Taking Profits In Carnival Cruise Lines

Summary:

- Although financial results in 2022 were less bad than they were in 2021, “less bad” is still “bad.” This is no longer the same firm it was in 2019.

- I want to buy when others are nervous about the challenging results, not when they’re upbeat.

- The calls I bought have done very well. For 20% of the risk, call buyers received about 50% of the gains of the stockholders.

piola666/E+ via Getty Images

It’s been just under four months since I wrote my comparative piece where I determined that Carnival Corporation (NYSE:CCL) was a much superior investment to Norwegian Cruise Line Holdings Inc (NCLH). Since then, the S&P 500 is up about 10.7%, the shares of Carnival have returned about 61%, and Norwegian Cruise Lines is up about 32%. It seems that my obsession to buy relatively cheap shares has done me in good stead yet again. A wiser and stronger man than I would not take this opportunity to brag, but, as the song says “I gotta be me.” Anyway, since Carnival has just released financial results, I thought I’d review the name yet again to see if it’s worth hanging on or taking profits. I’ll make that determination, as is my wont, by reviewing the financials themselves and by looking at the valuation. Additionally, in my previous article, I suggested call options as a great risk adjusted way to “play” the stock of this somewhat troubled firm. I’m absolutely champing at the bit to write about how that trade worked out.

We’re all very busy people. For instance, I imagine that you are trying to decide whether to cruise in Alaska or the Caribbean this year before you decide which supermodel you want to go to dinner with tonight. For my part, I’ve got to catch up on the entirety of season 49 of “The Young and the Restless.” Either way, we’ve all got things to do, and I want to be mindful of your time. One of the ways that I try to save you time is by writing a “thesis statement” paragraph at the beginning of each of my articles. This allows you to get in, get the “gist” of my thinking so you don’t have to read all 1,500 words, riddled with odious bragging as they are. You’re welcome. I’ll be taking profits on Carnival Cruise Lines this morning, because I am of the view that it’s still in very troubled financial waters (sorry). In spite of that, the market seems to be rather optimistic at the moment, and I consider this to be a very bad combination. Finally, call options achieved a much better return on a percentage basis than did my shares. Specifically, the calls that I bought earlier have returned about 50% of the dollar returns of the shares, while exposing only about 20% of the capital for that result. If you’re not yet familiar with how options can enhance returns while lowering risk, I would recommend you familiarise yourself with these instruments. That’s the gist of my argument. If you read on from here, that’s on you. I don’t want to read any moaning in the comments section about the bragging, or the fact that I spell words like “colour” correctly.

Financial Snapshot

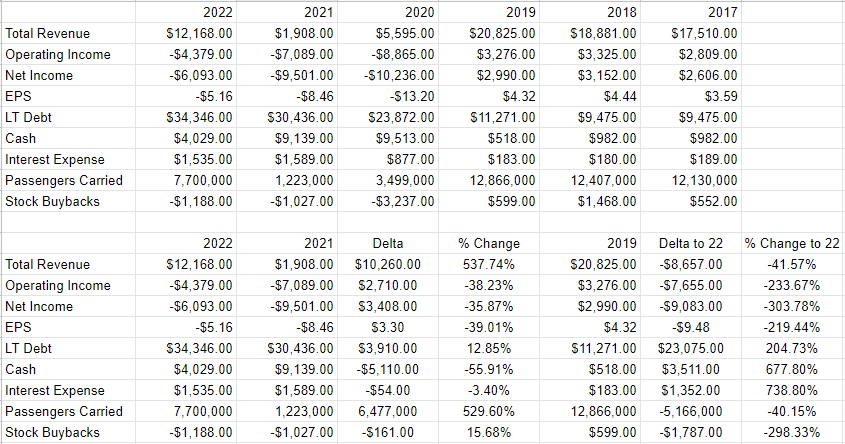

I’d characterise the financial year just ended for Carnival Cruise Lines as somewhere between “severely worse” and “less bad.” Revenue was up a massive 537% relative to 2021, which is understandable given that the company carried an additional 530% more passengers than they did in 2021. As a result of all of this, the company reduced the loss from $9.5 billion in 2021 to $6.09 billion last year.

As you may recall, the world was still in the grip of a global pandemic as we entered 2021, so comparisons to that year may be less relevant. When we compare 2022 to the latest year prior to the pandemic, things today look rather awful. For instance, revenue in 2022 was still 42% lower than it was in 2019, and net income has swung from a positive $2.99 billion in 2019 to a loss of just over $6 billion in 2022. Additionally, the capital structure has deteriorated massively, with long term debt up by about 204% or $23 billion. This is not the same firm as it was in 2019.

Interestingly (to me at least), certain expenses are actually higher now than they were in 2019. While it’s understandable in some ways that the company spent an additional $595 million, or 38% on fuel in 2022 relative to 2019, other increases are a mystery to me. Selling and administrative expenses are higher by 1.1%, and the mysteriously named “other” is similarly up by 1.1%. Finally, although revenue is down 41.6% relative to 2019, payroll expenses are only lower by about 3%. I’d suggest that there’s little financial flexibility here.

All of that written, the company has certainly been a sound investment for me at the right price, so I’d be happy to remain long, or even add to my stake, if the price is reasonable.

