Summary:

- T remains a compelling dividend investment due to the stable profitability, rich yields, and strong FCF guidance, despite the recent price appreciation.

- Even so, we believe that the market’s optimism surrounding the DIRECTV divestiture has been well warranted, attributed to its leaner operations and intensified focus on the telecom business.

- T’s core business shows excellent performance metrics as well, with the lower churn, consistent net adds, and increased service convergence supporting its excellent FY2024 guidance.

- Despite a fully valued position and moderated dividend yields, the telecom’s healthier balance sheet and promising long-term prospects make it a great buy for dividend oriented investors.

Richard Drury

T Remains A Compelling Dividend Investment Idea Despite The Recent Price Appreciation

We previously covered AT&T (NYSE:T) in September 2024, discussing its robust dividend investment thesis, attributed to the stable profitability, rich yields, and strong FY2024 FCF guidance.

Combined with the promising potential for additional shareholder returns through share repurchases and/ or dividend raises, once the management achieved its leverage target by H1’25, we had continued to rate the stock as a Buy then.

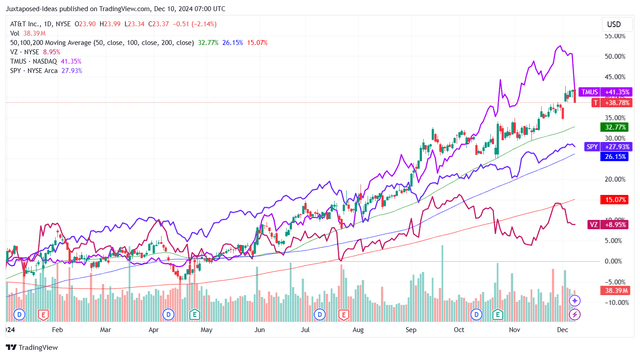

T YTD Stock Price

Since then, T continues to race upwards with a total return of +12.9%, compared to the wider market at +11.2%, without losing the momentum gained during the recent market rotation in July/ August 2024.

Part of the tailwinds are naturally attributed to the DIRECTV divestiture of the telecom’s remaining 70% stake for $7.6B – with it further underscoring its leaner operations along with the stronger focus on its core business, building upon the previous spin off of WarnerMedia in 2022.

For reference, T previously acquired DIRECTV in 2015 for $67B and Time Warner in 2018 for $85.4B, with these two deals naturally contributing to the telecom’s hefty debts of $176.5B at its peak in FY2018.

These divestitures/ spin offs complete its strategic turnaround to be a telecom focused on “high-quality 5G & fiber customers” indeed, with the management seemingly putting their media ambitions well behind them, as the media industry also transitions from cable/ satellite TVs to streaming.

The stock’s ongoing rally is partly aided by T’s robust FQ3’24 performance as well, with revenues of $30.2B (+1.3% QoQ/ -0.6% YoY), richer adj EBITDA margins of 38.4% (+0.5 points QoQ/ +1.6 YoY), and Free Cash Flow generation of $5.1B (+10.8% QoQ/ -1.9% YoY).

T’s Successful Convergence

Most importantly, T’s core business continues to generate net adds for 19 consecutive quarters while reporting lower churn to 0.78% (-0.01 points QoQ/ -0.06 YoY), resulting in the robust Mobility service revenues growth to $16.5B (+1.2% QoQ/ +4% YoY) and Consumer broadband revenues of $2.8B (+3.7% QoQ/ +6.4% YoY).

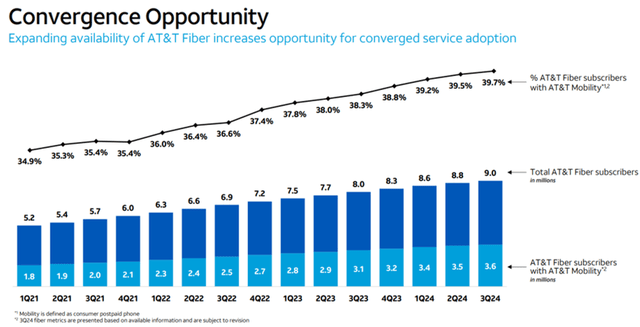

The same has also been observed in its ability to increasingly cross sell to existing consumers while growing new adoption, given the expanded service convergence opportunity at 39.7% by FQ3’24 (+0.2 points QoQ/ +1.4 YoY) and the richer adj EBITDA margins as discussed above.

These results are also why we believe that T remains on track to achieving their FY2024 guidance, with robust growth in the Wireless service and Broadband segment likely to well balance the lower demand for legacy voice and data services in the Business Wireline segment.

