Summary:

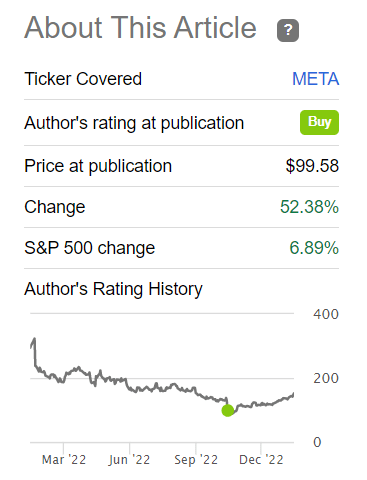

- META stock is up >50% since my latest and only bullish call back in late October 2022.

- The company will report Q4 FY2022 results on February 1. This situation represents a moment of truth for the company – I’ll discuss why.

- Litigation risks cause not only reputational damage but also quite considerable material damage – the last quarter of 2022 confirmed this once again with the example of Meta.

- Meta is likely to benefit from potential US regulation limiting TikTok’s usage, as users may spend more time on Facebook and Instagram. Let’s dive into Sensor Tower’s data.

- My DCF model clearly shows that META is still undervalued even for a value company – the implied upside of 41% keeps me bullish.

jaanalisette/iStock Editorial via Getty Images

Intro & Thesis

I published my first and so far only bullish article on Meta Platforms (NASDAQ:META) on October 28, 2022 – literally the day after that fateful day for all investors when META plunged by >25%, reporting an EPS of $1.64 and missing the consensus forecast by -11.32%.

In that article, I assumed that META stock was unfairly oversold and that its fair value was in the region of $162, so the stock has an upside potential of >60% from that price.

All management had to do, in my opinion, was to reduce its “metabolism” in terms of CAPEX and future plans against a backdrop of rapidly rising capital costs. Since then, 2 months have passed – the words necessary for the growth of quotes were said and the META stock took off:

Bloomberg [November 09, 2022] Seeking Alpha![Bloomberg [November 09, 2022]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-16750744892971172.png)

My old price target is now within reach – plus META will report fourth-quarter FY2022 results on February 1. This situation represents a moment of truth for the company, as the stock has reached its 200-day simple moving average, which historically determines the long-term trend in the stock market; moreover, the price looks directly at the next strong resistance level, the movement from which may determine the further fate of META stock in the medium-short term:

Investing.com, META, author’s notes

In this article, I review the key points that have changed in the company’s valuation over the past couple of months. I also discuss the potential Q4 FY2022 results and provide a new price target in the event of a successful report on February 1, 2023. Let’s dive in.

The Bad & The Ugly During Q4 FY2022

The European Commission charged Meta with antitrust violations on December 19, 2022, relating to their abuse of dominant position in the market for personal social networks and the distorting of competition in online classified ads. The EC alleges that Meta tied its classified ads and Facebook Marketplace to its personal social network, and imposed unfair trading practices on Facebook Marketplace to harm competitors. If the allegations are substantiated, the EC can issue a ban and impose a fine of up to 10% of Meta’s global sales (approx. $11.8 billion in FY2021). Meta has the opportunity to defend itself against the charges, but the existing risks are very significant in my opinion.

Also in December 2022, Meta agreed to pay $725 million to settle a class action lawsuit related to data access by Cambridge Analytica and other third parties. Despite federal and state regulatory and antitrust litigation against Meta in the US, actual regulatory legislation has been stalled for years, while the EU passed the Digital Markets Act and Digital Services Act in July 2022 to constrain big tech and regulate illegal and harmful content on large social media platforms like Meta. The new EU legislation is expected to lead to more regulatory investigations and lawsuits against Meta when it takes effect in 2023 and 2024.

The Cambridge Analytica incident and subsequent controversies exposed the dangers of Meta having access to a massive amount of personal user data, which it leverages to increase the value of its targeted advertising for marketers. So if a significant number of users choose to withhold their personal data from Meta, the effectiveness of its advertising could decrease.

In the US, President Biden supports bipartisan legislation to curb tech industry abuses and improve digital privacy, but chances of meaningful legislation are limited due to congressional donations from tech companies. Nevertheless, stringent regulatory enforcement and litigation against big tech will likely continue in the US. Some politicians are even discussing breaking up the company due to its vast influence in the social media market.

On January 4th Ireland’s Data Protection Commission (IDPC) fined Meta $414 million [€390 million] for GDPR violations related to a lack of transparency in sending advertising to Facebook/Instagram users without consent. Meta must stop this behavior within 3 months and plans to contest the ruling. This is one of 5 IDPC’s fines totaling nearly $1.4 billion in the past 18 months. The IDPC is responsible for regulating Meta as its European headquarters is in Dublin.

Litigation risks cause not only reputational damage but also quite considerable material damage – the last quarter of 2022 confirmed this once again with the example of Meta. This topic has always been on the agenda for the company and will most likely remain on the radar of those interested in the story.

The Good

Meta, a tech company, announced a layoff of 13% of its workforce (11,000 employees) in November 2022 due to e-commerce demand returning to historical norms, increased competition, and the negative impact of Apple’s (AAPL) changes on its advertising business. The company reaffirmed its previous 2022 expense outlook of $85-87 billion but lowered its FY2023 outlook to $94-100 billion [a $1.5 billion decline at the midpoint]. In addition, the CAPEX plan also decreased by $1 billion in FY2023.

