Summary:

- The semiconductor memory market is undergoing significant changes, with High-Bandwidth Memory (HBM) projected for substantial growth, driven by AI applications.

- Micron is strategically positioned to capture market share in the HBM market, with plans to increase capital investments and expand production.

- Micron’s forward earnings are undervalued at ~12x 2025 earnings, with potential for at least ~32% upside, assuming strong demand and margin improvements.

- Despite potential risks, Micron’s ambitious plans to penetrate the HBM market and capitalize on AI infrastructure spending make it a Strong Buy.

Hiroshi Watanabe/DigitalVision via Getty Images

Investment Thesis

The semiconductor memory market is witnessing a few history-altering moments that are sure to change the course of the entire industry. GenAI already did its bit to rock the boat enough to create a brand-new growth market for semiconductor memory-HBM, or High-Bandwidth Memory, which is projected to post significant growth over the next twelve months.

In addition, the last twelve months have clearly outlined breakout players in the HBM space, with South Korean memory chip vendor SK Hynix claiming the top spot in terms of HBM production. Legacy leader Samsung (OTCPK:SSNLF) has fallen behind in this rapidly growing market.

This has left another market contender, Micron (NASDAQ:MU), in a strategic position to capture market share in the HBM market. Micron’s resilient management has aired their ambitions on numerous occasions to take advantage of the low-hanging fruit that lies ahead of them. Micron’s management has also indicated its capital investments are set to grow next year to support its expansion plans.

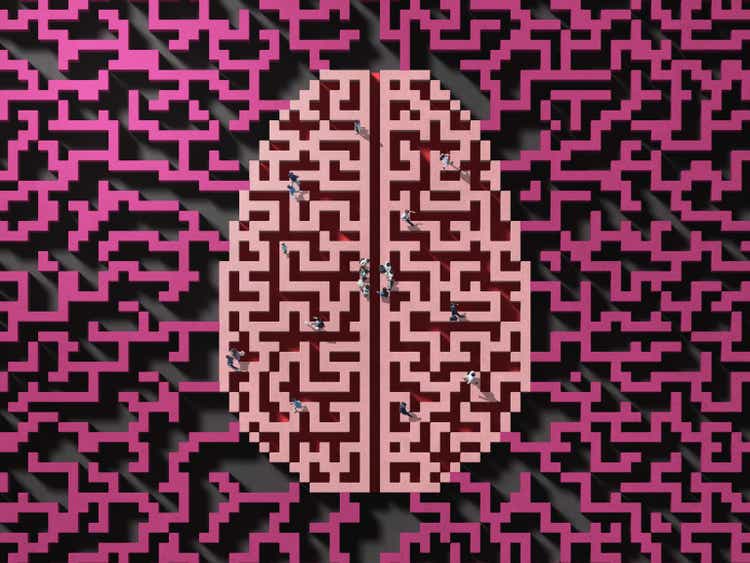

Unfortunately, the markets are still unsure about Micron’s 2025 prospects, judging by the swing in the company’s share price.

Exhibit A: Micron’s share price has swung to most likely settle at par with the broader market indices. (Seeking Alpha)

I believe Micron is on the cusp of a strong breakout in 2025 and is poised to run higher next higher. I am initializing my recommendation on Micron with a Strong Buy.

Trust Management’s Plans To Double Down On HBM Penetration

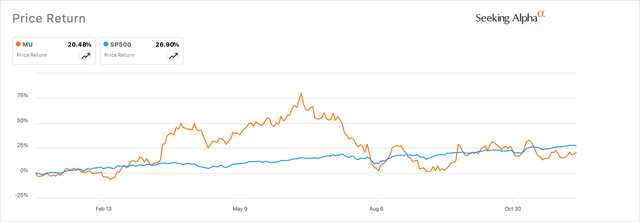

Demand for HBM chips has soared in the age of AI, with applications fanning a vast array of end markets, particularly in the GPUs used to power AI workloads. HBM is part of the DRAM memory portfolio but has become popular in AI data center deployments, is currently in its fifth generation of iteration-HBM3e-and is expected to account for 10% of total DRAM bit output in 2025, according to TrendForce. In 2024, HBM chips accounted for ~5% of DRAM bit output. In terms of total DRAM revenue, HBM’s contribution to the overall DRAM market is also expected to exceed the 30% market due to higher ASPs, up from 21% revenue contributions seen in 2024.

Exhibit B: HBM’s 2025 contribution to the total DRAM market is set to exceed 30% in 2025. (TrendForce via Statista)

Naturally, with a rapidly growing corner of the DRAM market, leading players would want to move fast to either consolidate or expand their share. This becomes even more interesting for players such as Micron when larger incumbents have fallen behind and lost ground. Currently, per the latest reports, SK Hynix is the leading market player in the HBM market at ~50%.

In Micron’s Q4 FY23 earnings call last year, management had laid the foundation of their ambitious plans to penetrate the HBM market by ramping production of HBM3e through the year:

Our goal is to ensure that we get our HBM share to be similar to our DRAM supply share. And to get there as soon as the hard ramp will allow. So that’s what we are focused on. And we have confidence in our plan to execute that.

Twelve months after last year’s Q4 call, Micron has actually expanded its market share by 260 bp, the most by any DRAM manufacturer per another report, and this has happened due to a superior performance in Micron’s server DRAM and HBM3e shipments. That also led to the company finishing their FY24 with a strong finish, per the Idaho-based company’s Q4 results.

