Summary:

- Chevron Corporation reported Q4 2022 results that disappointed the market.

- The results were better than the market seems to think, as the production decline was negligible and cash flow was solid.

- Near-term growth may not occur, as the company’s production will likely remain flat in 2023 and a recession could keep crude oil prices suppressed.

- Chevron boasts an incredibly strong balance sheet with almost no debt.

- Chevron Corporation appears to be undervalued today and may be worth purchasing.

Diy13

On Friday, January 27, 2023, integrated oil and gas supermajor Chevron Corporation (NYSE:CVX) announced its fourth-quarter 2022 earnings results. The market was certainly disappointed with these results, as the company’s stock fell fairly significantly following the news release. This is almost certainly due to the company failing to meet the earnings expectations that analysts had presented.

However, a closer look at these results reveals a lot to like. In particular, Chevron reported its strongest operating cash flow in history over the full-year period and raised its dividend by 6% year-over-year. As I mentioned in a recent blog post, Chevron is looking quite undervalued today. This overall could represent an opportunity for savvy investors.

Earnings Results Analysis

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Chevron’s fourth-quarter 2022 earnings report:

- Chevron reported total revenue of $56.473 billion in the fourth quarter of 2022. This represents a 17.34% increase over the $48.129 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $7.981 billion during the reporting period. This compares quite favorably to the $5.283 billion that the company reported during the year-ago quarter.

- Chevron produced an average of 3.01 million barrels of oil equivalents per day in the current quarter. This represents a 3% decline compared to the equivalent quarter of last year.

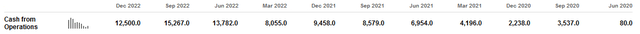

- The company reported an operating cash flow of $12.500 billion in the most recent quarter. This represents a substantial 32.16% increase over the $9.458 billion that the company reported in the same period last year.

- Chevron reported a net income of $6.353 billion in the fourth quarter of 2022. This represents a 25.68% increase over the $5.055 billion that the company reported during the fourth quarter of 2021.

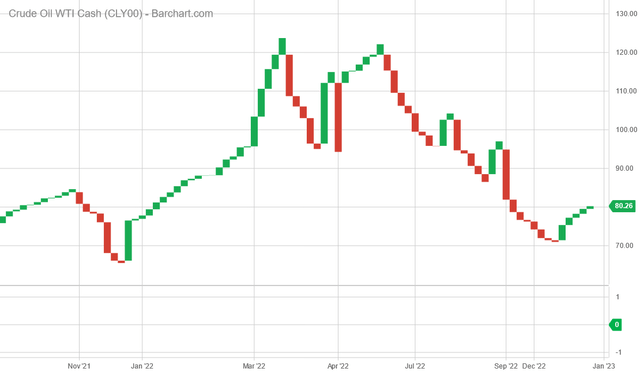

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that Chevron’s fourth-quarter 2022 results showed significant improvements over the comparable quarter of last year in all measures of financial performance. The company managed to accomplish these improvements despite the fact that its production was actually down by 3% year-over-year. The biggest reason for this is that energy prices were generally higher than in the year-ago quarter. This chart shows the price of West Texas Intermediate crude oil from October 1, 2021, until December 31, 2022:

Unfortunately, Chevron did not provide its realized average prices during the quarter, but we can clearly see that crude oil prices were significantly higher during the fourth quarter of 2022 than they were a year ago. The price of Brent crude oil and other grades of oil performed fairly similarly, although it would trade with either a discount or premium to West Texas Intermediate crude oil.

It should be fairly obvious why higher crude oil prices would have a positive impact on Chevron’s fundamentals. After all, the more money that Chevron can receive for each barrel of oil equivalent that it sells, the greater the company’s total revenues. This means that more money is available to cover the company’s expenses and ultimately make its way down to the bottom-line earnings and cash flow figures.

Unfortunately, all is rarely equal in the energy industry. We saw this in the highlights as Chevron’s production declined 3% year-over-year. This would exert negative pressure on the company’s revenues. After all, the fact that the company’s production was lower meant that it had fewer products to sell in exchange for revenue. Fortunately, the higher crude oil prices were able to offset this negative pressure from the lower production. Chevron’s finances improved year-over-year as a result.

