Summary:

- Apple has a reliable record when it comes to meeting street estimates.

- Despite a hazy outlook, there’s still a lot to like about the Apple story.

- The stock is now available at a forward P/E discount.

- The technical backdrop isn’t the most alluring.

Justin Sullivan

Q1 Earnings Headlines

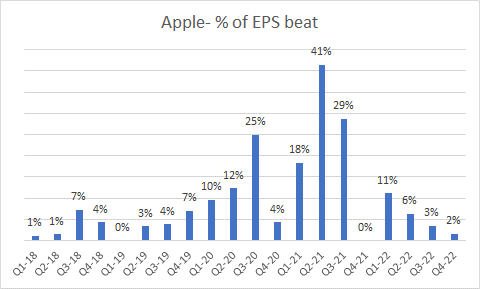

Apple Inc. (NASDAQ:AAPL) will release its Q1-23, after the closing bell on February 2 followed by an earnings call at 5 pm ET. Traditionally, as far as the headlines go, investors haven’t had to face a great deal of stress during earnings season as AAPL’s track record has been pretty stellar.

Just for some context, over the last five years, there have only ever been two events (Q1-19, and Q4-21) where the company has just matched street estimates on the bottom-line front. In all the other 18 quarters, AAPL has exceeded EPS estimates by roughly 10% or so. Needless to say, not once during this period has it fallen short of bottom-line estimates.

Seeking Alpha

The two headline numbers that investors should watch out for are the Q4 revenue estimate of$122bn, and the EPS estimate of$1.96. In the previous quarter, AAPL had delivered 8% topline growth, and management did state that the growth run rate would slow from those levels.

Well, if they end up delivering a figure in the ballpark of $122bn, that would not only represent a slowdown in the sales growth run-rate, but also negative YoY growth of -1.5%.

Looking ahead, in absolute terms, Apple’s revenue figure is expected to slide sequentially for the next few quarters and will likely bottom in Q3-23 at a revenue run-rate of $87bn. However, the YoY decline in revenue is likely to persist till Q4-23, and it’s only in Q1-24 that one will likely see some growth.

With regards to the EPS of $1.96 (implying earning decline of ~7%) it’s important to consider that this figure has been arrived at after a lot of negative revisions over the past three months. Just for some perspective, 92% of the total EPS revisions seen over the last three months have been downward, so perhaps it’s fair to say that most of the risks are baked in, unless the company delivers something out of the blue.

Balance Sheet and Cash-Gen Are Still Rock-Solid

I recognize there are certain sub-plots within the broad Apple story that look a little iffy in the short term. However, if one were to take a big-picture perspective, and consider the key themes such as cash generation and the balance sheet,(which is unlikely to turn awry overnight), you’d realize this is still a best-of-breed enterprise worth considering.

Firstly, Apple has a net cash position, and whilst there is a desire to get to a cash-neutral position over time, there isn’t any pressing need to abandon this defensive stance overnight. Secondly, the largest chunk of the asset base (~42%) is still taken up by a useful component of short-and long-term marketable securities.

Some may question why Apple needs to hold such a large chunk of these types of assets when it could be put to better use, such as indulging in larger bouts of M&A. But then again, do consider that this is the very same mix of assets that is returning close to 35% of cash flow, the highest it’s been over the last decade!

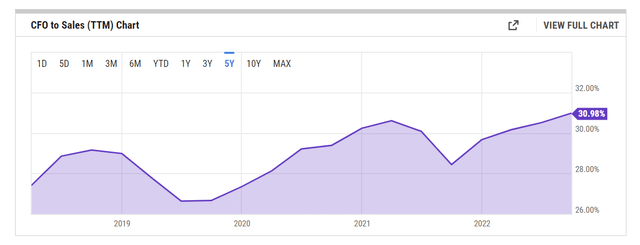

YCharts

Three years back, AAPL was generating operating cash flow of $69.3bn (no mean feat); these days, you’re looking at operating cash flow generation of over $122bn, implying an impressive CAGR of ~21%. Some investors are troubled by Apple’s slowing sales growth, but conversely, also consider that they are also converting a lot more sales into cash flow, which I believe is the more pertinent statistic. The CFO to sales margin has been trending up encouragingly and is now well past its 5-year average of 29%!