As I mentioned in my recent article on Google (GOOG) (GOOGL), layoffs are a necessary cost optimization measure that every tech company needs these days. META has proven to be perhaps the most radical company in this regard, laying off over 40% of those who it has managed to hire during the period of rapid market growth and low cost of capital [since 2019]:

From my article on Google stock [January 24, 2023]![From my article on Google stock [January 24, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-1675075417947501.png)

About 98% of all revenues still depend on the advertising business – the economy is of paramount importance to the company, so in times as difficult as now, responsible capital management is what everyone wants to see.

However, the situation in the advertising market is even more important now – the consensus in the market now is the assumption of a recession in the U.S. [which I agree with] and that the advertising market is cooling. This is why META is expected to lose 12% of its revenue in FY2023, YoY [Seeking Alpha data].

However, we must not forget that META is still not profiting from Reels, one of its fastest-growing segments and a direct competitor of TikTok. According to a Bank of America study, 2023 will be a turning point for the company in this regard, possibly contributing to a 2-3 point revenue uplift in FY 2024:

Meta is likely to benefit from potential US regulation limiting TikTok’s usage, as users may spend more time on Facebook and Instagram. However, evidence suggests TikTok’s growth is slowing, with a decline in US users and slower growth in international users. Advertiser adoption and revenue growth for TikTok have also slowed in recent quarters. According to Sensor Tower, TikTok’s US user growth has dropped from 225% YoY in Apr 2020 to a 1% YoY decline in Dec 2022. International user growth has also slowed, going from 112% YoY in May 2020 to 8% YoY in Dec 2022:

At the same time, total time spent on Facebook and Instagram has seen an improvement in 2022, with Reels likely contributing to the growth. As per Sensor Tower, Facebook’s US total time spent increased to 7% YoY in Dec 2022 (compared to -4% in Jan 2022), and the international growth increased to 11% (compared to -2% in Jan 2022). Meanwhile, Instagram’s total time spent growth declined in 1H 2022, but it rebounded in 2H 2022:

If these indirect signs are anything to go by, Q4 FY2022 results may marginally beat market expectations, which seem too pessimistic at the moment.

Valuation Impact

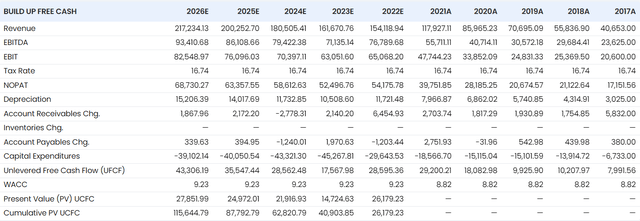

The first thing that should impact valuation is lower CAPEX. BofA analysts project that the share of CAPEX has fallen from 28% in FY2022 to 23% in FY2024 – I think this trend will decline to 18% by FY2026.

Working capital ratios will be in line with historical averages, in the direction of increasing the passive part of the balance sheet – the company will need more “free financing”.

I expect sales growth to be in line with consensus expectations – I think that’s quite conservative because a 12% year-over-year decline in sales is a serious decline in itself for a company with a market capitalization of $400 billion. We know approximate guidance on expenses – I will try to fit them into my model.

Calculating WACC is always quite tricky – there are too many assumptions that need to be taken into account. The main thing here is to reconcile the result with common sense. I make the following assumptions when calculating WACC:

- the risk-free rate of 3.52%;

- cost of debt of 7%;

- tax rate of 16.74%;

- the beta of 1.16;

- the market risk premium of 5%.

I receive 9.23% – quite reasonable in my subjective opinion. Here’s what I got as an output:

Stratosphere.io, author’s inputs

Assuming that FCF grows by only 3% in perpetuity [Gordon’s g-model], I get an equity per share of $213.5, which is about 41% above the current market price. This is my medium-term price target if Meta Platforms beats consensus EPS/revenue estimates and performs better than most investors fear.

The Verdict

My guess is that many fears have already been priced in by the market. Therefore, Q4 FY2022 results should be the moment of truth for the company and the direction of its quotes shortly. A strong report will help break through a key resistance level and move higher, or it will bounce off and lose all the accumulated strength if the facts do not go against the estimates this time.

But of course – META will most likely continue to be under additional regulatory pressure, and the development of Reels and metaverse initiatives will require increased CAPEX in any case. A CAPEX-to-revenue ratio of >of 25% is huge and should be considered.

Anyway, my DCF model clearly shows that META is still undervalued even for a value company – the implied upside of 41% keeps me optimistic [bullish]. Any positive development or indication of faster growth shortly will give META the opportunity to get a very important catalyst to reduce its undervaluation – in the best way for its shareholders.

Thanks for reading!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Struggle to navigate the stock market environment?

Beyond the Wall Investing is about active portfolio positioning and finding investment ideas that are hidden from a broad market of investors. We don’t bury our heads in the sand when the market is down – we try to anticipate this in advance and protect ourselves from unnecessary risks accordingly.

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!

![BofA [January 27th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-1675079303923367.png)

![BofA [January 27th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-16750795736854212.png)

![BofA [January 27th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-1675079696786524.png)

![BofA [January 27th, 2023]](https://static.seekingalpha.com/uploads/2023/1/30/49513514-1675079410495392.png)