Particularly, the telecom is likely to exceed the FY2025 target of 30M+ consumer and business locations with fiber by FQ4’24, based on the FQ3’24 number of 28.3M (+0.5M QoQ/ +7.6M YoY) and the intensified capex of $13.4B on a YTD basis (+0.7% YoY).

Despite the higher investments, T continues to report increasingly rich Free Cash Flow margins of 16.6% over the LTM (+0.4 points sequentially/ +0.6 from FY2019 levels of 16%), with it demonstrating why the stock remains attractive for dividend oriented investors seeking stable quarterly incomes.

The Consensus Forward Estimates

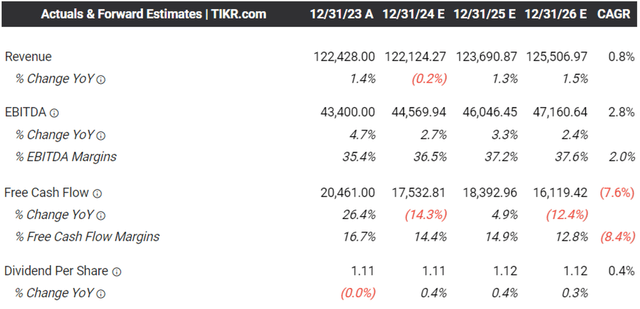

If anything, the same robust numbers have been observed in the consensus forward estimates, with T expected to generate decent profitability (adj EBITDA & Free Cash Flow) over the next few years, with it underscoring the safety of its annualized dividend payouts worth $8.19B.

The same has been guided by T, based on the FY2027 Free Cash Flow generation guidance of over $18B and the total dividend payouts of over $20B/ share repurchases of $20B between FY2025 and FY2027.

This is despite the impact of approximately -$2.4B from DIRECTV annualized distributions, resulting in the FY2025 Free Cash Flow guidance of over $16B in 2025 after discounting DIRECTV (-8.5% YoY).

While T has yet to disclose their plans for the $7.6B payout, we believe that part of the payment may be used to further deleverage its balance sheet from the current net debt to adjusted EBITDA of 2.8x (from 3.54x in FY2020) to H1’25 target of 2.5x.

It is unsurprising then, that the market has rewarded the stock with the robust YTD stock price gains compared to the VZ and the wider market.

So, Is T Stock A Buy, Sell, or Hold?

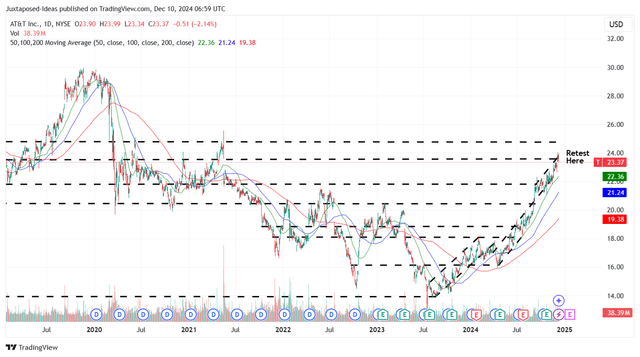

T 5Y Stock Price

For now, T has charted an impressive +65.6% recovery since the August 2023 bottom, with the stock continuing to run away from its 50/ 100/ 200 day moving averages.

This capital appreciation has also directly contributed the telecom stock’s moderating forward dividend yields of 4.65%, compared to the peak of 8.2% observed in 2023, its 4Y average yields of 6.34%, and VZ at 6.40%.

Even so, as discussed above, we maintain our belief that T remains a great buy, thanks to the still excellent dividend investment thesis, robust shareholder returns, and healthier balance sheet.

The telecom’s ongoing reversal from the prior acquisition sprees, hefty debts, and lead-lined issues have been very promising indeed, with it underscoring its brighter long-term prospects, assuming a similar execution ahead.

Risk Warning

It goes without saying the telecom sector is typically not a high growth sector, with T’s recent rally already triggering a notable moderation in its forward dividend yields as discussed above.

It has also triggered its fully valued position to our estimated price target of $22.00, based on the 10Y P/E mean of 10.02x and the management’s FY2024 adj EPS guidance of $2.20 at the midpoint (-8.7% YoY).

With FY2025 bringing forth a divestiture impact and T guiding FY2025 adj EPS of $2.02 at the midpoint (-8.1% YoY) excluding DIRECTV, we believe that the stock is likely to trade sideways in the intermediate term. This is based on our long-term price target of $22.90, attributed to the consensus FY2026 adj EPS estimates of $2.29.

While the management may have guided a rather promising adj EPS growth acceleration in the double-digit percentages through 2027, we believe that it may be more prudent to temper our expectations for now, given the flattish 10Y adj EPS growth at a CAGR of -0.4%.

For now, investors may simply wait patiently while collecting T’s rich dividends.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.