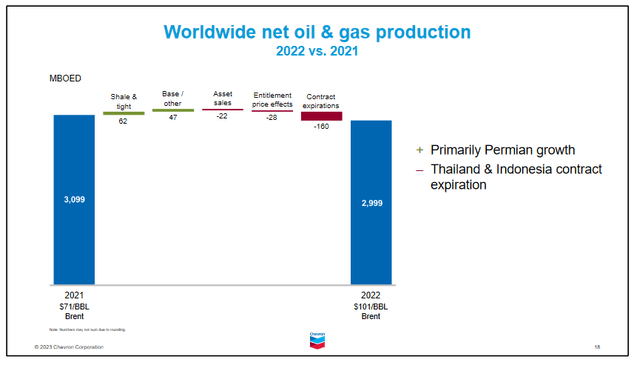

The fact that the company’s production declined is somewhat disappointing. After all, a production increase is one of the only two ways that an energy company can produce growth for its investors. It is also the only method that is at least somewhat within the oil company’s control. After all, even an energy company as large as Chevron only has a minimal amount of control over resource prices. The decline in production was not exactly unexpected, though. This is because the decline was caused by the end of Chevron’s concessions with the nations of Indonesia and Thailand. A concession is an agreement between an oil producer and a national government to develop the country’s resources. Basically, the oil company is allowed to operate and exploit the state’s mineral reserves for a limited period of time. The concessions that the company had with Indonesia and Thailand ended over the past year, meaning that the company was not able to produce oil from these deposits in the fourth quarter of 2022 but it could in the fourth quarter of 2021. That naturally caused the company’s production to decline. Chevron was able to partially make up for this decline by increasing its production in the United States:

In total, Chevron increased its production by 4% year-over-year, primarily in the Permian Basin. That was not enough to completely offset the 7% decline due to the loss of the Thailand and Indonesia concessions but it was enough for the company to hold its production decline to only 3%.

The company’s forward production guidance is not particularly encouraging. Chevron stated during the earnings conference call that it expects full-year 2023 production to come in generally flat relative to 2022 levels. Thus, we cannot count on much near-term growth from the company. This is exacerbated by the fact that energy prices might decline in 2023, although they are unlikely to decline very far. The biggest possible cause of a near-term decline is that there are a growing number of indicators that the United States will enter into a recession during 2023. After all, the Leading Economic Indicators fell pretty significantly in December, following a steep decline in November. During a recession, the demand for crude oil typically declines as consumers cut back on their unnecessary travel, resulting in falling demand for gasoline. That causes prices to decline due to the laws of supply and demand.

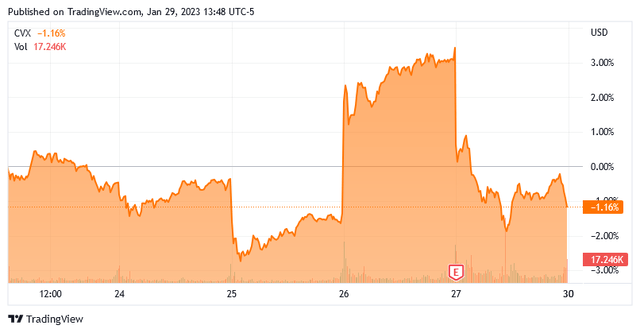

As mentioned in the introduction, Chevron’s stock price fell significantly following the earnings announcement:

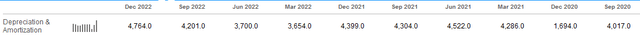

This was probably because the company’s earnings came in at $4.09 per share, which missed the expectations of its analysts by $0.20 per share. However, earnings are not everything for an energy company. This is because these companies have substantial capital assets. After all, it costs a great deal of money to construct refineries, pipelines, oil wells, and many other things. This causes these companies to have a substantial amount of depreciation and amortization expenses. Chevron had $4.764 billion worth of depreciation and amortization during the quarter, which was substantially higher than the company’s depreciation and amortization expenses during the prior quarters:

However, depreciation and amortization do not actually represent money leaving the company. In fact, many of these assets have a useful life that is far longer than the depreciation rate would suggest. As such, the company does not have to spend money to replace them as soon as the depreciated value suggests that the asset is worthless. As depreciation and amortization has the effect of reducing the company’s net income, however, it makes net income a rather poor metric to use to measure Chevron’s financial performance.

A far better measure of the company’s financial performance is the amount of cash that it generates from its operations. After all, it is ultimately cash that the company uses to pay off its debt, finance its operations, and return to its shareholders. Chevron delivered a very strong performance in this area during the quarter, as we can clearly see by looking at its operating cash flow:

As we can see, during the fourth quarter, Chevron had an operating cash flow of $12.500 billion, which was a fairly significant improvement over the $9.458 billion that it had during the prior-year quarter. Admittedly, the figure was not as high as during the second or the third quarters of 2022 but this was due mostly to crude oil prices being somewhat lower during the most recent quarter than earlier during the year. Over the full-year 2022 period, Chevron had an operating cash flow of $49.6 billion, which was an all-time record for the company. Overall, the company’s financial performance during the quarter and over the year was much better than the market’s reaction to its earnings announcement might lead one to believe.

Financial Considerations

It is always important to look at the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity is because debt must be repaid at maturity. This is usually accomplished by issuing new debt and using the money to repay the existing debt. The big problem with this is that it can cause a company’s interest expenses to increase following the rollover depending on the conditions in the broader market. In addition to this risk, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. This is something that can be a very real concern in the energy industry due to the overall volatility of commodity prices. Back in 2020, Chesapeake Energy (CHK) entered Chapter 11 bankruptcy protection, so we can clearly see the risk that a company like Chevron might face if it employs too much leverage.

