenges to the company imply that it won’t quite reach back to previous levels, there’s still a lot of room for it to rise further.

What next?

As a result, there’s little reason to change the Buy rating on AMZN. Its latest numbers continue to reflect rapid financial progress, especially with the increasing contribution of its e-commerce segment to profits. Further, even with its much higher P/E compared to peers, Amazon has distinct advantages that can justify its market multiples.

It would be a feather in the company’s cap it were to successfully resolve its labor challenges, considering that they have dragged on for some time now and the pressure can increase. Added political criticism pertaining to labor issues isn’t helping either. It might even be holding back AMZN’s price, even as the stock promises to inch up further in the foreseeable future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—