Summary:

- Harley-Davidson faces moderate growth (4.3% CAGR) as it balances legacy brand strength with challenges in attracting younger customers, reflected in a Hold rating amid a ~2% forward dividend yield.

- Management’s efforts, including ventures into electric bikes, face criticism for modernizing, risking alienation of its core 45-65-year-old demographic while struggling to appeal to youth.

- Valuation models suggest slight overvaluation with limited upside; the company’s survival depends on preserving its legacy rather than taking excessive risks for transformative growth.

ferrantraite/iStock Unreleased via Getty Images

Investing in Harley-Davidson (NYSE:HOG) is a bet on legacy survival, rather than on forward-focused innovation successfully captivating the youth (though management is trying). The company’s core customers are 45-65 year olds, and there’s nothing wrong with that. At approximately a fair valuation, a likely 4.3% CAGR in its enterprise value over the next five years, and a forward dividend yield of ~2%, my rating is a Hold. However, I admire the company and believe it will endure for years to come, albeit with moderate growth and periods of volatility amid changing global demographics.

Operations, Management, & Financials

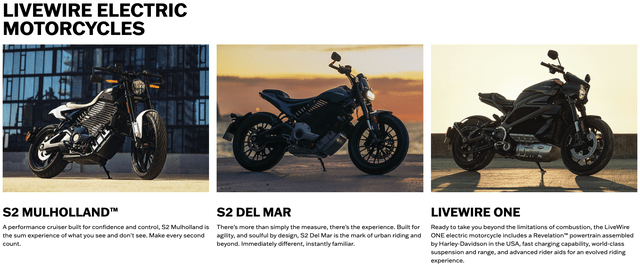

Harley-Davidson is one of the world’s most famous motorcycle manufacturers, but in recent years the company’s reputation has become notably weaker. The company operates through two primary divisions, namely Motorcycles and Financial Services. The company’s most popular models include the Touring, Softail, Sportster, Street, and the electric LiveWire. Its Financial Services segment provides financing options and insurance products for dealers and retail customers. Recently the company has been venturing into electric motorcycles and bikes—a move some have criticized along with allegations that management have opted for a “woke” management style, prioritizing diversity, equity, and inclusion (‘DEI’) over meritocracy independent of class, age, race, and gender. Thankfully, the company has not operated a DEI program since April 2024 after heavy backlash from its community.

Harley-Davidson.com

On the note of management style, the company’s current CEO, Chairman, and President is Jochen Zeitz, who has a tenure of over four years. Zeitz held prominent roles at Puma (OTCPK:PMMAF) and Kering (OTCPK:PPRUF) (OTCPK:PPRUY) prior to joining Harley-Davidson. Some criticize Zeitz for his modern and conscious approach to management. Indeed, it seems the company culture is going through a bit of a mid-life crisis, and as a result, many long-time fans are transitioning to other manufacturers, like Indian. Harley-Davidson has long dominated the North American motorcycle market, but Indian Motorcycle has been gaining ground, particularly under Polaris’ (PII) ownership. The two companies compete directly in touring, cruiser, and bagger motorcycles. Polaris states that Indian’s global market share has increased significantly over the past decade, to 13% in 2023.

Looking at Q3, and Harley-Davidson had a rough quarter, with global motorcycle shipments decreasing by 39%, and LiveWire electric motorcycles saw a revenue decrease of 41%. Zeitz acknowledged the challenging macroeconomic environment with high interest rates, but he expressed optimism about the company’s ability to post a better performance in 2025.

Unfortunately, in my opinion, there’s little to be bullish about here. Future growth rates are unlikely to be substantial. To be conservative but optimistic, we may forecast 3.5% annual revenue growth over the next five years. Though management is working to reduce dealer inventory and managing costs to improve profitability, we probably aren’t looking at Tesla (TSLA) levels of margin expansion. The five-year average EBITDA margin for Harley-Davidson is 15.87%, and its trailing 12-month EBITDA margin is 14.78%. I’ll be using the five-year average in my valuation model.

Valuation

Starting with trailing 12-month revenue of $4.52 billion and compounding this at a 3.5% CAGR over the next five years leads to a December 2029 revenue estimate of $5.37 billion.

At an EBITDA margin of 15.9%, the company will have a December 2029 EBITDA of $853.57 million.

The company has a forward EV-to-EBITDA ratio five-year average of 15 and a trailing 12-month EV-to-EBITDA ratio five-year average of 16.3. I will be using the approximate midpoint of these two figures, 15.65, as my terminal multiple. The result is a December 2029 enterprise value estimate of $13.36 billion. As the company’s current enterprise value is $10.84 billion, the implied CAGR over five years is 4.27%.

Harley-Davidson’s weighted average cost of capital is 5.01%, with an equity weight of 36.27% and a debt weight of 63.73%, with equity costing 13.21% and debt at 0.41% after tax. When discounting back the company’s December 2029 enterprise value estimated at $13.36 billion using the weighted average cost of capital as my discount rate, the present-day intrinsic enterprise value is $10.46 billion. This indicates a -3.49% negative margin of safety for investment against the current enterprise value of $10.84 billion.

Harley-Davidson Valuation (Author’s Table)

Risks

Harley-Davidson’s primary customer demographic has traditionally been middle-aged men, particularly Baby Boomers and Generation X, with a significant portion of customers aged 45-65 years. It’s also struggling to attract a younger audience, even though management is trying. I think this is the biggest problem that the company faces—it’s simply too well-established as a brand of the past, an item of nostalgia, of legacy, almost of history. Some may say that Harley-Davidson can be saved, it can turnaround and become the next Suzuki (OTCPK:SZKMF) (OTCPK:SZKMY) or Honda (HMC), but that’s just not accurate. Indeed, it’s all about marketing. If the company goes too modern and “woke”, it will irritate its largest current customer base of 45-65-year-old men. If it fails to adopt somewhat of a modern approach, younger generations will generally not be amused. The company has to strike a careful balance if it wants to broaden its appeal, but I fear that it can’t do it without taking on excessive risk in the process of a major brand reimagining and turnaround. Indeed, if the company took on such a task, would Harley-Davidson even be the same company at the end? Arguably not.

Given that the brand definitely has an ‘aged’ feel after over 120 years in operation, alienating the younger audience, let’s look at some of the competitors that have captured the imagination of youth. Models like the Honda CB350 and CB750 are highly sough after for their affordability and ease of maintenance, and Kawasaki’s (OTCPK:KWHIY) (OTCPK:KWHIF) Ninja series is popular among the young for those drawn to racing heritage and aggressive styling. In addition, KTM is known for its high-performance off-road and street bikes, appealing to adventurous motorsports enthusiasts. From a macro perspective, the biggest issue might be the type of bikes that Harley-Davidson focuses on, which prioritize comfort, luxury (expense), and stability, over affordability, agility, and a sleek modern design.

Conclusion: Hold

My valuation model shows a minor overvaluation and only a 4.3% enterprise value CAGR over the next five years. As a result, my rating is a Hold, especially as Harley-Davidson only has a forward dividend yield of ~2%. The brand seems to be surviving, but I certainly would not say it is currently thriving. A successful reinvigoration would probably take a risky brand and management restructuring, which could leave the company worse off than it currently stands. Harley-Davidson has a rich legacy, and I think it will reward investors the best if management can maintain that rather than sacrificing its core customer base for speculative growth based on acquiring younger customers moving forward.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.