Summary:

- Block, Inc. broke out of a two-year range in December 2024, driven by its strong and underappreciated ecosystems in Square and Cash App.

- Square’s POS systems empower SMBs with essential digital tools, creating a sticky, long-term customer base despite temporary inflationary headwinds.

- Cash App’s integration with Square, including rewards and financial services, enhances user engagement and shareholder value.

- I am highly bullish on Block, considering it my top long pick for 2025, with significant growth potential in its intertwined ecosystems.

koto_feja

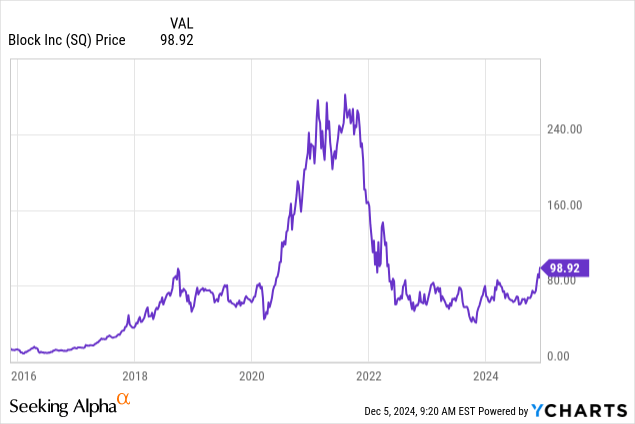

After a post-COVID boom and the sharp selloff during the inflationary bust that followed, Block, Inc (NYSE:SQ) remained range bound for over two years. The stock finally broke out during the first trading week of December, bringing renewed attention to the beaten down Fintech.

I initiated coverage of Block in February of 2023. Much of the narrative that existed in early 2023 still exists today: the company has two sprawling ecosystems that it has been stitching together for several years. Each segment has its own distinct market positions and competitive advantages. These segments work in harmony to create an enormous opportunity for Block that I believe the market is underappreciating. I believe Block could be one of the best, if not the best, performing stocks in 2025. Block is my top long pick for 2025 and I am more bullish than ever on the company.

Square

The Square segment, offering POS (point-of-sale) payment terminals, has given SMB’s (small-to-medium sized businesses) access to a suite of hardware and software required to run a modern, digital native business. It allows businesses of all sizes to build websites, track inventory, facilitate vendor orders, manage timesheets, pay employees, run marketing campaigns, start rewards programs, schedule client appointments, and a host of other services that are critical to scale a business in the internet age. Block focuses on several distinct verticals with unique needs like restaurants and beauty shops, but the product set is broadly the same.

Square carved out a strong market position by following a ‘trust, then verify’ model for merchant onboarding. This flew in direct opposition to the prevailing approach at the time and solved a key issue facing many small merchants. The company was founded in 2009, at a time when it was becoming clear that businesses had to accept card payments to survive and scale. At the time, processing card payments required a bank account. However, many very small merchants (think: your local farmers market) struggled to get bank accounts because they didn’t have meaningful sales. They struggled to generate meaningful sales because they couldn’t accept card payments! Banks are conservative institutions, especially in 2009 in the wake of the Great Financial Crisis, so they follow a ‘verify, then trust’ approach to KYC (Know Your Customer).

Jack Dorsey and his Cofounder Jack McKelvey solved this issue by creating a tiny dongle that attached to smart phones and processed card payments without requiring a bank account. This technology quickly began spreading in a very grassroots way, and today many companies have grown because Square opened them to the world of electronic payments.

This market is more saturated today than it once was, and Square’s GPV growth has been in sequential decline for a few quarters. Inflation weakened the consumer while rapidly rising rates reduced access to cheap capital for SMBs. These are temporary headwinds that matter little to Square long-term. Square’s product set becomes extremely entrenched once businesses have grown with it. The longer a merchant uses Square, the stickier it becomes. Now, Block is focused on deepening its product set with new hardware and software offerings, expanding traditional banking services with loans and lines of credit, and making it easier for businesses to buy bitcoin. Finally, tying the Cash App ecosystem more closely together with the Square ecosystem has been the key focus in 2024. Cash App users can see their rewards balances with Square merchants in the app, can access cheap short-term debt with Afterpay, and can see Square merchant advertisements as well. Tying the square ecosystem closer together with Cash App will generate enormous value for shareholders over time, but the benefits will take time to fully materialize.

Cash App

Similar to Square, Cash App carved out a sticky customer base driven largely by a differentiated go-to-market strategy. Unlike Venmo, a Cash App account doesn’t require linking an external bank account. New users can be onboarded simply by receiving money from an existing user, making the CAC (customer acquisition cost) extremely low. Ease of onboarding plus referral bonuses allowed Cash App to easily proliferate its target markets but has also resulted in a user base with a much lower average net worth than Venmo.

Cash App’s relatively loose KYC standards (which have been improving) attracted a certain narrative about the user base that was the target of a short report in 2023. I discussed the report here. There were accusations of inflated user base metrics and rampant fraud, but the company shrugged the report off and Cash App has continued to grow well. Block did tighten up KYC standards and worked to collect more accurate information on all users, with stepped up KYC requirements based on transaction complexity. For example, a simple P2P (peer-to-peer) payment only requires a Cash App account, which only requires name and phone number. However, if you want a CashApp Card, to buy or sell Bitcoin or stocks, or to open a savings account, you’ll need a government issued ID, a social security number, and a range of other basic KYC information.