One metric that we can use to evaluate the company’s financial structure is the net debt-to-equity ratio. This ratio tells the proportion to which the company is financing its operations with debt as opposed to wholly-owned funds. In addition, the ratio tells us how well the company’s equity will cover its debt obligations in the event of bankruptcy or a liquidation event. This second point is arguably much more important.

As of December 31, 2022, Chevron had a net debt of $8.210 billion compared to $159.627 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.05 today. Here is how this compares to some of Chevron’s peers:

|

Company |

Net Debt-to-Equity Ratio |

|

Chevron Corporation |

0.05 |

|

Exxon Mobil (XOM) |

0.08 |

|

Marathon Oil (MRO) |

0.27 |

|

Hess Corporation (HES) |

0.77 |

|

ConocoPhillips (COP) |

0.13 |

|

Occidental Petroleum (OXY) |

0.71 |

(all figures are calculated using the most current balance sheet released by each company as of January 29, 2023.)

As we can clearly see here, Chevron compares incredibly well to its peers in terms of this metric. Indeed, the company has virtually no net debt. This is a very good situation to be in considering that many banks and asset management companies are actively attempting to cut off the flow of capital to fossil fuel companies like Chevron. The takeaway for investors though is that we do not have any reason to worry about Chevron’s debt as the company is at no risk of bankruptcy even if the price of crude oil declines substantially from today’s levels.

Dividend Analysis

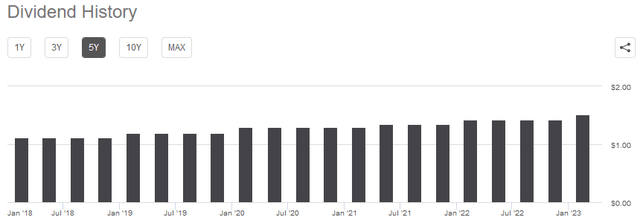

One of the most attractive things about Chevron is the company’s long history of rewarding its shareholders through dividends. As of the time of writing, Chevron has a 3.37% yield, which is substantially higher than the 1.56% yield of the S&P 500 Index (SP500). Chevron also has a history of growing its dividend over time, which is a tradition that it continued with a 6% increase that accompanied the earnings announcement:

The fact that Chevron consistently increases its dividend over time is something that any shareholder should appreciate during inflationary times, such as the one that we are suffering from today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This can make it feel as though we are getting poorer and poorer with the passage of time. The fact that the company is constantly increasing the amount that it pays to its shareholders helps to offset this effect and ensures that the purchasing power of the dividend is maintained.

Naturally, we need to verify that the company can actually afford the dividend that it pays out. After all, we do not want Chevron to be forced to cut the dividend since that would both reduce our income and almost certainly cause the company’s share price to decline.

The usual way that we judge a company’s ability to maintain its dividend is by looking at its free cash flow. The free cash flow is the amount of money that was generated by a company’s ordinary operations and is left over after it pays all of its bills and makes all necessary capital expenditures. This is ultimately the money that can be used to benefit the shareholders through debt reduction, share repurchases, or dividends. During the full-year 2022 period, Chevron reported a free cash flow of $37.6 billion. That was substantially more than is needed to cover the $11.000 billion that the company paid out in dividends. Chevron is also buying back $15 billion of its stock annually, which offsets some of the costs of the dividend hike. Overall, Chevron is not likely to have any problem carrying the dividend, especially since crude oil prices are unlikely to decline very much from today’s levels.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of an integrated energy company like Chevron, one metric that we can use to value it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to its earnings per share growth and vice versa. As I have pointed out numerous times though, most stocks in the fossil fuel sector are dramatically undervalued today. As such, we want to compare Chevron’s valuation to that of its peers in order to determine which company offers the most attractive relative valuation.

According to Zacks Investment Research, Chevron will grow its earnings per share at a 14.49% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.79 at the current stock price. This is a clear indication that Chevron is quite under-priced today. Here is how Chevron compares to its peers:

|

Company |

PEG Ratio |

|

Chevron Corporation |

0.79 |

|

Exxon Mobil |

0.49 |

|

Marathon Oil |

0.33 |

|

Hess Corporation |

N/A |

|

ConocoPhillips |

0.58 |

|

Occidental Petroleum |

0.43 |

As we can clearly see, all of these companies, with the notable exception of Hess Corporation, appear to be quite undervalued today. This confirms my earlier statements that nearly everything in the traditional fossil fuel sector is cheap relative to its earnings growth. Although Chevron is not the cheapest of its peers, it is still undervalued sufficiently to support adding to a position in the company today.

Conclusion

In conclusion, the market was not particularly enthusiastic about Chevron Corporation’s fourth-quarter earnings, and the stock sold off in response. However, a deeper look at the company’s actual financial statements reveals a great deal to like. Chevron has managed to make significant strides at reducing its debt and the company now has next to no net debt. Chevron also generated a record amount of cash during the full-year 2022 period, which it is using to reward its shareholders. When we combine all this with the company’s attractive valuation, we see that Chevron Corporation has the makings of a fantastic investment today.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long various energy-focused funds that currently hold long positions in XOM and CVX. I exercise no control over these funds and their holdings may change at any time.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!