Carnival Cruise Lines Financials (Carnival Cruise Lines investor relations)

The Stock

As my regular readers know, I’ve talked myself out of some profitable trades with words like “if the price is reasonable.” In response to this criticism, I’d point out that I’m of the view that it’s better to miss out on some gains than lose capital. My regulars also know that I consider the “business” and the “stock” to be quite different things. Every business buys a number of inputs and turns them into a final product or service, like “fun and memorable vacation services at great value.” The stock, on the other hand, is an ownership stake in the business that gets traded around in a market that aggregates the crowd’s rapidly changing views about the future health of the business, future demand for leisure travel, future margins, and so on. The stock also moves around because it gets taken along for the ride when the crowd changes its views about “the market” in general. A reasonable sounding, if counterfactual, argument can be made to suggest that some bump in the value of Carnival shares relates to the rise in the S&P 500 itself since I bought. It’s impossible to prove this point definitively, but it’s worth considering. In any case, the stock is affected by a host of variables that may be only peripherally related to the health of the business, and that can be frustrating.

This stock price volatility driven by all these factors is troublesome, but it’s a potential source of profit because these price movements have the potential to create a disconnect between market expectations and subsequent reality. I absolutely hate to sound like I’m bragging about it, but this is exactly how I generated a very decent return on my Carnival investment over the past four months. The market was overly pessimistic, and I took advantage of that. I don’t want to be too repetitive, but in my view this is the only way to generate profits trading stocks: by determining the crowd’s expectations about a given company’s performance, spotting discrepancies between those assumptions and stock price, and placing a trade accordingly. I’ve also found it’s the case that investors do better/less badly when they buy shares that are relatively cheap, because cheap shares correlate with low expectations. Cheap shares are insulated from the buffeting that more expensive shares are hit by.

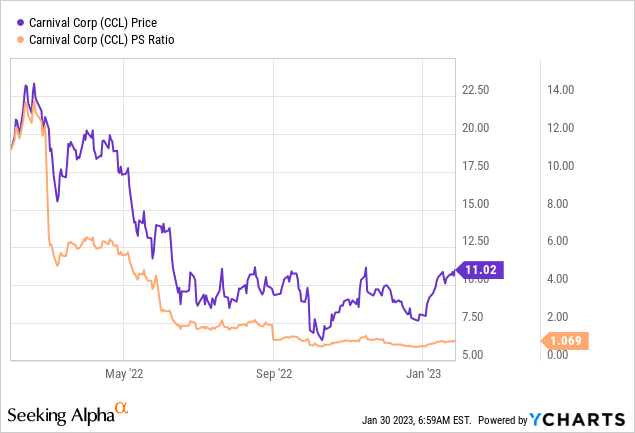

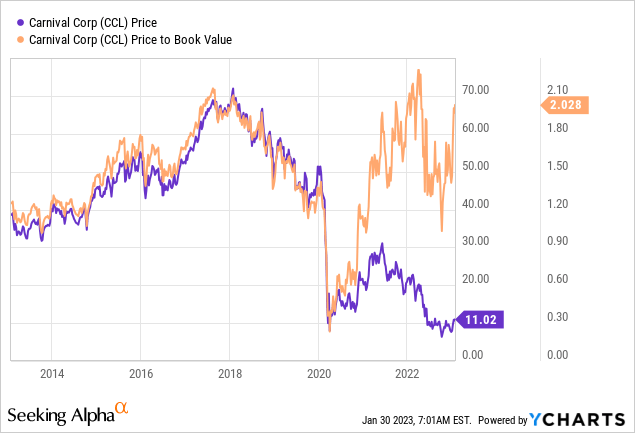

As my regulars know, I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. For example, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In case you don’t have your copy of “Doyle’s Almanac of 2022 Trades” in front of you, I turned very bullish on this stock when it was trading at a discount to Norwegian of between 32.5% and 80%. Specifically, the shares were trading at a price to sales ratio of about 1.375 times and a price to book ratio of 1.1. Fast forward to late January 2023, and here’s the lay of the land:

Source: YCharts

Source: YCharts

Shares are actually about 22% lower on a price to sales basis, but about 82% more dear on a price to book basis. Curiously, the company is trading near a multi decade high on a price to book basis, which I find extraordinary given what’s going on with the business itself.

One more thing my regulars know is that I want to try to understand what the crowd is currently “assuming” about the future of a given company, and in order to do this, I rely on the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit dense, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and then infer what the market is currently “expecting” about the future.

Anyway, applying this approach to Carnival Cruise Lines at the moment suggests the market is assuming that this company will grow profits at a rate of about 5% from here. In my view, that is a pretty optimistic forecast, even for a company that we’ve collectively decided is on the mend. Given that I’m in the mood to preserve capital, I’m going to take my chips off the table at this point.

Options Update

For those who don’t remember, I’ll remind you that I recommended call options on Carnival Cruise Lines as a great, lower risk, alternative to outright stock ownership. Specifically, I recommended the March calls with a strike of $7.50, which were asked at $1.52 at the time. These same calls are currently trading at $3.60-$3.70. So, the call investor has done much better than the stock investor on a percentage return basis. The call investor has earned “only” $2.10 on their investment, as compared to the $4.15 the stockholder has earned, but the call owner put up only 22% of the capital of the stockholder. So, in sum, the call owner earned about 50% of the returns of the stockholder while risking only about a fifth of the capital. Thus, I think the calls have done much better on a risk adjusted basis. This is yet one more example of how options have the potential to dramatically improve your risk adjusted returns.

Since I am pulling away from Carnival at the moment, I’m going to take profits on these over the next week, but I will revisit the trade if shares crater from current levels.

Disclosure: I/we have a beneficial long position in the shares of CCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Although I’m technically long as I type this, I’ll be taking profits today.