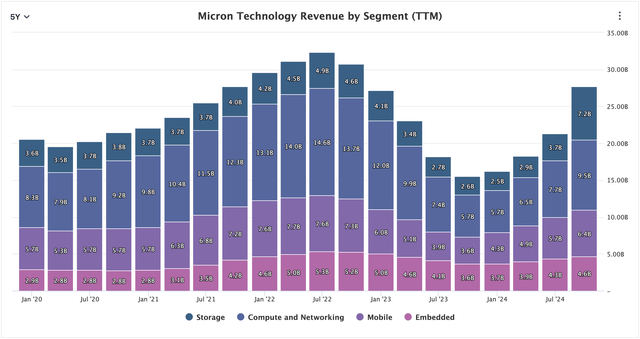

Exhibit C: Micron’s Q4 revenue growth was the strongest in over 8 years led by robust HBM3e and DRAM shipments. (Company sources)

Like many upstream semiconductor companies that operate as key manufacturers of the semiconductor value chain, Micron relies on charting out its future growth by investing its resources and allocating its budgets towards upgrading its equipment and deploying leading-edge node semiconductor production processes.

With its FY24 results, Micron has tasted blood, still sees enough runway in the DRAM market to expand, and is keen to keep penetrating the market as it has demonstrated so far. The company’s investor presentation added some insight into their plans for next year:

We expect the HBM TAM to grow from approximately $4 billion in calendar 2023 to over $25 billion in calendar 2025. As a percent of overall industry DRAM bits, we expect HBM to grow from 1.5% in calendar 2023 to around 6% in calendar 2025.

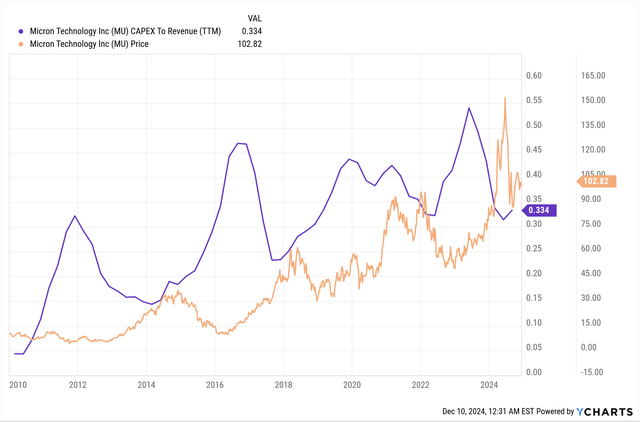

These are quite significant CAGRs in TAM expansion, signaling ambitious efforts by Micron to penetrate further, and should not be taken lightly. Micron has guided for CAPEX to be “meaningfully higher,” somewhere “at around mid-30s percentage range of revenue based on our current capex and revenue expectations.” Micron expects a large portion of its capex dollars to fund its HBM ambitions.

History reveals that expansionary capex plans, especially when capex dollars are allocated for technology transitions, have always been good for Micron’s future revenues and its share price.

Exhibit D: Micron’s capex plans have always been a strong indicator of where its revenues and its share price is headed. (YCharts)

Currently, Micron has spent about ~33% of its $25.1 billion FY24 revenues on capex. Its 2025 outlook points to the company spending ~35% of its 2025 revenues on capex. If bit demand for DRAM is expected to sustain through next year in the “mid-teens percentage range,” as management projects, I believe management will be in pole position to reap benefits from these early investments and penetrate the HBM market further.

Micron looks severely undervalued in 2025

There is no better way to say this than to just put up the market’s valuation of Micron’s 2025 forward earnings, which are currently at ~12x 2025 earnings.

That is cheap. Period.

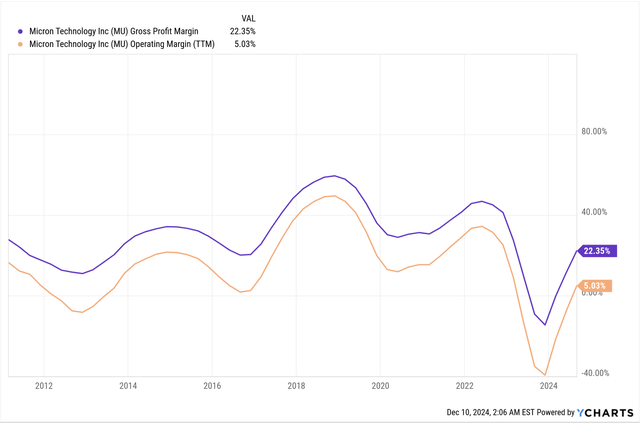

Markets themselves are projecting revenues to grow revenues by strong double digits, with earnings per share set to outpace overall revenue growth. Margins have substantially improved through the year, in line with management’s prior promises of delivering cost reductions in DRAM and NAND segments.

Exhibit E: Micron’s margins have substantially improved and are expected to expand even further in 2025. (YCharts)

Micron should be able to deliver at least 50 bp of GAAP operating margins, assuming the strong demand environment and continued cost reductions. Accounting for those 50 bp 2025 margin expansions and ~$600 million in annualized interest expenses, I believe Micron should be valued at least at ~15x 2025 earnings. This implies at least ~32% upside in the stock over the next year.

Risks & Other Factors To Be Aware Of

A big part of the margin expansion assumption above is based on the company selling into a strong bit demand environment, leading to a double-digit consensus-led projection of its revenue growth. If the demand environment were to reverse course lower, it would impact Micron’s outlook severely. A few analysts have called for a possible “DRAM winter“ that could be shaping up due to an oversupply of DRAM. But with ASPs likely headed higher, the demand environment remains conducive for players such as Micron.

Takeaway

I believe investors are not fully digesting the broad scope of Micron’s management to capture share in the rapidly growing HBM market. AI infrastructure spending is likely to continue next year with revenues expected to support those plans, and such robust demand trickles down through the semiconductor value chain to key manufacturers such as Micron, who will be beneficiaries.

Investors should disregard the noise surrounding Micron and buy its ambitious plans to capture share next year. This is a Strong Buy in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.