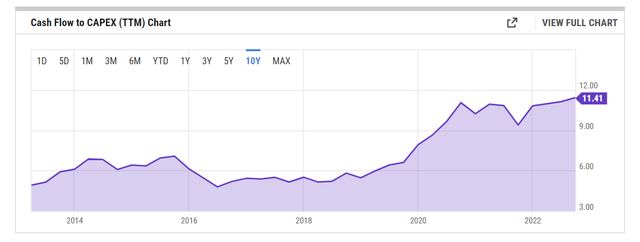

YCharts

CAPEX is unlikely to be a major hindrance to free cash flow development next year; in fact management stated that they expect it to be fairly stable in FY23 as well. Even if they decide to change tack halfway down the line, it’s not as if Apple will be running helter-skelter to cobble together funds. If anything, they should have more than enough, with the CFO to CAPEX coverage now in double-digit territory, the highest it’s been in a decade (the historical coverage average has been less than 9x)!

YCharts

What Do The Valuations Look Like?

The last time we covered Apple back in mid-Sep 2022 the stock was trading at the $165 level and above its 5-year average on a forward P/E basis. Now that is no longer the case, as the price has contracted at a greater pace (~11%) than the earnings revisions. Just for some context, in Sep 2022, we were looking at a 1-year forward EPS of $6.11, implying annual earnings growth of ~6%, now that figure has dropped by another ~5% to $6.139, implying annual earnings growth of less than 1%.

YCharts

Admittedly some investors may think twice about shedding out a forward P/E of ~24x for a stock that will likely only bring 1% earnings growth this year. However, this is a stock, that is rarely ever available on a discount, and currently, you can pick it up at a ~6% discount relative to its long-term forward p/e average.

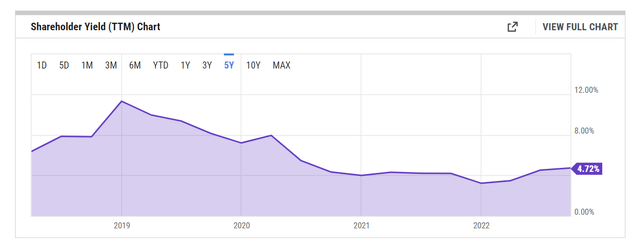

I recognize that some investors also pursue AAPL on account of its fidelity to shareholders via capital distributions. In keeping with that theme, one may also consider looking at the current shareholder yield on AAPL’s stock (the shareholder yield is a function of dividends, buybacks, and debt pay downs) and compare it against the historical average of over 6.2%. Unfortunately, the current yield is around 150bps lower than what you’d normally get.

YCharts

Closing Thoughts- Is AAPL stock a BUY, SELL, or HOLD?

AAPL’s stock price imprint over the last three years is akin to a flag; from the COVID lows, just above $50 levels, we saw a meteoric rise to the $182 levels in early 2022. Since then, we’ve seen a pullback of sorts, with the stock chopping around within a certain channel.

Investing

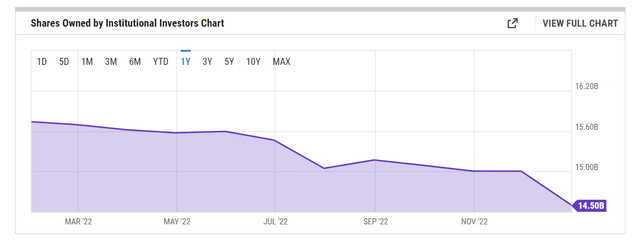

If you’d want to see a breakout beyond the upper boundary of the channel, I suspect the AAPL stock would need the backing of investors with deep pockets, aka the institutions (separately also note that the average price target of Wall Street Analysts is a little over that upper boundary at $168). Unfortunately, the institutional community continues to bail on AAPL stock with the net shares owned trending lower 31-Aug. Whilst December’s sequential decline of 3.3% was quite steep by historical standards, some of this “may” be attributed to the tax-loss selling syndrome. Regardless, even if that level of selling was a one-off, the point is, these guys are yet to turn buyers on a net basis.

YCharts

Whilst AAPL’s stock has been holding up pretty well off late, it’s difficult to get too enthused about a long position at this juncture, considering the reward/risk on offer. Keeping in mind where the upper and lower boundaries of the channel are currently placed (Upper: ~$165, Lower: $123), at the current share price, the R/R would be less than 1x (0.83x) which is not ideal.

Finally, when you look at AAPL’s positioning relative to the Technology Select Sector SPDR ETF (XLK), it no longer looks overextended beyond the long-term ascending channel, but it is still quite some way from the lower boundary of the channel, and the mid-point of the long-term range.

Stockcharts

Similar dynamics are reflected on the AAPL:SPY chart where AAPL has a much lower weight. Even here, it’s difficult to get too excited about AAPL as a suitable rotational candidate within the SPY.

Stockcharts

Source: Stockcharts

To conclude, whilst I still take comfort in Apple’s fundamentals, the unappealing technical backdrop makes the stock a HOLD at this price point.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.