Cash App has a sticky user base because it catered to an underserved population. Many Cash App users wouldn’t have access to modern financial tools without the app, so it has naturally become indispensable to them. The company has leaned into this with the “Banking Our Base” strategy set off in 2024. Management is focused on deepening the Cash App product suite and making it more enticing for higher-income individuals and families too. Users can access high-yield savings, setup direct deposit, buy/sell bitcoin and stocks, and can even manage their taxes in the app. Users can also get a debit card linked to their Cash App.

As with all Fintech apps, user quality is of utmost importance for sustained success. The best way to increase user quality is by deepening relationships either by attracting new money from existing users or by increasing average products per customer. Block has mostly focused on products per customer, but the Bitcoin bull run has also made many Cash App users richer. Cash App users selling their bitcoin not only generates fee revenue for Block but also essentially brings new money into the ecosystem. By expanding access to financial services, Cash App has created a robust network of stick users that add enormous value to the Block enterprise.

With the Banking Our Base strategy, Block has effectively scaled a modern-day digital bank without any of the expensive brick-and-mortar overhead. Traditional big banks have high customer acquisition costs, long onboarding periods, strict KYC requirements for basic services, and outdated technology. They attempt to attract customers by offering the best rates (which is a race-to-the-bottom pricing game), the fullest product set, and relationship-based servicing. Cash App did this the opposite. It attracted a sticky user base by offering a quality product for free. Then, the company built out its product set and deepen relationships with its users. This has resulted in a culture of trust for Cash App and has led many people to become dependent on it for their financial livelihood. Cash App is becoming increasingly like SoFi (SOFI) and decreasingly like Venmo.

Today, the market basically only analyzes Block’s enterprise value as a sum of parts of the Square and Cash App segments. This isn’t appropriate. Block is one of the leading providers of Bitcoin services and is an enormous benefactor to Bitcoin’s ongoing rise. Ignoring Block’s bitcoin business is a critical error in analyzing the company.

Bitcoin

The Bitcoin network achieved a major milestone and recently eclipsed $100,000 per bitcoin. At face value, this benefits Block enormously. For one, Block maintains one of the largest corporate bitcoin treasuries, holding 8,068 btc. The company has also begun dollar-cost-averaging into a larger btc position by using 10% of its Bitcoin gross profit to buy additional btc. Second, as mentioned earlier, Block allows both Square merchants and Cash App users easy access to buy bitcoin. Any Square merchants or Cash App users that used these services have become richer with money that is invested in Block’s network. Any buying or selling of bitcoin results in fee revenue for Block and as merchants or users sell their bitcoin at a profit they’ll bring more cash into Block’s ecosystem organically. By allowing easier access to the Bitcoin network, Block is enriching its user base. It doesn’t stop there, though.

A market price of $100,000 means that there is approximately $46.8m in new bitcoin minted each day (using 3.25 btc minted every 10 minutes). Bitcoin mining, the process of solving puzzles on the blockchain to earn bitcoin rewards, is a highly competitive industry that depends on highly specialized hardware. With nearly $50m in new btc being created daily, the mining industry has blossomed into highly competitive space. Similar to AI companies, Bitcoin miners need the best hardware to win. Bitcoin mining ASICs are distinctly different from traditional CPUs and GPUs, which has led the hardware market to be relatively underserved. Most leading-edge mining ASICs are supplied by Chinese companies. Many American chipmakers are now much more focused on AI than anything else. Meanwhile, the Proto team at Block is trying to challenge Chinese dominance in the mining hardware space.

Block has already made headway into this market when they announced the design and tape-out of a 3nm mining ASIC earlier this year. Then, they announced the coming availability of a Mining Development Kit (“MDK”) to bring flexibility and support for a broad range of use cases. Finally, the team came to an agreement to supply nearly 15 EH/s (exa-hashes per second) worth of mining chips to Core Scientific (CORZ). This was announced in July of 2024, and in November of 2024 the company formally announced the Proto division.

The biggest barrier to entry for mining hardware is the ability to design high quality chips. Block has plenty of experience with chip design since Square terminals have used custom ASICs for years. By offering a leading-edge chip, a flexible platform, and high-quality software interfaces, Block believes it can win a strong position in the mining chip market. The bitcoin mining hardware industry is a multi-billion dollar per year industry whose demand will grow in lockstep with the price of bitcoin.

Investor Takeaway

Despite being a leading beneficiary to Bitcoin’s rise, Block’s stock price has not followed bitcoin’s price much this year. The market is entirely ignoring both the existing benefits (richer Square merchants and Cash App users) and the benefits looming on the horizon (winning market share in the mining hardware business). For these two reasons, I believe the market misunderstands Block’s enterprise value from the ground up. Investors are only focused on Block’s role in traditional finance, something that will change as the Proto division begins driving profitable growth for Block’s bitcoin segment in 2025. Proto will begin driving meaningful growth next year and I believe that the market will wake up to this opportunity when that begins.

For these reasons, I believe Block is one of the best stock picks approaching 2025 and strongly believe an inflection is looming.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2025 Long/Short Idea investment competition, which runs through December 21. With cash prizes, this competition – open to all analysts – is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.